European Stocks Trade Lower as Familiar Concerns Return

Stock-Markets / Stock Markets 2010 Jun 22, 2010 - 09:52 AM GMTBy: PaddyPowerTrader

China’s de-peg from the Dollar over the weekend initially gave risk assets a shot in the arm Monday. But on closer examination the markets were seriously underwhelmed. Investors will want to see more evidence that China’s FX policy is taking a true turn rather than just a tactical ploy to get the G20 off their back and stop being called a currency manipulator in the US . Disappointing stock market action in late US hours suggested that China has provided too few details so far.

China’s de-peg from the Dollar over the weekend initially gave risk assets a shot in the arm Monday. But on closer examination the markets were seriously underwhelmed. Investors will want to see more evidence that China’s FX policy is taking a true turn rather than just a tactical ploy to get the G20 off their back and stop being called a currency manipulator in the US . Disappointing stock market action in late US hours suggested that China has provided too few details so far.

As the afternoon New York session saw markets tail lower, not helped by comments out of easy on the eye uber banking analyst Meredith Whitney, saying that the US housing market will experience a ‘double-dip’ recession “for sure”. A Fitch downgrade of French bank BNP Paribas on asset quality deterioration, Standard & Poor’s revised upwards their loan loss assumptions for Spanish banks to euro 99.3bn (from euro 81.6bn) and French ECB council Noyer member unhelpfully confessed that some banks “are facing funding difficulties”. There was also disappointing news that the ECB itself “only” bought 4bn of PIGS bonds last week.

Tuesday has started as a risk off day with European banks funding issues and under capitalization back firmly in the spotlight along with a more general feeling that the 9 day rally in the Stoxx 600 may have over egged it considering the prospects fro economic growth & company earnings. The ECB Spain rep Ordonez comments that the country’s Caja’s (savings banks) have asked for Eur 10bn from the FROB thus far. This is despite reassuring noises from US rating agency Moody’s who suggested that Spanish banks have already made provisions for 75% of the debt on their books.

Today’s Market Moving Stories

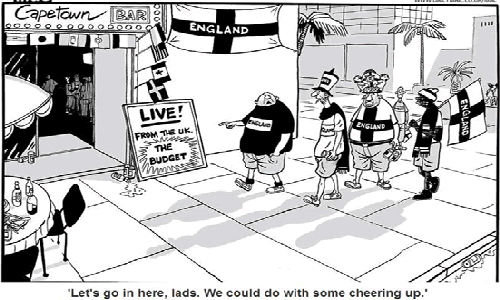

•Very Quick thoughts on the UK emergency budget:….The deficit in full year 2010-11 is projected at £149bn (10.1% of GDP) which is a bit un-ambitious methinks. In the longer term, policy will target a zero structural current balance by 2015-16. Public borrowing is projected to hit 1.1% of GDP by 2015-16. Key near- term measures include a hike in VAT from 17.5% to 20% in Jan 2011 and a levy on banks intended to raise £2bn per year. The budget also took the axe to the welfare system with restrictions and benefit freezes across the board and capital gains taxes to rise for higher rate tax payers. Sweeteners include a rise in personal tax allowances and 1% per year cut in corporate taxes over next 4 years.

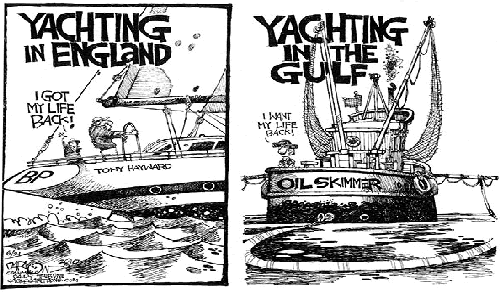

•BP dropped again down 3.3% this time an various reports that the embattled company aims to sell assets, improve its safety standards and may replace Chief Executive Officer Tony Hayward as part of a three stage recovery plan according to Handelsblatt.

•Other notable movers on the day are Chemring Group (down 5.4%) falling for a fourth day on news that the developer of missile avoidance gear for the U.S.’s Joint Strike Fighter said first- half net income fell to 18.4 million pounds from 21.5 million pounds.

