Gold Swap with BIS is Positive for Gold

Commodities / Gold and Silver 2010 Jul 07, 2010 - 07:16 AM GMTBy: GoldCore

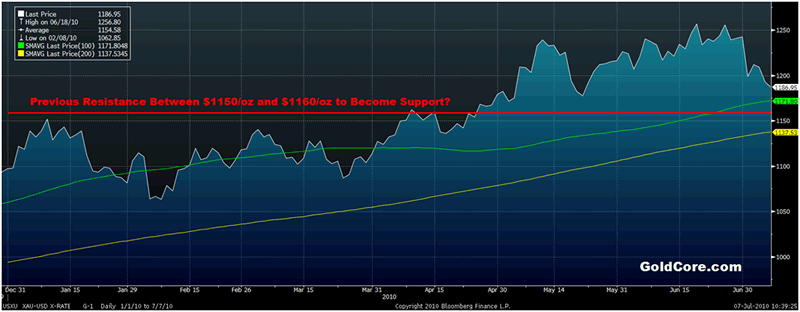

Risk aversion has returned today with Asian equity indices mostly down and European bourses also under pressure early after the increased risk appetite seen yesterday faded. Equities and commodities surged in value in Asia and European trade yesterday, but Wall Street did not follow through with equities giving up their early gains and ending up marginally. The increased risk appetite saw gold come under pressure again yesterday and once $1,200/oz was breached, gold quickly fell to the $1,190/oz level. Technical damage has been incurred and further falls to support at $1,160/oz seem possible.

Risk aversion has returned today with Asian equity indices mostly down and European bourses also under pressure early after the increased risk appetite seen yesterday faded. Equities and commodities surged in value in Asia and European trade yesterday, but Wall Street did not follow through with equities giving up their early gains and ending up marginally. The increased risk appetite saw gold come under pressure again yesterday and once $1,200/oz was breached, gold quickly fell to the $1,190/oz level. Technical damage has been incurred and further falls to support at $1,160/oz seem possible.

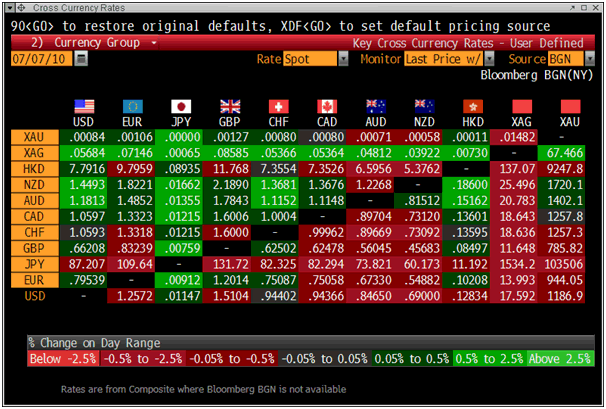

Gold is currently trading at $1,188/oz and in euro, GBP, CHF, and JPY terms, at €946/oz, £786/oz, CHF 1,258/oz, JPY 103,518/oz respectively.

Gold in USD with 50 and 200 Day Moving Average - 6 Month (Daily)

Short term vulnerability should not obscure the fact that the supply and demand fundamentals remain sound, meaning that gold's medium and long term prospects remain sound. Premiums for gold coins remain high and it is still difficult to secure British sovereigns and other European small gold coins (Swiss franc, French franc, German mark gold coins etc.) in larger quantities. Premiums for physical bullion internationally and in Asia remain healthy and even Japan is showing an increased appetite with premiums in Tokyo rising in recent days.

The gold market continues to digest the news of the 346 tonne gold swap with the BIS. There is a lot of uncertainty regarding the news which has not been confirmed or clarified by the BIS or the IMF. The Wall Street Journal said the swap was made by central banks while another respected financial newspaper said the sale was by commercial banks (see News below).

Speculation is that it was by central banks and may have been by one or a combination of three of the PIGS - Portugal, Spain and or Greece. The news may have led to weakness in the gold market yesterday and todayas it created uncertainty and jittery traders may have sold until clarity is gained.

