Inflation, The Runaway Train

Economics / Inflation Jul 13, 2010 - 09:33 AM GMTBy: Kieran_Osborne

Inflationary risks have seemingly fallen out of the mindset of many investors recently, with the European debt crisis causing many to reevaluate their outlook for global economic growth in concert with record low headline CPI numbers being released. Despite this, gold, traditionally a hedge against inflation, continues to move up in price. Is this dynamic inconsistent? We don’t think so. Of course, some of gold’s price movement may reflect its safety aspect, given renewed concerns over the long-term health of the economy, but in our opinion, inflationary concerns are very much valid and should be front and center of any investment strategy going forward.

Inflationary risks have seemingly fallen out of the mindset of many investors recently, with the European debt crisis causing many to reevaluate their outlook for global economic growth in concert with record low headline CPI numbers being released. Despite this, gold, traditionally a hedge against inflation, continues to move up in price. Is this dynamic inconsistent? We don’t think so. Of course, some of gold’s price movement may reflect its safety aspect, given renewed concerns over the long-term health of the economy, but in our opinion, inflationary concerns are very much valid and should be front and center of any investment strategy going forward.

We believe there may be considerable inflationary pressures built into the system, which may become apparent over the coming years. Importantly, we believe structural changes to the global economic landscape have raised the risk of inflation in the U.S. substantially, regardless of whether the U.S. economy experiences strong or weak economic growth through the medium term.

We have never been in the “V” shaped recovery camp, and maintain this position. Having said that, many market participants contend that the U.S. will experience substantial above-trend economic expansion over the coming years. Curiously, many of these same people also believe that deflation, not inflation, is the major risk facing the U.S. economy, pointing to factors such as resource slack, high unemployment, and the substantial price decline in commodities and natural resources as reasons why inflation is unlikely to be an issue. Many of these same factors underpin the Federal Reserve’s (Fed) benign inflationary outlook. Many also hold the view that the Fed should continue to print money to ensure the recovery becomes self-sustaining, downplaying the risks to inflation, seemingly having trust that the Fed will be able to rein in any inflation if it does raise its ugly head. We find this stance counterintuitive for a number of reasons.

Over the very near term, we agree that if one looks at the most commonly followed measure of inflation – the CPI – we appear to be experiencing the mildest inflationary period in the last 40 years. After all, we have seen commodity prices across the board come back substantially from their peaks (albeit substantially off lows) and a slow down in end user demand, which has had a marked effect on the overall price of goods. Having said that, if we were to more adequately incorporate the average costs incurred by households, such as healthcare cost increases, one may come to a slightly different conclusion. In our opinion, there are significant inflationary risks on the horizon that may play out, regardless of whether the U.S. economy rebounds strongly or experiences slow economic growth.

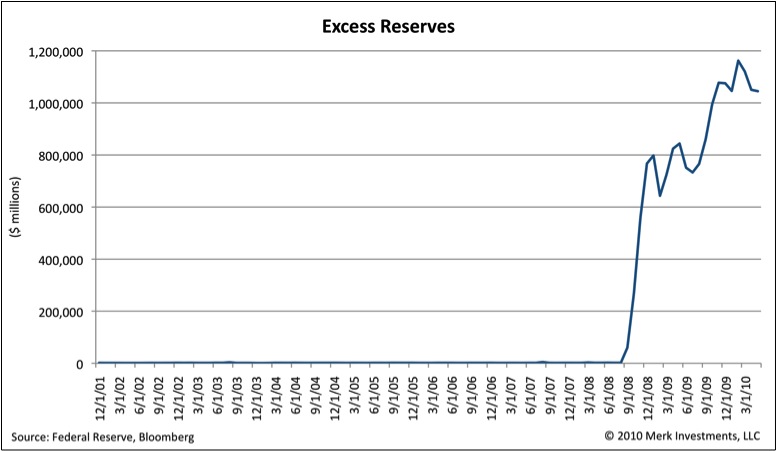

Let’s assume you are in the camp that believes the U.S. economy will experience strong economic growth as consumer confidence comes back, businesses begin redeploying all the cash that is sitting on their balance sheets, hiring employees and further reinforcing a recovery. It appears that both the government and Fed want the U.S. economy to grow at any cost (we are particularly concerned about the “at any cost” part of this equation – see below). Given this outlook, it is hard to fathom how we wouldn’t experience inflation. After all, a natural pre-requisite for this outcome to transpire would be a reversal of risk-aversion at both the business and personal level. Overlay this with the fact that there are presently $1.1 trillion of bank reserves just sitting on the sidelines waiting to be deployed (see chart below). This has never happened before. The reason? Banks are unwilling to lend for fear those loans will go bad. Said another way, banks continue to be extremely risk averse.

If we have even a marginal thawing in risk aversion, the likelihood that much of this money flows back into the system is high. After all, the banking industry is a highly competitive one; if Citi sees JP Morgan beginning to lend once more, they won’t want to miss out on a piece of the action, nor would any other industry player. It is quite likely that all these excess reserves may flow back into the economy rather quickly, flooding the economy with liquidity and creating massive inflationary pressures. Additionally, consider the huge amount of cash businesses are sitting on: according to the Federal Reserve, cash and liquid assets of non-financial firms presently stands at $1.84 trillion; cash represents 7% of all company assets, the highest level since the 1960’s.

