Stock Market Making Bearish Lower Lows, Gold Bull Market Intact

Stock-Markets / Stock Markets 2010 Jul 12, 2010 - 01:41 AM GMTBy: Steve_Betts

"What do we mean when we say that first of all we seek liberty?

"What do we mean when we say that first of all we seek liberty?

I often wonder whether we do not rest our hopes too much upon constitutions, upon laws and upon courts. These are false hopes; believe me, these are false hopes.

Liberty lies in the hearts of men and women; when it dies there, no constitution, no law, no court can save it; no constitution, no law, no court can even do much to help it... What is this liberty that must lie in the hearts of men and women? It is not the ruthless, the unbridled will; it is not the freedom to do as one likes. That is the denial of liberty and leads straight to its overthrow.

A society in which men recognize no check on their freedom soon becomes a society where freedom is the possession of only a savage few -- as we have learned to our sorrow. What then is the spirit of liberty? I cannot define it; I can only tell you my own faith.

The spirit of liberty is the spirit which is not too sure that it is right; the spirit of liberty is the spirit which seeks to understand the minds of other men and women; the spirit of liberty is the spirit which weighs their interests alongside its own without bias..."

--- Learned Hand -- (1872-1961), Judge, U. S. Court of Appeals -- Source: Learned Hand, in "The Spirit of Liberty" - a speech at "I Am an American Day" ceremony, Central Park, New York City (21 May 1944)

I seem to recall from my business law classes way back when that my professor considered Learned Hand the best judge to ever put on a black robe. I also seem to recall that the Supreme Court never overturned any of his decisions. I have no doubt that if Judge Hand were alive today he would have little or no regard for our modern day version of liberty, and he would be appalled at how we disemboweled the US Constitution. I receive a lot of article from clients every day, and more and more have to do with abuse of authority: a policeman shots an unarmed motorist in the head, in front of his wife and child, during a routine traffic stop, a citizen who filmed two policemen committing a crime is jailed for taping the event illegally, under the Patriot Act Americans are jailed without right to trial and council, fictional weapons of mass destruction as an excuse to invade a foreign country, censorship and lies regarding the Gulf oil disaster, and then we have the question of US troops operating illegally within the borders of the United States and against US citizens. Recently I read of an idea being thrown around Washington, DC of giving Obama a “kill switch” for the Internet… I won’t even dignify that with a comment.

The circumvention of the US Constitution began almost one hundred years ago with the creation of an income tax and the formation of the Federal Reserve. According to the Constitution only gold and silver can be used as money, and yet today’s world is flooded with “federal reserve notes” backed by nothing but a hope and a prayer. I don’t need a direct line to God to know that’s one prayer that will never be answered. Even worse than the fiat currency debacle is the fact that the Fed transformed the United States from the world’s biggest creditor nation to the world’s biggest debtor nation. Now the Fed is extremely busy taking private debt and converting it into public debt, a debt that you’ll have to pay, in order to benefit a select few. Congress, the Department of the Treasury and the White House are all hard at work facilitating the conversion under the guise of stimulus designed to create jobs, infrastructure, and consumption in the US.

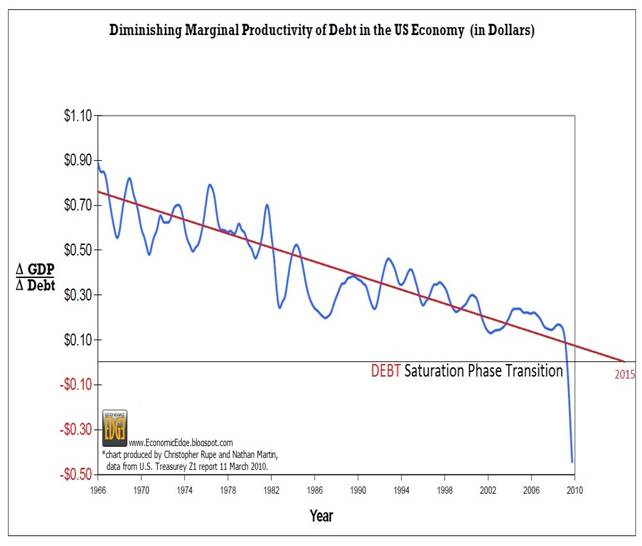

As you can see the level of debt is such that any additional liabilities taken on by the government are counterproductive. The reason is that the debt bestowed on the large financial institutions produces absolutely nothing. For example when the Tarp (synonym for free) money entered Bank of America they in turn deposited that money with the Fed and earned a nice interest rate. They did not loan this money out to the private sector that could have put it to work building plants, creating jobs, or expanding existing facilities. The fact that money is not filtering out into the economy is causing a contraction and that is leading to deflation. This lack of liquidity is evident in the following chart of the money supply in the US:

