Deflation becomes the Dominant Economic Trend

Economics / Deflation Jul 12, 2010 - 09:34 AM GMTBy: Clif_Droke

One of the abiding fears since the government stimulus effort began in earnest last year has been the fear that runaway inflation will once again rear its ugly head. Legions of market commentators have predicted the return of inflation in spite of the deflationary environment we find ourselves in.

One of the abiding fears since the government stimulus effort began in earnest last year has been the fear that runaway inflation will once again rear its ugly head. Legions of market commentators have predicted the return of inflation in spite of the deflationary environment we find ourselves in.

Can we reasonably expect a return of inflation in the foreseeable future? The Kress Cycles say “No!” and tell us to expect just the opposite, namely a deflationary trend. This has certainly been the dominant economic trend since the credit crisis of 2008 and, in some areas, even before then.

Government has for years been dead set on fighting deflation with re-inflationary countermeasures. The combined efforts of government spending and central bank pump priming have by and large met with success in combating the immediate effects of deflation. After the unprecedented rollercoaster ride of the past two years, however, it’s beginning to look like policy makers have capitulated to the deflationary trend. In place of the reactionary Keynesianism of years past, a startling about-face has occurred in which governments and central banks in the developed countries have embraced austerity and capitulation to the deflationary trend.

Congress recently failed to extend unemployment benefits and abandoned plans for another round of stimulus to combat what is the worst economic recession in over a generation. Ironically, a leading socialist news service found itself in the unlikely position of criticizing the Democrats for their collective failure to increase government spending. Under the headline ”Obama, Democrats abandon stimulus for austerity,” the International Committee for the Fourth International (ICFI) wrote, “With long-term unemployment at its highest level since records began in the 1940s, the Obama administration and Democratic congressional leaders are abandoning even the wholly inadequate economic stimulus measures of last year and focusing instead on budget-cutting and austerity.” The article went on to lament the administration’s 5 percent budget cut, amounting to $250 billion over 10 years. This prompted one commentator to ask, “Will President Obama be America’s first deflationary Democratic?”

ICFI also emphasized Federal Reserve Chairman Ben Bernanke’s demand that Congress and the White House formulate a plan to sharply reduce the US deficit, projected to reach $1.6 trillion this year. The widespread obsession over deficit reduction, both here and abroad, is deflationary.

ICFI continues, “Under conditions of harsh budget-cutting across Europe, renewed crisis and volatility in financial and currency markets and the threat of a new global credit crunch, the prospects for a serious revival in US production and exports are remote. Yet the White House and the Democratic-led Congress are essentially ignoring the jobs crisis and condemning the American people to years of near-doubled-digit unemployment. They are doing so at the behest of the major banks and financial firms, which demand fiscal austerity to protect their speculative investments, profits and gargantuan salaries.”

It’s quite remarkable and even amusing to read a left-wing commentary that is critical of what is widely considered a socialistic federal government. Obama was widely hailed by the socialists as a political savior when he was first elected. And yet here we are 18 months later and it has come to this.

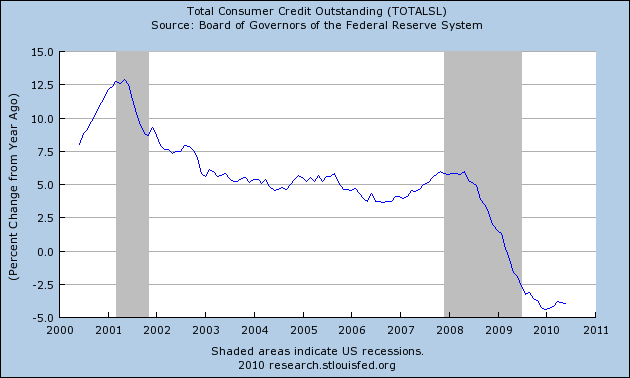

An article appearing in the Wall Street Journal recently drew attention to a surprising deflationary mindset among policy makers. “Deflationary Mindset Makes Itself at Home,” writes Kelly Evans in a recent issue of WSJ. As Kelly observed, “Policy makers generally have an easier time slowing an overheated economy than trying to stimulate a contracting one.” In the present case it appears that policy makers have given up even trying. Kelly points out that in spite of multi-decade lows in mortgage rates, borrowing activity is falling, not rising. The same declining trend in borrowing can be seen in the long-term graph showing consumer credit outstanding.

