Asian Stampede Into Gold Safe Haven Hedge Against Government Debt Devaluations

Commodities / Gold and Silver 2010 Jul 01, 2010 - 10:52 AM GMTBy: Gary_Dorsch

What’s behind the Global Flight into Gold?

What’s behind the Global Flight into Gold?

The value of Gold has been subject to intense debate for centuries. Nathan Mayer Rothschild was once the richest man in Britain and probably in the world. In 1840, his company, - NM Rothschild was appointed as the bullion broker to the Bank of England and went on to operate the Royal Mint Refinery in 1852. When asked what the value of the barbaric metal was worth, Nathan used to reply, “I only know of two men who really understand the true value of gold – an obscure clerk in the basement vault of the Banque de Paris and one of the directors of the Bank of England. Unfortunately, they disagree.”

N M Rothschild & Sons rose to prominence in areas that included lending, underwriting government bonds, discounting commercial bills, direct trading in commodities, foreign exchange trading and arbitrage, and dealing in gold bullion. It was the brilliance and cunning of Nathan, who paved the way for the firm to become the first international banking cartel.

N M Rothschild & Sons rose to prominence in areas that included lending, underwriting government bonds, discounting commercial bills, direct trading in commodities, foreign exchange trading and arbitrage, and dealing in gold bullion. It was the brilliance and cunning of Nathan, who paved the way for the firm to become the first international banking cartel.

In 1870, the Rothschilds formed the world’s second largest oil producer, the Caspian and Black Sea Petroleum Company. The Rothschild’s financed DeBeers Diamonds, becoming the biggest shareholder, and financed the railroad system of Europe and the Suez Canal for Britain. By 1905, the Rothschild interest in copper miner Rio Tinto amounted to 30-percent.

NM Rothschild was heavily involved in the gold market for nearly two decades. In 1919, Rothschild was appointed to chair the London meetings of the five principal market makers that performed the daily gold fixing, and executed trades on behalf of customers, and as a principal, trading gold directly with customers.

So it was of great interest to bullion traders, when on April 15th 2004, with the price of gold trading at $402 /ounce, NM Rothschild & Sons, which had fixed the price of gold twice a day for 85-years, suddenly announced its withdrawal from the London Gold Pool. By withdrawing from the Gold Pool, NM Rothschild was no longer obligated to sell its gold to anyone, including central banks. Were the Rothschilds anticipating some new dynamics that would send the yellow metal soaring to new heights?

Since then, the yellow metal has tripled in value to around $1,250 /oz. Central bankers overseeing emerging economies have become net buyers of gold, and mergers and acquisitions in the gold mining industry, have put more of the yellow metal’s supply into fewer hands. Also tilting the balance into gold’s favor is the biggest explosion of the global fiat money supply in history.

Central bankers have monetized trillions of dollars worth of government bonds and mortgage debt, in Euros, British pounds, Japanese yen, and US-dollars. In response, investors from all corners of the globe, including central banks in China, India, Russia, and Saudi Arabia, have been accumulating vast quantities of gold, as a hedge to protect their purchasing power of their national reserves or savings.

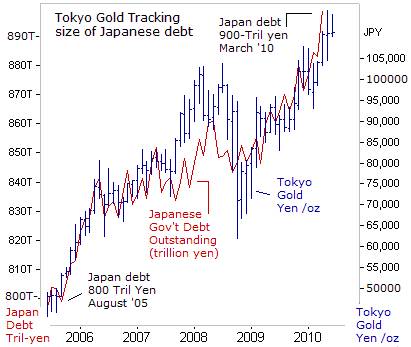

Tokyo Gold acts as a hedge against Government debt

Historically, Gold has been renowned as a hedge against inflation, by tracking the direction of key commodities, such as grains, crude oil, and industrial metals, for early clues about the future direction of inflation. Gold is also touted as a “safe haven,” from tensions between warring nations, currency devaluations, or dangers lurking from a banking crisis. Recently, the very same factors that have caused global stock markets to plunge have lifted the price of gold sharply higher. Today, the widespread integration of the global economy has made it possible for banking and economic failures in Europe or the US, to destabilize the entire world economy.

