Fractional Gold And Silver Accounts

Commodities / Gold and Silver 2010 Jun 29, 2010 - 04:06 AM GMTBy: Darryl_R_Schoon

Deceit becomes fraud only when you can’t deliver

Deceit becomes fraud only when you can’t deliver

Many of those interested in Austrian economics have been waiting for what Austrian economist Ludwig von Mises called the crack up boom. My advice: Don’t wait. The crack-up boom may already have happened. Get ready for what’s next.

From Ludwig von Mises, Human Action, 1949:

The credit expansion boom is built on the sands of banknotes and deposits. It must collapse. If the credit expansion is not stopped in time, the boom turns into the crack-up boom [bold, mine]; the flight into real values begins, and the whole monetary system founders. Continuous inflation (credit expansion) must finally end in the crack-up boom and the complete breakdown of the currency system.

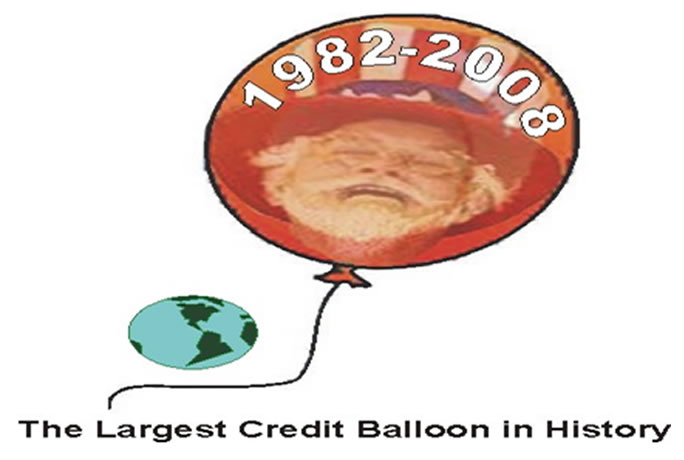

The period from 1982-2000/2008 was capitalism’s longest sustained expansion. It was an expansion, however, driven by ever–increasing amounts of credit emanating from Wall Street and central banks. Capitalism’s longest and greatest expansion was, in fact, a credit bubble in disguise.

The historic and extraordinary credit expansion boom faltered in March 2000 when the US dot.com bubble collapsed. More cheap credit from Greenspan’s Fed then reflated the bubble, driving markets to new highs only to again collapse in 2008, a cataclysmic rendering resulting in global losses exceeding $10 trillion.

The explosive growth of credit from 1982 to 2008 was credit-based capitalism’s final blow-off, the late-stage credit expansion predicted by von Mises in 1949; the resultant and parabolic rise in equities from 1997-2000 a sign that von Mises’ crack-up boom was underway.

That the crack-up boom has already happened is further evidenced by von Mises’ flight into real values which began in 2001, a consequence of the crack up boom. The flight into real values started after the dot.com bubble collapsed and investors began moving to the safety of gold (the price of gold has since quintupled); and, when markets collapsed again in 2008, the flight to real values, i.e. gold, accelerated.

The Financial Times reported in September 2008:

Investors in gold are demanding “unprecedented” amounts of bullion bars and coins and moving them into their own vaults as fears about the health of the global financial system deepen..Industry executives and bankers at the London Bullion Market Association annual meeting said the extent of the move into physical gold was unseen and driven by the very rich.

Regarding the consequences of the crack up boom, von Mises wrote:

…As in every case of the understanding of future developments, it is possible that the speculators may err, that the inflationary or deflationary movement will be stopped or slowed down, and that prices will differ from what they expected.

Speculative uncertainties caused by previously latent but now unleashed inflationary and deflationary forces are now clearly evident. A deflationary collapse in demand is again in motion which monetary authorities may attempt to offset by a hyperinflationary deluge of printed money.

The belief that the trillions borrowed and spent in 2009 reversed the 2008 economic collapse is belied by the fact that demand is again falling. Much to central bankers’ collective dismay, the global economy is contracting.

