China; Equities More Flexible Friend

Stock-Markets / Stock Markets 2010 Jun 21, 2010 - 09:01 AM GMTBy: PaddyPowerTrader

On Saturday, the Chinese central bank the PBoC issued a statement on exchange rate policy which has moved the goalposts & spawned today’s rally. In essence what the announcement boiled down to is an equity abandonment of the 2 year old peg to the Dollar and the resumption of exchange rate reform through a more flexible approach to the yuan by letting it gradually appreciate in a managed manner rather than a once off big bang revaluation. Global equities are rallying hard today on the prospect that any Chinese yuan appreciation will tame inflation and reduce the need for interest-rate increases.

On Saturday, the Chinese central bank the PBoC issued a statement on exchange rate policy which has moved the goalposts & spawned today’s rally. In essence what the announcement boiled down to is an equity abandonment of the 2 year old peg to the Dollar and the resumption of exchange rate reform through a more flexible approach to the yuan by letting it gradually appreciate in a managed manner rather than a once off big bang revaluation. Global equities are rallying hard today on the prospect that any Chinese yuan appreciation will tame inflation and reduce the need for interest-rate increases.

The bottom line is that China in addressing a major global imbalance and by doing so is sharing some of its growth with the rest of the world. Chinese consumers will have more purchasing power and the economy in theory will rebalance away from it’s over reliance on commodities & property into domestic private consumption. As ever with such moves the timing is interesting ahead of the G20 summit and the US mid term elections with all the potential they had for imposing disastrous tariffs and retaliatory sanctions against China hurting world growth and free trade.

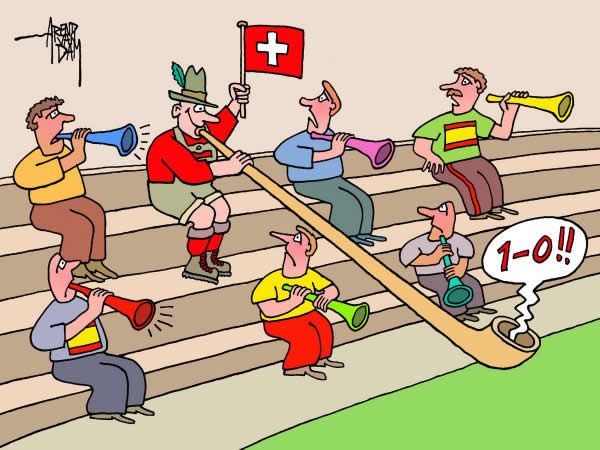

Rewinding , Friday was a day of surprises, albeit only in the football. Quadruple witching appeared to have provided a bid to the market, particularly in financials. The stress test news also helping the sector although late Reuters headlines indicating that German banks may not comply leaves some question marks over the proposals. A list of banks that could fail – include Commerzbank, EuroHypo, Postbank, Dexia, Credit Agricole, Bank Inter , AIB and even Deutsche Bank. In truth though the thinking today is that the all prevailing ambient pessimism of the last few weeks had gone too far and that the left field move from China which seems to have caught many on their heels looks like keeping the Eurozone sovereign & banking crisis “off the front page” for a few days & has been the catalyst to press that “risk on” or buy equities switch for now

Turning to today and stocks benefitting from this Chinese sponsored rally include basic resources & mining stocks which are not surprising well bid today with the usual suspects such as BHP Billiton up 4.2% to it’s best level since April 30th, Rio Tinto has rallied an impressive 5.3% while Kazakhmys gained 3.9% and Vedanta, India’s largest copper producer, increased by 5.5% as copper, lead, nickel, tin and zinc rose on the London Metal Exchange.

Man Group, the largest publicly traded hedge-fund firm, rose 1.6% this morning to 252.3 pence as Credit Suisse raised its 2011 earnings forecast for the company by 11% and increased its price estimate for the shares by 5.7 percent to 280 pence. Separately BofA-Merrill Lynch cut its price objective for Man Group’s shares by 1.4%to 355 pence but that’s still some 43% above last week’s closing price.

German luxury auto makers are having a decent day with Daimler and BMW head by 3.1% and 3.5% respectively as China is among the luxury carmakers’ biggest individual markets. Separately Porsche has advanced 4.1% today as Commerzbank lifted its recommendation on the carmaker to “hold” from “reduce”, saying “while it is risky, we believe upside potential matches downside risk at current share price levels.”

Akzo Nobel is better by 1.8% this Monday after the world’s biggest maker of paints agreed to sell its National Starch business for $1.3 billion in cash.

Acergy has soared 12%after the U.K provider of oil services agreed to buy Subsea 7 for about 15.8 billion kroner ($2.5 billion) in shares to create a “global leader” in seabed engineering and construction.

Aegon is up 2.6% on news that the owner of U.S. insurer Transamerica is preparing to sell its British life and pension insurance business, including Scottish Equitable, for £1.5 billion, the Mail on Sunday reported, without saying where it got the information.

TNT jumped 3.3% as Het Financieele Dagblad said CVC Capital Partners Ltd. is in talks to buy part of the postal unit of Europe’s second-biggest express-delivery company. The newspaper cited unidentified people familiar with the matter.

