What's the Point of Macro Events Research in Forecasting?

Economics / Economic Theory Jun 22, 2010 - 02:05 AM GMTBy: John_Mauldin

I am back in Tuscany and will head to Milan tomorrow early, give a speech at the Bloomberg offices and then back home. But it is Monday and that means it is time for another Outside the Box. And I have found a most excellent offering. Dylan Grice from Societe Generale in London wrote on value for an OTB a few weeks ago, and he follows that up with more thoughts on the use of macro trends versus value investing. This is a real think piece, and worthy of more than one read.

I am back in Tuscany and will head to Milan tomorrow early, give a speech at the Bloomberg offices and then back home. But it is Monday and that means it is time for another Outside the Box. And I have found a most excellent offering. Dylan Grice from Societe Generale in London wrote on value for an OTB a few weeks ago, and he follows that up with more thoughts on the use of macro trends versus value investing. This is a real think piece, and worthy of more than one read.

I have to hit the send button, as my last dinner in Italy awaits (and real Italian food has been a revelation, and the wines! I am something of a chardonnay snob, and usually turn my nose up at Italian and French whites, but I found some local Tuscan chardonnays that were up to the best in California. And at reasonable costs.).

Your not wanting to leave Tuscany analyst,

John Mauldin, Editor Outside the Box

What's the Point of Macro?

By: Dylan Grice

Most people would see the macro strategist's role as timing macro events ... switching between defensives and cyclicals, adjusting duration, risk-on/risk-off trades, and so on ... the only problem is that most of us are rubbish at seeing macro events coming, let alone timing them, as our evolutionary programming blinds us to events which are forecastable (and many are not even that). Perhaps we should embrace our limitations by accepting that 'outlier events' are actually quite regular, and use macro research to aid in the search for appropriate insurance strategies.

* A few weeks ago I mapped out a strategy that was based on the idea that since global banks' solvency was so dependent on government bond holdings, central banks would have no option but to quantitatively ease in the face of future government funding crises. I argued that such funding crises could provide opportunities to buy cheap risk assets before liquidity/QE-induced rallies and that some value was beginning to emerge, but also that that value still wasn't extreme enough to go all in.1

* As usual, I received some interesting feedback - some favourable, some not (one pm said my 'deflation-begets-inflation' view was a "dog's leg" forecast). But one client asked why I bothered looking at valuation at all. Surely my extreme macro views trumped such considerations? "I just don't understand how you can separate your ... economic research from your stand-alone valuation tools." I thought this was a brilliant question because it gets to the heart of a permanent tension between macro and micro: what should the relationship between top-down macro and bottom-up valuation be?

* At the risk of oversimplifying what our more macro-focused clients do every day I'd characterize pure macro-focused managers as being less concerned with valuation. For a start, the traditional macro instruments such as commodities and currencies are difficult to value. But by far the biggest macro market - the bond market - is largely priced off central bank perceptions of what the economy is doing, and risk assets tend to be priced off those bond markets. Since mispriced assets can become even more mispriced depending on the macro climate and central banks' reading of it, timing is everything and for such managers an understanding of the 'big picture' is far more important than valuation.

* But at the opposite end, where the pure value hunters reside, Warren Buffett has said that even if he knew the Fed's exact interest rate moves two years in advance it still wouldn't make any difference to how he would invest today. Indeed, most value investors shun macro completely and focus entirely on bottom-up valuations. They view recessions as good times to buy and have little confidence in anyone's ability to predict them. But they don't really care because they know recessions occur frequently enough and they are patient enough to wait. So why bother with macro?

At last year's Value Investing Congress, David Einhorn neatly reconciled the top-down versus bottom-up investment philosophies. He was describing his Damascene conversion following a foray into a high quality US homebuilder just before the housing bubble burst:

"At the May 2005 Ira Sohn Investment Research Conference in New York, I recommended MDC Holdings, a homebuilder, at $67 per share. Two months later MDC reached $89 a share, a nice quick return if you timed your sale perfectly. Then the stock collapsed with the rest of the sector. Some of my MDC analysis was correct: it was less risky than its peers and would hold up better in a down cycle because it had less leverage and held less land. But this just meant that almost half a decade later, anyone who listened to me would have lost about 40% of his investment, instead of the 70% that the homebuilding sector lost.

"I want to revisit this because the loss was not bad luck; it was bad analysis. I downplayed the importance of what was then an ongoing housing bubble. On the very same day, at the very same conference, a more experienced and wiser investor, Stanley Druckenmiller, explained in gory detail the big picture problem the country faced from a growing housing bubble fueled by a growing debt bubble. At the time, I wondered whether even if he were correct it would be possible to convert such big picture macro-thinking into successful portfolio management. I thought this was particularly tricky since getting both the timing of big macro changes as well as the market's recognition of them correct has proven at best a difficult proposition. Smart investors have been complaining about the housing bubble since at least 2001. I ignored Stan, rationalizing that even if he were right there was no way to know when he would be right. This was an expensive error.

