Gold Suffers Sharp Correction on Fund Liquidation

Commodities / Gold and Silver 2010 Jul 02, 2010 - 06:16 AM GMTBy: GoldCore

Gold has bounced after yesterday's 3% fall to $1,206.70 an ounce with traders deeming the sell off overdone and bargain hunters entering the fray. Fund liquidation of equities, commodities and gold amid low volume, thin trading ahead of the holiday weekend contributed to the extent of the sell off yesterday. They will likely be a factor again today as markets await the important nonfarm payrolls data. Analysts expect the employment numbers to disappoint again today and this could lead to safe haven demand as it has done on recent poor employment reports. However, should a poor non farm payroll number lead to a further sell off in equity markets than gold's short term correlation with equities could be in evidence again.

Gold has bounced after yesterday's 3% fall to $1,206.70 an ounce with traders deeming the sell off overdone and bargain hunters entering the fray. Fund liquidation of equities, commodities and gold amid low volume, thin trading ahead of the holiday weekend contributed to the extent of the sell off yesterday. They will likely be a factor again today as markets await the important nonfarm payrolls data. Analysts expect the employment numbers to disappoint again today and this could lead to safe haven demand as it has done on recent poor employment reports. However, should a poor non farm payroll number lead to a further sell off in equity markets than gold's short term correlation with equities could be in evidence again.

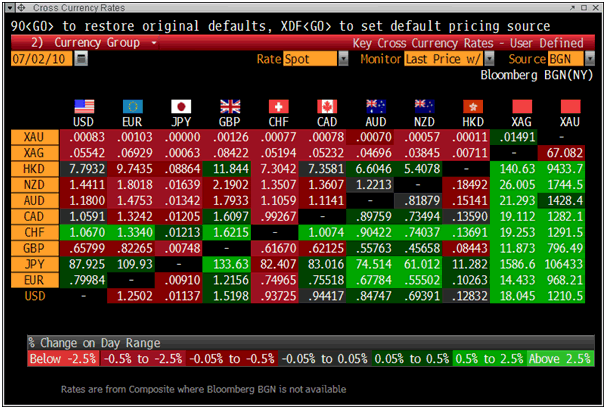

Gold is at the moment trading at $1,211.97/oz, €969.42/oz and £796.72/oz in dollars, euros and British pounds respectively.

Gold's technicals have deteriorated with gold falling through support yesterday and a close below $1,200/oz could see further falls to $1,165/oz. Gold is set for its second consecutive weekly lower close which is also short term bearish technically.

Another indication that gold may suffer further falls in the short term are the open interest gold futures numbers on the COMEX which rose to an all-time high on Wednesday when bullion prices rose on safe-haven demand in the face of weaker equity markets, exchange data showed. COMEX gold open interest climbed 4,654 to 605,792 lots on Wednesday, surpassing its previous record of 603,688 contracts. However, it would be wrong to assume that the record high numbers will definitely lead to further liquidation. Open interest figures could continue to increase and it is surprising that given the degree of uncertainty in markets that they have only reached record levels this week. Also, many of the longs may be of a more passive long term nature (a small but growing majority will wish to take physical delivery) and may not be as easily shuck out of the market as they have been in recent years.

Silver

Silver is currently trading at $18.02/oz, €14.42/oz and £11.85/oz.

Platinum Group Metals

Platinum is trading at $1,508.50/oz and palladium at $429/oz. Rhodium is trading at $2,325/oz.

News

Gold is nowhere near a bubble even after a record-setting rally, according to Jeff Clark, editor of the Casey's Gold & Resource Report investment newsletter.

The chart of the day compares the metal's price for immediate delivery since 2001, as compiled by Bloomberg, with its surge in the 1970s and the Nasdaq Composite Index's run-up during the 1990s.

"We've got a long way to go before we start legitimately using the 'bubble' word," Clark wrote in a June 26 posting on the website of Casey Research, the newsletter's publisher. The entry featured a similar chart.

Gold has risen nine straight years, its longest string of gains since at least the 1940s, and is poised to extend the streak this year. The precious metal was 13 percent higher for 2010 as of yesterday and traded at an all-time high of $1,256.30

an ounce on June 21.

Even so, gold's performance for the past decade pales beside its earlier advance. The 456 percent increase in its price since 2001 compares with a more than 16-fold jump, to $589.75 an ounce, between 1970 and 1979.

The Nasdaq Composite, boosted by a bubble in Internet-related stocks, increased about 11-fold between 1991 and 1999. The index peaked in March 2000 after rising another 24 percent. Yesterday's close was 58 percent lower than its record (Bloomberg).

The U.S. Mint sold 452,000 gold coins, weighing a total of 151,500 ounces, in June (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.