The China Syndrome Has Stock Markets Seeing Red

Stock-Markets / Stock Markets 2010 Jun 29, 2010 - 08:37 AM GMTBy: PaddyPowerTrader

European bourses opened in the red Tuesday taking their cue from the Asian action overnight (Shanghai was down 4.3%). Investors were shocked when the Chinese conference board corrected its April gauge for the outlook of China’s economy. The index of Chinese leading economic indicators rose just 0.3% in April, so, far less than the 1.7% previously reported on June 15th due to a “calculation error” thus fuelling fears that the Chinese economy may be slowing at a much faster rate than the central government intended.

European bourses opened in the red Tuesday taking their cue from the Asian action overnight (Shanghai was down 4.3%). Investors were shocked when the Chinese conference board corrected its April gauge for the outlook of China’s economy. The index of Chinese leading economic indicators rose just 0.3% in April, so, far less than the 1.7% previously reported on June 15th due to a “calculation error” thus fuelling fears that the Chinese economy may be slowing at a much faster rate than the central government intended.

On top of this it appears that the much heralded IPO of Agricultural Bank of China (once muted to be worth $23 bn) was not exactly flying out the doors and they have been forced to cut the price of the initial public offering by a whopping $7bn. Sentiment was further soured by the news that Japan’s industrial production and household spending slipped in May, while the unemployment rose unexpectedly. This has raised concerns that the recovery in the second largest economy is beginning to slow.

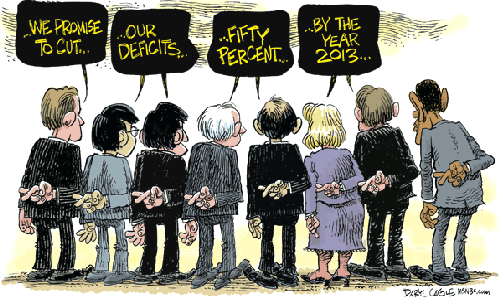

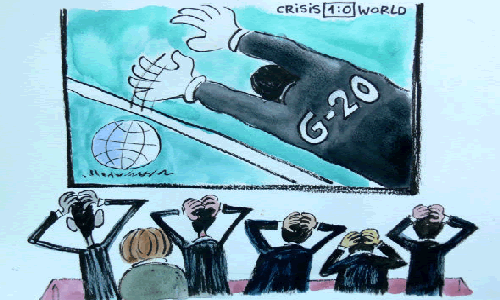

While in Europe, investors are growing increasingly cautious ahead of bank repayments to the ECB on Thursday, which may leave a liquidity shortfall. Over the more medium term the market is questioning whether that the severe austerity measures the G20 announced to realign budget deficits will lead to a double dip recession. A Citibank research note Monday predicts that Chinese exports face “severe headwinds” in Q2.

Furthermore, more questions are being asked whether the reluctance of those in power to address existing structural trade imbalances within Europe will delay any recovery among the peripheral nations. The euro currency is continuing to weaken reaching 0.8115 pence sterling. This is of course positive for the Irish economy and very beneficial for listed companies including DCC, CandC and Paddy Power who generate significant revenues in the UK

Other measures of risk aversion I watch such as the Eur/CHF (which has fallen to an all time low today and vols have hit an all time high) and USD/JPY crosses are flashing red while Eur/JPY is getting crushed. Elsewhere the US and German bond markets have been flashing warning signals about riskier assets for many weeks. Yesterday, the huge rally in US treasuries continued, overnight the 10 year yield dipped below 3% for the first time in 14 months with the 2 year yield falling to an all time low. The 10 year yiled is back at levels seen in the very initial stages of financial market recovery in early 2009. Fears that the global outlook will lead to a deflationary trend, cemented by fiscal retrenchment in many countries, are driving flows into the safe haven, as it is still perceived, of US treasuries. It may take at least two of the three key US economic releases beating expectations to change the dynamic. On the day before the last non-farm payroll report less than a month ago, US 10-year treasuries were yielding 3.36%. This morning, the yield is 2.98%. That disappointing payroll report sparked the initial sharp rally. But a number of data misses, renewed worries about Greece (despite the bailout), sliding Chinese leading indicators and the trend towards fiscal retrenchment have seen heavy buying of US (and German) government bonds

Today’s Market Moving Stories

•There’s a distinct whiff of risk aversion in the air today. Markets are getting more and more nervous. The Euro may be in for a tough 48 hours. Lots of euro risk events, concentrated on Wed and Thursday should see Euro weaken today and tomorrow in anticipation.

(1) Wednesday, we have a presidential election in Germany which could undermine Merkel’s authority if the candidate she backs doesn’t get through.

(2) Greece bonds to fall out of bond indexes

(3) On Thursday, Spain will try to auction €2.5-3.5 bn of 5 year bonds (saw euro weakness ahead of last auction, followed by relief rally afterwards).

(4)Also on Thursday, ECB due to absorb €442 bn in 12 m cash.

Is the expiry of ECB 12m cash on July 1 really a terrible thing? It’s not as bad as it sounds, as any bank who needs cash can still get unlimited amounts of it from the 3m facility. But if you’re an investor who hasn’t time to look into the details of ECB plumbing, you’ll probably sell euros “just in case” on fears that it will only add to funding difficulties at Eurozone banks.

•The recent strength of the Swiss Franc could potentially pose problems for Austrian Banks who according to the IMF today have a lot of unhedged CHF borrowings i.e. due to the low interest rates the CHF was used as a funding currency which is all very fine until it starts appreciating and as the folks in Iceland found you have to repay a lot more capital than you originally borrowed.

