Stock Market Trading, Two Issues You DON’T Want To Own

Stock-Markets / Stock Markets 2010 Jul 06, 2010 - 09:36 AM GMTBy: David_Grandey

Going into last week we said: “We’re in the middle of the road and could go either way”

Going into last week we said: “We’re in the middle of the road and could go either way”

Up to that point in time we were just looking at a normal pullback off the recent highs and everything was going according to that plan all up till the big gap down day. That gap pushed the markets down hard and fast and changed what was a normal pullback in the markets to a resumption of a full blown second leg down of this correction.

Make no mistake the markets are extremely oversold and a short cover rally could ensue at any time. It’s in that short cover rally that we want to initiate short-sell trades. But with the market being so oversold, we don’t want to do that here as in the short term on the short side we do not chase buses. We will watch for that short cover rally, or snapback rally as we often call it, and THEN we will look to go short.

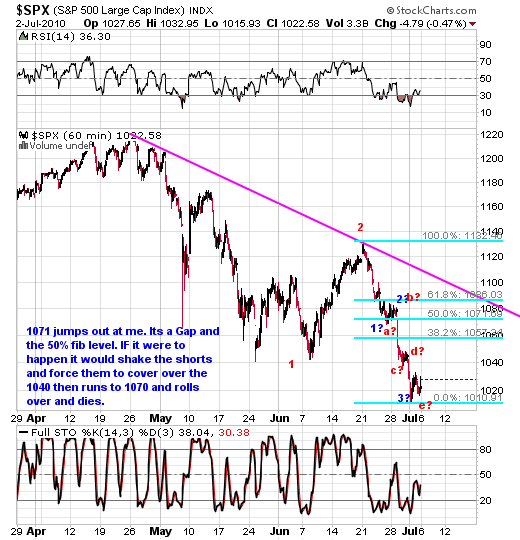

In the short term charts below we have laid out some potential short term bounce levels to be aware of (Fibonacci retracements in light blue). It doesn’t mean we are exactly going there as the market is the boss. But it’s levels that hold confluence and potential.

Going into early next week, we have what could be a little more some slop to deal with much like Thursday and Friday’s back and forth trade. There’s also the potential for a short term shake the tree for good measure if it wants to but we’ll take it one step at a time.

As you can see in the chart above the blue numbering shows that of wave 1, 2and 3 of 5 waves down. The red letters show (abcde) us being complete. If the blue numbers are in play we’ve got one more shake the tree coming early next week. If the red letters are in play (abcde) then we have our five waves down complete and it’s time for bounce mode.

Keep in mind bounce mode has initial resistance at 1040.

During that rally attempt we’ll want to really want to pay attention to many of the names that “didn’t get it” in the first leg down as those will be the prime candidates that could get it this next go around. Those are the ones we want to be short AFTER we get a bounce.

Those are also the names that we want to watch for bearish channels and the like to develop and use those patterns to short off of. But not now because we don’t chase buses.

Remember if the markets are zigging and we are zigging with it then all of a sudden it decides to zag we have to honor that. Why?

1. The market is the boss not us, the market is going to do what IT wants to do.

2. We want to stay in synch with it and trade in tandem with it. No easy task in volatile markets, but overall we’ve done a good job at rolling with the swings.

So to sum it up, the bullet points are:

Bounce

Reposition

And enjoy the next leg down.

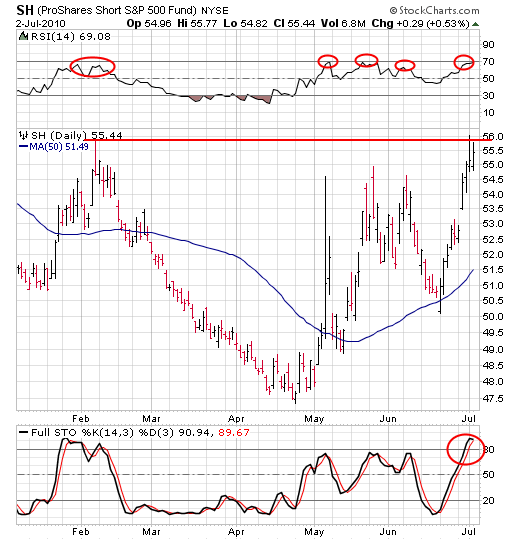

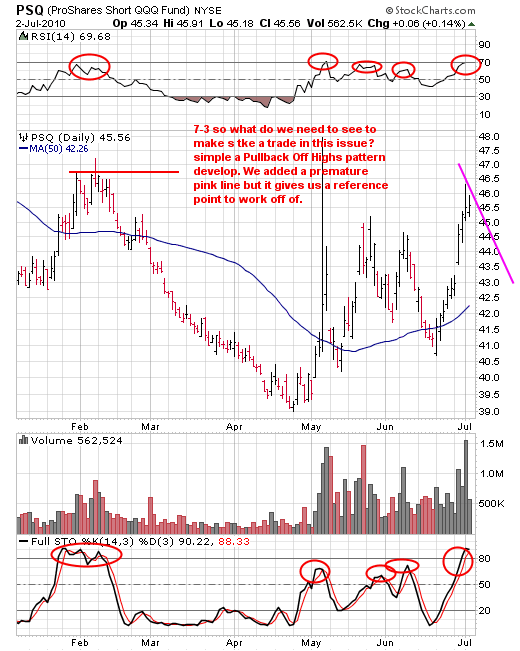

In the two issues you DO NOT want to buy department we have PSQ and SH which are both inverse index etf’s. As you can see they are both of the chasing the bus variety right now. But should they develop a longside Pullback Off Highs pattern we will want to look at them in the coming days/weeks. In PSQ we’ve drawn what we need to see develop in order to get us interested on the longside (Short exposure to the indexes) the same would apply to SH and every other inverse index ETF.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.