Wretchedness of Stock Market "Management"

Stock-Markets / Stock Markets 2010 Jul 01, 2010 - 04:16 AM GMTBy: Brian_Bloom

Wealth cannot be dropped by helicopters. The solutions to the issues facing humanity lie beyond the realms of finance.

Wealth cannot be dropped by helicopters. The solutions to the issues facing humanity lie beyond the realms of finance.

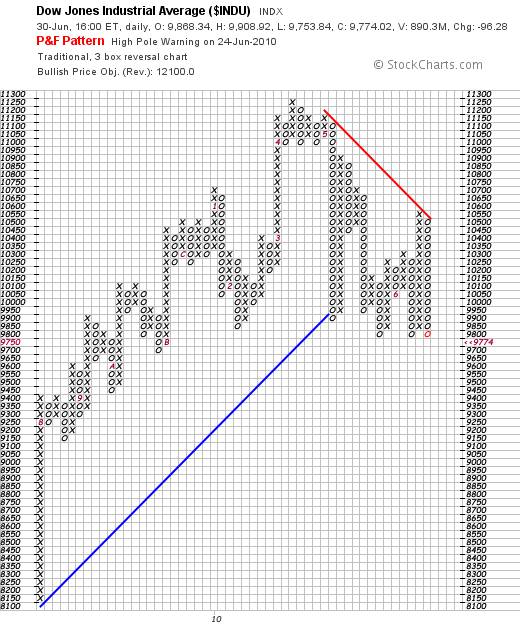

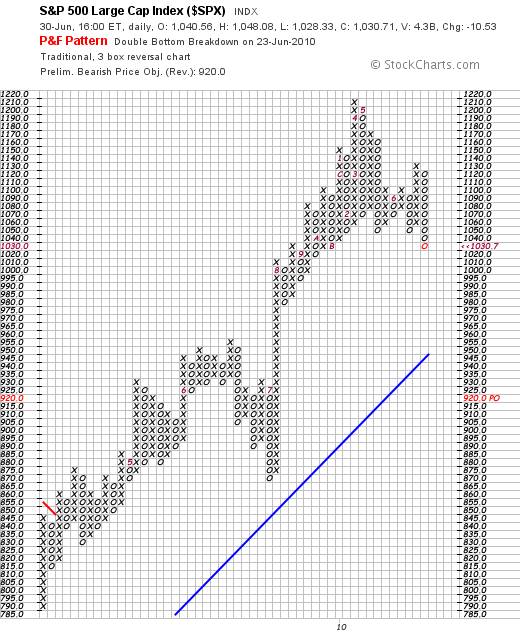

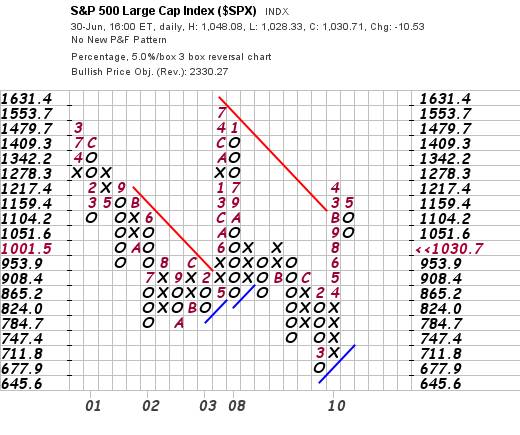

The first four charts below require no further comment. The Dow Jones consists of 30 stocks and it did not break to a new low on June 30th 2010. The Standard and Poor consists of 500 stocks and it did break to a new low (Charts courtesy stockcharts.com)

