The Only Stocks I’d Own Right Now

Stock-Markets / Dividends Jul 01, 2010 - 02:29 AM GMTBy: Graham_Summers

Because I regularly receive emails from investors who need to remain invested in stocks to the long-side, I thought today we’re discuss which companies to own and why.

Investing has never been easy, but the last 15 years have been some of the toughest investors have ever faced, largely due to the fact that the US stock market has either been in a bubble or post-bubble Crash for most of that time.

Indeed, we officially entered a bear market in 1999 (or 2007 depending on how you look at it) but because so much of the US’s collective wealth and economic activity relies on financial speculation, the Federal Reserve has essentially blown serial bubbles to combat the collapse ever since.

Because of this, many investors today view the stock market with suspicion. After all, if the only investing environments that occur are speculative bubbles or gut-wrenching collapses, it’s hard to find any fundamentally sensible reason to invest in stocks.

Thus, in order to get a sense of why anyone would want to buy stocks now, we need to consider how the markets operated before the doctrine of serial bubbles took over.

For starters, the first thing you need to know is that historically dividends have accounted for 70% of all stock market gains.

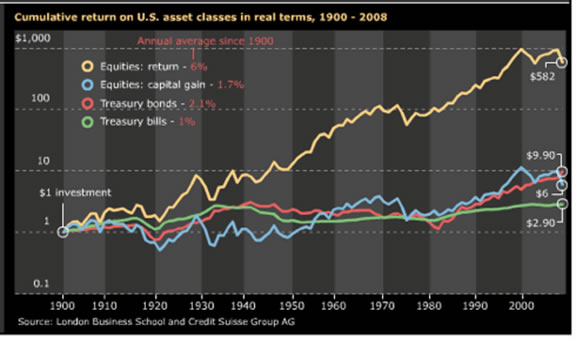

According to a study performed by the London Business School, when you remove dividends, stocks have returned a mere 1.7% in average annual gains over the last 109 years. To put this into perspective, this is less than you’d make from owning long-term US Treasury bonds (2.1%) over the same time period.

Indeed, if you’d invested $1 in stocks in 1900 and reinvested your dividends, by 2009, you’d have made $582 (adjusted for inflation). Take out dividends and you’d have only seen $6 from price appreciation. Yes, $6 from 109 years’ worth of capital gains.

Put another way, by focusing solely on capital gains when it comes to stock investing you’re only doubling your money about every 18 years (remember, this analysis simply focuses on the returns generated by the market… which outperforms most professional and individual investors).

So… if you want to remain invested in stocks to the long-side right now, make darn sure you own a company that pays a dividend. The benefits of this are multiple: aside from providing most of stocks’ historical returns, dividends also provide you with a cushion against market drops (if a company pays 3%, then stocks need to fall more than 3% for you to actually record a loss for the year).

Almost as important as the dividend itself, you want to make sure you own companies that will be able to maintain and hopefully grow their dividends. This means companies that have plenty of cash, little debt, and a history of raising dividends.

These criteria alone mean you’re likely to be investing predominantly in large caps (these are the companies that have the cash and the history of paying dividends). Here are a few that have increased their dividends recently.

If you need to stay long the stock market, companies like the ones above are a good place to start looking. But whatever you do, be sure to find companies that DO pay out a good dividend and that WILL likely raise it in the future.

Good Investing!

Graham Summers

PS. If you’re worried about the future of the stock market, I highly suggest you download my FREE Special Report detailing SEVERAL investments that could shelter your portfolio from any future collapse. Pick up your FREE copy of The Financial Crisis “Round Two” Survival Kit, today at: http://www.gainspainscapital.com/MARKETING/roundtwo.html

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.