China Announces Yuan Exchange Rate Flexibility

Currencies / China Currency Yuan Jun 20, 2010 - 03:34 AM GMTBy: EconGrapher

So China has just announced that it will "Further Reform the RMB Exchange Rate Regime and Enhance the RMB Exchange Rate Flexibility". See the full statement here.

Just what exactly this means remains to be seen, but this is a very positive move, and from a global economic stability standpoint will now allow some of the focus to be shifted towards some of the other sources of imbalances like US (and other developed nations) profligacy both on consumer finances and government finances.

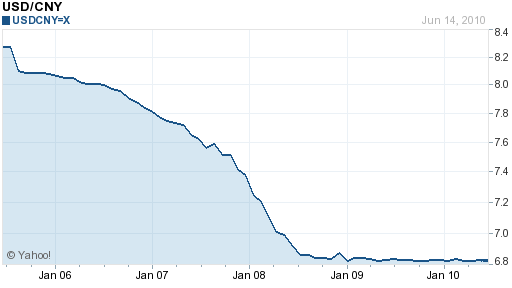

But more on the announcement, and some clues as to what might follow... Here's what happened last time (for some more background on the CNY click here):

They have already explicitly ruled out a large one-off revaluation.

"China´s external trade is steadily becoming more balanced. The ratio of current account surplus to GDP, after a notable reduction in 2009, has been declining since the beginning of 2010. With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist."

They also noted that the daily 0.50% band will not change:

"In further proceeding with reform of the RMB exchange rate regime, continued emphasis would be placed to reflecting market supply and demand with reference to a basket of currencies. The exchange rate floating bands will remain the same as previously announced in the inter-bank foreign exchange market."

So, we're left with no change to the band, and no large one-offs. This leaves a few possibilities like changes in the basket of currencies to which the yuan is pegged. But most likely it will just mean that the authorities there will take a slightly more hands-off approach to the Yuan. So for example we could see a series of daily 0.50% moves. So this may end up in a more flexible market driven state. But of course the point of a market is that prices can move (up or down) depending on demand and supply - and relative prices. So there could even be scope for a depreciation of the Yuan against some currencies.

But above all this remains a very positive development in terms of financial and economic reform in China, and a vote of confidence in the Chinese economy:

"The global economy is gradually recovering. The recovery and upturn of the Chinese economy has become more solid with the enhanced economic stability. It is desirable to proceed further with reform of the RMB exchange rate regime and increase the RMB exchange rate flexibility."

And indeed, a vote of confidence in the global economic recovery. The move will also serve to assuage some of the protectionist sentiment that had been rising e.g. US tariffs etc. This is important, because protectionism needs to be avoided at all cost in ensuring the recovery. But above all this announcement may herald the rise of a truly sustainable, and structural global economic recovery.

By Econ Grapher

Bio: Econ Grapher is all about innovative and insightful analysis of economic and financial market data. The author has previously worked in investment management, capital markets, and corporate strategy.

Website: http://www.econgrapher.com

Blog: http://econgrapher.blogspot.com

© 2010 Copyright Dhaval Shah - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.