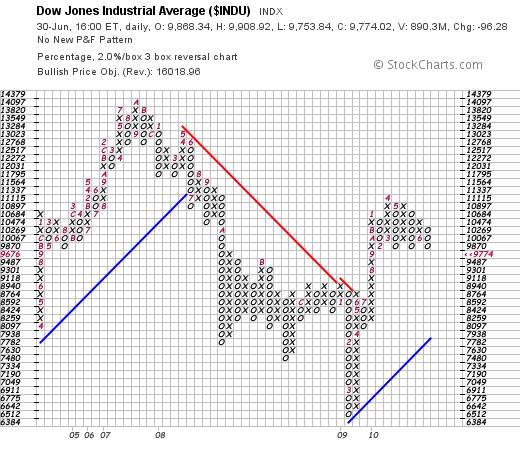

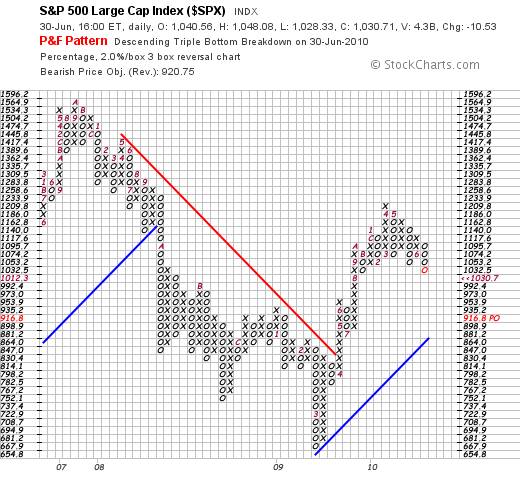

The next two charts reflect a different scale (2% X 3 box reversal)

If you study the next chart below (5% X 3 box reversal) you will see what happened following 2003. The market spiked from 865 to 1553 and then pulled all the way back to where it started from. “Theory” says, the market will pull back this time to at least 677.

The two upward spikes (from 2003 and from 2009) were caused by Fed intervention.

Not how bond yields dropped to a new low in 2003

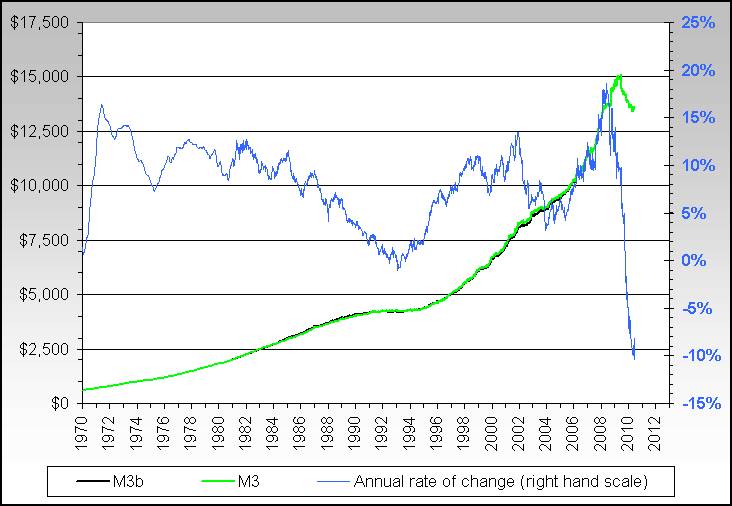

Note how, from the chart below, M3 money supply spiked upwards in 2003, then fell in 2004 and then was ramped upwards until early 2010 (Source: http://nowandfutures.com/key_stats.html )

In early 2010 the ramping stopped. In early 2010 equity markets gave their first major sell signal. (See: http://www.marketoracle.co.uk/Article16769.html written by this author and published on January 25th 2010)

Note also how the bond yield tanked immediately following the September 2008 crash – which crash was anticipated in the opening chapter of Beyond Neanderthal (published in June 2008).

