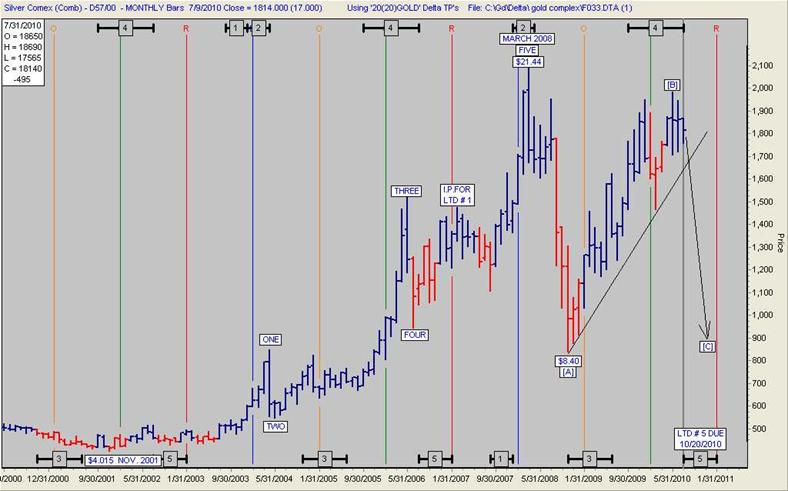

Silver Heading for Price Crash to $9

Commodities / Gold and Silver 2010 Jul 12, 2010 - 06:21 AM GMTBy: Ronald_Rosen

To put it mildly, more than a telescope will be needed to find the silver lining on the silver charts posted in this update.

To put it mildly, more than a telescope will be needed to find the silver lining on the silver charts posted in this update.

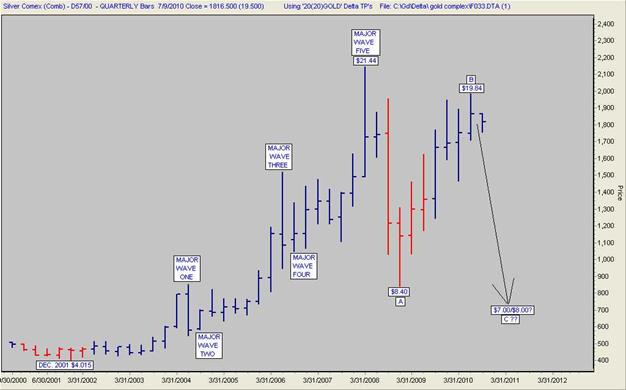

There is quite a bit written about silver being manipulated. If there is any manipulation taking place it appears that Mother Nature is doing the manipulating. As the saying goes, “Don’t mess with Mother Nature.” I suggest we follow her lead. That means one more decline to below $8.40 an ounce.

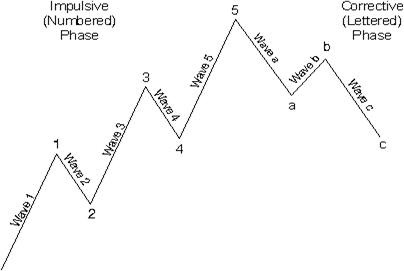

“A five-wave impulse (whose subwaves are denoted by numbers) is followed by a three-wave correction (whose subwaves are denoted by letters) to form a complete cycle of eight waves.” E.W.P.

SILVER QUARTERLY

A glance at these charts and one can not help but suspect that, “Something is rotten in the state of Denmark.” Just substitute the state of silver for the state of Denmark.

“There's a reason the words, "state of Denmark" rather than just Denmark is used: the fish is rotting from the head down—all is not well at the top of the political hierarchy.” www.enotes.com

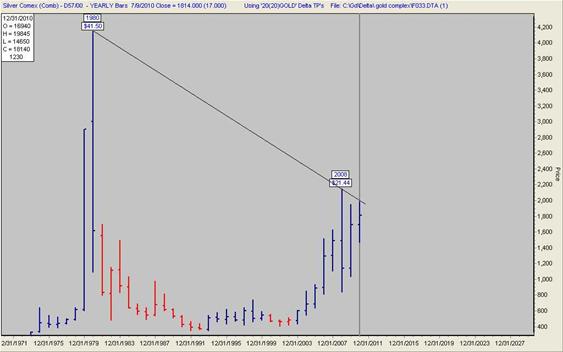

GOLD YEARLY

SILVER YEARLY

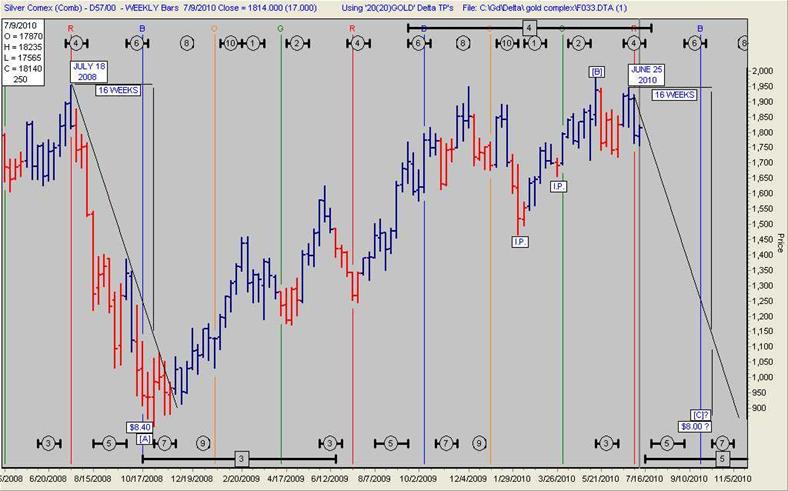

SILVER WEEKLY

The Long Term Delta turning points are an excellent timing tool. If you want to know just how powerful they really are, read the Delta story by Welles Wilder.

http://www.wilder-concepts.com/theDeltaStory.aspx

The Delta Turning points for the precious metals complex and a number of other important market items are available by subscription to:

THE ROSEN MARKET TIMING LETTER

www.wilder-concepts.com/rosenletter.aspx

SILVER MONTHLY

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.