Financial Markets React to G20 Confusing Conclusion

Stock-Markets / Financial Markets 2010 Jun 28, 2010 - 02:25 PM GMTBy: PhilStockWorld

We’re going to cut those deficits… As soon as we’re done spending more money!

We’re going to cut those deficits… As soon as we’re done spending more money!

That’s the conclusion of the G20 summit this weekend as the official statement says:

While growth is returning, the recovery is uneven and fragile, unemployment in many countries remains at unacceptable levels and the social impact of the crisis is still widely felt. Strengthening the recovery is key. To sustain recovery, we need to follow through on delivering existing stimulus plans, while working to create the conditions for robust private demand. At the same time, recent events highlight the importance of sustainable public finances and the need for our countries to put in place credible, properly phased and growth-friendly plans to deliver fiscal sustainability, differentiated for and tailored to national circumstances.

While growth is returning, the recovery is uneven and fragile, unemployment in many countries remains at unacceptable levels and the social impact of the crisis is still widely felt. Strengthening the recovery is key. To sustain recovery, we need to follow through on delivering existing stimulus plans, while working to create the conditions for robust private demand. At the same time, recent events highlight the importance of sustainable public finances and the need for our countries to put in place credible, properly phased and growth-friendly plans to deliver fiscal sustainability, differentiated for and tailored to national circumstances.

Those countries with serious fiscal challenges need to accelerate the pace of consolidation. This should be combined with efforts to rebalance global demand to help ensure global growth continues on a sustainable path. Further progress is also required on financial repair and reform to increase the transparency and strengthen the balance sheets of our financial institutions, and support credit availability and rapid growth, including in the real economy. We took new steps to build a better regulated and more resilient financial system that serves the needs of our citizens. There is also a pressing need to complete the reforms of the international financial institutions.

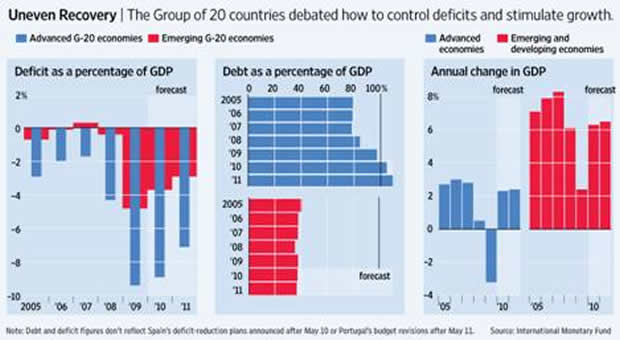

There’s 26 pages of this nonsense but the gist of it is: We promise to keep bailing out the economies but as soon as that’s done then we are right on top of this deficit thing. Of course, the underlying assumption there is that the bailouts are working in the first place - something that is difficult to convince the World’s 500M unemployed workers, who would rather have jobs than a robust banking system. From a global perspective, our short-term outlook is less than robust so far:

We did a nice global economic overview on the weekend where we explored the austerity alternative to our previous assumption that the US will ultimately choose either "Default or Hyperinflation" and, after a raucous discussion in our Member Chat with good points being made on both sides of the aisle (the right side and the wrong one) - I will have to stand by my original conclusion that you will NEVER get this country to agree to go the austerity rout in any meaningful way so it looks like it’s Hyperinflation or, literally, bust…

I don’t mind inflation as long as it includes WAGE INFLATION. Wage inflation solves many problems (see "Inflation Nation"), it allows anyone who is willing to work to create a realistic path to getting out of debt. It increases the value of middle-class people’s assets relative to the amount they owe on them and it helps people save for the future by paying them a reasonable rate of return for their wages. Who doesn’t like inflation, then? Creditors! Banks don’t want to lend you $200,000 to buy a $250,000 home only to have you pay them back $432,000 (yes, that’s how much you pay them back! See "Interest Scams and How to Avoid Them" where I show you how to save $100,000 on almost any mortgage) over 30 years in money that has less value than when you started.

I don’t mind inflation as long as it includes WAGE INFLATION. Wage inflation solves many problems (see "Inflation Nation"), it allows anyone who is willing to work to create a realistic path to getting out of debt. It increases the value of middle-class people’s assets relative to the amount they owe on them and it helps people save for the future by paying them a reasonable rate of return for their wages. Who doesn’t like inflation, then? Creditors! Banks don’t want to lend you $200,000 to buy a $250,000 home only to have you pay them back $432,000 (yes, that’s how much you pay them back! See "Interest Scams and How to Avoid Them" where I show you how to save $100,000 on almost any mortgage) over 30 years in money that has less value than when you started.