The current market behaviour was also anticipated in the following article: http://www.marketoracle.co.uk/Article11361.html (Published June 16th, 2009)

In this June 2009 article reference was made to an earlier article – published in March 2009 – which explained why the rising stock market prices should be regarded as a technical bounce within a Primary Bear Market. (See: http://www.marketoracle.co.uk/Article9758.html )

Conclusion

In the interests of avoiding a long and rambling dissertation, the following is the “bottom line” conclusion of all the above and the preceding articles referred to (and some which I have also written but were not referred to here):

The Federal Reserve System does not exist for the benefit of the voting public. Whilst, ostensibly, it manages markets to smooth out the booms and busts, the reality is that it artificially prolongs the boom which, when the cycle reverses, results in a Primary Bear Market which is more savage than it would have been had the market just been left to its own devices. The reality is that the primary beneficiaries of the machinations of the Federal Reserve System are those who participate in the financial markets. These beneficiaries, when the markets eventually top out, fall away, glutted and satiated – leaving those who populate the opposite end of the financial spectrum financially destitute, confused and wretched. Wealth is created by entrepreneurial value-add activity. Economic growth is “driven” by small businesses which are owned by entrepreneurs and which are established to fill gaps in the market place. But these drivers are the visible drivers. The invisible driver is “energy”. The emergence of a new energy paradigm drives the emergence of new technologies. The new technologies are adapted to facilitate the creation of new products which replace legacy technology products. The “enemies” of these new technology products are the owners of the legacy technology products who are fat and happy. They do not want change. So they divert part of their cash flows to buy political influence to block the change. At the end of the day that is why the Kyoto Protocols were not ratified by the USA and Australia. The arguments regarding Carbon Dioxide causing Climate Change were just a side show. Climate change is driven by Astronomical forces. CO2 plays a small (but significant) role.

Author Comment

Fort almost 40 years I have been thinking about the drivers of world economic activity – but from a sociological perspective as opposed to a materialistic perspective. The next “wave” of energy will be Natural Gas but, in my view, it will not be sufficiently powerful to drive the world economy to new heights. The reason for this is that the world’s population has grown too large, too quickly; which is why the “energy per capita” output of fossil fuels has recently begun to contract. In my view, the sociological issues will not be addressed (as they have in historical times) by a relatively short, sharp, war. The US, for example, has seen its Defense Spending fall from 9.2% of GDP in the Cold War to around 4.2% today; and this ratio will likely fall further because Baby Boom entitlements are crowding out defense spending. In any event, nearly half of the US’s personnel on the ground in places such as Iraq and Afghanistan are contract workers. Wars are won on heroism. Money is not a cause to die for. Contractors will not fight for any cause. Therefore, the economic pressures will be long and lingering. The best we can hope for is that the Natural Gas wave will allow us to tread water whilst the world’s economic infrastructure is repaired. This will likely take 10-15 years from now. From 2025 onwards a new energy paradigm will (in theory) become sufficiently commercially viable to drive the world economy to new heights. There are those who believe that paradigm will be Nuclear Fission. I am currently drafting the manuscript of a factional novel – due for completion in 9-12 months time, which will take a hard-nosed but even-handed look at nuclear fission. The obstacles to success of Nuclear Fission as an economic driver go beyond merely technical issues. They go to the heart of how modern society is structured. In the meantime, Beyond Neanderthal remains (in my view) an unusually important book because it takes a holistic view of human society from the year 3,113 BCE to the present day. It examines the human issues which will need to be addressed, regardless of which energy paradigm we may finally embrace. It also examines – in some detail – a possible alternative to nuclear fission. We need to stop kidding ourselves. Whilst wind and solar are technologically very valuable and important technologies, they currently produce a tiny proportion of the total energy consumed in the world. I have heard some scientists make the case why “base-load” energy will be capable of being provided by solar and wind. They may be right, but that will require a paradigm shift in energy storage technologies (batteries). Lithium batteries are currently the “fashionable” proposed response to this challenge. Let’s not kid ourselves. What is needed is “industrial strength” energy storage technologies. Beyond Neanderthal is a factional novel whichproposes an alternative, outside-the-box, industrial strength response. It can be ordered via the website below or via Amazon.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.