"The lesson that I have learned is that it isn't reasonable to be agnostic about the big picture. For years I had believed that I didn't need to take a view on the market or the economy because I considered myself to be a "bottom-up" investor. Having my eyes open to the big picture doesn't mean abandoning stock picking, but it does mean managing the long-short exposure ratio more actively, worrying about what may be brewing in certain industries, and when appropriate, buying some just-in-case insurance for foreseeable macro risks even if they are hard to time."

I think most people would agree with this very reasonable hybrid approach: use macro analysis to avoid economic turbulence by managing your portfolio's "long-short exposure ratio" more, and bottom-up analysis to maintain a value bias to the holdings within your portfolio.

But there is still a problem with the applicability of this philosophy: your ability to 'actively manage' your portfolio's beta is a function of your ability to accurately call the market's shortterm direction correctly on average over time. But just because most of us think we are reasonably competent at calling such short-term moves doesn't mean we are. In fact, the reality is that we're appalling at it.

The future is wild, but our forecasts are mild

One problem is that many of the big moves we're supposed to "trade around" are fundamentally unpredictable (Taleb's Black Swans) and no amount of research will predict such events. Perhaps a more important thought is that we're simply not hardwired to see and act upon the big moves that are predictable (Taleb's Grey Swans).

To see why, it's important first to understand the nature of those big "outlier" moves. Benoit Mandlebrot, the inventor of fractal geometry, distinguished between uncertainty that is "mild" and that which is "wild."2 For in a sample from a population that is only mildly random, extreme occurrences won't change the estimated characteristics of the population. To use Taleb and Mandlebrot's example3, imagine taking 1000 men at random and calculating the sample's average weight. Now suppose we add the heaviest man we can find to the sample. Even if he weighed 600kg - which would make him the heaviest man in the world - he'd hardly change the estimated average. If the sample average weight was similar to the American average of 86kg, the addition of the heaviest man in the world (probably the heaviest ever) would only increase the average to 86.5kg.

With mild distributions, extreme outliers are insignificant to our understanding of the likely weight of someone randomly chosen from the population. The insignificance of such outliers makes the uncertainty around people's height, blood pressure or IQ so mild that fairly accurate probabilities can be judged using the well-known Gaussian "bell curve" distribution. The bell curve is usually referred to as the normal distribution because it has known and convenient properties, yielding safe and predictable probabilities, and we like to think that safe and predictable is normal.

But it's not actually that normal. There are plenty of very important variables which are more "wildly" random and in which outliers make a transformative difference. For example, suppose instead of taking the weight of our 1000 American men, we took their wealth. And now, instead of adding to the sample the heaviest man in the world we took one of the wealthiest, Bill Gates. Since he'd represent around 99.9% of all the wealth in the room he'd be massively distorting the measured average so profoundly that our estimates of the population's mean and standard deviation would be meaningless. If wealth distribution was mild this would never happen. But it's not. So it does. If weight was wildly distributed, a person would have to weigh 30,000,000kg to have a similar effect!

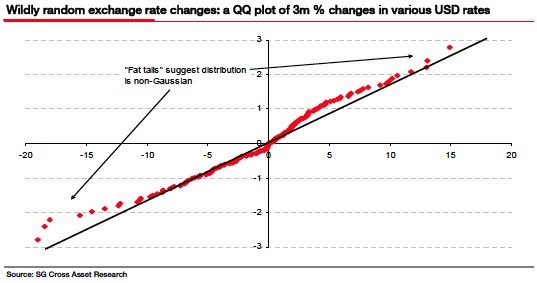

The simplest way to see if something is mildly random - if it follows a Gaussian distribution - is through a QQ plot. You plot the variables of the series you're interested in on one axis with manipulations of the same variable (which ensures it is Gaussian by construction) along the other, and if the scatter plots a neat diagonal line, your distributions roughly match and your variable is likely normally distributed. If it doesn't you may have a "wildly" random variable on your hands.

The following chart shows a QQ plot of three-month changes in various dollar exchange rates from mid-2006 to the present. Simply eyeballing the data shows that we can't draw a neat straight line through the scatter plot, suggesting the data is non-Gaussian (more rigorous statistical tests show this to be true) and the "fat tails" are clearly visible. It has been known for some time that financial market variables were not mildly random, but LTCM demonstrated just how dangerous assuming away wild randomness could be.

