Why Uranium Will Make Someone Rich

Commodities / Uranium Jun 17, 2010 - 01:53 PM GMTBy: OilPrice_Com

Uranium is a very unusual sector. For one, it's small. So small, that at one point in history top-producing nations like Canada and France tried to form a uranium cartel to control prices for the metal.

Uranium is a very unusual sector. For one, it's small. So small, that at one point in history top-producing nations like Canada and France tried to form a uranium cartel to control prices for the metal.

The "uranium OPEC" failed. But production today is de facto controlled by a handful of companies.

Consider this. The world's top ten uranium mines account for 59% of global production. (The top mine, Saskatchewan's McArthur River, alone puts out 15% of the world's supply.)

This is very concentrated, compared to other sectors. In the copper sector, the top ten mines turn out just 30% of global supply. For gold, the number is even lower. About 19%.

This means that what happens at a just few uranium mines around the world makes a big difference to the price for the metal.

For this reason alone, good uranium projects are interesting. Any deposit that could become a significant supplier will garner a lot of interest. From would-be producers who want to break the stranglehold existing suppliers have on the market. And from same existing suppliers, who want to keep as much control as possible over the sector.

But the severe concentration of global production is just one reason to look at uranium projects. Another (perhaps better) reason is the extremely skewed grade distribution of the world's uranium mines.

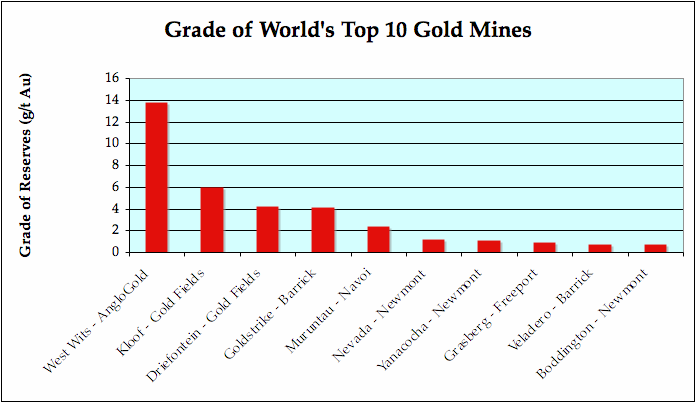

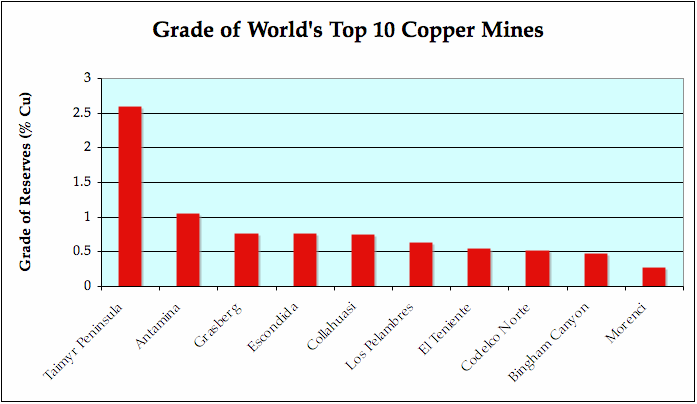

Let's look at some charts. The first two show average reserves grade at the world's top ten biggest-producing copper and gold projects (thanks to Dan Edelstein and Micheal George from the U.S. Geological Survey for help in putting these together). The grade distribution for both is fairly even, forming an orderly curve.

For gold, the world's highest-grade mine (West Wits in South Africa) is 230% higher in grade than the second richest mine. And 1,970% higher in grade than the tenth richest.

Copper grades are even more clustered. Russia's Taimyr Peninsula runs 2.6% Cu, which is 250% higher-grade than the second-richest mine. And 960% richer than the tenth richest mine.

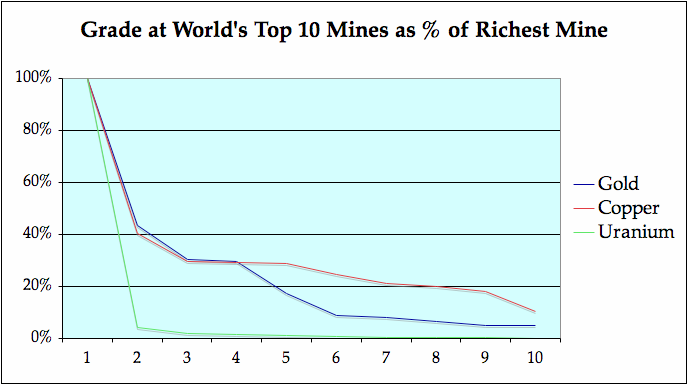

The point being: there is about an order of magnitude difference in grade amongst the world's top gold and copper mines.

