UK Government Scraps NHS GP and Hospital Waiting Time Targets

Politics / NHS Jun 21, 2010 - 12:35 PM GMTBy: N_Walayat

The New UK ConDem government has scrapped Old Labours efforts to hold GP's and the NHS Hospitals to account by means of feeble waiting time targets such as of being able to see ones GP within 48 hours, or be assessed at your local hospital within 4 hours. I say feeble because GP's have long since developed tricks, simple mechanisms to avoid falling fowl of Labours targets such as not picking up the phone on patients calling to make appointments, or telling patients to come in on a later date to make an appointment.

The New UK ConDem government has scrapped Old Labours efforts to hold GP's and the NHS Hospitals to account by means of feeble waiting time targets such as of being able to see ones GP within 48 hours, or be assessed at your local hospital within 4 hours. I say feeble because GP's have long since developed tricks, simple mechanisms to avoid falling fowl of Labours targets such as not picking up the phone on patients calling to make appointments, or telling patients to come in on a later date to make an appointment.

Another target abandoned is that of hospitals seeing patients within 18 weeks of being eventually referred by their GP's. I say eventually because GP's get paid by the visit, so delaying a proper consultation with many short worthless visits so as to maximise surgery earnings ultimately results in actual patient waiting times of 26 weeks rather than 18 weeks (if the patient has not given up by that point).

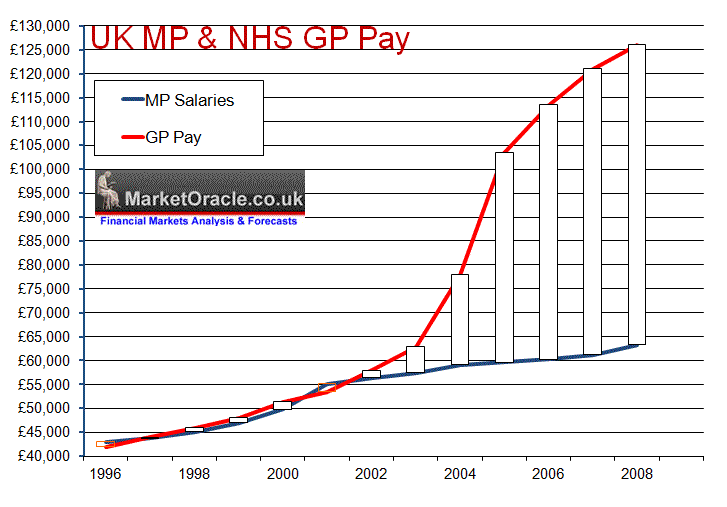

However now there is even less incentive for NHS GP's to do a proper job who under Labour have enjoyed a pay rise bonanza which contributed towards the MP Expenses scandal as apparently greedy and easily corruptible members of parliament, grew increasingly green with envy at the growing year on year pay disparity between MP's and NHS GP's that were able to effectively award themselves pay rises of over 30% per annum as illustrated by the below NHS GP and MP Pay graph that shows divergence in pay following Labours Incompetent NHS spending spree with a tripling in GP Pay resulting in LESS hours worked.

When Labour came to power in 1997 average MP pay was £43,722 against average NHS GP pay of £44,000, so both were inline with one another at that time. However as the above graph clearly illustrates in 2003 something started to go seriously wrong with GP Pay which took off into the stratosphere as GP's decided to award themselves pay hikes of more than 30% per annum at tax payers expense that has lifted average GP pay to £126,000 per annum against £64,000 for MP's.

How could this happen, unfortunately this was as a consequence of the now infamous GP contracts where to be blunt greedy GP's hoodwinked gullible incompetent Labour government health ministers into signing upto contracts which were meant to deliver greater value for money for the tax payer but were designed to do the opposite and resulted in GP's pay doubling whilst at the same time cutting back on hours worked. This was not only a total fiasco for the nations health and finances but also ignited jealousy amongst MP's that directly led to the adoption of the policy of claiming expenses to the maximum so as to fill the ever widening gap between MP's and NHS GP's, as MP's could NOT get away with awarding themselves pay hikes of 30% per annum without losing their seats at the next general election in response to voter outcry, therefore across the board systematic abuse of expenses started to take place which basically means real average MP pay is currently approx £98,000 per annum.

NHS Bankrupting Britain

The country is currently running an annual £156 billion budget deficit i.e. the government spends £156 billion a YEAR more than it earns in revenue which is contributing to towards igniting Britains inflationary debt spiral, that risks accelerating trend towards an hyper inflationary bust leaving savers with worthless paper and the economy in ruins, i.e. bankrupt unless urgent action is taken to bridge the gap.

The NHS budget under Labour has grown from £40 billion in 1997 to £121 billion for the last financial year. NHS budgets increasing in line with inflation (CPI) would have seen the budget under a Conservative regime rise to stand at £51.6 billion, and probably nearer £60 billion to allow for an ageing population. So the Labour government is in effect spending an extra £60 billion a year, more than double that which the Conservative would be spending on the NHS.

