Signs of a Very Sick Stock Market

Stock-Markets / Stock Markets 2010 Jul 09, 2010 - 07:16 AM GMTBy: Steve_Betts

"The very existence of the state demands that there be some privileged class vitally interested in maintaining that existence. And it is precisely the group interests of that class that are called patriotism." --- Mikhail Bakunin, Russian anarchist

"The very existence of the state demands that there be some privileged class vitally interested in maintaining that existence. And it is precisely the group interests of that class that are called patriotism." --- Mikhail Bakunin, Russian anarchist

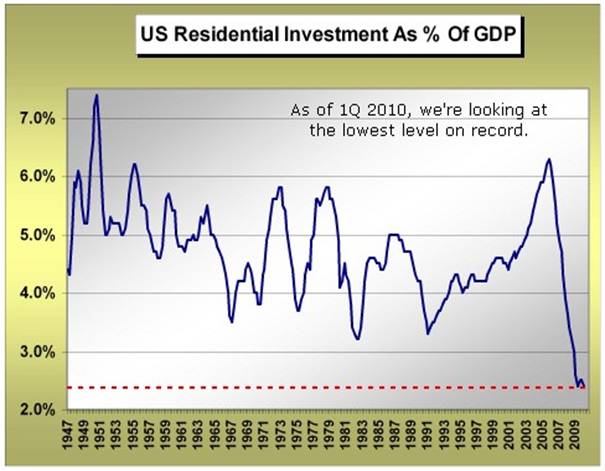

The world is rejoicing with the good news this morning as claims for unemployment benefits took an unexpected drop. This completely overshadowed the fact that the nationwide foreclosure rate is 3.2 percent, meaning that more than 12 percent of mortgages are now delinquent or in foreclosure. Florida and Nevada lead the nation in non-current mortgage loans, with 22.4 percent and 21.8 percent respectively. Additionally, the number of delinquent loans that are “cured” (become current) is declining, meaning that fewer and fewer people who become delinquent on their mortgages are able to catch up on payments. Yesterday I mentioned that the occupancy rate for commercial property is as low as it’s been in seventeen years and yet it pales in comparison with the problems facing the housing market. Take a look:

This is at the lowest level since they began keeping records and, together with consumption is the life blood of the US economy.

Over in Europe the European Central Bank chose to leave interest rates unchanged and that shouldn’t come as a surprise to anyone. With respect to the current situation the ECB president, Jean-Claude Trichet said they are still providing “unlimited liquidity” in the form on one week to three month loans. He then went on to say that we are living in an environment of “high uncertainty”. I wonder if he figured that out all by himself! In any event the ECB is now awaiting the results of stress tests being applied to European banks and savings and loans. It’s amazing how closely the ECB is sticking to the Fed playbook, especially since there is absolutely no evidence that the Fed has had any success.

Owning stocks today is the equivalent of having lodging in the first class deck of the Titanic. Yesterday we saw a 90% up day as the Dow rallied 274 points to end the day at 10,018. This is the seventh 90% up day since the April 26th high and has been mixed in with no less than ten 90% down days and I see this as a sign of a very sick market. The last 90% up day came on June 15th and then the Dow proceeded to lose 800 points over the next nine sessions. A look at the Dow’s daily chart also shows that it recently completed the head-and-shoulders formation and the down trend from the April 26th high is not even close to being violated. Finally, I’ve read a number of commentaries by noted analysts, including Richard Russell, where they say the Dow is extremely oversold but that just isn’t the case. The RSI is currently at 47.84 and that is in neutral territory. What’s more RSI hasn’t dipped below 30 in months. In case if you’re curious, a look at the weekly and monthly charts (not posted) paints the same picture of a neutral market.

I’ve also circled the so-called “death cross” that occurred a couple of days ago in the Dow, and indication that the downward trend will be gaining strength over the coming weeks and months. A similar event occurred with the Shanghai Stock Exchange back in March and you can see how that turned out. As some of my clients know by now, I think the Dow is following the Chinese market so this chart gives you a glimpse of the future. Right now the Dow appears to be distributing in a range from 10,334 to 9,704, and once that is over we’ll see a quick trip down to 9,064 and maybe even lower. The current reaction has stocks up 65 points at 1:30 pm EST and should be running out of gas sometime this afternoon or tomorrow morning. Then we’ll retest the support at 9,704.

Finally, many of you took umbrage at my recommendation to sell 25% of your gold stocks. Let me say that my concern is derived from the possibility that the financial markets could cease operations, for days or even weeks, at some point later this year. If that happens you could own the best gold stock in the world, gold could go up like a rocket (or fall like a stone), and you’re absolutely helpless to do anything about it.

The greatest stock in the world isn’t worth the paper it’s written on if there is no market to trade it in. Remember 9/11 when the Dow was closed for a week and you couldn’t get out of stocks while wondering if another attack was imminent? What I see coming will be worse. If I own physical gold and silver, I can bury it in the back yard or barter it. I have alternatives. If the market closes down the only alternative you’ll have is a corrupt black market that will pay you 50 cents on the dollar if you are lucky. I am not willing to take that risk so I am going to unload my gold stocks over the next couple of weeks, take 25% of the proceeds and buy physical silver, and turn the rest into Swiss Francs and wait for better days.

[Please note that the new website at www.stockmarketbarometer.net will become operational this week. Also, note that you can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).]

By Steve BettsE-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.