Gold Robust as Equities Fall On Concerns Over U.S. Economic Recovery and Sovereign Default Risk

Commodities / Gold and Silver 2010 Jun 23, 2010 - 07:02 AM GMTBy: GoldCore

Gold's slight gains and resilience yesterday has surprised the bears who were expecting further falls. The downside reversal pattern seen on Monday may not have incurred as much technical damage as thought - especially if gold can manage to eke out a higher weekly close this week - above $1255/oz.

Gold's slight gains and resilience yesterday has surprised the bears who were expecting further falls. The downside reversal pattern seen on Monday may not have incurred as much technical damage as thought - especially if gold can manage to eke out a higher weekly close this week - above $1255/oz.

Interestingly the open interest figures only fell 2199 contracts to 600,895 which suggests that rather than spec liquidation, the sell off on Monday may have been a bear raid by shorts in order to flush out speculative longs. In the short term, this may have been a success but as ever supply and demand for physical will be the driving fundamentals of price. Further long liquidation and a lower weekly close would be bearish in the short term.

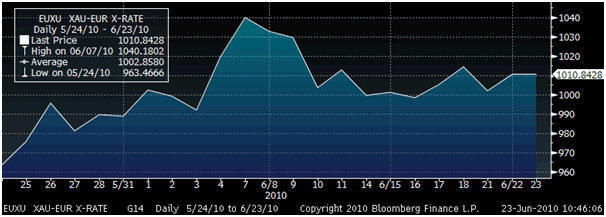

Gold is currently trading at $1,235/oz and in euro, GBP, CHF, and JPY terms, at €1,012/oz, £834/oz, CHF 1,376/oz, JPY 112,339/oz respectively.

Gold in Euro - 30 Day (Daily)

The reappearance of risk appetite was brief and concerns about the European banking system and sovereign debt issues continue to bubble along beneath the surface (see Soros warning in News below). The risk of sovereign defaults remains present and thus any pullback in gold is likely to be short lived. Also, the increasing chatter of a move away from the dollar as global reserve currency should see the dollar come under pressure again in the coming months, resulting higher gold prices.

Cross Currency Rates at 1030 GMT - GBP, NZD, XAG and XAU Stronger / CAD, AUD, CHF and USD Weaker

Silver

Silver is currently trading at $18.91/oz, €15.37/oz and £12.66/oz. Bullion banks have revised up their previous bearish silver forecasts but remain tepid in their outlook for silver despite the strong fundamentals.

Platinum Group Metals

Platinum is trading at $1,578/oz and palladium is currently trading at $484/oz. Rhodium is at $2,425/oz.

News

South Korea will have a gold exchange established inside its main bourse in January 2012 which will help the government better regulate the local gold market, the government said Wednesday. According to the Ministry of Strategy and Finance, its policy- makers in a weekly meeting decided to set up a spot exchange market inside the Korea Exchange (KRX) to minimize operating costs. The government is also considering separating the gold exchange from the KRX and making it into a specialized spot trade market that handles other commodities such as crude oil, refined petroleum and farm product, if its size expands, the ministry said. Once it is set up, the ministry will work in close cooperation with the Financial Services Commission, the knowledge economy ministry and the National Tax Service to oversee the gold exchange.It is estimated that South Korea's gold trading volume reaches 150 tons worth 5 trillion won (4.2 billion U.S. dollars) on an annual basis (Xinhua via COMTEX).

China's spot gold market turnover rose 22.6 percent last year to become the biggest in the world,the industry Web site Hexun.com said today, citing a Shanghai municipal government official.Total turnover of spot gold traded on the Shanghai Gold Exchange in 2009 was 1.1 trillion yuan ($162 billion), Hexun said, citing Fang Xinghai, director general at the government financial services offices in Shanghai (Bloomberg).

Morgan Stanley increased its 2010 forecast for silver by 6 percent to $18.56 an ounce. The metal should outperform gold in the next two years, the bank said in a report today (Bloomberg).

Bank of America Merrill Lynch raised its gold forecast for this year 8 percent to $1,200 an ounce and increased its 2011 estimate for the metal 17 percent to $1,350 an ounce. The bank raised its silver forecast for this year 3 percent to $18 an ounce, and increased the metal's 2011 outlook 7 percent to $20.25, according to a report dated June 21 (Bloomberg).

Gold and gold receivables held by euro zone central banks fell by one million euros to 286.691 billion euros in the week ending June 18, the European Central Bank said on Tuesday. Net foreign exchange reserves in the Eurosystem of central banks rose by 0.1 billion euros to 172.8 billion euros, the ECB said in its regular weekly consolidated financial statement. Gold holdings fell because of a technical adjustment by one euro zone central bank, the ECB said (Reuters).

German's budget savings policy risks destroying the European project and a collapse of the euro cannot be ruled out, billionaire investor George Soros said in a newspaper interview released on Wednesday. "German policy is a danger for Europe, it could destroy the European project," he told German weekly Die Zeit. Soros, who earned $1 billion in 1992 by betting against the British pound, added that he "could not rule out a collapse of the euro". "If the Germans don't change their policy, their exit from the currency union would be helpful for the rest of Europe," he said. Chancellor Angela Merkel unveiled plans earlier this month for 80 billion euros ($107 billion) in budget cuts over the next four years -- a package she hopes will bring Germany's structural deficit within European Union limits by 2013. "Right now the Germans are dragging their neighbours into deflation, which threatens a long phase of stagnation. And that leads to nationalism, social unrest and xenophobia. Democracy itself could be at risk," Soros said. "Germany is globally isolated ... Why don't they let their salaries rise? That would help other EU states to pick up." Merkel on Monday defended her budget cut plans after U.S. President Barack Obama preached patience in clamping down on public spending. A German government official said on Tuesday Berlin did not expect to come under pressure at a G20 summit in Toronto this weekend to provide fresh stimulus measures (Financial Mirror).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.