Gold and Gold Stocks are the Last Hope for Most

Commodities / Gold and Silver 2010 Jul 06, 2010 - 03:32 PM GMTBy: Jordan_Roy_Byrne

Tell this to a baby boomer or a middle aged person and they would be quite skeptical. Their neighborhood financial advisor or planner doesn’t advocate Gold. It is too dangerous. It could drop to $500. Gold stocks? Hell no! After failing to get you out of stocks not once but twice in the last ten years, your advisor tells you its time to play it safe. You need to save more.

Tell this to a baby boomer or a middle aged person and they would be quite skeptical. Their neighborhood financial advisor or planner doesn’t advocate Gold. It is too dangerous. It could drop to $500. Gold stocks? Hell no! After failing to get you out of stocks not once but twice in the last ten years, your advisor tells you its time to play it safe. You need to save more.

As we now should know by now, when it comes to the capital markets, conventional advice is eventually deadly. It identifies trends too late and fails to warn when risk increases and reward diminishes. However, most people would rather feel more comfortable than be a contrarian. Most people are too weak minded to find the answers, which usually oppose the herd.

Look at the capital markets today and the trends are clear. With global growth likely to remain low to stagnant for quite some time, stocks and commodities will not help your portfolio. Treasury bonds are performing well but the threat of severe inflation and sovereign bankruptcy looms. Precious metals are the only winner, yet the herd doesn’t see it that way. To them, the bull market in precious metals isn’t even a bull market. It is an aberration. It is a mistake.

The vast majority looks at the 1980s and 1990s as the norm. This is especially true of the financial industry. They don’t make any money from Gold and Silver so they don’t pay attention to it. It is only a nuisance. When will the financial media care about Gold? The answer is when it can make money selling Gold-related ads and products.

It is interesting how much has changed. Fifty or sixty years ago you were supposed to have 10% invested in Gold and that was regardless of market conditions. Today, the mainstream advisors and analysts that like and recommend Gold, own less than 10%. They like it but they are afraid of it. It reminds me of a quote: The philosophies of one age have become the absurdities of the next.

Most people look at the last 30 years as the norm, when the norm was the 170 years before that. Monetary systems are restructured several times per century. It’s nothing new. A monetary system without an anchor will ultimately fail. The greatest generation and their forefathers knew this and owned Gold. It paid off in their time. Those with a long view of history know that the real risk is the current monetary system and not Gold/Silver. Every fiat currency in history has failed. Is it doom and gloom to expect the current monetary system to fail? No, its just prudence and foresight.

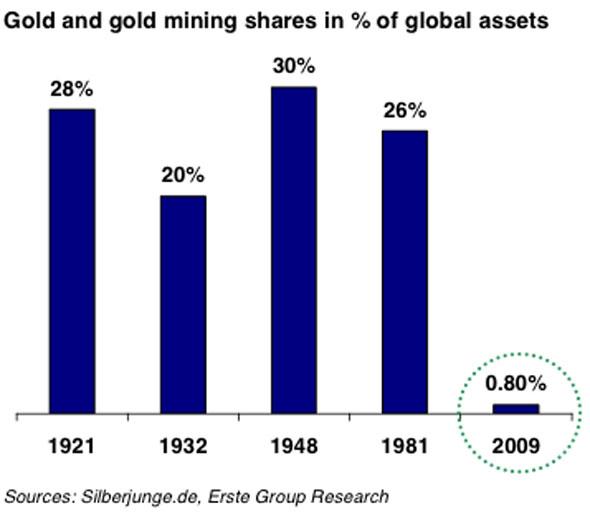

Now that we’ve established this let’s refute the bubble calls. Because of the recent collapse in so many markets and industries (technology, internet, homebuilding, mortgage finance, banking, oil) investing professionals and the public are now quite wary of any market that rises materially. Most will miss the coming explosion in precious metals because they are too scared of an eventual collapse. Yet, they don’t even realize that precious metals are not even close to bubble territory. If precious metals were really in a bubble then please explain this chart to me:

As of last year Gold and gold shares were 0.8% of global assets. If we are in a bubble then what was 1981? A volcano?