Historically, Gold has been renowned as a hedge against inflation, by tracking the direction of key commodities, such as grains, crude oil, and industrial metals, for early clues about the future direction of inflation. Gold is also touted as a “safe haven,” from tensions between warring nations, currency devaluations, or dangers lurking from a banking crisis. Recently, the very same factors that have caused global stock markets to plunge have lifted the price of gold sharply higher. Today, the widespread integration of the global economy has made it possible for banking and economic failures in Europe or the US, to destabilize the entire world economy.

Seeking to counter the worst downturn in the global economy, since the Great Depression years of the 1930’s, the “Group-of-20” finance ministers and central bankers initiated emergency support measures for their economies, which included issuing trillions in sovereign debt and printing trillions in paper currency. The IMF calculates debt in the Group of 20 economies will reach 118% of GDP in 2014, up from about 80% before the crisis, yet so far, the massive issuance of G-20 debt has avoided the ire of bond investors and credit rating companies.

However, one of the key drivers that’s been propelling the gold market to record heights, is the massive build-up of debt, - issued by the world’s biggest debtor nations. The dynamic is based upon a simple equation. At the end of the day, more debt will equal more money printing by central banks. Japan for instance, is issuing a record 44-trillion yen ($473-billion) of bonds this fiscal year, as falling tax revenues and the rising costs of supporting an aging population widened Japan’s deficit.

Japan’s public borrowings, including bonds and short-term bills, totaled a record 883-trillion yen as of March 31st, up 4.3% from a year earlier. Japan’s $8.73-trillion of outstanding debt equals 178% of its $4.9-trillion annual economic output, by far, the highest debt-to-GDP ratio in the world. Tokyo now spends 35% of its tax revenue on servicing its debt. As such, Tokyo has turned to the Bank of Japan (BoJ) to monetize, or buy-up to roughly half of its debt issuance this year, equaling 21.6-trillion yen of purchases of Japanese government bonds (JGB’s).

Japan’s public borrowings, including bonds and short-term bills, totaled a record 883-trillion yen as of March 31st, up 4.3% from a year earlier. Japan’s $8.73-trillion of outstanding debt equals 178% of its $4.9-trillion annual economic output, by far, the highest debt-to-GDP ratio in the world. Tokyo now spends 35% of its tax revenue on servicing its debt. As such, Tokyo has turned to the Bank of Japan (BoJ) to monetize, or buy-up to roughly half of its debt issuance this year, equaling 21.6-trillion yen of purchases of Japanese government bonds (JGB’s).

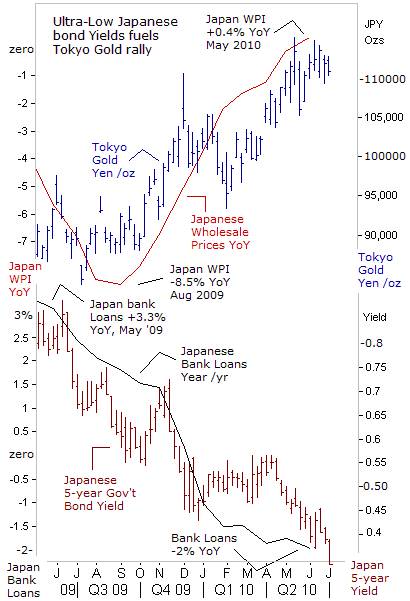

The BoJ’s monetization of the government’s debt has flooded the local banking system with ocean of liquidity, and is exerting downward pressure on bond yields. Despite an avalanche of new debt sales this year, and projections for a 57-trillion yen deficit next year, Japan’s 5-year bond yield tumbled to 0.34% this week, the lowest level in seven-years. The ability to print unlimited quantities of yen, by the central bank, and its coveted status as a member of the G-7 clique, has so far, allowed Tokyo to escape the debtor’s prison that the Greek government finds itself.