Against this extra spending instead of Brit's experiencing the impact from effectively paying for TWO NHS's, the NHS is experiencing year in year out loss in productivity, i.e. the more the government spends on the NHS the LESS output the NHS delivers as more tax payer funds disappear into the NHS black hole. In theory this suggests that the NHS budget could in-effect be halved to £60 billion and still deliver a functional health service that the the country can afford. Off course that is not going to happen, but still a mere 10% cut in the NHS budget would contribute some £12 billion of annual savings from this out of control spending black hole that like a cancer is eating through the countries balance sheet.

The government's annual budget deficit is running at £156 billion a year or at 23% of the total budget i.e. the the governments total revenues are £520 billion against estimated expenditure of £676 billion, hence a deficit of £156 billion added to the national debt known as the Public Sector Net Debt (PSND) currently standing at about £850 billion, though excluding the hidden tax payer liabilities that extend to several more trillions of pounds. Nevertheless £850 billion of debt costs about £35 billion in interest per year to service, as the debt grows so does the cost of servicing the debt, more so as the supply of government bonds increases then so will the market demand ever higher interest rates to buy this flood of debt which illustrates why running anywhere near an £156 billion annual budget deficit is NOT sustainable, as it would ignite the earlier mentioned inflationary debt spiral as interest payments soar which therefore requires urgent action to CUT the deficit to BELOW 6% of GDP / £75 billion, with some £80 billion necessary to be cut comprising of tax increases, economic growth and spending cuts in the region of £60 billion.

However the ConDem government has tied one arm behind its back by stating that they will continue to increase the two largest areas of government spending, the NHS and Pensions which amount to 1/3rd of total government spending, which means that deeper budget cuts will have to be borne by other spending departments which may not be possible to achieve.

NHS Pumping Out Bogus Performance data

A lengthy report earlier this year into the REAL performance of one of Britians top ranked hospitals placed The Mid Staffordshire NHS Foundation Trust as a killing field for patients that walk through its doors, this is set against NHS phony statistics on hospitals and GP surgeries that relentlessly paint a picture of everything is great, against the facts of actual patient experience as reported by the Telegraph -

Up to 1,200 patients are thought to have died unnecessarily at the trust between 2005 and 2008.

A damning report on the deaths found chronic staff shortages, receptionists in casualty departments assessing the urgency of cases and nurses switching off equipment that did not know how to use.

Both trusts are “Foundation Trusts” a status supposedly awarded to only the best in the NHS.

We were told by the Department of Health that Mid-staffordshire NHS Trust was a one off, an aberration. Now barely a few days later we find that it is barely the tip of the ice-berg with now another 24 Hospitals with the similar problem of engaged in the process of reducing their waiting lists by unnecessarily killing off patients, all according to the NHS produced phony data are doing well as reported by the Daily Mail -

Twenty five hospital trusts should be urgently investigated over fears that thousands of patients may have died unnecessarily, an expert said last night.

Excessive death rates at the trusts could be down to serious failings in the way patients were treated, according to Professor Sir Brian Jarman.

He said a total of 4,600 more patients had died at the 25 trusts than would be expected between 2007 and 2008

Remember these are are NHS trusts that are ranked by the NHS as the BEST hospitals in Britain ? Why ? because as with the rest of the NHS, they self certify their OWN performance data. Which means a hospital such as the Mid Staffordshire can hide 1,200 unnecessary deaths.

The same applies to as many as 1/5th of GP surgeries that self certify as being good, but actual patient experience does not match the phony statistics, in this regard the Department of Health funded UK Patient GP Survey enables patients to find the truth about their GP Surgery as per actual patient experience - To find out your GP's actual performance visit the UK GP Patient survey results site.

The only answer to the NHS GP and Hospital delivery crisis is in greater competition between surgeries and hospitals which ultimately means privatisation, as the existing system of no real competition means the incompetent are rewarded with more resources in the face of inability to delivery whilst those that excel are punished with less resources so as to pull all services down towards the under performing mean.

The only way excellence can be rewarded and act is the goal to be achieved is if competition drives out the inept and incompetent GP surgeries as they lose patients and resources to the better run GP surgeries which can only happen in a private system of healthcare delivery, where patients would in effect be handed NHS credit cards to enable them to buy healthcare at ANY health facility whether NHS run or private.

Given the actual performance of the NHS, I would imagine that closing 20% of the worst performing NHS Hospitals and GP Surgeries would result in IMPROVED life expectancy for Brit's as well as contribute £24 billion of annual savings to help bring the unsustainable £156 billion annual budget deficit under control, though that is not going to happen in tomorrows Budget.

Comments and Source: http://www.marketoracle.co.uk/Article20487.html

By Nadeem Walayat

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.