An Austere G20 Impresses the Markets For Now

Stock-Markets / Stock Markets 2010 Jun 28, 2010 - 07:33 AM GMTBy: PaddyPowerTrader

Markets certainly have slipped into full summer slumber mode this Monday, but to recap on Friday’s action which saw U.S. stocks tread water but managing to marginally trim the biggest weekly S&P 500 drop since May, as banks popped higher after Congress water down the financial-reform bill. JPMorgan, Bank of America and Goldman Sachs led S&P 500 financial shares to a 2.8% percent gain after congressional negotiators agreed on reform that doesn’t ban hedge-fund and buyout-fund investing. Moody’s Corp. surged 6.8% as lawmakers agreed to modify legislation that would have made it easier to sue credit-rating companies. Newmont Mining rose 4.6%as commodities prices gained on a U.S. dollar decline.

Markets certainly have slipped into full summer slumber mode this Monday, but to recap on Friday’s action which saw U.S. stocks tread water but managing to marginally trim the biggest weekly S&P 500 drop since May, as banks popped higher after Congress water down the financial-reform bill. JPMorgan, Bank of America and Goldman Sachs led S&P 500 financial shares to a 2.8% percent gain after congressional negotiators agreed on reform that doesn’t ban hedge-fund and buyout-fund investing. Moody’s Corp. surged 6.8% as lawmakers agreed to modify legislation that would have made it easier to sue credit-rating companies. Newmont Mining rose 4.6%as commodities prices gained on a U.S. dollar decline.

As half time in 2010 approaches equity markets are again facing growing economic concerns, which resulted in an overall negative development last week. After weaker indications from leading indicators in Europe and in Asia in the past few weeks, now also the growth data in the US are weakening. Data on new home sales fell to a new record low (the lowest level since the series began in 1963). That is even more concerning as by far the biggest public support for the housing market is still in place (mortgage financing through the Government Sponsored Enterprises Fannie Mae and Freddie Mac). The markets interpret the housing slowdown as an indication that the US is heading to a double dip in housing, with all negative spill over effects on the financial system. In this context, the Fed comments also fit, reflecting the weaker growth data, indicating that the US is going to exhibit more moderate growth in the coming months. Based on the muted economic sentiment, particularly the cyclical sector was among the most negatively affected. Besides this sector group, European Financials were confronted with new highs in Greek sovereign CDS as well as the fear of imminent money market tension caused by the expiring first 12M tender of the ECB this Wednesday with a volume of EUR 442.2bn.

Today’s Market Moving Stories

•Is the US unemployment rate about to surge? No, not the unemployment figure due to be released on Friday (which is from June), but rather July’s figure (which is due to be released in early August). Zerohedge notes Congress’ decision on Friday not to extend the benefits program for long-term unemployed. He says, having their benefits cut will force 2 million Americans to actively seek employment again. If jobs cannot be found, then these people will be registered as unemployed pushing the unemployment rate higher. If you’re confused how this works, just remember that the US unemployment rate is calculated based on a monthly survey of about 50k US households. If you tick the box that says you are jobless and have not actively sought employment in the last 4 weeks, then you are “not” included in the unemployment rate you must be seeking a job to be included. Zerohedge implies many of those on long-term benefits have abandoned search for work, and calculates that unemployment rate could rise to 10.5% in July from 9.7% in May, as they are suddenly forced to look again.

•An aritcle in Germany’s Zeit draws attention to potential for widespread municipal defaults in USA. Based on a CNBC report from a month ago worryingly entitled: “more cities on the edge of bankruptcy”. Clearly any hint of a default from a US city risks throwing the spotlight on the broader US fiscal deficit, and would be USD negative.

•Ambrose Evans-Pritchard in the Telegraph says Fed is authorised to expand balance sheet to $5 trn. Quotes from a RBS client note “We cannot stress enough how strongly we believe that a cliff-edge may be around the corner, for the global banking system (particularly in Europe) and for the global economy. Think the unthinkable. Note says Fed could follow the 1940s strategy of capping bond yields at around 2pc. He says the US is already embarking on fiscal austerity implying an increased need for more monetary stimulus. Congress has cut off benefits for those unemployed beyond six months and California has to slash $19bn in spending this year as much as Greece, Portugal, Ireland, Hungary, and Romania combined. Federal stimulus from the Obama fiscal stimulus package peaked in Q1. and the only plausible escape route for the West is a decade of fiscal austerity offset by helicopter drops of printed money, for as long as it takes.

•Korean Peninsula: North Korea’s official KCNA news agency said “US forces introduced weapons [to the DMZ truce village of Panmunjom] at around 7:25 a.m. on June 26 … If it does not comply with the principled demand of the Korean People’s Army, strong military counter-measures will be taken in the area”. A US military spokesman could not immediately comment on what may have occurred in the truce village on Saturday that triggered the North’s comments.

•Japan: Retail sales rose 2.8% y/y in May, the slowest pace of growth in four months, down from a 4.9% rise in April (which was the strongest increase since March 1997). The consensus forecast had anticipated a 4.6% increase in May. Governments subsidies for some goods ended in March, while others expire in September and December.

•UK: Hometrack’s survey of estate agents and surveyors showed an average rise of 0.1% month on month in house prices in June, down from 0.2% in May, and a year on year rise of 2.1%.

