Stock Markets Treading Water as the U.S. Celebrates

Stock-Markets / Stock Markets 2010 Jul 05, 2010 - 10:19 AM GMTBy: PaddyPowerTrader

U.S. stocks dropped again Friday, pre the holiday weekend, condemning the Dow to its longest losing streak since the 2008 leg of the financial crisis, on concern the economic rebound is slowing after companies added fewer jobs than consensus expectations and factory orders slumped. General Electric, Caterpillar and Bank of America all shed at least 1.2% to lead the Dow to a seventh straight decline. Elsewhere Equity Residential, the largest publicly traded U.S. apartment landlord, fell 24% after Citigroup downgraded the shares. Airlines also retreated while drug makers rallied on takeover speculation.

U.S. stocks dropped again Friday, pre the holiday weekend, condemning the Dow to its longest losing streak since the 2008 leg of the financial crisis, on concern the economic rebound is slowing after companies added fewer jobs than consensus expectations and factory orders slumped. General Electric, Caterpillar and Bank of America all shed at least 1.2% to lead the Dow to a seventh straight decline. Elsewhere Equity Residential, the largest publicly traded U.S. apartment landlord, fell 24% after Citigroup downgraded the shares. Airlines also retreated while drug makers rallied on takeover speculation.

Double-dip fears are the pervading influence on market psychology at present even as European sovereign concerns appear to be easing. Friday’s release of the June US jobs report did little to alleviate such concerns but the headline payrolls number was less negative than the indications provided by other jobs data. To recap, nonfarm payrolls dropped by 125k, whilst private payrolls increased 83k. The unemployment rate dropped to 9.5% but worryingly this appeared to be due to a big decline in the labour force that will most likely reverse. The drop in hours worked and earnings, detailed in the report, also send ominous signals for consumer incomes and spending. But the muted response in the markets reflected that the data largely validated a worsening consensus view, reflected in the continual slide in equities over the last two weeks (S&P -10% over the period).

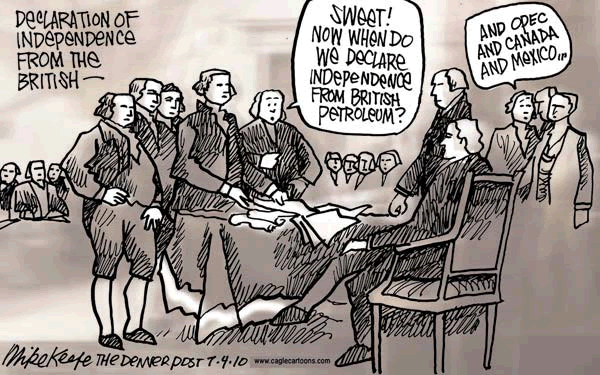

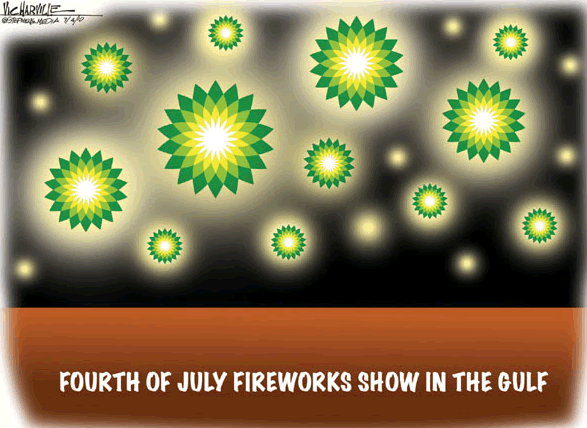

Monday lethargy and US holidays are keeping markets subdued this Monday in Europe. As we struggle for direction mining and basic resources stocks are softer on more disappointing data from China (see below) while BP has found a mild bid on walk of a search for a “strategic partner”

Today’s Market Moving Stories

•A Chinese services industry index slid to a 15 month low in June, adding to signs that the world’s third-biggest economy is cooling. The measure fell for a third month to 55.6 from 56.4, HSBC Holdings Plc and Markit Economics said in an emailed statement. Today’s data adds to manufacturing indexes last week and a services index released July 3 in signalling that growth is slowing as the government cracks down on property speculation and the effects of stimulus measures fade. A non-manufacturing index released by the Federation of Logistics and Purchasing on July 3 slid to 57.4 from 62.7 in May.

•This mornings UK services PMI came in weaker than expected in June, falling to 54.4 from the previous 55.4. The breakdown showed that, while new business increased to 53.4 from 52.8, the outstanding business declined to 46.7 from the previous 48.1, and, more importantly, business expectations the more forward-looking components of the index plunged to 64 from the previous 72.1. On a more positive tone the employment sub-index marked a modest increase to 50.1 from the previous 49.7. Price charged remained broadly stable (at 51.3), while input prices fell to 55.6 from the previous 58.2. While the headline figure remains high, pointing to a still decent growth momentum in Q2, some warning signals have emerged: firstly, the fact that the index is now clearly off the peak recorded in February this year, and, secondly, the dramatic drop in business expectations suggest that Q2 is likely to mark the peak of GDP growth (we expect 0.5% QoQ). Growth prospects in the services sector are in fact probably dampened by the ongoing financial market turmoil and the austerity measures taken by the new government in the emergency budget. The only encouraging signal remains the resilience in the labour market so far.

