Euro to Fall Further and Gold Breaks Traditional Relationship With Dollar

Currencies / Euro Jun 22, 2010 - 05:20 AM GMTBy: Miles_Banner

The devaluation of the euro in recent months, which has continued in spite of huge political attempts to reverse the trend, has recently accelerated.

The devaluation of the euro in recent months, which has continued in spite of huge political attempts to reverse the trend, has recently accelerated.

The Euro value against the USD (US dollar) has nosedived. The 30, 90 and 200 weekly averages have been falling steeply. Something known as a ‘golden cross’ has formed, whereby the 30 and 90 weekly averages have fallen through the 200 weekly average.

A ‘golden cross’ is a bearish sign which could spell further falls ahead for the euro (If you’re uncertain of what these moving averages are don’t worry, we’ll write an article on these soon).

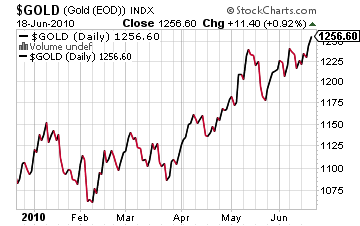

As confidence in the euro continues to erode, gold prices today find themselves at record highs for the euro, pounds sterling (GBP) and US dollars.

The dollar and gold relationship changes

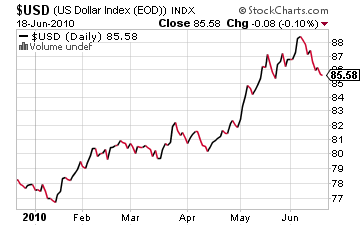

Whilst new records are being reached for gold priced in US dollars the dollar too has seen an improvement over the year.

This week saw the gold futures up more than 15 percent on a year to date basis, and the dollar index up 10 percent, the long term ‘Inverse dollar gold relationship‘ is being discarded. Gold has been rising in tandem with the dollar for the past few months.

The US dollar and gold are still being sought as safe haven assets, and as such they have grown as the economic instability has fed the growth of investors fears.

Notably the stock market has also been climbing in recent weeks. As the stock market continues to post gains the underlying gold prices really reflect investors sentiment. The high gold prices reflect peoples fear about a double dip recession or at least a correction. This will only become greater as the stock market goes higher.

The rise of the US dollar and gold together is based on the need for capital to find safety. What we should not forget is that although the stock markets are rising this does not indicate stability in currencies and economies. Despite the apparent safe haven of the US dollar, there can only be one conclusion. It will have its day of reckoning, it’s just a question of when.

Digger

Gold Price Today

We leave you this week with a fascinating article forwarded to us by one of our readers, James. It’s a Bloomberg story that reveals the insatiable appetite for gold amongst central banks – Central Bank Gold Holdings Expand at Fastest Pace Since 1964

© 2010 Copyright Gold Price Today - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.