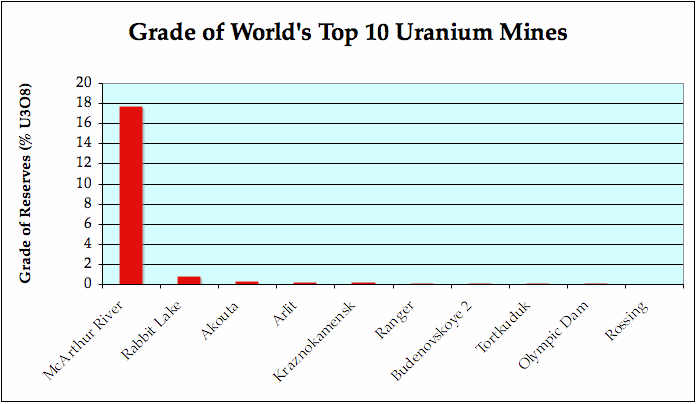

Now look at the same chart for uranium.

Top producer McArthur River grades a towering 17.7%. After this, the world's other top mines barely show up! McArthur is 2,360% richer than number two Rabbit Lake. And a staggering 59,000% higher than the number ten mine, Rossing.

In fact, four of the world's top ten uranium mines (Budenovskoye 2, Tortkuduk, Olympic Dam and Rossing) grade less than 0.1%. (Although mines like Olympic Dam make up for some of this shortfall by producing by-product metals.) The grade discrepancy across the top ten mines is over two orders of magnitude. Significantly more out-of-whack than copper or gold.

Here's another way of looking it. This chart shows the grade of the world's top ten mines in all three sectors, presented as a percentage of the highest-grade mine. Gold and copper ramp down fairly smoothly. Uranium grades, however, cliff-dive into low numbers very quickly.

All of which is to say that there is a big disparity across uranium deposits. The world has one very rich production center (Saskatchewan), and a bunch of much, much lower-grade mines.

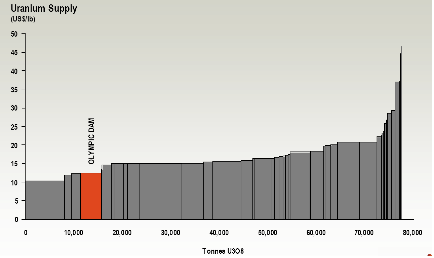

This has some important implications for price. I've shown the chart below before, but it's instructive to look at it again here.

The cost "curve" for uranium is more like a hockey stick. We have a good deal of low-cost production in the world, which can be extracted for $10 to $15 per pound. Much of this comes from Saskatchewan, where high-grade ore makes for lower costs.

But once demand pushes past what these mines can deliver, costs ramp up fast. The move from $20 to $50 uranium (and even higher) comes quickly.

And we are pushing that curve right now. The World Nuclear Association estimates 2010 global uranium requirements at 81,000 tonnes. Putting us squarely on the far right side of the chart above.

Here's the project opportunity. The disparity in grade and production cost across the global uranium sector creates a chance to "poach the curve".

Most current uranium projects are focused on low-grade deposits that come in at the high-end of the cost curve. A number of such deposits are known globally (and have been known for decades), so the exploration work required is minimal.

But what the world is lacking is low-cost production. Anyone who can come up with a sub $30 deposit capable of producing on any kind of scale will have something very valuable to the world's uranium producers, most of whom are still skeptical about buying projects with costs above $40. The successful team is going to make a lot of money.

(The majors' fear of high-cost deposits is largely due to uncertainty over Saskatchewan's Cigar Lake deposit. Cigar would rival McArthur River in terms of grade and scale, producing a projected 8,200 tonnes yearly at 17% U3O8. Except that it flooded in 2006, and the development timeline has been unclear since. If Cigar does come on-line, it will displace the need for a good chunk of higher-cost production, likely lowering prices. If it goes bonk, the need for new uranium projects is going to be all the more urgent.)

Finding new, low-cost deposits requires some work and fresh thinking. A few ideas spring to mind. Go after high-grade, Athabasca-basin look-alikes (or near look-alikes) in under-explored places like West Africa. This is capital intensive, and would likely key off of new technology.

Or, take the Olympic Dam approach and go after low-grade deposits that come with significant credits from other metals, lowering the attributable uranium production cost. This is my personal favorite. North African phosphates are a great candidate.

The case is there for pursuing good, new ideas in uranium. The next step is to pick out some specific plays for a more detailed economic and technical evaluation. Over the next few weeks, I'll be putting together an "idea sheet" and directions for future work.

Source: http://oilprice.com/Metals/Commodities/Why-Uranium-Will-Make-Someone-Rich.html

Dave Forest

By Dave Forest for OilPrice.com who focus on Fossil Fuels, Alternative Energy, Metals, Crude Oil Prices and Geopolitics To find out more visit their website at: http://www.oilprice.com

© 2010 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.