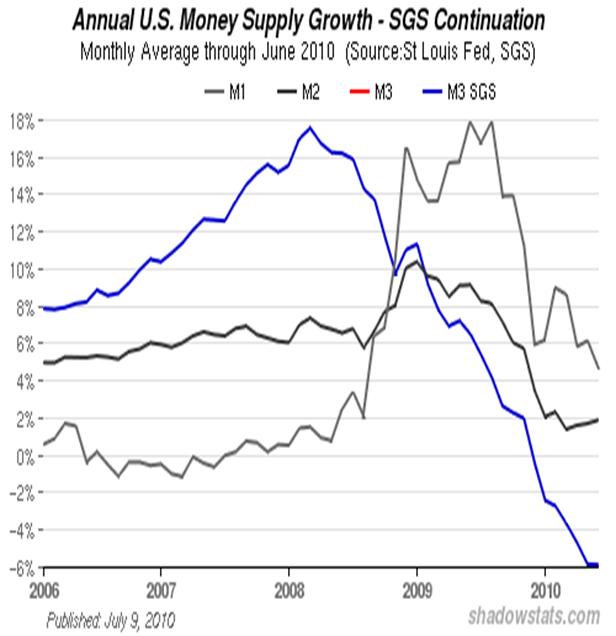

Much has been made of Bernanke’s famous quote about having a printing press and helicopters and knowing how to use both. Now the market is having its say and it is following the same path that it took in 1907 and again in 1930, with no regard what-so-ever for printing presses and helicopters. Since the Fed has no intention of helping the average American, you can expect the velocity of money, as well as the money supply, to continue their downward trajectory. Anything else is wishful thinking! Americans continue to cut back on everything and are actually trying to save because they know the government has no intention of helping them. If the Fed were a rock-and-roll band, they would be playing to an empty house!

Now I want to focus a lot of attention on the stock market since we have conflicting and changing opinions as to what is happening. I want to keep things as simple as possible so I’ve made the following chart:

Here you see the pattern in the Dow from the April 26th intraday high of 11,258.01 through yesterday’s close at 10,197.72. This chart is clear and easy to understand as it shows three lower lows and two lower highs, and it appears to be working on a third lower high right now. Here are the characteristics of each move down:

- The first move down ran from 11,258 to 9,869 for a decline of 1,389 points over eight sessions. The subsequent reaction saw the Dow recover 1,041 points, almost exactly 75%, to reach 10,910.

- The second move down ran from 10,910 to 9,757 for a drop of 1,163 points over seventeen days. The reaction that followed recovered 837 points, about 71%, over nine days to die out at 10,594.

- The third move down began at 10,594 and fell down to a new lower low at 9,614 for a loss of 980 points. So far the Dow has recovered 583 points or close to a 60% advance.

Finally, notice that the first two lower highs died out when they ran up against the 50-dma, the 50-dma has turned down, and it recently crossed below the 200-dma initiating a significant sell signal.

If things run true to form then we should see this reaction run its course after it recuperates 75%, taking it to the 10,349 area which just happens to coincide with strong Fibonacci resistance at 10,334 and is slightly above the 50-dma at 10,304. Everything seems to be following a pattern and so far so good, at least if you are short the market. Assuming you believe the market will continue to decline, you need to ask yourself what could change the outcome.