A central bank or central banks having to resort to swap their best performing monetary asset in order to raise funds is a further sign of the distressed state of the international financial and monetary system. The fact that the central banks swapped the gold rather than sold it is also an indication of their favourable view of gold and a sign that central banks are increasingly unlikely to liquidate gold holdings. Indeed, they look set to become net buyers of gold again in 2010.

While 346 metric tonnes of gold sounds like a lot, it is actually only worth some $13bn at current prices - miniscule compared to wholesale money markets and to foreign exchange reserves of creditor nations such as India, Russia and China. The news has created uncertainty which may lead to further short term weakness but it is bullish for gold long term.

The role of gold itself as an important safe haven currency within international currency reserves and within the monetary system is being increasingly appreciated. Indeed it is not beyond the realms of possibility that we may see gold sharply revalued in the coming months (as was done by Roosevelt in the 1930s) in order to stave off a deflationary depression and provide stability to the international monetary system.

Silver

Silver is currently trading at $17.61/oz, €14.02/oz and £11.65/oz.

Platinum Group Metals

Platinum is trading at $1,505/oz and palladium is currently trading at $434/oz. Rhodium is at $2,450/oz.

News

(Bloomberg) -- Gold demand in China, the world'ssecond-largest consumer, gained in the first half as governmentmeasures to cool the property market and falling equitiesspurred investment demand, the Shanghai Gold Exchange said. The total volume of gold traded on the exchange jumped 59percent in the first six months from a year earlier to theequivalent of 3,174.5 metric tons, said Song Yuqin, vice generalmanager at the exchange. Silver turnover soared more thanfivefold, Song told a conference in Beijing today.

(Bloomberg) -- China's gold output this year maygain 5 percent from about 313 metric tons last year, SongQuanli, deputy party secretary general at China National GoldGroup Corp., China largest gold producer, said in an interviewtoday. "But the output growth cannotkeep up with the demandgrowth so far this year given investors' enthusiasm for physicalgold holdings such as gold bars," Song said. "Ourretail branches reported 30 percent to 40 percent growth insales in the first half of this year."Separately, the company is considering listing its non-goldrelated assets in Hong Kong, Song said.

(Bloomberg) -- Russia's central bank said the valueof its gold holdings advanced 2.8 percent last month to $28.2billion, in an e-mailed statement today.That's the highest level since Bank Rossii startedreporting the value of its gold holdings in 1993.

(Bloomberg) -- South Africa's gold and foreigncurrency reserves increased 1.4 percent in June as the bullionprice rose and the dollar's rally stalled, maintaining the valueof reserves held in precious metals and other currencies.Gross reserves climbed to $42.2 billion from $41.6 billionin May, the Pretoria-based Reserve Bank said on its websitetoday. Net reserves rose to $38.2 billion from $37.9 billion,according to the central bank."The Reserve Bank has stated its commitment to steadilybuild reserves so we expect to see a modest improvement," KevinLings, chief economist at Stanlib Asset Management inJohannesburg, said before the release of the data. "Goldwould've also helped."

(Bloomberg) -- Gold may rise to higher than $1,300an ounce in the second half of this year, GFMS Ltd. ExecutiveChairman Philip Klapwijk said in slides prepared for delivery ata Beijing conference today. "Investors will remain the principal driver of prices thisyear, with abreach of $1,300 in the second half a strongpossibility," he said in the slides.

(FT) -- European commercial banks have begun using their holdings of gold to raise cash with the Bank for International Settlements, in a further sign of strains in the money markets on which many rely for funding. The BIS, the so-called "central banks' central bank", took 346 tonnes of gold in exchange for foreign currency in "swap operations" in the financial year to March 31, according to a note in its latest annual report. In a gold swap, one counterparty, in this case a bank, sells its gold to the other, in this case the BIS, with an agreement to buy it back at a later date.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.