Copper: More Than China's Property Market

Commodities / Metals & Mining Jul 12, 2010 - 05:44 PM GMTBy: Dian_L_Chu

Despite an improved risk sentiment, copper price is still sitting at 20% below its April peak mostly from the following concerns:

Despite an improved risk sentiment, copper price is still sitting at 20% below its April peak mostly from the following concerns:

- Demand slowdown in China as Beijing is attempting to tame inflation and property bubbles

- Recent drop in China copper imports

- “Double dip” in Europe from austerity programs

- Copper is down around 13% for the year so far

The pessimism has prompted some analysts forecasting further downward pressure, or even a catastrophe of the red metal.

On the other hand, much of the focus has been put on China, while some other equally important factors are currently being overlooked by investors. The following sections will highlight some of the emerging trends in the copper market.

China Is Not the Only Game in Town

Copper is a base metal used predominantly in building construction, power generation and electronic products. As such, the metal tends to be highly sensitive to the macro environment.

China is the world’s biggest copper user—about 27% of world copper demand (Goldman Sachs estimate)-- followed by the U.S. Since the growth in the United States is likely to be subpar in the medium term, China will likely remain the main catalyst of copper.

However, as other emerging and developing economies race to catch up with the West, China is not the only game in copper town.

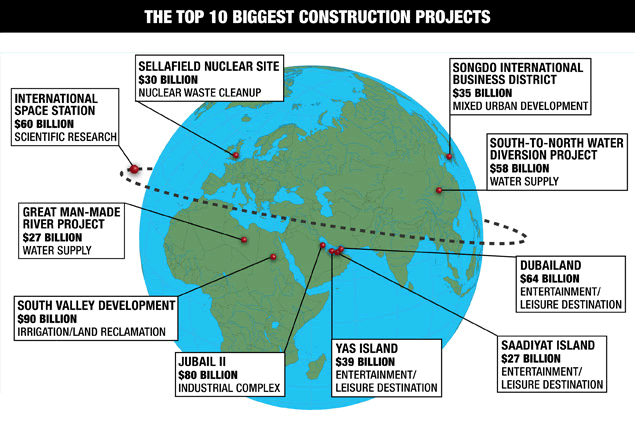

A review of the top 10 global mega construction projects (See Graph) identified by Engineering News-Record (ENR) shows multi-billion-dollar projects ranging from the 60-Billion land reclaimation in Egypt to Saudi’s $80 Billion effort to diversity its economy away from oil and gas.

Source: ENR

Don't Forget About India

The head of India’s state-run Hindustan Copper Ltd told Reuters that “India’s copper demand will likely grow by at least 7% in 2010-11 fed by power sector, while demand from real estate and construction remains weak.”

According to Platts, India suffers from a peak power deficit of about 12.7%, and is expected to begin tendering nine major Indian power transmission projects following approval from the regulatory authority.

The projects are estimated to cost more than $12.3 billion in total. There are also other power projects around the rest of Asia as well. (See Table)

Source: Platts

These are all indications that copper demand and pricing is also supported by the social and economic evolution outside of China, amid the new normal of global twin-speed growth between Asia and the West.

China Copper Import vs. Demand

Riding on a $586 billion stimulus package and record lending, China imported a record 3.2 million tons of the refined metal in 2009, up 119% from the previous year. So, the recent decline of China copper imports has caused much distress among investors.

Bloomberg’s calculation, based on customs data, shows June shipments of copper and products of China declined 31% from a year ago, and 17% from May. This is a third straight month of such decline. In addition, Xinhua also reported that China's refined copper imports this year is expected to drop 28%

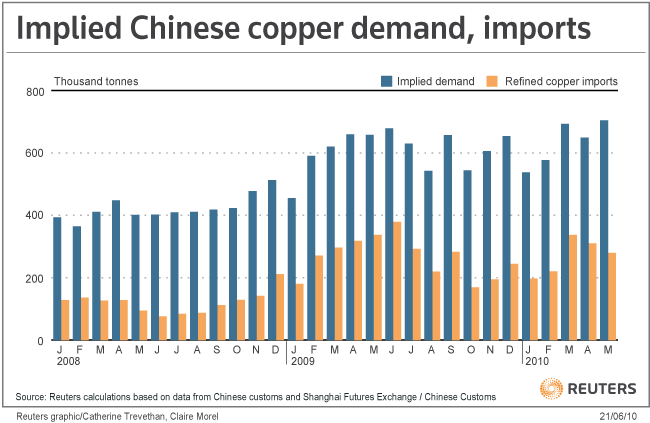

The drop in imports may be partly attributed to inventory destocking, and not entirely indicative of all the underlying market factors. In a separate analysis (see chart), Reuters concluded that

“Apparent daily appetite for refined copper in China grew 5% in May from April, as a fall in imports was offset by rising output and a drop in stock levels.”

