U.S. Treasury Bonds Safe Haven Could Sink

Interest-Rates / US Bonds Jul 10, 2010 - 01:17 AM GMTBy: Casey_Research

By David Galland, Managing Editor, The Casey Report writes: This morning I read an interesting story in Soundings magazine. It recounted the final voyage of the S.S. Morro Castle, purportedly one of the safest ships afloat back in 1934 when it regularly transported revelers on junkets between New York and Havana. Then, on the night of September 8, a series of unfortunate events occurred that ended with the ship washing up on the New Jersey shore the next day, close to half of its 300 or so passengers dead.

By David Galland, Managing Editor, The Casey Report writes: This morning I read an interesting story in Soundings magazine. It recounted the final voyage of the S.S. Morro Castle, purportedly one of the safest ships afloat back in 1934 when it regularly transported revelers on junkets between New York and Havana. Then, on the night of September 8, a series of unfortunate events occurred that ended with the ship washing up on the New Jersey shore the next day, close to half of its 300 or so passengers dead.

First, the ship was hit by a storm. Then, while fighting the towering waves, the veteran captain clutched his chest and fell dead from a heart attack, moving a less experienced man into command.

Next, a ship's steward discovered a group of drunken passengers entertaining themselves by flicking lit cigarettes into a trash can in one of the salons. About an hour later in that same salon, a fire broke out.

With the ship still battling through the heavy waves, the crew now had to turn to putting out the fire - but were shocked to discover that there was no water pressure, rendering the fire hoses useless.

With the ship still battling through the heavy waves, the crew now had to turn to putting out the fire - but were shocked to discover that there was no water pressure, rendering the fire hoses useless.

Making matters decidedly worse, shortly afterwards the fire ignited an explosion that blew out the salon window, sucking in the air necessary to turn the blaze into an inferno.

Quickly thereafter, the raging fire burned through critical ship's wiring, causing the electricity to short out. That, in turn, resulted in a failure in the steering, leaving the ship helplessly afloat in the turbulent seas.

With the blaze rapidly spreading, the replacement captain gave the command to abandon ship, but as there had been no lifeboat drills, the scene quickly descended into chaos and death that ended several hours later with the burned-out hulk washing ashore... turning the floating party palace into the ruined remains seen in the photo here, in the proverbial blink of an eye.

The story resonated with me on a number of levels, but first and foremost as a cautionary tale that even when everyone agrees that something is "safe," events can quickly prove otherwise.

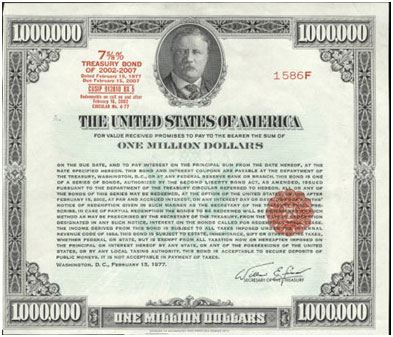

For example, in the current economic context, U.S. Treasuries are considered the safest of harbors for storm-weary investors. But that assumption contains within it the further expectation that the status quo will prevail - that, proverbially speaking, no captains will drop dead, or drunken passengers will set a fire by playing a truly mindless parlor game. Further, should such unexpected events occur, a widespread belief holds that the water pressure will be there when needed, and that the power won't cut out at the worst possible moment.

That's a lot of assumptions. And those just named are specific only to a ship at sea - not the complex system of the U.S. economy, which is, in turn, but a cog in a globally interconnected market. In other words, a system that is unimaginably complex.

In the pre-history days of emerging human consciousness, upright apes viewed the overt expressions of the complex system that is nature - volcanic explosions, lightning, seasons, drought, pestilence, etc. - and tried to make sense out of it all by organizing around belief systems that today would be considered laughable. At the time, however, dancing around open fires bedecked in certain animal skins or allowing shamans to sacrifice virgins were seen as effective methods for controlling the natural chaos of things.

Even though the nature of our belief systems has grown less barbaric, we modern humans still persist in nonsensical notions and associated rituals that are viewed in much the same light - rituals that do little more than pretend to control the chaos intrinsic to life on this small globe spinning through space.