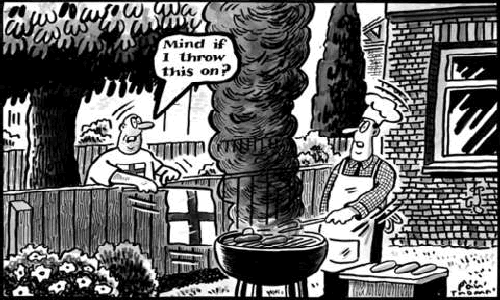

•G20: The G20 has pledged to halve their budget deficits by 2013 without stunting growth, and to clamp down on risky bank behaviour without choking off lending, now that would be a neat trick. However, leaders nonetheless agreed to move at their own pace and adopt “differentiated and tailored” policies. Host Stephen Harper, the Canadian prime minister, said that government debt, as a proportion of GDP “should be at least stabilised or on a downward trend by 2016”. However, he added that short-term economic stimulus measures would still be needed. Harper also stated that proposals for a global levy on banks had been dropped. One thing is for sure with all this infectious hair shirt austerity growth will be lower and interest rates will be staying at record lows for much longer than the markets are currently forecasting.

•President Obama: “Our fiscal health tomorrow will rest in no small measure on our ability to build jobs and growth today … all leaders recognise that fiscal consolidation is not an end in itself. There will be a continued role for ongoing stimulus in the short term as we develop the framework for strong sustainable and balanced growth … our challenges are as diverse as our nations”.

•EU officials said in a statement “The EU came to Toronto with a clear agenda. The summit’s result reflects widespread convergence around Europe’s approach”. The IMF’s Dominique Strauss-Kahn said “Talking about halving the deficits is oversimplifying the problem because it differs from one country to another … I am more interested in the fact that countries do implement the right measures.”

•G20/China: Addressing a reporter’s question about the CNY, President Obama said “A strong and durable recovery also requires countries not having an undue advantage. So we also discussed the need for currencies that are market driven … as I told President Hu yesterday, the US welcomes China’s decision to allow its currency to appreciate in response to market forces”. However, any reference to commitment to currency reform was dropped from the statement at China’s request (it noted that it was a sovereign matter).

Those US Bank Lobbyists Certainly Earned Their Corn

As the final version of the US financial regulation legislation approved on Friday shows largely a positive read through from the US for the European banks, especially for capital markets as although tough stance maintained, it is not business destroying.

5 key potentially meaningful parts:

1) The biggest threat to banks came from the original proposal to force all derivatives business into separate, very conservatively capitalised subsidiaries. Instead, most new OTC deals will shift onto central clearing; and remaining OTC will be centrally reported and require much tougher capital and collateral requirements. Most interest rate, FX and investment grade CDS swaps will be retained, though other new CDS and less vanilla products will be forced into separate subsidiaries. Combined, these moves mean less revenue and lower profitability from derivatives businesses, but the business model will still be allowed to exist in a credibly profitable way; and existing contracts will be grandfathered.

2) Pure proprietary trading will no longer be allowed, with investment in hedge and private equity funds restricted to 3% of bank capital. This should not require any meaningful changes for European banks.

3) There is an unexpected USD19bn one time levy on the industry to pay for the new legislation, expected to be paid over 5 years: ie USD4bn pa. European banks active in the US are likely to be required to pay their share, but should be well below 5% ‘normal’ earnings for all.

4) Systemically important’ banks will face tougher requirements on capital, leverage and liquidity starting in 5 years time. They will also need to prepare ‘living wills’, ie formalised bankruptcy procedures. Also, more conservative definition of ‘core capital’ excludes trust preferred securities, though 5 years grandfathering allowed. This is already factored into our expectations for Eurobanks.

5) Creation of a Consumer Financial Protection Bureau and a Government controlled resolution authority with powers to takeover banks posing a risk to the financial system. This is already factored into our expectations for Eurobanks.

Company / Equity News

•The deadline for non binding bids for AIB’s Polish unit Bank Zachodni is today, according to several reports. The shortlist of bidders is expected by mid-July and a complete sale is expected by September according to Polish newspaper reports. Also the supervisory board of Poland’s largest lender, PKO, is reported to have approved preparing an initial bid to buy the stake. Finally, AIB may place its stake in M&T in the market, at a “single digit” discount, if M&T merger talks with Banco Santander fail, the Sunday Times reported.

•Boeing have won orders of $1.4bn for new planes for Air China to be delivered between 2013 and 2015.

•Peugeot rose 2.2%, leading a gauge of auto shares to a 2.1%gain after the carmaker lifted its 2010 sales target for the DS3 model to 70,000 from 45,000.

•Premier Oil surged 8.2%, the most in two months on news the U.K. explorer said the Catcher East sidetrack well in the U.K. Central North Sea encountered “excellent quality” oil-bearing sandstones.

•EnCore Oil jumped 46% after the British exploration company may say this week that it has found an oil field containing as much as 300 million barrels, the Sunday Times reported.

•PV Crystalox Solar dropped for a second session, losing 1.4% on a broker downgrade by Goldman Sachs who downgraded the supplier to solar-cell markets that first sold shares in June 2007 to “sell” from “neutral.”

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.