Gold, Silver and Austerity Versus Growth

Commodities / Gold and Silver 2010 Jun 30, 2010 - 02:20 AM GMTBy: Bob_Kirtley

We will kick off with a look at gold as she dances and teases her way around the previous record highs in a ‘will she or will she not’ frame of mind, as analysts wait patiently for a sign to hit the button. Is that a buy button or a sell button you ask? Austerity versus Growth is now the order of the day.

We will kick off with a look at gold as she dances and teases her way around the previous record highs in a ‘will she or will she not’ frame of mind, as analysts wait patiently for a sign to hit the button. Is that a buy button or a sell button you ask? Austerity versus Growth is now the order of the day.

There are many pieces of data that go towards influencing these decisions and one of them to look for is the unemployment figures for the United States which will be published on Friday. If they are close to expectations then their effect on market perception will be of a minor nature, however, if they are out with those expectations analysts will parlay them into something far more dramatic, that is until the next piece of data hits their screens. If you are not trading the market minute by minute then this sort of information can be misleading and cause you to take your eye of the major trends and react with a buy or sell order that does not fit in with your overall strategy.

If we step back a little then the advent of the G20 meeting comes into focus where the rhetoric appears to be behind a move to austerity and the balancing of the books. This has to be weighed against the possibility of such measures having a knock on effect on a fragile recovery. Whether the recovery has started or not is a debate for another day, what we see as the issue for today is whether or not the politicians have the courage or not to pursue the austerity solution with all the gusto that it requires.

Politicians and bureaucrats are short-term thinkers by nature with their main objective being to get re-elected, so our expectation is that they are not about to suddenly find a spine and do what is required. The exception to this opinion may well be the UK where the newly formed government appear to understand the problem and have announced measures that if implemented would go a long way to balancing the budget in around five years from now. Austerity is the medicine to provide a foundation for a sound economy, however, it will reduce the amount of disposable income that people will have to maintain consumer spending and in turn will reduce demand for goods and services resulting in a double dip recession.

However, when the general public reacts to theses measures, which are widely viewed as impositions not of their making, strike after strike will surely follow testing the resolve of any administration. So, what will they do then? They will do what they have done so far and print their little socks off, flooding the economy with more paper and inflating the money supply beyond belief.

Gold and silver have alerted us to this, with gold prices marching steadily forward for the last decade. So beware the words of the short term thinkers, the bubble heads, the precious metals bears, etc, and let the major trends be your guiding hand.

It appears to us that we are inundated with more and more articles by the ‘if it does that then do this and if it does the other then do the other’ brigade, which is understandable as we cannot see just what events lie in wait ready to throw our hard work, research and analysis off track. However, the trend still remains your friend so consider such deliberations as white noise and confine it to the background in order to avoid being forced into decisions that will surely cost you dearly in the long run.

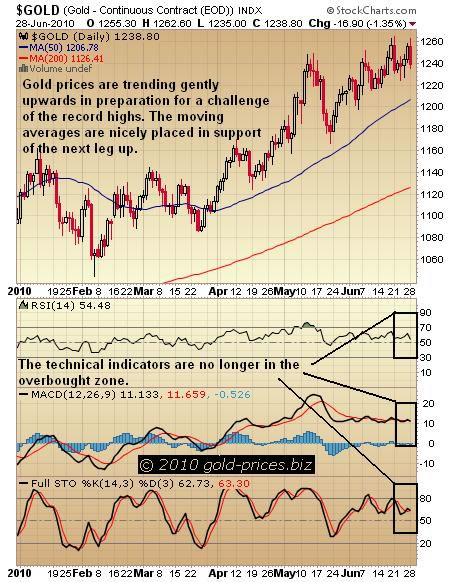

Taking a quick look at the above chart of gold prices we can see that they are trending gently upwards in preparation for a challenge of the record highs. The moving averages are nicely placed in support of the next leg up and the technical indicators have vacated the overbought zone, its a nice chart for a gold bug.

The chart below depicts the progress of silver prices which are also positioned nicely just above the 50dma with one eye on an upward thrust to the $20.00/oz level. Again the moving averages are lining up in support. The technical indicators are moving sideways at the moment which is fine and dandy for now.

Have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

The latest trade from our options team was slightly more sophisticated in that we shorted a PUT as follows:

On Friday 7th May our premium options trading service OPTIONTRADER opened a speculative short term trade on GLD Puts, signalling to short sell the $105 May-10 Puts series at $0.09.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Recently our premium options trading service OPTIONTRADER has been putting in a great performance, the last 16 trades with an average gain of 42.73% per trade, in an average of just under 38 days per trade. Click here to sign up or find out more.

Silver-prices.net have been rather fortunate to close both the $15.00 and the$16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.