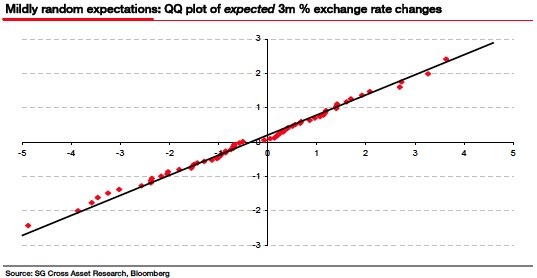

Now take a look at a similar plot below, only this time of forecast 3m changes (I calculated these using Bloomberg's history of quarterly forecasts relative to the 3m forward rates prevailing at the forecast date). Contrast the near perfect diagonal straight line below to the poorly fitting one above. Forecasts are mildly distributed along Gaussian lines (more formal statistical tests show this to be true). Thus, even though we know changes in financial market variables are non-Gaussian, our expectations of those changes remain Gaussian. We see the world in which we live as mild even though we know it's wild.

Why we all think we're great traders

I was dumbstruck in a recent meeting I did with Albert when one of the attendees, who was a well known tech bull in the late 1990s, dismissively claimed (with a completely straight face) that Albert's call to overweight bonds relative to equities in 1999 was "pretty consensus at the time really." This was a time when the tech mania was in full swing, when adding "dot com" to the end of a company name was enough to double its share price that day, when the Nasdaq was trading at a PE in excess of 50x, and when Jim Cramer was telling investors in his hedge fund that PE ratios were redundant because none of his favourite stocks even had earnings "so we won't have to be constrained by that methodology for quarters to come."4 Yet Albert's call to sell stocks and buy government bonds at this time was "pretty consensus"!

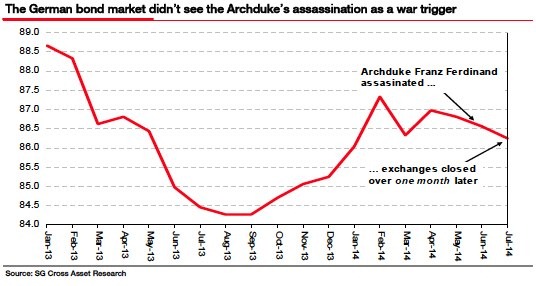

Niall Ferguson has given a brilliant example of how such "selective memory" can permeate the collective psyche. In his book "War of the World", his fascinating interpretation of the 20th century's rolling conflicts, he shows that pretty much any narrative of WW1 will painstakingly show how all the warning signs of an impending conflict were there and how inevitable the war must have seemed at the time. Germany and France almost came to blows in 1911 over Morocco in the Agadir crisis, a European arms race was in full swing as Russia committed in 1912 to rebuilding its military, and the Kaiser's determination to surpass Britain's naval supremacy was intensifying the armaments build-up in Germany and the UK. Indeed, at Germany's Imperial War council meeting of 1912, von Molkte even argued (now famously) for an immediate attack on Russia since war with her was "unavoidable, and the sooner the better." The march to war was clearly on, wasn't it ....

Well yes, with hindsight perhaps, but no-one realised it at the time. The now familiar historical notion is that a tension was slowly building up between the European powers and that this reached such a fever-pitch that by 1914, when Archduke Franz Ferdinand was assassinated in the Balkans, Europe was a like a barrel of gunpowder just waiting for a spark. But as Ferguson shows in his book, this notion is in fact highly dubious. It implies that everyone knew how significant the above events were at the time, which they did not.

Or at least, the bond market didn't. The chart below shows German bond prices (which were considerably higher than they had been a year earlier) had barely budged following the assassination of the Archduke, which ultimately triggered the "war to end all wars"!

The classic study on hindsight bias was done by Fischhoff and Beyth5 who asked their students to estimate probabilities for possible outcomes during Nixon's visit to China in 1972 before it occurred (for example, "what is the probability that the USA will establish a permanent diplomatic mission in Peking, but not grant diplomatic recognition"). What the subjects didn't know was that they would be later asked to recall those probabilities. But when they did, between two weeks and six months after the visit, they recalled that their estimate of events that did happen was much higher than their actual estimate had been, and likewise that their estimate of events that had not transpired had been much lower.

This hindsight bias helps explain our inability to see outliers. If you were perfectly rational in forecasting returns, an unexpectedly positive or negative number would widen your volatility estimate. But if you "knew it all along" you wouldn't accept that the return was unexpected. Your estimate of potential price volatility would be unchanged and you'd continue to disregard the possible outlier events as too unlikely because your forecast range would remain too narrow. This was actually evident when I put the data together for the QQ charts above. The standard deviation of the actual exchange rate changes was 5.7%; that for the forecasts was only 1.8%.

This over-confidence bias is well documented. In spelling tests, subjects who mark answers they're "100% certain" of are only correct 80% of the time. Where an error of 0% is expected, one of 20% occurs. But hindsight bias contributes to this natural pre-disposition towards overconfidence because if you think you predicted past events accurately, you'll think you can predict future events too.