The above graph is the very epitome of deflation and in a nation like the U.S. whose economy is heavily depending on consumer spending, there is no bigger indication that deflation is the dominant long-wave economic trend.

The housing market is another major indication of how K Wave and Kress cycle deflation is exerting its influence. “The bigger worry,” as Kelly observed, “may be that a deflationary mindset has taken hold in the housing market. This has buyers in no hurry to lock in even today’s low rates.” A recent survey by the Conference Board found that only 1.9 percent of consumers plan to buy a home in the next six months, one of the lowest readings since 1982. Tighter lending standard, as Kelly points out, is another roadblock to inflation as many households remain cash-strapped.

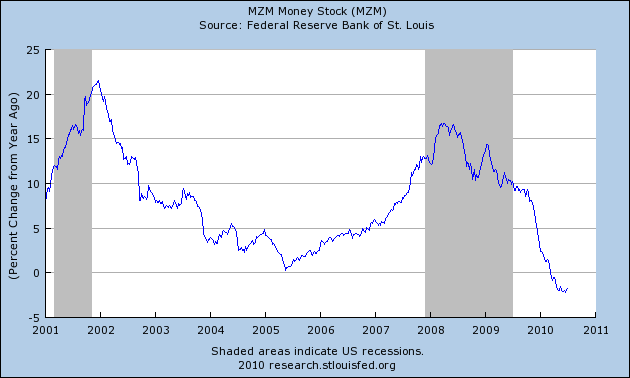

Yet another indication of deflation is the fact that the level of MZM money stock has diminished significantly over the last 12 months, and for only the sixth time in the last 50 years. One reason for this diminution of MZM is that only some of the money has come out of the bunker since the crisis of 2008, while there continues to be a general decline in risk appetites and the desire to borrow. As analyst Mark Dodson observed, “One conclusion is that in spite of all the action that the Fed has undertaken, Fed policy remains more deflationary than inflationary.”

It’s not any coincidence that the credit crisis of 2008, being six years from 2014, was technically when the final “hard down” phase of the Kress 60-year cycle started. The hard down phase of the 60-year cycle, scheduled to bottom in 2014, is defined as the runaway deflationary leg of the cycle. It also roughly coincides with the Kondratieff long wave, which also implies a deflationary environment as we head toward 2014.

K Wave analyst David Knox Barker has pointed out that government tends to be behind the curve where the economic long wave is concerned. Not uncommonly does history record the belated actions of the feds in trying to extinguish financial fires, of which the credit crisis of 2008 affords an excellent example. Had the combined efforts of the Fed and the Treasury been any slower in coming to the rescue at that time, the financial superstructure might have been entirely consumed in the credit conflagration.

Unfortunately, as history attests, government action in fighting against deflation tends to be inadequate and deflation at some point usually gains the upper hand. As Barker has stated in his book on the K Wave, government has a tendency to underestimate the severity of the deflationary problem and therefore does too little to counteract the hyper-deflationary forces of the economic long wave. That appears to be the case now as the government sits on its proverbial hands under the false assumption that its previous efforts at staving off deflation were ultimately successful.

As we touched on earlier, this year is the “down” year of the alternate, or 2-year, cycle. In the down year of this particular cycle the deflationary bias of the bigger cycles, namely the 40-year and 60-year cycles, tend to be especially felt if there isn’t a counteracting influence such as a massive monetary stimulus. Since this is an unlikely event anytime soon, it means investors will need to be on the lookout for the reappearance of extreme volatility, particularly in the months of August and September and until the 2-year cycle bottoms later this fall.

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.