•EasyJet is softer by 2.9% after a broker downgrade. The LCC airline was cut to “neutral” from “overweight” at JPMorgan Chase & Co.

•Chancellor Angela Merkel’s government rebuffed U.S. calls to focus on bolstering growth over debt reduction, setting a course for conflict at the Group of 20 summit in Canada this week. “Nobody can seriously dispute that excessive public debts, not only in Europe, are one of the main causes of this crisis,” Finance Minister Wolfgang Schaeuble told reporters in Berlin today alongside Merkel. “That’s why they have to be reduced.” Germany is holding to G-20 commitments on exit strategies from fiscal stimulus, and “not violating international requirements for a coordinated strategy for sustainable growth,” Schaeuble said. “We will face up to the international debate and I think we can do that with a great deal of self confidence. President Barack Obama, in a letter to his G-20 counterparts dated June 16, urged a focus on economic growth, saying order to public finances should be restored in the “medium term”.

•The latest evidence that Germany is taking the recession on the chin came in the form of the key June IFO business climate survey which recorded an unexpected increase to 101.8 from 101.5 previously (consensus expectations of 101.2). The rise was all due to the current assessment subindex, which improved significantly from 99.4 to 101.1 (consensus of 99.8). Meanwhile, the expectations subindex, which is the more relevant series from a leading indicator perspective, slipped back to 102.4 from 103.7 (consensus of 102.7) though it is still at an elevated level which has been historically consistent with annual real GDP expansion of around 2.5

•Remember Baltic Dry? It’s down again. There was a time during the crisis when we tracked this index almost daily. It was an excellent indicator of the steep fall in global output during November 2008 and February 2009. It since recovered, but guess what, it is slumping again. It was down 18% this week, now at 2694 still comfortably above the crisis level of under 2000, but this movement is not good. FT Alphaville has dug it up, together with a comment from Barclays Capital, who write that the index is a good leading indicator for the global economy. And while it does not yet point to a double-dip recession, it sets alarm bells ringing.

Commodities Corner

Goldman Sachs has reduced its price forecasts for crude oil because commodity markets are “fragile” on concern growth in Europe and China will slow. West Texas Intermediate oil was forecast at $87 a barrel for a three-month period, the bank said in a report today. That’s down 9.4 percent from a $96 prediction Goldman made in a May 10 report. It also downgraded estimates for six-month and 12-month crude and for Brent oil.

Gold prices hit on Monday a fresh record high of almost $1,265 a troy ounce following the revelation that Saudi Arabia, the world’s largest oil exporter, is sitting on more than twice as much gold as previously thought, according to new estimates, reports the FT. The disclosure points to the revival of bullion as part of emerging economies’ official reserves and comes as investors pour money into the yellow metal.

Company / Equity News

•Banco Santander , Spain’s biggest bank, is trying to resurrect talks to combine its U.S. business with M&T Bank after negotiations collapsed last month, said three people with knowledge of the matter. Santander and M&T recently scheduled a meeting between the banks’ top executives, two of the people said, speaking on condition of anonymity because the matter is private. The banks’ leaders still disagree on who would control the combined firm the issue that led the discussions to break down in May, the people said. Before talks fell apart, Santander had been discussing a stock merger of its Sovereign Bank unit and M&T in which the Spanish bank would end up with a minority stake, Santander was seeking a deal that would allow it to eventually gain control of the combined bank, a move that M&T resisted, the person said. Combining with Buffalo, New York-based M&T, whose stock market value is about $11 billion, would add scale to Sovereign, which had $73.4 billion of assets and $41.8 billion of deposits as of March 31, according to data from the Federal Deposit Insurance Corp. M&T had $67.5 billion of assets and $47.4 billion of deposits. Santander has also been considering buying AIB’s 22.5% stake in M&T. Either way AIB has until end 2010 to sell its stake so time is far from unlimited. M&T’s stock rose to a 21 month high of $77 last night.