For those of us who follow Dow Theory we have half the puzzle, and if you are bearish stocks you should feel quite comfortable with your current position. It is worth remembering though that there is another half of the puzzle, and by that I mean the behavior of the Transportation Index. It is always worth remembering that the Transports led the Dow up throughout the latter half of the bull market, and the Transports have been leading the Dow down since the bull market topped in October 2007. For some insights into what is going on now, take a look below:

The Transports made a top with a closing high of 4,806.01 on May 3rd, a full week after the Dow topped, and therefore the high was “unconfirmed”. Once the Transports turned down the chart took on the same appearance of the Dow with three lower lows and two lower highs. You should also observe that the 50-dma in the Transportation Index has yet to cross under the 200-dma so we don’t have the bearish sell signal that’s emanating from the Dow. There is one other difference that is worth mentioning and that is that the Dow made an intraday as well as closing new low for the year while the Transports aren’t close to their respective February intraday low of 3,742.01, and marginally below the strong Fibonacci support found at 3,764.11.

This is where it gets interesting! What happened is that a correction into February 8th took the Dow down to 9,908.39 and the Transports closed down at 3,792.89 on the same day. From there the Dow rallied to its April 26th high while the Transports rallied until May 3rd and were not confirmed by the Dow. Then both averages turned down and the Dow fell below its February 8th closing low on a number of occasions while the Transports have yet to match it. Richard Russell views this as an important non-confirmation, but I have certain reservations and here’s why. If the Dow failed to confirm the top in the Transports in the bear market rally, what validity does a non-confirmation by the Transports have four months later on the way down. Here’s what Mr. Russell had to say on July 5th:

"Important, first, I want my subscriber to get ready for Tuesday. I want to point to an important potential Dow Theory situation. On February 8, 2010, the Dow hit a low of 9908.39. On the same day, the Transports closed at a corresponding low of 3792.89.

"Here's where things get interesting. Both Averages proceeded to rally to highs -- then they turned down again. On June 7, 2010, the Dow closed below its February 2010 low with a 9816.49 close, continuing to move lower over the course of the month. The Transports did not confirm -- and still have not confirmed.”

He makes no mention of the non-confirmation that occurred in late April, a full two and a half months before the more recent non-confirmation. I spent some time reading up on my Dow Theory and I can’t find anything that speaks to such a conflict. My question is with respect to the validity of this last non-confirmation and I really do not have a good answer.

Whenever a situation like that occurs it is always best to approach the markets with caution and error on the side of prudence. I don’t object to Mr. Russell’s point of view but I do object to his shift in position from black bearish to somewhat bullish in his Friday report:

“Following the Transport non-confirmation, yesterday the market surged higher, Dow up 274 and Transports up 152. But that's not all. What I noticed was that yesterday was a 90% up-day -- the formula for a bottom.

So has the market handed us a fooler? Have we seen the worst on the downside? It's a question I'm asking myself. The proof will come in the action, good or bad, of the market in coming weeks. So far (today) the follow up looks impressive. All this should place my subscribers in a quandary. Play the upside or skip it? My suggestion -- bold subscribers might take a position in the DIAs with stop losses. It's an interesting speculation with a limited loss prospect so long as you use the stop losses.

It was just a couple of weeks ago that he was quoted on Bloomberg and Barron’s as telling everyone to sell everything but the kitchen sink since the market would more than likely crash. This non-confirmation has existed since May 8th and well before he advised people to sell everything, so where is the surprise? This week’s rally was on low volume, and Friday was exceptionally low, indicating that the funds are not participating, and that has been the case for quite some time. So far the Dow has rallied for four days and that is less than the five and nine day declines from the first and second moves lower respectively, so we have nothing out of the ordinary there. Then we see that the two previous reactions both retraced 75% while the current reaction has yet to approach that level, so we still haven’t seen anything new. Certainly I see nothing to justify going long at this stage of the game. I believe the Dow will rally for another two or three days and will test strong resistance in the area of 10,334, and should the Dow surpass this resistance, only then would I begin to consider the possibility of a move higher. That is still a long way off so I would just sit tight until then.