BASF advanced 1.2% on news that the world’s biggest chemical maker has completed a final analysis of Cognis GmbH and will agree to buy the specialty-chemical maker tomorrow for about 3.2 billion euros, Financial Times Deutschland reported, citing people familiar with the transaction.

A recent pick of mine Banco Santander advanced a further 1.6% today as the Times reported the Spanish bank is considering selling parts of its U.K. operations that may be worth as much as 25 billion pounds. The newspaper didn’t say where it got the information.

Shipping giant A.P. Moeller-Maersk A/S gained 3.6%, heading for the highest close since September. Maersk Lines has set itself a target of delivering cargo by deadline 95% of the time after finding that could raise revenue as much as 17%, Copenhagen-based Maersk said in its company newsletter Maersk Post.

Solarworld jumped 6.7% o a broker upgrade from Deutsche Bank to “buy” from “hold.” And Mediaset Italy’s biggest private television broadcaster, climbed 2.7% as Citigroup recommended buying the shares.

But BP is again a drag and limited gains in European shares, sliding back 4.8% after the Sunday Times said the company is seeking to raise $50 billion to cover the cost of the oil spill in the Gulf of Mexico.BP may first raise $10 billion from a bond sale this week and is talking to banks to get a $20 billion loan, the newspaper reported, without saying where it got the information. The remaining $20 billion would come from asset sales over two years, the newspaper said. BP wants to move quickly to raise cash because of concern its ratings may be downgraded, boosting its borrowing costs, the newspaper said.

Today’s Market Moving Stories

- China: On its website, the PBOC stated “The global economy is gradually recovering … The recovery and upturn of the Chinese economy has become more solid with the enhanced economic stability. It is desirable to proceed further with reform of the CNY exchange rate regime and increase the CNY exchange rate flexibility.” It added, however, that there is no basis for “large-scale appreciation.” In an interview, Li Daokui, an adviser on the People’s Bank of China’s policy board said “China has ended its crisis-mode exchange-rate policy as the economy recovers strongly and inflationary pressure continues to build … The CNY’s future trend depends on the EUR’s movement, and the trends of other major currencies.”

- US Treasury Secretary Timothy Geithner welcomed said “We welcome China’s decision to increase the flexibility of its exchange rate … the test is how far and how fast they let the currency appreciate.” He added “Vigorous implementation would make a positive contribution to strong and balanced global growth. We look forward to continuing our work with China in the G20 and bilaterally to strengthen the recovery.

- Euro-zone: The Times picks up on ECB President Jean-Claude Trichet’s comments to the Welt am Sonntag newspaper. He said that France and Germany paved the way for the European sovereign debt crisis by setting a bad fiscal example, with repeated violations of the EU Stability and Growth pact allowing budgetary discipline to loosen across the bloc. He said “The governments were extremely unreliable over the course of months and years … I wish the German public had reacted with the same indignation to the breach of the stability pact in 2004 that they showed toward our decision to buy government bonds.”

- Jean-Claude Trichet tells Russia Today (news channel) “In the case of … Greece … we are in a situation where we have a strong programme and we are very keen to control its implementation on the spot … My working assumption is that it will work”. He added “European investments are attractive, I have always said … that the EUR is a very credible currency which has its

value in terms of price stability over 11-½ years”. - Japan: Fitch Ratings sovereign analyst Andrew Colquhoun said “What would be negative to ratings is if Japan has no credible fiscal adjustment plans in place by the end of year”. Fitch is looking for a sustained fiscal consolidation plan over the medium-term, hence Colquhoun noted “From that perspective, we are not overly focused on a debt issuance target in one year”. Advisor to Prime Minister Kan, Professor Yoshiyasu Ono has said “The consumption tax should be raised as early as next year … Substantial tax hikes are needed if we are to create new jobs and cut the jobless rate to 3%”.

- While the US Congress puts finishing touches on its financial-regulatory overhaul, Wall Street lobbyists are preparing for a new battle out of the public spotlight and inside nearly a dozen federal agencies. If the bill passes in roughly the form being negotiated by House and Senate lawmakers, regulators will be directed to write hundreds of new rules, conduct dozens of studies, combine two banking agencies and bring industries such as mortgage brokers under federal oversight for the first time. The process will take place in an arena where technical knowledge and relationships with regulators take precedence over old fashioned legislative arm-twisting. The lobbying will be intense because a slight change in the wording of a rule or in the definition of terms such as “major swaps participant” could curtail a firm’s business — or allow it to flourish.

- In UK news, London home sellers raised asking prices to a record as they sought to tap the housing-market recovery and benefit from the scrapping of costly disclosure rules, Rightmove Plc said. Average asking prices in the capital rose 2.2 percent in June from the previous month to 429,597 pounds, the operator of Britain’s biggest property website said in an e- mailed statement in London today. Prices increased for a sixth month in the country as a whole, climbing 0.3 percent. The supply of new properties for sale in London rose 34 percent from May, and is up 88 percent from a year earlier. The time a property spends on the market dropped to 58 days from 83 days during the previous month, Rightmove said.