Despite the wide availability of ultra-low 0.1% borrowing rates, Japanese banks are finding few takers. Japanese bank lending is -2% lower than a year ago. There are signs that Japan’s fragile economy is stagnating again, and is at risk of a “double-dip” recession. Japan lost 240,000-jobs in May, the fourth straight monthly drop in employment, for a total of 820,000-jobs lost since February. The jobless rate rose to 5.2%, with the number of employed workers tumbling to a 20-year low.

Spending by working households in Japan slid -1% in May to a 24-year low in real terms, and annual export growth slowed for a third consecutive month. Japan could feel the pain from Europe’s debt crisis later, and European-bound shipments could take a hit from further rises in the yen against the Euro. Thus, Japanese bankers are funneling excess yen into JGB’s, and 5-year yields could approach zero-percent, if the central bank ramps up its money printing operations.

For yield starved fixed income investors in Japan, holding $16.5-trillion in domestic savings, the nightmare scenario is getting worse. Investing in higher yielding bonds overseas, entails substantial risks, from adverse currency fluctuations. However, for many investors, the safer bet is buying Tokyo Gold, which has increased in value by 150% against the yen, over the past five-years, for an annualized return of 30%.

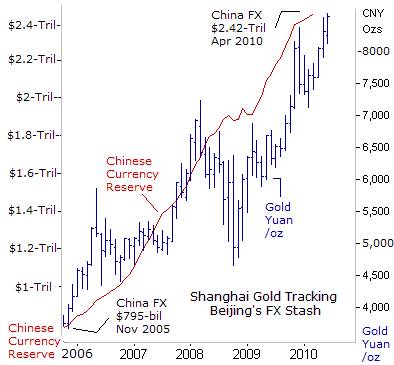

Shanghai Gold Tracking FX Reserves, Base Metals Tumble

When Far Eastern central bank buying of gold begins to outstrip Western central bank selling, the price of gold could soar to levels that most observers can scarcely imagine today. China has vaulted ahead of India to become the world’s biggest gold consumer, buying 461-tons last year, spurred by ultra-low Chinese bank deposit rates of 2.25% that are yielding less than the rate of inflation. Turnover of spot gold traded on the Shanghai Gold Exchange increasing +22.6% last year, and totaled 1.1-trillion yuan (US$162-billion).

When Far Eastern central bank buying of gold begins to outstrip Western central bank selling, the price of gold could soar to levels that most observers can scarcely imagine today. China has vaulted ahead of India to become the world’s biggest gold consumer, buying 461-tons last year, spurred by ultra-low Chinese bank deposit rates of 2.25% that are yielding less than the rate of inflation. Turnover of spot gold traded on the Shanghai Gold Exchange increasing +22.6% last year, and totaled 1.1-trillion yuan (US$162-billion).

China is also the world’s largest gold miner with output reaching a total of 310-tons in 2009. In Shanghai, traders keep an eye on the size of China’s foreign currency reserves, which has mushroomed to $2.45-trillion. Traders suspect the government is diversifying its currency holdings into gold, - clandestinely buying the yellow metal directly from state owned miners - and at lower prices than elsewhere.

If Beijing is buying gold from its own miners, then it’s exporting less, and keeping supplies off the world markets. The Chinese Politburo doesn’t need to disclose the size of its official gold reserves to the world, until it deems the timing to be strategically advantageous. China is in a tenuous position, since any announcement of even a small increase in its gold reserves could jettison the yellow metals’ price sharply higher. Beijing can play this card if or when it wishes to.

