Gold Consolidates Near Record Highs Up 12% in Quarter; Silver Up 6%

Commodities / Gold and Silver 2010 Jun 30, 2010 - 07:10 AM GMTBy: GoldCore

Risk aversion led to falls in equity and commodity markets yesterday but gold again managed to eke out a 0.5% gain. The complacency of recent months is being challenged by a raft of negative data and by increasingly precarious fundamentals. Concerns about Chinese and global economic growth and about the European banking system and sovereign debt are leading to continuing diversification into gold.

Risk aversion led to falls in equity and commodity markets yesterday but gold again managed to eke out a 0.5% gain. The complacency of recent months is being challenged by a raft of negative data and by increasingly precarious fundamentals. Concerns about Chinese and global economic growth and about the European banking system and sovereign debt are leading to continuing diversification into gold.

Gold is currently trading at $1,244/oz and in euro, GBP, CHF, and JPY terms, at €1,013/oz, £828/oz, CHF 1,344/oz, JPY 110,343/oz respectively.

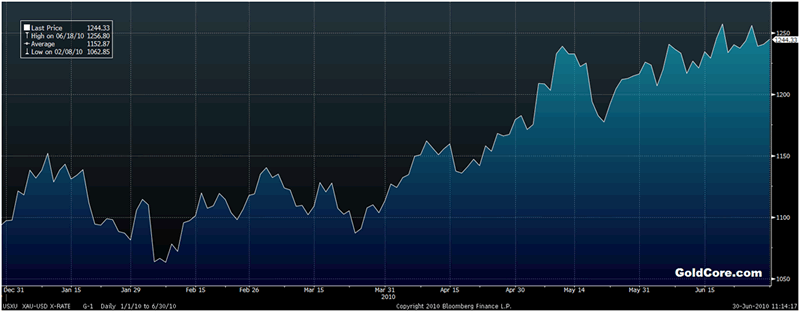

Gold in USD - YTD 2010.

Government bonds (particularly US) and gold remain the top performers in the quarter and year to date. While equities and commodities have come under pressure. Gold looks set for its biggest quarterly advance (+12% in USD) since the final three months of 2007 due to continuing safe haven demand. Gold's gains in other currencies, especially the euro, have been even larger (see charts).

Gold in GBP - YTD 2010.

The S&P 500 has dropped more than 10 per cent since the start of April and equities internationally have come under pressure. Commodities are heading for their worst quarter in more than a year on investors' concern that slower growth from China to the US will sap demand. The S&P GSCI Total Return Index of 24 raw materials plunged 10 percent since the end of March, led by declines in industrial metals, gasoline and crude oil. That is the steepest decline since the first quarter of 2009. The index fell 2.9 percent yesterday, the most in three weeks on concerns that the world's largest economy may experience a double dip recession.

The Russian espionage has created geopolitical tension and talk of 'Cold War' tensions. The alleged Russian spies were accused of collecting information ranging from research programs on small-yield, high-penetration nuclear warheads to the global gold market. This may lead to increased concerns that Russia could use its vast dollar and currency reserves as a geopolitical weapon in order to undermine the dollar and position the ruble as an internationally traded currency.

Gold in EUR - YTD 2010.

Silver

Silver is currently trading at $18.73/oz, €15.23/oz and £12.47/oz.

Platinum Group Metals

Platinum is trading at $1,543/oz and palladium is currently trading at $462/oz. Rhodium is at $2,500/oz.

News

Amid all the market doom and gloom, the world's largest gold fund is quietly celebrating another major milestone: SPDR Gold Shares, an exchange-traded fund backed by physical bullion, has recently surpassed $50 billion in assets. Driven by concerns over the euro zone sovereign debt crisis and a double-dip recession, investors have plowed $5.4 billion of net cash into the fund during the first five months. At the same time, gold prices have continued to set records - gaining 13.4% so far this year - helping boost the fund's size. As of Monday's close, the fund - boasts total assets under management of $53.3 billion. The fund - known as GLD because of its ticker symbol - now hoards a total of 1,316.18 metric tons of gold and rivals most of the world's central banks. If GLD were a central bank, it would rank fifth - just below France and above China. Gold's safe-haven trait was in evidence again on Tuesday, as stocks were hammered globally and commodity markets were mostly a sea of red. Gold futures for July delivery eked out a gain of $3.8, or 0.3%, to settle at $1,242 per troy ounce at the Comex division of the Nymex (Wall Street Journal).

Nearly a quarter of central banks believe gold will become the most important reserve asset in the next 25 years, according to an annual poll by UBS. The result highlights the sea-change in attitudes in the official sector towards the yellow metal. For two decades, central banks were net sellers of gold but that trend has reversed as central banks in Europe are scaling down their sales and others, such as China, India and Russia, are making significant purchases. Asked what the most important reserve asset would be in 25 years, about half of officials polled by UBS said the US dollar but 22 per cent pointed to gold. Bullion was the second most popular response, well above others such as Asian currencies or the euro. UBS surveyed more than 80 central bank reserve managers, sovereign wealth funds and multilateral institutions with over $8,000bn in assets at its annual seminar for sovereign institutions last week. The results were not weighted for assets under management.The reversal of the trend of central bank gold sales has boosted sentiment towards the metal while removing a significant source of supply (Financial Times).

When federal officials arrested 11 alleged Russian spies yesterday, it seemed natural that the accused agents would be interested in the CIA leadership, the Obama administration and Afghanistan. But who knew that they were goldbugs? James G. Rickards, senior director for market intelligence at Omnis, pointed us to the fact that the FBI complaint mentions that the global gold market was one of the key sources of interest of the Russian Federation and its intelligence agency, SVR. "On a number of occasions, the SVR specifically indicated that information collected and conveyed by the New Jersey conspirators was especially valuable. Thus, for example, during the summer and fall of 2009, Cynthia Murphy, the defendant, using contacts she had met in New York, conveyed a number of reports to [Moscow] Center about prospects for the global gold market." According to the complaint, the SVR responded in November 2009 that the information on the gold market was very useful and had been forwarded to Russia's Ministry of Finance and Ministry of Economic Development (Fortune).

Gold prices may extend this year's advance and climb to a record $1,385 an ounce, according to technical analysis by Barclays Capital. Barclays maintains its "bullish bias" for gold after the precious metal rose above the 21-day moving average (Bloomberg).

A new United Nations report released on Tuesday calls for abandoning the U.S. dollar as the main global reserve currency, saying it has been unable to safeguard value. But several European officials attending a high-level meeting of the U.N. Economic and Social Council countered by saying that the market, not politicians, would determine what currencies countries would keep on hand for reserves. "The dollar has proved not to be a stable store of value, which is a requisite for a stable reserve currency," the U.N. World Economic and Social Survey 2010 said. The report says that developing countries have been hit by the U.S. dollar's loss of value in recent years (Reuters).

UK consumer confidence fell for the fourth month in a row in June ahead of a budget that imposed hefty spending cuts and tax hikes in a bid to rein in a record national budget deficit, a survey showed on Wednesday. The GfK NOP Consumer Confidence Index dropped by one point to -19, the lowest level since December 2009, but still six points higher than this time last year (Reuters).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.