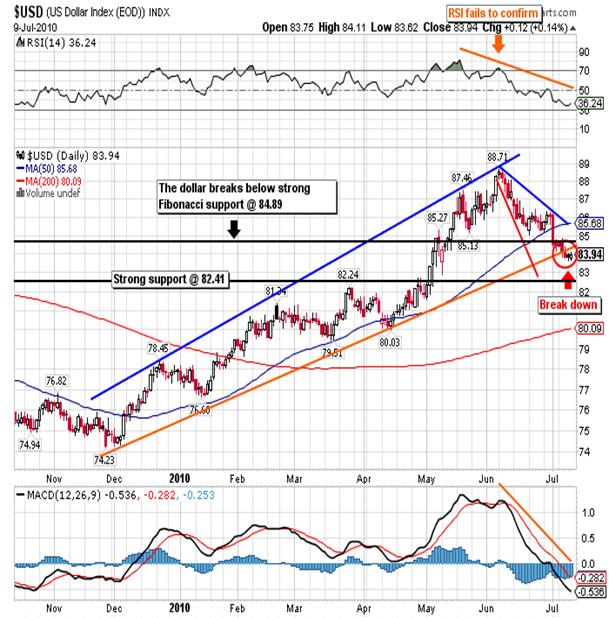

Like the Dow the US dollar now appear to have topped and is now on its way down. How the move down will play out and what affect that will have on other markets is the question of the day. For months the dollar rallied as deflation put the squeeze on dollar denominated debt in every corner of the world. This of course prompted calls for a new bull market for the greenback but such calls came from people who have no grasp of the laws of supply and demand. The US deficit for 2010 is estimated to exceed US $1.6 trillion and tax revenues are on the decline, so the only way out is the printing press. Like most reactions it ran longer and went higher than most thought possible as you can see below:

One interesting facet is that this last leg up ran six months, almost to the day, and topped out at the same level as the previous reaction, at 89.00 and just shy of strong resistance at 89.97. You can also see that RSI, MACD, and the histogram all failed to confirm the June 7th intraday high of 88.71. More recently you can see that the greenback broke down below the bottom band of a trading range that goes back to late November 2009, this occurring just days after a break of strong Fibonacci support at 84.89. The next line in the sand is down at 82.41, and since the dollar is not yet extremely oversold, it is within reach.

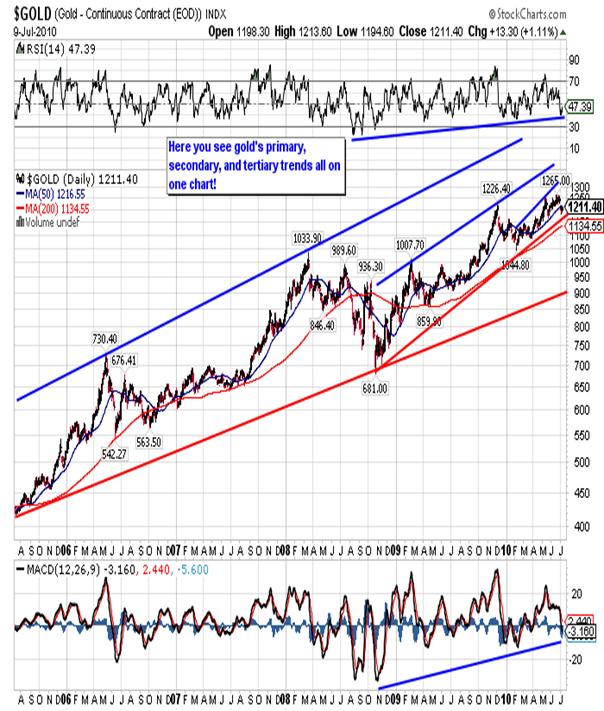

For those of you who subscribe to the idea that a rising dollar is bad for gold, you’ll see that over the same exact time frame the yellow metal has ground its way higher:

Over the past nine months gold has rallied with and without the dollar, with and without the stock market, and in the face of a declining commodities market as well as a deflationary environment. More than anything else, gold has an army of unfaithful, ready to jump ship or sell it short on a moment’s notice. Gold has a bullish primary, secondary and tertiary trend and yet it can’t buy a friend with a bucket full of Krugerrand!

Over the last decade central banks and international institutions like the IMF have done everything possible to suppress the price of gold. England sold half of the UK’s gold supply, the IMF announced it was selling 400 tons at a crack, Greenspan called it a barbarous relic, and now central banks are being urged to sell it in order to raise cash to inject into the world’s economy, and yet gold’s price continues to move higher. Analysts of the stature of Robert Prechter call end after end to the bull market and yet the yellow metal continues to move higher. If I believe everything I read and hear, gold doesn’t have or deserve a friend in the world and yet it is the proverbial “little engine that could”. I have been in the markets for a long time and I have never seen anything like it. I have been very bullish the yellow metal since it bottomed at 681.00 way back in October 2008, and it has gone up steadily since then, almost doubling in price, and yet every hiccup generates disbelief, anger and feelings of betrayal. People can own stocks in the Dow and not blink when it drops 1,000 points in a week but gold falls $30.00 in a day and you’d think the world was coming to an end.