Reduced risk aversion throughout the economy would likely speed up the velocity of money (banks lend more; businesses spend more; consumers spend more), which slowed down considerably throughout the crisis (a key reason why all the additional money printing has not yet been inflationary). As money velocity accelerates, this will likely only feed the inflationary fire, and the Fed may find itself incapable of curtailing it. To use an analogy, it might be like asking a freighter ship to act like a jet boat, and turn on a dime. Given the competitive nature of the banking industry, the excess reserves may be drained rather quickly; can the Fed suck that money back out of the system so easily and so fast, with little inflationary impact? We doubt it.

Regardless of one’s U.S. economic outlook, we believe inflationary risks are heavily skewed to the upside. In our assessment, the U.S. economy is unlikely to experience substantial above-trend growth over the coming years, for a multitude of reasons. Yet we still believe there are significant inflationary threats. Our logic has nothing to do with the “resource slack” explanation Bernanke and many at the Fed have been constantly touting as the core reason why inflation will not be an issue for the foreseeable future. Our reason? China.

Consider China for a moment. We know two things about China: 1) the government is incentivized to have a strong, stable economy, and; 2) China has moved up the value chain in terms of goods produced.

To stay in power, China’s communist party must maintain social stability. History has shown that a strong, stable economy fosters social and political stability, whereas high inflationary environments tend to lead to social unrest, uprising and political disaster. It logically follows that the Chinese government is incentivized to foster a strong economy and mitigate inflationary pressures. We believe China’s recent approach to curtailing inflation is rather ineffective and inefficient. Instead of imposing rather draconian measures on the banking sector, we have long argued that allowing the currency (the Chinese yuan – CNY) to appreciate would be a more effective way to manage inflationary pressures. Indeed, the Chinese have recently signaled their intention to allow the CNY to trade more freely. That said, we don’t believe this will happen overnight; it’s likely to be a gradual, drawn out process over multiple years.

The Japanese yen (JPY) may provide some insight as to the extent of currency appreciation likely to be exhibited by the CNY. When the Japanese allowed the JPY to float freely, it appreciated quite substantially on the back of relatively lousy economic growth; in contrast, the Chinese economy is likely to experience much higher levels of economic growth over the coming years. We therefore believe there is significant upside potential for the CNY.

China has allowed many of the lower value industries to fail and migrate to other Asian nations, such as the Philippines and Vietnam (the toy industry is a prime example). As a result, we consider that the Chinese have greater pricing power and a greater ability to pass on any increases in production costs. Labor costs have gained headline attention lately – both Honda and Toyota recently agreed to substantial wage increases to end strikes at their Chinese plants, while iPhone maker Foxconn increased wages after hitting headlines for its high employee suicide rate. These examples are not isolated incidents – minimum wages have been raised throughout China. As an example, in Shenzhen, minimum wages were recently raised by an average of 15.8%. Combine this with increases in the cost of commodities and natural resources and China may be facing significant upward increases in the cost of doing business for the foreseeable future.

The ability to pass on cost increases, in combination with an appreciation of the Chinese yuan, leads us to believe that it is highly likely that the Chinese may simply export inflation to the West, and the U.S. Importantly, this dynamic would have nothing to do with whether there is resource slack in the U.S. economy or whether the U.S. economy bounces back strongly. We have already seen this dynamic play out. In the spring of 2008, before the global market meltdown, we saw reports of triple digit increases in prices for goods such as coat hangers. The reason? Chinese manufacturers could no longer absorb the increased costs of raw materials brought about by the massive run up in the price of oil and other commodities. In our opinion, we are likely to see this phenomenon happen again, but this time on a larger scale.

Consequently, we believe there are significant inflationary risks evident for the U.S. economy. Moreover, we do not think the Fed will be capable of reining in inflation should it become apparent.

The Fed has widely discussed its anticipated liquidity-draining program, namely the use of reverse repurchase agreements (reverse repos). The Fed has stated they are unlikely to sell any of the $1.25 trillion in mortgage-backed securities (MBS) held on its balance sheet. After all, you would be hard pressed to find a willing buyer over the near term, not to mention the significant upward pressure this would likely have on interest rates (which may cause the economy to crash right back down given the continued high levels of consumer debt). What scares us is that the Fed’s anticipated use of reverse repos may work in theory, but has never been proven in practice; these fears are compounded given the especially large scale that may be required. The total size of demand for such repos may fall substantially short of the total amount required. We estimate that the indicative size of demand is unlikely to be much more than half the $1.1 trillion dollars represented by excess reserves, which leads to our next point.

Any central bank policy is only as good as the trust in that central bank to follow through with that policy. As outlined above, it may only be time before it becomes abundantly clear that the Fed’s liquidation policies, at best, are questionable; at worst may fail. If this happens, market confidence in the Fed will erode; the Fed’s credibility with regards to its ability to counteract any inflationary pressures will be put under severe pressure. In our opinion, the biggest factor impacting inflation are inflationary expectations – when credibility in the Fed erodes, this is likely to place significant upside pressure on inflation expectations and therefore inflation itself. To us, there appears little the Fed could do in such a situation. Inflation may be a runaway train, derailing the Fed’s integrity.

Either way we look at it, there seems to be significant inflationary risks baked into the system. It is within this context that investors may want to consider adding a currency component to their portfolios in an attempt to protect against the purchasing power of their savings. Ensure you sign up to our newsletter to stay informed as these dynamics unfold. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. This analysis is a preview of our annual letter to investors; to learn more about the Funds, please visit www.merkfunds.com.

Kieran Osborne, CFA

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.