If you ask a class of students how many expect to finish in the top 50%, come the end of the year around 80% will put their hand up. Similarly, I've been amazed at the number of clients who've told me they think "buy and hold is dead" and that "these markets have to be traded." For traders in the market, the odds are considerably worse than students in exams. Performance data typically show that around 70-80% of active managers underperform the indices6 while studies of brokerage accounts show similar odds for individual traders.

There is absolutely nothing wrong with "trading these markets" if that's what you love doing and it's what you're good at. But the evidence clearly shows that the vast majority of us aren't. Worse, the vast majority of those who think they are good at it aren't either, and they will be competing against traders who are. So my advice to anyone about to embark upon Einhorn's path of using macro to "actively manage your long-short exposure." is to think long, hard and honestly about what your sphere of competence actually is. Otherwise, the chances are that you'll be making your broker far happier than your investors.

So what is the point of macro research?

So if our confidence in our forecasting ability is for most of us more likely to be reflecting a cruel trick of our evolutionary development than any real ability, is macro research completely redundant? I don't think so. In fact, I agree with the second part of David Einhorn's conclusion in the excerpt above, of "when appropriate, buying some just-in-case insurance for foreseeable macro risk".

At this year's Berkshire Hathaway conference, Charlie Munger said that while most people and firms do whatever they can to avoid large losses, Berkshire Hathaway is designed to take them. "That's our edge", he said. When asked about his successor at the helm of Berkshire, Buffett said that the most important thing his successor at Berkshire must be able to do is "to think about things which haven't happened before." Most insurance companies lose money on their underwriting operations but make money on the float. Berkshire Hathaway makes profits on both. They haven't been able to do this because they've been better at predicting the future than the competition - they openly admit to not even trying - but because their whole approach is grounded in a) the understanding that "outlier" events happen every few years, and b) being patient enough to hold capital in preparation for deployment when such "outliers" inevitably arise.

There are two broad approaches to a more insurance-based approach. The first and most simple is the avoidance of the purchase of overvalued assets. Ensuring an adequate margin of safety against the unknown and unknowable future - rather than trying to predict it - is the central philosophy behind Ben Graham's concept of value investing and one of the simplest differences between investment and speculation. It's as important today as it has always been and is why a careful and prudent analysis of valuation is so important. This is why I spend what some might think is an unusual amount of time on equity valuation for a macro strategist.

The second approach is to focus on the "grey swans" - the tail risks which are predictable - by devoting time to thinking about them and to finding effective and efficient protective insurance should they happen. Most of the research Albert and I write aims in this direction. It is for most of us, I believe, a more fruitful use of macro research than trying to predict various markets' short-term moves. There is a very big difference. Some have interpreted my work on government solvency as a reason to short government bonds, and JGBs in particular. I've actually never suggested doing this. To get it right you have to get your timing right, and ? well ? see the above on how confident most of us (myself included) should be about that.

But just because you can't predict when something will happen doesn't mean you should act as though it won't happen. If, for example, you are as worried about the implications of what appears to be widespread public sector insolvency in developed markets as I am, there are numerous insurance products worth considering. Popular Delusions is of course a strategy product, and regulatory boundaries preclude me from making too specific recommendations, so I'm going to end by doing something I very rarely do: shamelessly plug my colleagues (look away now if you don't want to be soiled by such unbridled commercialism!).

I think it's fair to say that derivatives is one of SocGen's genuine competitive strengths. We have a world class and award-winning derivatives operation and, as far as I know, compete favourably with any other house on the street. So if you're like most of the clients I talk to and are interested in insuring against any of the scenarios Albert and I have explored in our research (whether an inflation crisis in Japan, the break-up of the euro, a funding crisis in the US, a Chinese hard landing) or indeed any that we haven't, but don't know the best way to do so, let me know and I will put you in contact with the appropriate members of the derivatives team here. Having sat down with them in recent months, seen them work and seen the tailevent hedges that can be squeezed out of the options market I'd be surprised if you weren't impressed at what can be done. I certainly have been.

Footnotes:

1 "Print baby, print ... emerging value and the quest to buy inflation", Popular Delusions, 27/05/2010

2 See "The (Mis)behaviour of markets: A Fractal View of Risk, Ruin and Reward" by Benoit Mandlebrot. In the "Black Swan" Taleb drew a similar distinction between Mediocristan and Extremistan

3 See "Mild vs Wild Randomness: Focusing on those Risks that Matter" by Benoit Mandelbrot and Nassim Taleb

4 "Winners of the New World" by Jim Cramer, speech given at the 6th Annual Internet and Electronic Commerce Conference and Exposition, 29 Feb 2000

5 See "I knew it would happen" Baruch Fischhoff and Ruth Beyth (1975)

6 See for example Standard and Poors SPIVA Scorecard results...

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.