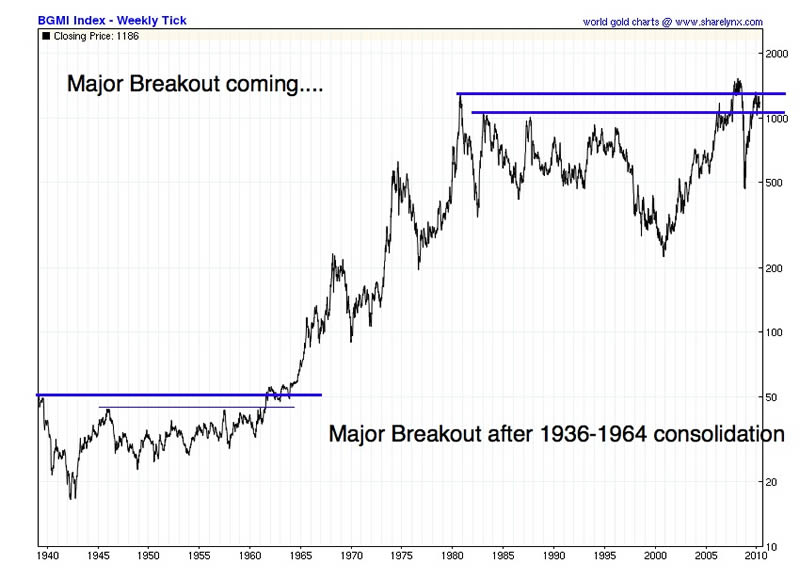

And how are we in a bubble when the gold stocks have yet to breakout to new all time highs. (See the chart below). In fact, one of the best times to buy is when a market is on the cusp of a breakout to new all time highs. There are numerous examples of this in history.

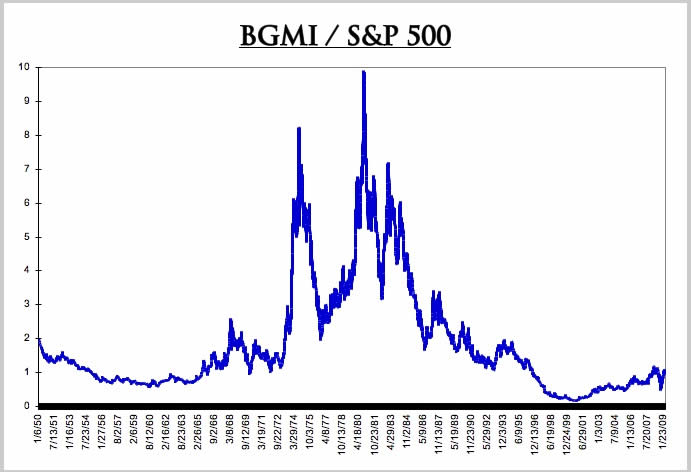

Moreover, gold stocks are still much closer to historic lows when compared to common stocks. See the chart below of the Barron’s Gold Mining Index against the S&P 500. It is highly probable that gold stocks will outperform common stocks over the next five years.

Meanwhile, even though Gold has outperformed stocks for 10 years, this chart suggests that outperformance has much more room to run. This is why one has to look at 100 years of history and not 10.

The reality is that too many investors will continue to make terrible decisions either on their own or through a mainstream advisor. They are convinced that precious metals are risky. You can’t even get them to put 5-10% of their assets in precious metals. We are talking about the only bull market! This isn’t 2003-2007.

Going forward, it is a near certainty that precious metals will outperform. Why? This is what happens in a major credit contraction. There is a run for real money. It doesn’t matter if there is hyperinflation or deflation. Since the crisis began we’ve had strengthening deflationary forces. Gold has advanced to a new all-time high and even higher against most currencies. Quality gold stocks have surged to all-time highs. Silver has outperformed nearly everything except Gold.

Amazingly, there is still time to get involved before the precious metals accelerate, leaving other markets in the dust. Looking to learn more? My publishers and I are hosting a CME-sponsored educational Webinar that will explain and educate on all things Gold, Silver and the mining stocks. It is completely free and you can sign up here.

We also maintain a professional service, which helps guide traders and investors through this bull market. We offer a free, no risk 14-day trial, which gives you access to a month’s worth of updates!

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.