•Eurozone banking stress tests. Over the weekend, France’s Fin Min Lagarde said expect results on or around July 23. Trichet says results will be an “important element” in restoring market confidence. Munchau in today’s FT is less convinced. Says for results to have positive impact, the tests themselves must pass three tests: they must include realistic scenarios; they must be credible; and they must be backed up by a plausible re-capitalisation strategy. Scenarios must test banks under assumption of 50% haircut on Greek bonds. Reports last week that sov bond holdings will be subject to a uniform 3% haircut “is a joke”. Says reason 3% could be used is because it is official EU policy to deny reality that Greece might default or restructure.

•The IMF has called on the UK government to triple the levy it has proposed the country’s banks pay into a safety system. The Guardian newspaper picks up on the IMF’s suggestion that fund to pay for future banking crises and rescue efforts should be beefed up to £6 bln from the £2 bln suggested by the government. It said the IMF believed the banking system under taxed and that the British banks needed to contribute far more to a global fund.

•Concerned governments around the world are curtailing stimulus measures too soon has spurred Barton Biggs to sell about half of his stock investments this week. Biggs, whose Traxis Partners LLC gained 38% in 2009 when he bought equities after the S&P 500 Index fell to a 12 year low, sold most of his U.S. technology holdings, he told Bloomberg Television yesterday. Signs the U.S. economy is weakening convinced Traxis to reverse course as the S&P500 posted a weekly slump of 5 percent, bringing its loss since April 23 to 16 percent. Biggs, 77, said yesterday he cut bullish bets by about half since June 29, when they made up 70% of his fund.

•Separately BofA Merrill Lynch Global Research’s European equity strategist Gary Baker lowered his 2010 year end forecast for the Stoxx 600 to 275, citing downgrades to U.S. economic growth forecasts. Baker reduced his 2011 per share profit growth prediction to “sub-10 percent” from 20 percent previously, according to a report today. And Peter Oppenheimer, Goldman Sachs Group Inc.’s head of strategy for pan-European stocks, downgraded his stance on the industrial goods, technology and construction industries, according to a report dated July 2 reported by Bloomberg.

Germany’s Real Estate Market Seems To Be Taking Off.

According to a survey made by Germany’s Bausparkassen, Germany’s real estate market is about to strengthen further, despite ongoing price declines in many other property markets worldwide, Der Spiegel reports. In March, apartment prices rose 8.5% YoY, the largest increase in 20 years. For instance, in Dresden (East Germany) prices for an 80m² flat rose 11.1% YoY, while in Frankfurt, Stuttgart and Hamburg prices rose around 7% YoY, in Berlin 5% YoY and in Munich 4.4% YoY. What is more, demand is growing for used single family houses, especially those close to city centres. In Munich (most expensive), an average single family house costs €750,000, up 3% YoY. In Wiesbaden and Heidelberg, prices stood at €500,000, respectively.

Company / Equity News

•Today in Europe, UK media group Pearson ahead by 2% after it was upgraded to a hold from a sell at RBS which said that the shares are now at their target price and they no longer see material downside.

•Abengoa jumped 7.2% Monday after U.S. President Barack Obama announced $1.85 billion in loan guarantees to the Spanish company’s Abengoa Solar unit and Abound Solar Inc. to build sun-powered facilities in the U.S. that he said will create thousands of new jobs.

•Homebuilder Berkeley Group is ahead by 2% after a broker upgrade to “outperform” from “neutral” at Credit Suisse.

•HMV, the music and DVD retailer, is down 1% on news that the company may sell its Waterstone’s book chain, the Mail on Sunday reported.

•Travis Perkins, the owner of the Wickes home improvement chain, has agreed to buy BSS Group for £557.6 million to create the U.K.’s largest plumbing and heating chain. BSS shares gained 2.1 percent to while Travis Perkins shares thread water.

•German chipmaker Infineon is better by 1.5% after a Goldman Sachs research note which said it had a “positive view” of semi conductor stocks and Deutsche telecom is up 1.4% on a broker upgrade at Credit Suisse.

•UBS and Credit Suisse may be required to double or triple their equity under new rules expected to be announced in late August or early September, Sonntags Zeitung reported, citing an unnamed participant in discussions being held by an expert commission. The panel, charged with studying the “too-big-to-fail” issue, is also considering moves to ensure that banks’ overseas units operate independently of their Swiss headquarters and that they have their own equity, according to the newspaper. A third area being studied by the commission is rules covering bankruptcies, SonntagsZeitung said.

•The UK government could begin to sell its stake in RBS as early as next year, according to chief executive Stephen Hester.

•Embattled BP has launched a search for a strategic investor to help secure its independence as it moves to defend itself against potential takeover bids, according to the Sunday Times. The company’s advisers are trying to drum up interest among rival oil groups and sovereign wealth funds to take a stake of between 5% and 10% at a cost of up to GBP6 billion, the paper says, without citing sources. BP management fear a takeover approach as soon as it has plugged the leaking oil well in the Gulf of Mexico, which is expected in the next few weeks. The Guardian is reporting that the Kuwait Investment Office is in talks about increasing its stake in the company to 10%. BP is up 2.5% today.

•General Motors plans to register for an initial public offering in mid-August, intending to use the proceeds to pay down debt and fund pension plans, Reuters reports Friday, citing a person familiar with the situation. GM spokeswoman Noreen Pratscher declined to comment. The company, which underwent a short stay in bankruptcy in 2009, hasn’t set the valuation for the shares and is likely to accept a lower figure rather than delay the IPO past August, the report says. The U.S. government, which owns nearly 61% of GM’s common shares as the result of a $50 billion bailout, plans to sell $10 billion to $12 billion inshares, sources said.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.