Source: ChinaMining.org

Real Estate = 10% of China Copper Demand

China's property boom has contributed much to its surging copper imports and demand pushing up prices last year. So understandably, much spotlight has been put on how China's chokehold on property would tank copper.

Realistically, the real estate sector accounts for just a portion--about 10% as estimated by Standard Chartered--of China's total copper consumption; whereas power generation is actually the biggest demand driver of copper. Furthermore, there are other sides of China's property story as well.

Population Growth & Migration

China's urban population is expected to surpass 700 million in the next five years, exceeding the number of rural dwellers for the first time, as reported by Xinhua. The country's population — already the world's largest at 1.3 billion — is expected to reach 1.4 billion in 2015.

This population growth and migration pattern would suggest that power grid development-- the largest consumer of copper--is expected to continue, as many Chinese cities are already struggling with overloaded infrastructure.

Moreover, it also indicates the current cooling-off in the property market, along with other copper consuming sectors, like automobile and home appliance, is likely temporary in nature.

Growing Demand of Floor Space

Xstrata, the world’s fourth largest copper producer, recently noted that building of new floor space in China is still growing at more than 20%. A China Daily article also described how billions of yuan continue to flow into new commercial and residential development despite a vacancy rate increase of 8.6%.

China's banks and state-owned enterprises are behind the demand for new buildings to get their own corporate identities. In addition, city dwellers have developed higher lifestyle expectations and want some sophistication in their personal space. Not to mention the growing one million+ "Ant Tribe" will eventually outgrow their slums and need nicer places as well.

Looming Supply Shortage

On the supply side, Chile, the United States, Peru and China are the top four copper producing countries in the world, based on the latest data compiled by U.S. Geological Survey (USGS). Chile’s Codelco, Freeport-McMoRan Copper & Gold Inc. of the U.S., Australia’s BHP Billiton, and Xstrata based in Switzerland, are the four largest producers.

Executives at Codelco and Freeport-McMoRan recently indicated global copper market could face a supply shortage due to higher costs, lower ore grades, and scares new resources.

Credit Suisse Group AG noted in a June 30 report, quoted by Bloomberg, that mining companies are missing analysts’ output forecasts because of lower-quality ore, providing “a bullish pricing signal,” while Macquarie Bank estimates next year’s shortage may be the biggest since 2004

Copper Inventory

As another sign of possible supply stress, global copper inventory level has been on a steady decline, particularly at London Metal Exchange (LME) and Shanghai (see chart).

The stockpile on LME has fallen about 20% since mid-February, and is now equal to about 8 days of global demand.

Source: Investmenttools.com

High-flying Copper in 2011?

Analysts views of copper prices ranging from $1.00 a pound (a 67% drop) by Resolved Inc to Standard Bank’s $8,940/mt (the highest on record reached in July 2008) “as early as the first quarter.”

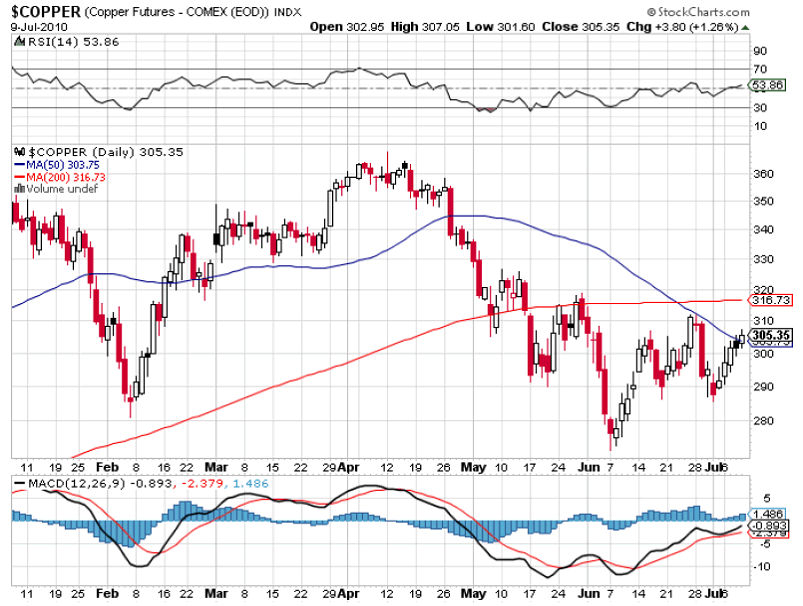

Although the longer term trend of copper is quite promising based on the discussion here, with its recent Death Cross, prices of the red metal will likely be range-bound in the short term. (see technical chart)

With measures by Beijing to cool growth and curb property speculation taking hold, and many economic uncertainties primarily coming from Europe and the U.S., a slowdown in the second half of this year from the U.S., Europe, or China, could push copper down to the $2.50 range on COMEX.

Alternatively, if global economy ends up showing definitive signs of growth and recovery, then copper should move towards or above $3.50.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.