The ECRI leading indicator produced by the Economic Cycle Research Institute plummeted yet again last week to -6.9, pointing to contraction in the US by the end of the year. It is dropping faster that at any time in the post-War era…The latest data from the CPB Netherlands Bureau shows that world trade slid 1.7pc in May, with the biggest fall in Asia. The Baltic Dry Index measuring freight rates on bulk goods has dropped 40pc in a month.

Faced with a potential deflationary collapse, RBS credit chief Andrew Roberts is predicting that central banks will attempt to prevent this possibility by a massive round of money printing: The next shock and awe will be in the form of large scale QME (Quantitative Monetary Easing).

Sufficient, i.e. excessive, money printing is Milton Friedman’s ineffectual solution to reversing monetary contractions. Printing more money leads, in fact, to von Mises’ predicted end-game. Von Mises crack up boom ends in the complete breakdown of the currency system, a progression that Friedman’s flawed theory has accelerated.

GOLD & THE COMPLETE BREAKDOWN OF THE CURRENCY SYSTEM

Predictions are circulating that the euro, only ten years old, may not survive the current crisis. The euro, however, like all fiat currencies was doomed from its beginning. No fiat currency has ever lasted as the advantages of fiat currencies are only temporary. In the long run, there are none.

In the not too distant future, paper currencies, e.g. the US dollar, the pound, the euro, the yuan, et. al. will go the way of all fiat money, into history’s dustbin, surviving only as monetary artifacts, evidence once again of man’s continual attempts to substitute fiat paper money with no intrinsic value for that which does.

Ralph T. Foster’s book, FIAT PAPER MONEY, The History and Evolution of our Currency, is a compendium of humanity’s repeated attempts to achieve and maintain the impossible. Since the invention of ink and paper in the East and now in the West, Foster’s book chronicles man’s constant attempts to pass off paper coupons as money, see http://home.pacbell.net/tfdf/.

FIAT PAPER MONEY is a disquieting read. It is a collection of facts that leaves an impression difficult to forget. Therein lies the value of the book. My interview with Ralph T. Foster about FIAT PAPER MONEY can be viewed on Youtube at http://www.youtube.com/watch?v=LKUpcCQ4Nwo.

Von Mises’ complete breakdown of the currency system leaves gold and silver among the few safe havens remaining. Erste Bank’s excellent report, In Gold We Trust (June 2010) by analyst Ronald Stoferle, is perhaps the best summary to date of the reasons for gold’s 10 year rise—a rise that Stoferle predicts will continue. Note: Stoferle adds an Austrian economic perspective to his analysis of gold’s future prospects, see http://c1.libsyn.com/..

THE SAFETY OF GOLD VERSUS THE ALLEGED SAFETY OF BULLION BANKS

On June 25, 2010, an article in the Wall Street Journal noted: Individual investors are increasingly demanding to take possession of their gold holdings, rather than just owning shares in a mining company or a gold-related fund.

What the Wall Street Journal failed to report is the possibility that many gold investors may not, in fact, actually have the gold or silver they purchased and believe to be safely stored in a bank vault.

Gold and silver investors are discovering that banks possess only a small fraction of the gold and silver allegedly bought by banks for customers.

Banks, unknown to their customers, use a fractional reserve system for their accounting of gold and silver inventories. Only a small percentage of gold and silver bought by customers is actually held and stored by banks.

Banks for years have been charging their customers for precious metal purchases without actually buying the metals, booking the precious metal “purchases” as bank liabilities, not as the custodial accounts customers assumed, see http://www.reuters.com/..

The following interview with investors who believed their bank was storing silver on their account is revealing as it is disturbing. Although charged by the bank for the purchase of silver bullion in addition to storage and insurance fees, the bank did not actually have the silver as the investors discovered, see http://www.kingworldnews.com/..

Their discovery is no different than the facts uncovered when Morgan Stanley was successfully sued in a class action suit brought by Selwyn Silberblatt in 2007, on behalf of himself and others who bought precious metals -- gold, silver, platinum and palladium in bullion bar or coins -- from Morgan Stanley DW Inc. and its predecessors and paid fees for their storage. The suit covered investors who did so between Feb. 19, 1986, and Jan. 10, 2007, see http://www.reuters.com/..

Question: Do you know where your gold or silver is?

Fool me once, shame on you.

Fool me twice, shame on me.

You’ve been warned.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.