Stock Market Bearish Signs on Increasing Risks of Double Dip Recession

News_Letter / Financial Markets 2010 Jun 29, 2010 - 01:45 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

June 27th, 2010 Issue #38 Vol. 4

Stock Market Bearish Signs on Increasing Risks of Double Dip RecessionInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader No weekend commentary for next 2 weeks, focus is on UK economy and housing market analysis and concluding forecasts. Nadeem Walayat Editor, The Market Oracle Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Joshua S. Burnett Most articles begin with a purpose statement revealing what the author desires to convince the reader of. This article is different. These few paragraphs begin with a plea for someone to tell me that I’ve got the evidence all wrong and that what I see and know is a smoke filled illusion void of reality.

By: Lorimer_Wilson My first reaction when I read an article on this site by Arnold Bock - articulating why gold would go to $10,000 – by 2012 no less - was amazement. Who in their right mind would suggest that gold would eventually reach $2,500, let alone $5,000 or even $10,000?

By: Jim_Willie_CB SDR Strawman & Gold-Backed Euro - The world faces challenges and uncertainty these days like perhaps never before in modern history. Broken insolvent banking systems match the insolvent homeowners living in despair but with newfound hope from simply not paying home mortgages in large numbers.

By: Washingtons_Blog It's the largest environmental disaster in U.S. - and possibly world history. But do you know exactly where it is? Could you point to a map and show where the oil rig sank? Do you know what the topography of the surrounding area is?

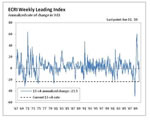

By: Nadeem_Walayat An early Monday stocks rally to just above Dow 10,300 concluded in a downtrend into the close to 10,200. The Dow opened up Tuesday, with the trend continuing higher into the end of the week with the Dow closing up 239 at 10,450 (10,211), which built on the preceding weeks 279 points advance.

By: Nadeem_Walayat George Osbourne, the Coalition governments chancellor looks set to announce deep spending cuts and significant tax rises in tomorrows budget. However what will be the lasting impact of the budget will be the changes to the rate and scope of VAT with the aim of raising at least £15 billion extra revenue per year, that will come to be seen as the budget that sparked the wage price spiral.

By: Brian_Bloom History will remember this day. Whether or not the equity market cracks tomorrow or the next day or in a few weeks time, today is the day that it gave off a critically important signal. Today is the day that it showed that the 200 day moving average represents resistance to further rises as opposed to support against further falls.

By: Jon D. Markman Stocks rose worldwide over the past week -- ranging from +2% in U.S. big caps to +6% in gold -- as investors swelled with sudden courage in response to positive reports on Chinese economy and glimmers of hope that European governments can get their financial houses in order.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.