Most prevalent among the modern belief systems is that shamans of government and high finance can, by virtue of their Harvard degrees and clearly advanced intellects, effectively manage large economies. The fallacy in this notion should be evident to everyone - here in the U.S., it's as simple as noting how everyone from the Fed chairman to almost all of the nation's political leaders and the best and brightest on Wall Street failed to anticipate the current crisis. Any way you slice it, the lot of them were caught as flatfooted as the crew and passengers on the last voyage of the Morro Castle.

One minute, big party... the next, diving over the side of a ship to an uncertain future in mountainous, storm-tossed waves.

Forget assuming the power and water will stay on - for the shamans to have missed the pending crisis is akin to the ship's captain entirely dismissing even the idea that a storm at sea were possible.

But a failure of foresight isn't the worst of it. The worst of it comes from the idea that, when troubles do arise, the modern shamans can dissect the entrails and proscribe a regulatory brew that magically solves the troubles, and solves them for essentially all times.

Case in point, currently the European Union is laying the bricks for a new round of regulations that limit bankers' compensation and require some substantial percentage of any bonuses they receive to remain in escrow for years, and be payable only if the bank does well. The eurozone is not alone; similar legislation is in the works in the U.S. as well.

This, we are told, will somehow prevent any further excessive risk taking of the sort that laid the world's economy low. This, of course, completely ignores the lead role the world's governments played in creating the debt bubble at the heart of the crisis - but that's not a topic the shamans will be addressing anytime soon.

Even so, I would concur that in the cases where a bank receives government funds - which it shouldn't - the government, as shareholders, could agitate with other stakeholders to vote down excessive, or excessively risky, compensation schemes. But that's an entirely different thing than a heavy-handed new attempt at regulating out all risk in the banking sector. Should such regulation pass, and it likely will, all it will actually serve to do is create an exodus of the more intelligent members of the sector to banks operating in less restrictive regimes. Money goes where it is treated best, and so do bankers.

And, again, this is just a speck of dust on a broader body of legislation and regulation that will get much worse before it is finally revealed for the virgin burning that it is.

Am I suggesting that any and all regulation should be done away with? I have to admit I find that idea tempting because it would immediately create an environment in which people would have to rely on their own judgment - or on that of those they trust - before making an important decision.

Think about it. What would happen if the government pulled its deposit guarantees from the banking system? I can assure you people would pay a lot more attention to the capital levels and loan policies of their financial institutions.

That said, I can get my head around the idea that some minimal operational standards may need to exist. Flipping back to the cruise ship metaphor, I could see some requirement that the proverbial fire dousing systems be kept up to code, and that the steering has a backup system. But even if those standards didn't exist, I have to believe that cruise ships would soon learn to compete on safety measures as well as luxury.

Alternatively, people could risk sailing on a less expensive and somewhat less secure line... or not take a cruise at all. It's not a perfect world, and not everyone is going to enjoy the perfect life, no matter how much the shamans promote the idea that they can deliver just that.

Back to the financial matters, it's increasingly important to view the steady passage of draconian legislation and regulation in much the same light you'd view the sacrificing of virgins. In almost all cases it accomplishes nothing and solves nothing. In fact, as often as not, it is decidedly counterproductive - lulling people into a false sense of security or causing them to make misguided decisions about their businesses or finances. Not to mention forcing businesses to spend money that could otherwise be invested more profitably on nonsense such as carbon taxes.

Back to the financial matters, it's increasingly important to view the steady passage of draconian legislation and regulation in much the same light you'd view the sacrificing of virgins. In almost all cases it accomplishes nothing and solves nothing. In fact, as often as not, it is decidedly counterproductive - lulling people into a false sense of security or causing them to make misguided decisions about their businesses or finances. Not to mention forcing businesses to spend money that could otherwise be invested more profitably on nonsense such as carbon taxes.

Of course, I am but an inconsequential squeak in the night: The current belief system will remain intact for many years into the future, probably the rest of our lifetimes.

Thus, the best thing you can do is to become as self-responsible as you can - trusting no shaman and approaching every important decision with a clear understanding that if things go wrong, no one - and no entity - will be there to make it right. Increasingly, as the sovereign states get noticeably bankrupt, that will be the case.

Viewing the world in that context, it's hard to consider the unbacked IOUs of any government a safe investment, no matter how fancy or elaborate are the shamanic runes decorating the paper.

David Galland, investing legend Doug Casey, and economists Bud Conrad and Terry Coxon make up the editorial team of The Casey Report. Every month, they analyze big-picture trends in the making and find the best investment opportunities to profit from them. To learn how to make money even in the worst of times - click here.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.