•As we approach half (and Quarter) year end it is worth noting that US equities are down 8% over the quarter and European markets down 10.4%. At the same time US Treasury bonds have posted gains of 4.7% whilst European government bonds are roughly flat (thanks to peripheral markets dumping ). Passive funds (who slavishly follow an index) looking to rebalance portfolios will therefore generally be sellers of bonds and buyers of equities. However the way things are looking there may be plenty of sellers!

•French IMF MD Strauss-Kahn says he would like to consider the Chinese currency the CNY for membership of the IMF’s SDR basket eventually (basket constituents are due for their 5 year review before end 2010). But he said they could only do this if CNY was freely floating, he doesn’t expect a rapid rise in CNY, but China’s policy shift should “progressively correct” the undervaluation. Central parity rate hardly moved today.

•The WSJ reports that German Chancellor Angela Merkel faces a test of her authority and of her squabbling government’s cohesion when German lawmakers elect a new federal president on Wednesday. The German presidency is largely ceremonial, but the election could severely embarrass Ms. Merkel if her coalition partners don’t back her candidate.

•Tropical storm Alex was set to strengthen into a hurricane today, delaying BP’s efforts to increase siphoning capacity at the gushing oil well in the Gulf of Mexico.

•More trouble in Eastern Europe with a big move in the Romanian Leu as the opposition leader sought a no confidence vote.

•Japans finance minister Naoto Kan has rejected criticism that the DPJ is wavering on its plan to raise the country’s sales tax noting that his government has not moved from its initial position.

•In the third consecutive monthly increase, Japan’s unemployment rate rose to 5.2% in May from 5.1%.

•Household spending fell 0.7% y on y in May contrary to the consensus forecast for a rise of 0.5% and the same drop as recorded in April.

Ryanair Cuts UK Winter Capacity

Ryanair today announced it will cut UK winter capacity by 16% from November with the loss of over 2m passengers at UK airports this winter as the UK govt’s £11 tourist tax continues to damage British traffic, tourism and jobs. Ryanair will base 22 planes in Stansted this winter (24 last winter) with 135 fewer weekly frequencies and a loss of up to 1.5m passengers at Stansted between November and March 2011. Ryanair will switch these London based aircraft to other European bases where govts have scrapped tourist taxes and reduced passenger charges, in some case to zero, in order to grow tourism and traffic Michael O’Leary said, “Sadly UK traffic and tourism continues to collapse while Ryanair continues to grow rapidly in those countries which welcome tourists instead of taxing them. Ryanair’s 16% UK capacity cutback, 17% cut at Stansted, shows just how much the UK’s tourist tax and the BAA’s high airport charges are damaging UK tourism and the British economy generally.

“Independent capacity analysis shows that growth has returned to the Belgian, Dutch and Spanish markets after their governments scrapped tourist taxes and/or reduced airport charges, in some cases to zero, in order to stimulate tourism and jobs. Today’s cutbacks underline the urgent need to, (a) break-up the high cost BAA Airport Monopoly (as recommended by the Competition Commission) and (b) scrap the damaging £11 tourist tax which has caused UK traffic to collapse over the past two years.”

Company/Equity News

•Stocks on the move today include Vodafone which is down 2% on a broker downgrade at Credit Suisse who cut its recommendation on the company to “neutral” from “outperform.”

•To the upside is the in play Chloride Group which soared 12% after Emerson Electric offered to buy Chloride for £997 million in an effort to derail ABB’s planned takeover.

•Not surprisingly with the dodgy economic news from China miners, cement makers and basic resources stocks are under the cosh today. Rio Tinto has slid 4.8% today while BHP Billiton is off 3.1%. Expect names like Alcoa and Freeport-McMoran to be soft this afternoon.

•Fellow mining giant Anglo American has Tuesday denied a report in O Estado de S. Paulo that it had to buy iron ore from Cia. Siderurgica Nacional to meet a supply contract with Gulf Industrial Investment Co., a company spokesman said. The shares are down 3.4% today.

•National Express Group, the U.K. bus and rail operator said that trading continued in line with forecasts through the second quarter of the year and that first-half normalised pretax profit will probably show “good progress” over the same period a year earlier.

•report from Moody’s Investors Services predicts that JP Moran, Bank of America and Wells Fargo may lose up to $1.36 bn in fees due to proposed caps of credit card swipe charges being considered by Congress.

•Dubai Jet Order Is at Risk. Financial woes appear to Put $29 Billion in Purchases in Doubt. The future of a $29 billion jetliner order that state-controlled Dubai Aerospace Enterprise placed with Airbus and Boeing Co. is uncertain amid the aircraft-leasing company’s growing financial concerns.

•With the deadline for bids for AIB’s Polish unit passing yesterday, it is reported today that PKO, the country’s largest bank has lined up a bid for Bank Zachodni. AIB intends to close the sale process by September.

•Siemens plans to set up its own bank in a move that underscores how large industrial groups are seeking rapidly to reduce their reliance on bank financing after the credit crisis. The German engineering group said that it would use a banking licence primarily to expand its sales finance business but also to be able to deposit some of its current €9bn ($11bn) cash pile at the Bundesbank and to broaden its sources of financing.

•Australian Prime Minister Julia Gillard said Tuesday she is confident renewed goodwill between the government and mining industry will help resolve the dispute over a controversial plan to levy a new 40% tax on mining super profits.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.