INVESTMENT RESULTS (FIVE-YEAR PERIOD)

ITEM PRICE(2006) PRICE(2010) PROFIT(LOSS)

DOW 11,200 10,198 (8.95%)

S & P 1,230 1,077 (12.44%)

US$ 88.50 83.94 (5.16%)

US BOND 117.00 126.28 7.93%

CRB INDEX 315.00 437.00 38.73%

OIL 62.00 76.00 22.58%

GOLD 425.00 1,211.00 284.98%

CHINA 1,150.00 2,470.00 114.78%

Even the darling of the financial world, China’s Shanghai Stock Exchange, pales in comparison, so can someone please tell me why very few people know about gold and even less people own it. I didn’t choose a five year period because it sets up well, you can go back ten years and the results are more or less the same, and if you go back fifteen years gold is still a winner. So why is acceptance so difficult? The answer is not as complicated you might think. Imagine a spectrum with gold on one end and fiat currency on the other end; the light versus the dark side respectively. Fiat currency is backed by nothing, is mandated by government decree as money, and as the old proverb says, money is power. Now gold is rising against every single major currency in the world, without exception, and that is eating into the power base of every major authority in the world. Gold cannot be devalued, it cannot be created out of thin air, and it cannot be relegated to the sidelines as Greenspan tried to do in the 1990’s. It’s been around for 5,000 years, it is recognized around the world, and there is a word for it in every language. In short governments have mandated that gold should not be discussed and that’s how it is.

Everybody is calling for the next big decline and someone is trying to push the price lower every single morning as New York opens for business, and yet it closed at 1,211.40 on Friday and just 3.3% below the all-time closing high, and still my e-mail sentiment gauge indicates that someone must have died! Amazing to say the least! As for gold’s future over the coming weeks and months, I remain adamant that the price of gold is headed higher sooner as well as later. Last week we had a sell-off down to good support at 1,185.40 and then buyers went bargain hunting. I expect gold to try and move back above the critical 1,219.20 area sometime this week, and sooner or later it will succeed. Contrary to popular belief, this leg up still has quite a ways to go, first to test the 1,298.10 resistance and then onward and upward to the 1,372.80 target. Gold is not done and it is taking its own sweet time in going about its business. This is because deflation makes the going a bit slower, but in the end you’ll end up with even higher prices than you would have had inflation taken hold. Finally I would like you to take a look at the following chart, and then I will end this analysis with a question:

Question: What is wrong with this chart?

Answer: Absolutely nothing!!

Solution: Buy gold today and every month! Don’t analyze it, or fret over it; just buy it and put it away someplace safe. Keep it to yourself. Don’t tell your friends and neighbors, not even your own family. If you try to explain your reasons, they look at you first with pity, then with curiosity, then with envy, and finally with hatred. Keep your own council and head toward the goal. You’ll be glad you did.

In conclusion nothing has improved. Yes, gold could fall and stocks could rally over the short term, but the final chapter for the Fed’s policy of infinite indebtedness has been written. As sure as Mussolini ended up hanging from a pole in the town square, with a group of little old ladies and beating on his cold dead body with baseball bats, the Fed is going down in flames. You have a choice, you can go with it or you can choose your own path. Could you fail? Could you possibly be wrong? Of course you could. There are no guarantees in life. But if I am going to make a mistake, it’s going to be my mistake. I will not follow a herd of sheep over a cliff. I will bet against paper and I will bet on gold. The latter has been around for five millennia while no fiat currency currently in use was around one hundred years ago. That doesn’t mean that you go “all in”, or that you have to somewhere down the road. You simply make small bets, at regular intervals, on the only real store of value that there is. Everything else is a pretender to the throne. If you don’t know how to buy gold, or you don’t know how to bet against paper, let us know and we’ll point you in the right direction.

[Please note that the new website at www.stockmarketbarometer.net will become operational this week. Also, note that you can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).]

By Steve BettsE-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.