Gold and Base metals move in opposite directions,

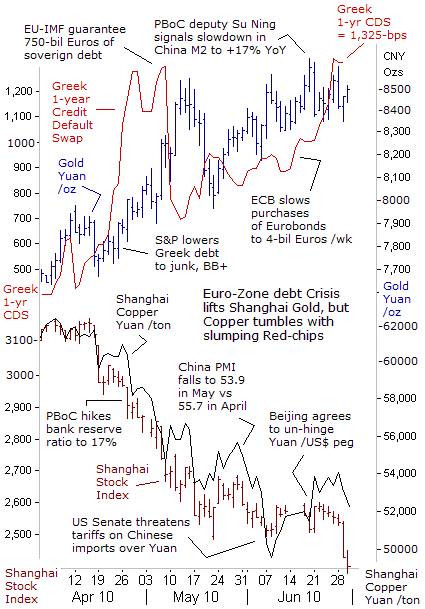

The specter of a Chinese – US trade war is just one of several worries that is driving the Shanghai red-chip index sharply lower this year. The Shanghai Composite index has tumbled to 2,398, its lowest close in 14-months, and is on course for a 22% slide over the second quarter, as the Euro zone debt crisis and a tighter Chinese monetary policy fueled a broad selloff. Property stocks have been very hard hit, amid fears that China’s real estate market could soon begin to deflate, which in turn, would badly hurt the earnings of China’s top banks.

On June 18th, Xia Bin, one of three top advisers on the People’s Bank of China's (PBoC) monetary committee, said China must pursue policies to tighten liquidity this year to deflate asset bubbles. He urged the PBoC and bank regulators to stick to plans to reduce new bank lending and curb property speculation. PBoC deputy Su Ning signaled that the central bank is aiming to slow the growth of China’s M2 money supply to +17%, from a +21% clip in May, and is also targeting 7.5-trillion yuan in new loans for this year, or roughly half of last year’s supply of credit.

On June 18th, Xia Bin, one of three top advisers on the People’s Bank of China's (PBoC) monetary committee, said China must pursue policies to tighten liquidity this year to deflate asset bubbles. He urged the PBoC and bank regulators to stick to plans to reduce new bank lending and curb property speculation. PBoC deputy Su Ning signaled that the central bank is aiming to slow the growth of China’s M2 money supply to +17%, from a +21% clip in May, and is also targeting 7.5-trillion yuan in new loans for this year, or roughly half of last year’s supply of credit.

This means that China's economy, the world’s biggest buyer of base metals, would likely slow from a +11.9% annualized growth rate in the first quarter, to around 8% growth by year’s end. The dollar’s upcoming devaluation, and /or threat of tariffs in the United States, is also likely to take a bite out of Chinese exports. Thus, global stock market operators cannot expect China to continue as the world’s economic locomotive that would protect it from the specter of a “double dip” recession.

Whereas base metals, such as aluminum, copper, nickel, and iron-ore, are tumbling in sympathy with the sharp slide in Shanghai red-chips, and fears of a global “double-dip” recession, the gold market has been moving in the opposite direction, climbing steadily higher to a record 8,614-yuan /oz. Shanghai Gold has been a safe haven from a “perfect storm,” –a Euro-zone debt crisis, a probable 5%-to-10% devaluation of the US-dollar versus the yuan, and instability in the Chinese banking system itself, due to souring loans on reckless real estate lending.

In 2009, China spent 343-billion yuan ($50-billion) on imports of iron ore and 206 billion yuan ($30-billion) on imports of copper, and $90-billion on crude oil, but it can expect to get better bargains on industrial commodities this year.

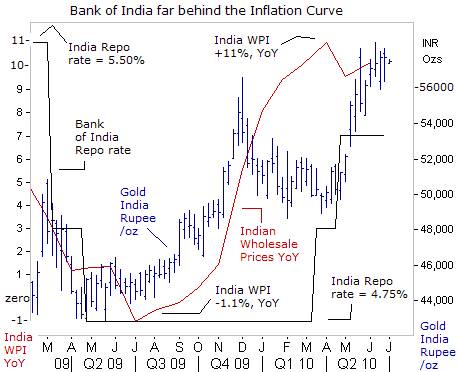

Bank of India Lingers far behind the Inflation Curve

In neighboring India, the central bank is lingering far behind the “Inflation Curve,” and is under considerable pressure to further tighten its monetary policy, despite the deepening troubles in the European and US economies. “For us, inflation is a bigger concern than Europe,” warned KC Chakrabarty, a deputy at the Reserve Bank of India (RBI), after a government report showed the benchmark wholesale-price inflation unexpectedly accelerated to 10.16% rate in May.