Here’s the scam in short: They get you to borrow $200,000 for 30 years at 6% interest with a $1,200 monthly payment. You take this payment on the assumption that your wages will go up and the home will be more affordable as life goes on. Then the Fed (who works for the banks, not the government) does everything it can to fight inflation, which includes wage inflation and, a decade later, you realize you are not making more money than you were 20 years ago but you’ve already made $144,000 worth of payments that assumed some pretty high inflation that never happened. If your circumstances change and you need to lower your payment by switching houses - bad news - the house didn’t inflate either and you still owe the bank another $288,000 in payments for 20 more years.

The article goes more into the math (and ways to save yourself) but this is how the Fed first tricked millions of people into taking on huge debt obligations and then did everything they could to make sure the underlying investments made no money for the homeowners while also making sure the banks were paid in full for all outstanding loans, no matter how many lending standards they violated to get those loans on the books! Even as I’m writing this, Rick Santelli is having one of his "made for YouTube" meltdowns pushing for austerity - no matter how many of the little people need to suffer!

Rick Santelli got famous for his "screw the homeowners" rampage on CNBC, which helped launch the Tea Party movement and helped insure that all those Trillions of bailout dollars went to the investing banks (including his employer, GE) with barely a rounding error’s worth of the bailout money (that the taxpayers paid for) actually finding it’s way to any taxpayers (and don’t confuse banks with taxpayers, they took write-offs that will have them living tax-free for a decade).

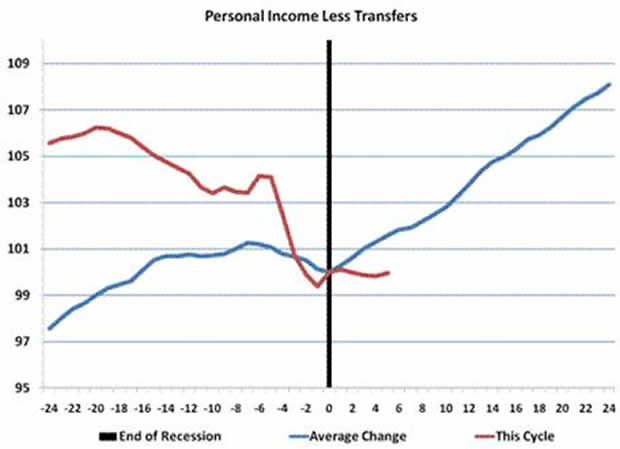

We got our Personal Income data this morning and, what a surprise, it’s down 20% from last month to 0.4% from 0.5% as another 1.9M pink slips were handed out since the last report. If you think that’s bad - just wait until we get the next report with the Senate Democrats unable to break the filibuster last week that sent 1.3M unemployed people’s income to zero with another 1M people joining them at that income level by the time we get the next report.

Amazingly, Personal Spending went up 0.2% last month, but it turns out it was all spent at the pump as the massive surge in gas prices ripped the money out of consumers pockets so fast, they were forced into more debt before they could adjust their consumption habits. Well, better luck next time consumers!

The May Chicago Fed National Activity Index was down to .21 from .25 in April as weaker contributions from employment and housing dragged the numbers down. Yes, Rick, what an ideal time it is to be cutting back on spending - I think I still see some people with hopes and dreams that haven’t been completely crushed… Treasuries are thrilled with the action (rich people have lots of T-Bills) and 2-year yields dropped to 1-year lows this morning on the G20’s austerity promises. Bond rates, on the other hand, are heading higher as the percentage of corporate bonds considered in distress is at the highest level in six months, signaling investors expect the economy to slow and defaults to rise.

Likewise, commodity shipping costs continue to fall for the 21st consecutive day as the Baltic Dry Index falls below the 2,500 line for the first time since October, 2009. Part of it is the slowdown in Chinese construction demand and part of it is the 7.2% increase in shipping capacity in the first half of this year as ships that were ordered in 2007 begin hitting the waters empty.

Not surprisingly, Asia was mixed to flat this morning and the FTSE was up and now flat but the CAC and the DAX are holding on to 1% gains and, despite the total incompetence of our global leadership, I’m still optimistic that we’re going to hold the bottom we formed last week. We have a lot of data to get through, including Case-Shiller tomorrow and Non-Farm Payroll on Friday but then it’s earnings season and we will then see how innovative our great US Corporations really are.

It’s going to be an interesting week!

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.