A Classic Stock Market “Fade The Gap” Day

Stock-Markets / Stock Markets 2010 Jun 21, 2010 - 01:18 PM GMTBy: David_Grandey

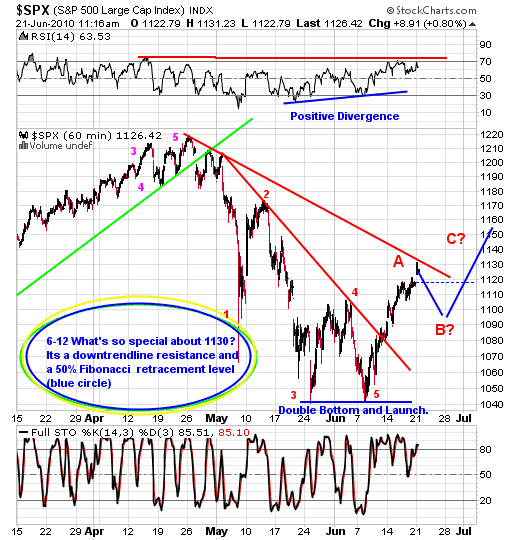

“What’s so special about 1130? It’s downtrendline resistance and a 50% fibonacci level”

“What’s so special about 1130? It’s downtrendline resistance and a 50% fibonacci level”

One look at the SPX chart below tells the story, all in a news driven pop based upon the Yuan.

Sure enough the opening gap took us right to those levels.

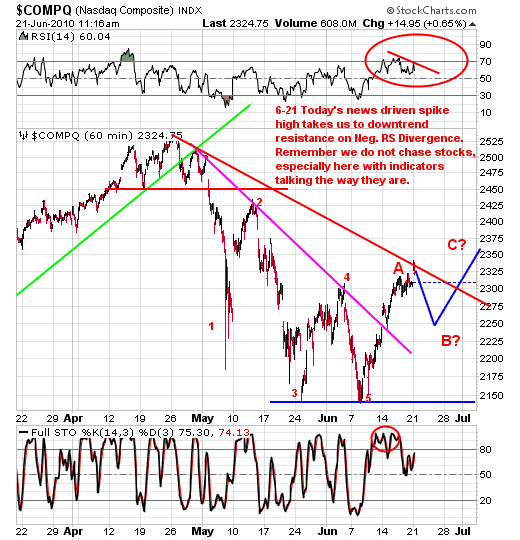

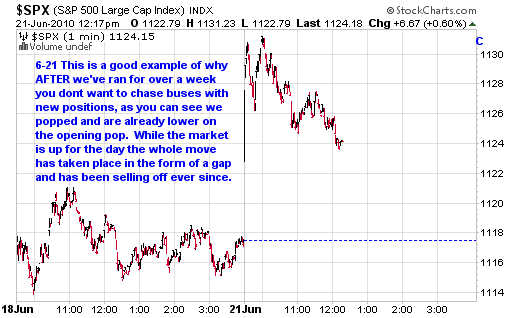

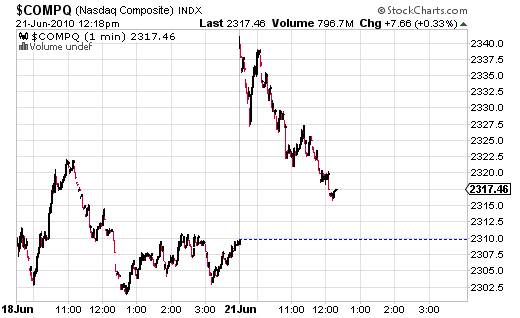

So are the markets really up today or are they down? Just look at the two charts below.

So in answer to the question of whether we are up or down for the day — how about BOTH?

To those who have been in the market before Friday’s close yes it’s up.

But to those who had to chase the market at the open and REACT AFTER THE FACT the market is down. This is what they mean when they say “Fade The Gap”. Folks going into today we were overbought to begin with and the Chinese Yuan news was just the icing on the cake to set up the fade the gap and lock in some gains.

Think about it, anyone who basically bought anything today is basically down from their entry.

Moral of the story — listen to the charts and above all NEVER CHASE BUSES BY REACTING.

In Summary:

The markets are stretched and hitting key resistance levels and a lot of individual stocks are also showing this — AKAM, SNDK,NFLX — all have technical indicators and nano-timeframe toppiness showing up as well. Right now we are going to go slow here and protect what we have, which we’ve done and employ the strongest centering phrase we know.

“What Do I Need To See To Make Me Take A Trade”

You would do yourself well by printing off that phrase and pasting it to your monitor somewhere to keep you focused and to ingrain it in your subconscious.

On the long side it’s all about “Pullbacks Off Highs” patterns. It’s really all you need to know and how to trade them of course.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.