India’s manufacturing growth surged +19.4% higher in April from a year earlier, its fastest pace in 15-years, leading to capacity constraints, and cementing India;s inflation rate in double-digit territory for the remainder of this year. The RBI says the prevailing inflationary situation is very “worrisome” and has hiked its repo rate 50-basis points since mid-March to 5.50-percent. But the RBI’s rate hikes have done little to contain inflationary pressures or the surging Bombay Gold market, where the yellow metal hit a record 58,600-rupees /oz. The RBI is expected to deliver another hike of 25-basis points to 5.50% on July 27th, but “too-little and too-late.”

India’s manufacturing growth surged +19.4% higher in April from a year earlier, its fastest pace in 15-years, leading to capacity constraints, and cementing India;s inflation rate in double-digit territory for the remainder of this year. The RBI says the prevailing inflationary situation is very “worrisome” and has hiked its repo rate 50-basis points since mid-March to 5.50-percent. But the RBI’s rate hikes have done little to contain inflationary pressures or the surging Bombay Gold market, where the yellow metal hit a record 58,600-rupees /oz. The RBI is expected to deliver another hike of 25-basis points to 5.50% on July 27th, but “too-little and too-late.”

According to the Bombay Bullion Association the surge in gold prices wasn’t fueled by demand for physical bullion. Rather, gold imports into India are projected to have fallen by 75% in June from 30-tons a year ago. India has traditionally been the world’s biggest consumer of the yellow metal, so after many years of steadily investing when gold was cheap, Indian investors own roughly 20,000-tons of gold worth about $800-billion in private hands, according to trade estimates.

While almost the entire holdings are parked in physical gold, there is a new class of Indian investors who are looking to take exposure to the yellow metal through gold exchange traded funds (ETFs). There’s been a 57% surge in gold ETF accounts this year, the biggest in any category of funds in percentage terms. Two mutual funds investing into shares of gold mining firms have attracted 17-billion rupees.

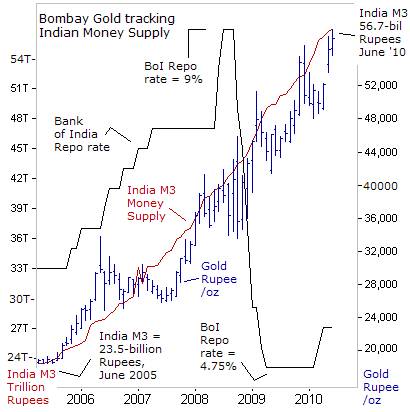

For Bombay gold traders, the yellow metal has served as a reliable hedge against the explosive growth of the Indian M3 money supply, which hit a record 56.7-billion rupees in June, or 140% higher from five-years ago. Even today, India’s M3 money supply is growing at a 14% annualized clip, far outpacing the 8% growth rate of its economy, and feeding the flames of inflation. Combined with historically low RBI interest rates, Bombay gold is going parabolic!

For Bombay gold traders, the yellow metal has served as a reliable hedge against the explosive growth of the Indian M3 money supply, which hit a record 56.7-billion rupees in June, or 140% higher from five-years ago. Even today, India’s M3 money supply is growing at a 14% annualized clip, far outpacing the 8% growth rate of its economy, and feeding the flames of inflation. Combined with historically low RBI interest rates, Bombay gold is going parabolic!

The RBI itself entered into an off-market transaction during October 19-20th 2009, by purchasing 200-tons of gold from the IMF at market-based prices, of an average of $1,045 /oz, trying to atone for a disastrous investment policy over the past two decades. India’s foreign exchange reserves have grown to $276-billion as of June 25th, of which gold comprised only $9.6-billion, or equaling just 3.4% of its FX stash, and down sharply from over 20% in 1994.

