Currencies, Crude Oil and Emerging Stock Markets Moves to Build On

Stock-Markets / Financial Markets 2010 Jul 10, 2010 - 06:16 AM GMTBy: Chris_Ciovacco

Last week, we mentioned stocks could surprise by year-end. Some hopeful signs supporting that thesis are being given in the commodity, currency, and stock markets. Specifically, recent moves in the U.S. dollar, crude oil, Australian dollar, S&P 500, emerging markets, and Sweden provide some additional evidence a double-dip recession is not as likely as some believe.

Last week, we mentioned stocks could surprise by year-end. Some hopeful signs supporting that thesis are being given in the commodity, currency, and stock markets. Specifically, recent moves in the U.S. dollar, crude oil, Australian dollar, S&P 500, emerging markets, and Sweden provide some additional evidence a double-dip recession is not as likely as some believe.

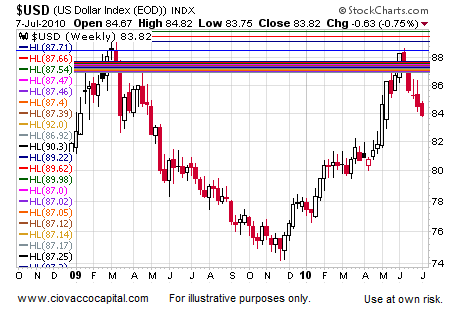

Despite monster deficits, the U.S. dollar has served, somewhat ironically, as a safe haven currency since the financial crisis began in late 2007, early 2008. While the U.S. dollar’s impact on the markets is often overstated, the pattern has been when investors are risk averse, they buy U.S. dollars; when they are more willing to embrace risk, they tend to sell U.S. dollars.

Without much fanfare, the U.S. dollar has dropped for six straight weeks, including the current week. This may be foreshadowing a return of risk appetite, which would tend to be good for stocks, commodities, and commodity-dependent currencies. All things being equal, if you are bullish on risk, you would rather see a weak dollar than a strong dollar. Weekly charts are shown in all cases below.

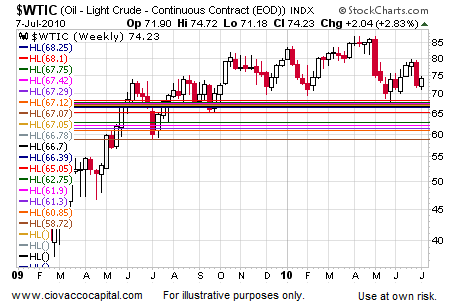

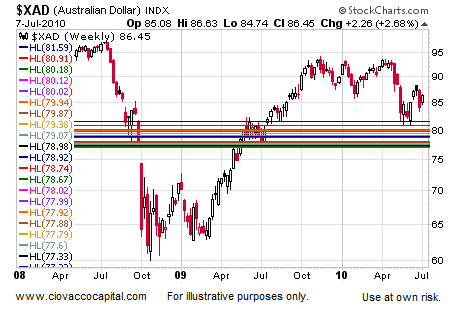

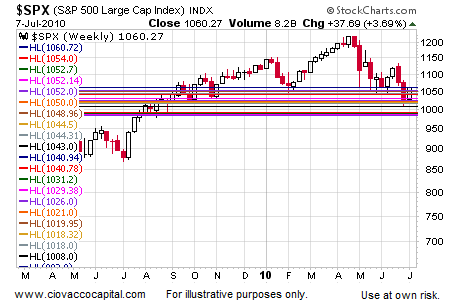

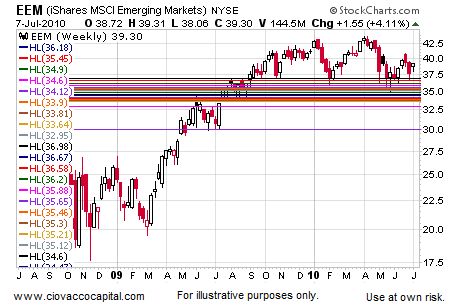

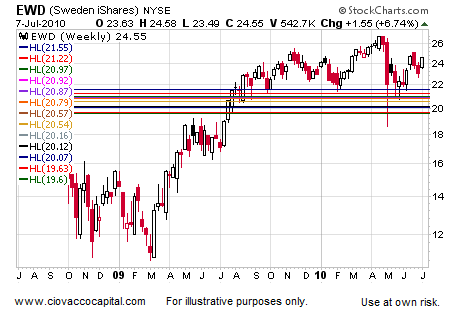

We use larger versions of the charts shown here to monitor price levels where buyers have perceived value in the past and price levels where buyers have felt a market is expensive. Past behavior can help us with possible future behaviors. The horizontal lines represent areas that have been important to market participants in the past, sometimes going back to the 1990s.

Crude oil’s recent relative strength does not support an imminent double-dip recession. Unlike the S&P 500, crude oil did not make a lower low in June. The fact buyers did not allow crude to make a lower low tells us something about their perception of future economic growth. Admittedly, a move of this duration could be a simple bounce, but a positive turn has to start somewhere.

Australia’s economy is highly dependent on the global demand for commodities. It stands to reason the Australian dollar is highly correlated to the commodity markets. In the past, market participants have become interested in the Australian dollar in a range between roughly $77.00 and $81.50. As if on cue, buyers recently stepped in as the Australian dollar dropped below $81.50. Continued strength in the Australian dollar would be an encouraging sign for future economic growth and risk assets in general. Recent economic data points to slower growth, but slower growth is not synonymous with a double-dip in terms of its possible impact on bull markets.

The chart of the S&P 500 is shown for comparison purposes. The relative strength of oil, the Australian dollar, and emerging market stocks (below) do not seem to align with a recession being around the corner.

If you are bullish on risk longer-term, you should hope emerging market stocks begin to reassert some leadership. Emerging market economies have grown in terms of their significance to overall global growth. Emerging markets bottomed first as we entered the current bull market. Unlike the S&P 500, they have not revisited their lows made in late May 2010; this is also a positive sign for risk in general.

The news from the European Union has been a tad on the negative side in recent months. The European Union is composed of 27 sovereign Member States: Austria, Belgium, Bulgaria, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden, and the United Kingdom. While Sweden does NOT use the euro as its currency, any positive news coming from Member States helps lessen concerns about a total meltdown in the European debt markets. Sweden’s equity markets (represented via the ETF below) have not made a new intraday low since the early May flash-crash, which shows impressive relative strength vs. other risk assets.

All the markets above may be participating in a dead cat bounce, but given where we are in the current economic and market cycle (relatively early), we believe these are hopeful signs that should be monitored. As outlined in more detail in Outlook For Stocks Positive Longer-Term, it is way too early to make a firm call, but the current attempt at a rally could mark the lows for the year. Many have been waiting for an opportunity to sell into a rally, which means we should expect some bouts of selling even if stocks manage to get up off the deck.

Additional comments can be found in Short Takes.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.