•Staying with Irish financials Irish Life & Permanent is to under go the Prudential Capital Assessment Review (PCAR) to be concluded by July. Anglo Irish Bank and Irish Nationwide will also under go a capital review to be concluded by September. Separately, KBC will sell its Irish asset management arm for €23.7 million to RHJ International . KBC has c€4 billion in asset under management. Bank of Ireland is currently selling BIAM, which has assets over €20 billion, with Australian infrastructure group Macquarie mentioned as a likely bidder in recent reports.

•Bloxham’s reports today that Smurfit Kappa has announced the appointment of Mr Roberto Newell as a non-executive Director at the group. The appointment is particularly interesting in the context of the growing importance of the Latin America region to Smurfit Kappa. In 2009, the group generated 17% and 26% of revenue and EBITDA respectively from Latin America.

•In contrast to yesterday basic resource and mining stocks are in retreat today with ENRC down 2.7% as copper, lead and nickel fell in London. Kazakhmys , Kazakhstan’s largest copper producer, has shed 3.2% and Xstrata , the world’s fourth-largest copper producer, slipped 2.6%. The FTSE 350 Mining Index is off by 2.2% percent after yesterday rallying 4.2% gain.

•Lockheed Martin , the world’s largest defense contractor won reinstatement to a U.S. contract valued at as much as $5 billion over 10 years to support special operations forces, a military spokesman said.

•On Continental bourses were seeing some weakness in banking stocks today as a carryover from Fitch’s cut in French bank BNP Paribas’s rating. The stock is lower by 3% today while fellow French financial Soc Gen is down 4.6% in sympathy. On the lighter side French bank Credit Agricole have dropped their add campaign featuring the national football side.

•Stateside Caterpillar, the world’s largest maker of construction equipment said its revenue will increase 25% and the company’s exports will jump 65%, Chief Executive Officer James Owens said today

•BG is lower by 4% Tuesday after the U.K.’s third largest natural-gas producer was downgraded to “neutral” from “buy” at Goldman Sachs after recent share-price gains.

•A report in the Frankfurter Allgemeine suggests that the sale of the Karstadt department store chain by the administrator to the investor Nicholas Berggruen is running into problems. Berggruen is attempting to negotiate a rent reduction with Karstadt’s main landlord Highstreet, but is publicly unimpressed by the concession currently being offered by Highstreet. The report suggests that although Highstreet has increased the rent concession offered to €400m by 2015, Bergruen considers this unacceptable as it is linked to taking a 30% stake in Karstadt.

•Visa and MasterCard , the world’s biggest payments networks, climbed more than 4% as the U.S. Congress worked toward a compromise that would protect transaction fees they charge to banks. The House will seek to maintain the Senate’s proposed cap on debit-card interchange, or “swipe” fees, according to Representative Barney Frank, the Massachusetts Democrat leading talks to produce a final regulatory overhaul bill. The plan from Senator Richard Durbin would empower the Federal Reserve to set fees charged to merchants that are “reasonable and proportional” to the cost of processing debit transactions

•A Board reshuffle at Sainsbury yesterday saw highly regarded CFO Darren Shapland being moved to Group Development Director, in charge of delivering Sainsbury’s aggressive UK growth plans, as well as new business development in convenience, Sainsbury’s Bank, Property and Group Strategy. According to speculation in today’s Times, Shapland may oversee a possible new venture into China.

•Segro announced that it had completed the acquisition of BAA’s 50% interest in the Airport Property Partnership (APP) first announced in April, which it will now own jointly with Aviva. Simultaneously Segro announced that it has agreed to sell GBP237m of assets into the JV, thereby increasing the assets in the JV from GBP447m to GBP684m. The properties being sold are trading estates and distribution centres near to Heathrow and Gatwick airports. The assets sold are not that different to Segro’s portfolio -net initial yield on the assets is 5.1% (net equivalent yield 7.2%), average lease length is 3.8 years (bit shorter than average) and vacancy rate 16.5%. The net impact will mean Segro will earn less of each property (buts still usually have control), but own more of them. In essence, asset diversification will be greater.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.