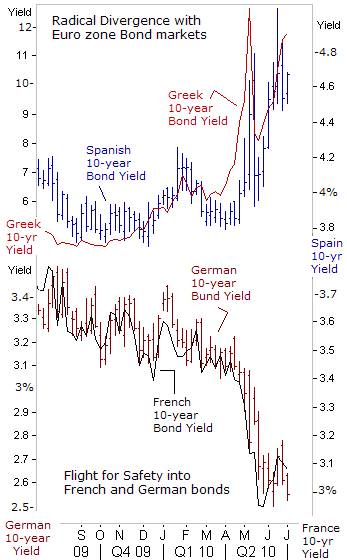

Fractures in Euro Currency, lifting Gold and Swiss franc

For almost a decade, yields on bonds issued by different Euro-zone governments moved in close synchronization. By joining the Euro-bloc currency regime, every member state could suddenly reap the benefits of “free-riding” or borrowing at almost the same interest rates as Germany, - the world’s fourth largest economy, - irrespective of whether the country’s finances justified the lower rate.

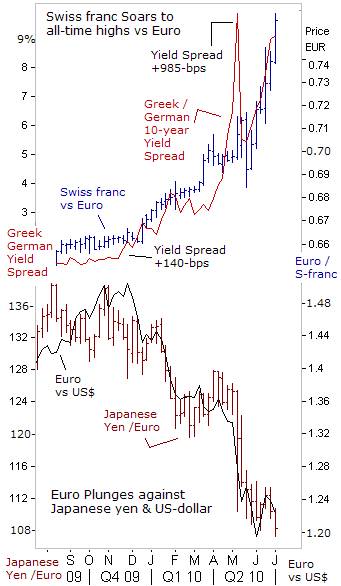

But as the Greek debt crisis exploded into mayhem in late April, yields in the Euro-zone bond market started to radically diverge. Global investors became more selective, and started demanding higher interest rates from member states with large budget and external trade deficits. Euro-zone yield spreads diverged more widely than at any time since the introduction of the Euro, with Germany and France enjoying the lowest interest rates and Greece and Portugal offering the highest.

The vision of Euro-zone economies and interest rates converging behind the shield of a shared currency, pulling Europe together economically in order to rival the might of the United States, has begun to unravel, raising skepticism about the long-term viability of the Euro itself, and sparking a flight into Gold as a safe-haven. Already, three Euro zone economies, - Spain, Greece, and Portugal, are under heavy attack from the global banking crisis and credit rating downgrades.

The vision of Euro-zone economies and interest rates converging behind the shield of a shared currency, pulling Europe together economically in order to rival the might of the United States, has begun to unravel, raising skepticism about the long-term viability of the Euro itself, and sparking a flight into Gold as a safe-haven. Already, three Euro zone economies, - Spain, Greece, and Portugal, are under heavy attack from the global banking crisis and credit rating downgrades.

Currency union may have narrowed the wide-gap between the richer and poorer nations of Western Europe, but the good times also masked the underlying structural differences between the various economies, which are now becoming more visible. The interest rate gap between the Euro countries is widening. Serious economists are wondering when the first state will go bankrupt. After that it’s only a short step to catastrophe - the collapse of the currency union.

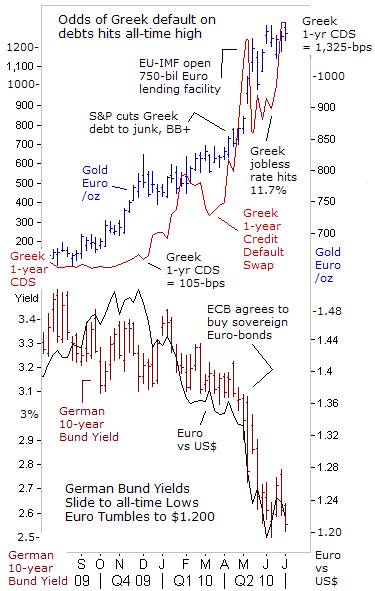

Membership in the Euro-currency was originally tied to strict budgetary discipline. The annual deficit of a member country was to be limited to a maximum of 3% and its total debt to 60% of the country’s gross domestic product (GDP). But for many years, Greece, Spain, and Italy took advantage of the easy money that came their way, borrowing beyond their treaty-set limits, while their trade deficits remained wide. But the music stopped when S&P downgraded Greece’s debt to BB+ on April 26th, or junk status, citing a budget deficit of approaching 14% of its GDP.

