Gold Gives Up New Record Nominal Highs

Commodities / Gold and Silver 2010 Jun 22, 2010 - 05:42 AM GMTBy: GoldCore

Gold rose to a new all-time intraday high of $1265.07/oz in early European trading and then gave up its earlier gains in London yesterday. Gold came under concerted selling pressure in New York and fell in the final hours of trade ending near its late session low of $1237.83/oz with a loss of 1.40%. It has range traded in Asian and early European trading today.

Gold rose to a new all-time intraday high of $1265.07/oz in early European trading and then gave up its earlier gains in London yesterday. Gold came under concerted selling pressure in New York and fell in the final hours of trade ending near its late session low of $1237.83/oz with a loss of 1.40%. It has range traded in Asian and early European trading today.

Gold's downside reversal pattern yesterday may be short term bearish but it is too soon to jump to conclusions. Should gold finish the week lower (opened at $1,255/oz) then it could lead to profit taking and another period of correction and consolidation. Today sees the release of existing homes sales data in the US. Other data this week includes EU consumer confidence, manufacturing and service PMI and revised US GDP - all of which will be keenly awaited by the markets. The US Federal Open Market Committee will begin its two day long meetings today, with its policy statement to come later tomorrow. Markets will be wary of comments ahead of next weekend's Group of 20 summit which could see significant financial developments.

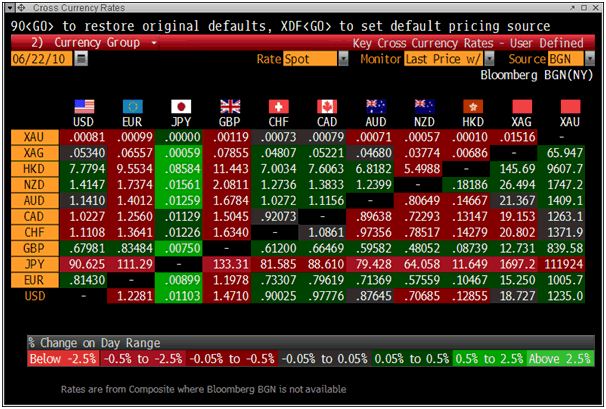

Gold is currently trading at $1,235/oz and in euro, GBP, CHF, and JPY terms, at €1,006/oz, £840/oz, CHF 1,371/oz, JPY 111,880/oz respectively.

The emergency budget in the UK is expected to be the harshest in over 30 years and could see a rise in the standard rate of VAT from 17.5pc to 20pc. A rise in VAT is the main concern for many consumers and will also contribute further to the recent rise in inflation in the UK, possibly signalling the beginning of the end of the recent deflation and the emergence of stagflation which would lead to gold remaining firm in sterling.

Gold continues to climb the classic wall of worry, common to all bull markets, with analysts and pundits continuously attempting to call the top and claim that the 'bubble' has burst. The level of skepticism towards gold remains high and most retail investors and many in the financial markets still do not understand the importance of having even a small allocation to gold. Lip service continues to be paid to diversification and crystal ball gazing regarding the future movement of asset prices remains prevalent. Meanwhile gold continues to gradually eke out gains in all currencies and remains in a secular bull market. Gold appears to consolidating above €1,000/oz and £800/oz.

Cross Currency Rates at 1130 GMT - JPY, CAD, CHF and XAU Strongest

Silver

Silver is currently trading at $18.73/oz, €15.23/oz and £12.72/oz.

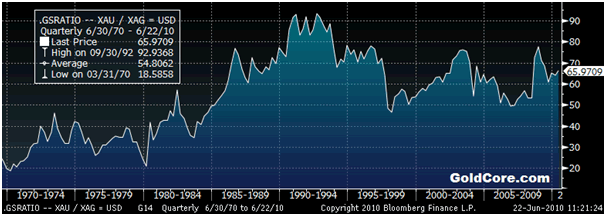

Gold to Silver Ratio at 66 - Silver Remains Very Undervalued Versus Gold

Platinum Group Metals

Platinum is trading at $1,594/oz and palladium is currently trading at $494/oz. Rhodium is at $2,425/oz.

News

Gold will be the best-performing asset for the rest of the year, according to about 30 percent of respondents in a UBS AG survey last week, the bank said today in an e-mailed report. UBS surveyed reserve managers, multilateral institutions and sovereign wealth funds, the bank said. More than 25 percent said global equities would be the best performer, followed by U.S. Treasuries (Bloomberg)

Silver may surge to as much as $23 an ounce next year, the highest price since 1980, as investors seek a cheap alternative to gold and a global economic recovery boosts industrial demand, according to Commerzbank AG. The metal may advance to as much as $21 an ounce by the end of this year, about 12 percent higher than yesterday's close, Eugen Weinberg, head of commodity research, wrote in a report, dubbing the metal "gold's little brother." Compared with gold, silver may be considered low priced, Weinberg wrote. Gold surged to a record $1,265.30 an ounce yesterday as investors sought to preserve their wealth against declining currencies, and China's decision to drop the yuan's dollar peg boosted commodity prices. There's rising demand for silver, of "poor man's gold," the Perth Mint said earlier this month. "Gold is still a priority for investors" who are looking for shelter from growing economic uncertainty, Ng Cheng Thye, a Singapore-based director at Standard Merchant Bank Ltd., said by phone today. There's also "a good chance for silver to rally higher," possibly to $20 an ounce, Ng said. Silver for immediate delivery traded at $18.8213 an ounce at 4:43 p.m. in Singapore, 11 percent higher since the start of the year. Gold, which has risen 13 percent in 2010, was at $1,239.75 an ounce.

Weinberg's targets add to signs of increased investor interest in precious metals. Assets in the SPDR Gold Trust, the biggest exchange-traded fund backed by bullion, have risen 15 percent in 2010 to a record 1,307.96 tons. The Perth Mint said Europe's debt crisis was spurring demand.

'Low-Cost Alternative'

"As with gold, silver is also considered to exhibit stabilizing characteristics when it comes to value," Weinberg wrote in yesterday's report. "Silver is reasonably priced compared to gold and constitutes a low-cost alternative." The ratio between gold and silver had risen to about 65 compared with an average of 59 over the past "several years," the report said. "We expect this ratio to swing back, leading to potential for silver," Weinberg said. An ounce of gold for immediate delivery bought about 65.81 ounces of silver today, compared with the 2008 low of 47.55 ounces and the decade average of 61.99 ounces, data compiled by Bloomberg show. Silver sales would be boosted by an expected recovery of industrial demand, with the metal used in solar cells, mobile- phone covers and photography, the report said. Global demand may increase by as much as 50 million ounces by 2011, it said. Economic growth in China, already a net importer of silver, would also boost sales, Weinberg wrote. China's import demands are likely to increase, "having a positive impact on the price," the report said (Bloomberg).

The Australian and Canadian dollars are becoming reserve currencies for central bankers seeking alternatives to deteriorating government credit quality in Europe, the U.S. and Japan. "They'll gain an increasing place in reserves because of diversification," European Central Bank governing council member Christian Noyer said in a June 16 interview with Bloomberg News in Paris. Russia may add the Australian and Canadian dollars to its international reserves for the first time after fluctuations in the U.S. currency and euro, Alexei Ulyukayev, the first deputy chairman of the nation's central bank, said in an interview in Moscow on June 15. The International Monetary Fund may add the Aussie and loonie to a basket of currencies it uses in transactions, strategists at UBS AG, the world's second largest foreign-exchange trader, predict (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.