Commodity Markets Analysis - Gold To Break $700 As Sept 11th Anniversary Nears

Commodities / Gold & Silver Sep 07, 2007 - 10:29 AM GMTBy: Gold_Investments

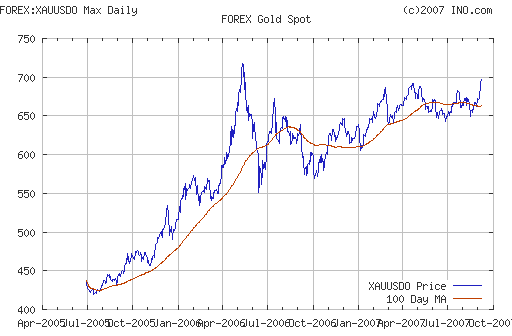

Spot gold was trading at $697.50/698.00 an ounce as of 1215 GMT.

Spot gold was trading at $697.50/698.00 an ounce as of 1215 GMT.

Gold has continued to show strength in Asian and European trading and remains near 16 month highs. Besides a weak dollar and near record oil prices, gold was also bolstered by a resumption of geopolitical tension in the Middle East, with Syria accusing Israel of bombing its territory. With the 6 year anniversary of September 11 atrocity next Tuesday and Osama Bin Laden again in the news, risk aversion and safe haven buying is contributing to gold's strength. This is seen in strong inflows into gold ETFs and we have experienced a strong pick up in sales of both physical bullion and Perth Mint gold certificates.

While there may be some profit taking it seems likely the psychological $700 mark will be passed in the near term prior to challenging the 27 year highs of $722 that was reached in May 2005. We continue to believe there is a good chance gold will challenge its record high price in 1980 of $850 before the end of 2007.

All eyes are on the U.S. non farm payrolls for August and there are concerns that the figure could be to the downside showing that problems in financial markets are now spreading from Wall Street to "Main Street" and the wider U.S. economy.

Silver

Spot silver is trading at $12.57/12.59 an ounce (1215 GMT).

PGMs

Platinum was trading at $1288/1292 (1215 GMT).

Spot palladium was trading at $332/338 an ounce (1215 GMT).

Forex and Gold

The euro remained strong against the USD despite the ECB deciding to leave interest rates unchanged at 4%. Trichet said that ECB monetary policy was still on the “accommodative” side but the words “strong vigilance” were conspicuous by their absence. These words usually serve as a precursor to an interest rate hike the following month and the fact they were not mentioned in the official statement has led many people to believe that the ECB will once again leave rates on hold at the October meeting.

Traders are holding their breath ahead of this afternoon's release of the key non-farm payrolls report for August. In terms of yesterday's numbers, markets in particular focused on the sharp fall (from 51.7 to 47.9) in the employment component of the services ISM. Consensus forecasts are showing an increase of 110,000 in the official payroll data but following the weak ADP report on Wednesday's and yesterday's numbers the risks to this forecast would now seem to be to the downside.

The credit crunch has not gone away and risk aversion remains the order of the day.

Oil

Oil prices continue their quiet and steady rise towards the all time record high of 78.77 USD reached on Aug 1.

At 1000 GMT , London's benchmark Brent for October delivery were down 29 cents at 74.48 USD per barrel. New York crude contracts for October delivery were down 24 cents at 76.06 USD per barrel. Yesterday, the contract hit a day high 77.43 USD, just over a dollar short of its all-time record.

High oil prices continue to be fundamentally a result of a very tight global supply/demand equation in oil. Many analysts have ignored oil's recent and continuing strength and this is another important and fundamental factor supporting gold.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.