On May 10th, the wealthier Euro zone nations and the IMF, unveiled a €750-billion bailout fund, representing a gigantic transfer of public funds to the Oligarchic banks, who are creditors of Greece, Portugal, Spain, and other heavily indebted borrowers in the private sector. The “shock and awe” rescue plan, was the biggest since G-20 leaders injected money into the global banking system following the collapse of Lehman Brothers. Standby loans and guarantees are offered, that could be tapped by Greece, and any government shut out of credit markets. Teetering on the edge of default, the banks have averted catastrophe with repeated short-term fixes.

The ECB agreed for the first time, to directly buy government and corporate bonds, by printing Euros. Though it might delay the bankruptcy of certain European countries, such a bailout would not repay their debts or reduce their budget deficits. The existing €110-billion European-IMF bailout plan for Athens would only end-up increasing Greece’s debt, while provoking a catastrophic collapse of its economy by pushing through massive cuts in state wages, and a higher VAT tax.

Greek unemployment jumped to a 10-year high of 11.7% in the first quarter, and is tipped to keep rising to 15% through 2010 as a savage austerity plan designed to repair the recession-hit country’s public finances takes effect. In the credit default swap market, the odds of a Greek default or restructuring of its debts hit an all-time high of 1,325-basis points this week, signaling that the EU-IMF’s scheme to put out the wildfire in the Greek bond market has failed. Likewise, gold has soared to record heights against the Euro, tracking the Greek CDS market, anticipating severe distress in the European banking system in the months ahead.

Greek unemployment jumped to a 10-year high of 11.7% in the first quarter, and is tipped to keep rising to 15% through 2010 as a savage austerity plan designed to repair the recession-hit country’s public finances takes effect. In the credit default swap market, the odds of a Greek default or restructuring of its debts hit an all-time high of 1,325-basis points this week, signaling that the EU-IMF’s scheme to put out the wildfire in the Greek bond market has failed. Likewise, gold has soared to record heights against the Euro, tracking the Greek CDS market, anticipating severe distress in the European banking system in the months ahead.

The recent run-up in gold prices versus the Euro, up +20% so far this year, is tracking the widening yield spread between Greek and German bonds, on ideas that the divergence in yields represents the first cracks in the Euro currency union. If a Euro-zone banking crisis turns into a credit crunch, the temptation for weaker member states to opt-out of the Euro regime, in favor of currency devaluation, or debt restructuring might become unavoidable.

There’s been widespread capital flight out of the Euro and into other pathetic paper currencies, such as the Japanese yen, Swiss franc, and US-dollar. In foreign exchange, the winners are the least ugly currencies at any given moment in time. Year-to-date, the Euro has lost -14.3% against the US-dollar, down -18.3% against the yen, and -10.9% lower versus the Swiss franc, hitting a record low.

On June 30th, Austrian central banker Ewald Nowotny tried to put a positive spin on the Euro’s sharp devaluation. “The stability of the Euro is guaranteed. We are approximately within the normal levels. And in reality it has had advantages for us that this overvalued euro has gone down. This helps our exports,” he said. But in the marketplace, there are no guarantees, and every investment entails risk.

As for Greece, Portugal and Spain, they export little outside the Euro-zone and other European countries with currencies pegged to the single currency. Only 4% of Greek exports are shipped to countries outside of the Euro-zone, 7% of Spain’s and 9% of Portugal’s. Thus, their recession ridden economies are not expected to benefit from increased external demand for their goods driven by a slide in the Euro exchange rate. In contrast, Germany exports 22% of its goods outside of Europe. The weaker links within the Euro-zone could break apart, if a “double-dip” recession unfolds.

How should individual investors respond to the crises that lie ahead? “You have to choose between trusting the natural stability of gold and the honesty and intelligence of members of the government. With due respect for these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold,” George Bernard Shaw, 1928.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.