- The number of UK business insolvencies fell in May as medium-sized firms improved, a survey showed Monday. According to the monthly Experian survey, the rate of newly announced insolvent companies fell to 0.08% in May, down from 0.10% in the corresponding month in 2009 and from 0.10% in April this year. The improvement was in medium sized firms with between 51-100 employees, where the rate of insolvencies slowed to 0.13% in May from 0.24% in April and 0.23% in May 2009, the financial information services firm said.

- Chancellor George Osborne is expected to impose a £3 billion levy on the UK banking sector, based on the size of balance sheets. In what could prove to be the template to be used across Europe, the levy will be imposed along similar lines to US proposals earlier this year. Osborne is also expected to a 40% capital gains tax on non business assets, which could have a significant impact on the UK property market.

- Reports this morning suggest that a number of Irish lenders are preparing to launch “negative equity” mortgages, allowing customers to borrow from lenders despite owing more to their lenders than their house is worth. The move, as reported in the Irish Independent, will see borrowers potentially able to move homes while still in negative equity with the lenders. The Nationwide in the UK currently offers the scheme to allow customers to borrow up to 125% loan to value. Over one third of all Irish mortgage holders are expected to be negative equity before the end of the year.

Company / Equity News

- JP Morgan Chase is proceeding with talks to buy a large Brazilian hedge fund and private equity group, despite impending US legislation aimed at limiting the involvement of commercial banks in such activities, reports the FT. The US financial group is in advanced discussions to buy Gávea Investimentos, an asset manager that oversees about $5.3bn in assets and was founded by Armínio

Fraga, former president of Brazil’s central bank, said people close to the talks. The talks could still collapse, but JPMorgan’s decision to push ahead highlights its confidence that the new regulatory regime will not prevent deposit-taking banks from owning hedge funds. - AIB is seeking to sell Goodbody Stockbrokers to Fexco, a closely held financial- services company, the Sunday Business Post said, without citing anyone. And in related news another potential suitor is emerging for AIB’s Polish assets. Polish cooperative bank Bank Polskiej Spoldzielczosci is interested in buying a stake in Bank Zachodni S WBK according to local media reports

- Royal Dutch Shell’ s gas project off the west coast of Ireland may cost as much as 2.5 billion euros to develop, the Sunday Times said, without citing anyone. The project, which is 45 percent controlled by Shell and 35 percent by Statoil , cost up 1.5 billion euros by the end of 2008, the newspaper said. Terry Nolan, the company’s managing director in Ireland, said the project may produce first gas in 2012 or 2013, the Times reported.

- The WSJ reports that in recent years, oil giant BP PLC used a well design that has been called “risky” by Congressional investigators in more than one out of three of its deepwater wells in the Gulf of Mexico, significantly more often than most peers, a Wall Street Journal analysis of federal data shows. The design was used on the well that exploded in the Gulf of Mexico on April 20, killing 11 workers and causing America’s worst offshore oil spill. The only other major well design, which is more expensive, includes more safeguards against a natural-gas blowout of the kind that destroyed the Deepwater Horizon. A Journal analysis of records provided by the U.S. Minerals Management Service shows that BP used the less costly design– called “long string”– on 35% of its deepwater wells since July 2003, the earliest date the well-design data were available. Anadarko Petroleum Corp., a minority partner of BP’s in the destroyed well, used it on 42% of its deepwater Gulf wells, though it says it doesn’t do so in wells of the type drilled by BP.

- News also of chemical giant TNT . A report in Dutch newspaper Het Financialel Dagblad suggested that CVC is in talks to acquire a “substantial interest” in its Post Division. The article indicates a sale will generate EUR1.5bn in proceeds, which would be consistent with TNT retaining a controlling interest (the value of the business is thought to be between EUR3bn and EUR4bn). This is not a surprise given strategic pronouncements from the Company, however the move towards less diversification and more reliance upon the more volatile express business is negative from a credit perspective, notwithstanding that in the near term management control of Mail will be retained and there will be significant cash proceeds coming in.

- According to the weekend press BP are looking to raise a $50bn war chest to cover the potential Gulf of Mexico clean-up costs, which will come from asset sales, $20bn new bank loans, $10bn from bond issues and raising the asset sales target to $20bn. While BP has not made any formal comment on the subject, this would be a sensible move to bolster the company’s liquidity and restore confidence in their long term viability, although given the limited documentary protection in BP’s existing bonds, the terms of any new debt will come under close scrutiny. Separately the relationship with BP’s 25% partner Anadarko in the Macondo well has now publicly deteriorated with Anadarko accusing BP of negligence in what looks like an expected attempt to avoid having pay for its share of the clean up costs. The other 10% partner, Mitsui has yet to comment publicly, although BP put out a statement this morning saying that “disagreement with other parties will not diminish its promise to clean up the spill and pay legitimate claims” and refuting claims of negligence, although clearly this will be a separate issue for the courts. Finally Moody’s also cut BP on Friday to A2 with the ratings left on review for downgrade, in a move that essentially mirrored S&P.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.