Gold Flat as Coffee Surges 20% in 6 Days and Oats Surge 40% in Week

Commodities / Commodities Trading Jun 17, 2010 - 07:17 AM GMTBy: GoldCore

Gold and silver fell marginally yesterday in lacklustre trade on thin volumes. Gold appears to be consolidating above $1,200/oz and support can be seen at $1,177/oz and $1,145/oz (see chart below). As ever in the short term anything could happen but given the continuing degree of sovereign risk, gold is more likely to move higher than lower in the medium term and $1,300/oz remains possible over the summer despite the traditionally negative season. Gold is currently trading at $1,234/oz and in euro, GBP, CHF, and JPY terms, at €998/oz, £834/oz, CHF 1,374/oz, JPY 112,664/oz respectively.

Gold and silver fell marginally yesterday in lacklustre trade on thin volumes. Gold appears to be consolidating above $1,200/oz and support can be seen at $1,177/oz and $1,145/oz (see chart below). As ever in the short term anything could happen but given the continuing degree of sovereign risk, gold is more likely to move higher than lower in the medium term and $1,300/oz remains possible over the summer despite the traditionally negative season. Gold is currently trading at $1,234/oz and in euro, GBP, CHF, and JPY terms, at €998/oz, £834/oz, CHF 1,374/oz, JPY 112,664/oz respectively.

Gold in USD - 1 Year (Daily).

Many banks and bullion dealers have recently been revising up their gold forecasts (the majority of which were again bearish on gold this year). Our year end price target of $1,350/oz to $1,400/oz remains viable and indeed there is the possibility of a spike to higher levels.

While Wall Street was flat overnight and Asian markets mixed, European equities have risen so far this morning showing risk appetite continues and for now markets are ignoring continuing significant financial, economic and monetary risks.

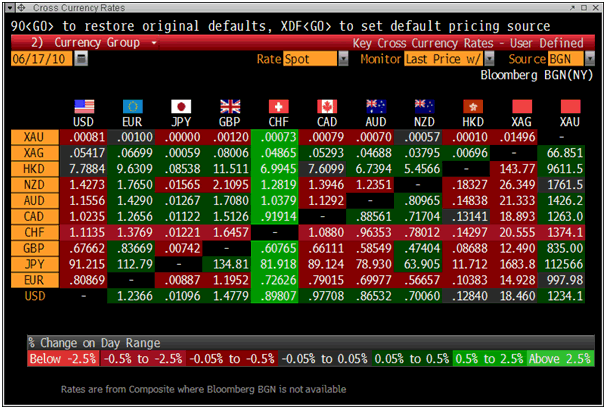

Cross Currency Table - 1030 GMT.

The Swiss franc, the euro, the pound and gold are stronger this morning with the US dollar and commodity currencies coming under pressure (see Cross Currency Table above). Coffee has surged 20% in a 6 day surge and oats have surged 40% in a week. The Reuters CRB remain below its highest levels of earlier this year and whether this is the start of a trend for higher commodity prices remains to be seen.

Gold remains sanguine with gradual movements up and down and rarely has seen movements of more than 2% in a day. Inter day volatility has jumped recently by gold's move up in recent months has been gradual and gold is only marginally above the price it was trading at in early December 2009. The six month period of consolidation and gradual rise would suggest that the (nominal) price highs seen recently are sustainable and not a bubble as proclaimed by some. The sharp movements seen in the coffee and oats markets are the type of price action that one would expect to see in the gold pits when we reach a gold mania or 'gold rush' or a bubble on a par with the 1970s when gold rose 25 times in 9 years and over 100% in one year - 1979. In 1979, gold rose 140.27 percent - from $US 234.40/oz to $US 563.20/oz.

The recent calm in debt markets has ended as Greek, Portuguese and Spanish bonds fell sharply and the Spanish German bond spread rose to its highest since the inception of the euro yesterday. Investors bought Spanish debt at a government auction today, assuaging concern that the nation will struggle to meet forthcoming redemptions for the moment. The sales were likely only possible after the sharp falls in price and rising yield seen in recent days. Spanish government bonds lost investors 4.3 percent this year, compared with returns of 6.5 percent for German bonds and a 15 percent loss for Greek debt, according to indexes compiled by Bloomberg and the European Federation of Financial Analysts Societies.

Inflation pressures remain internationally as seen in Britain where the CPI for May was at 3.4% and remains more than twice the rate in the eurozone and has been significantly above target since December. Many economists and the Bank of England maintain that this is a short term blip higher and is "temporary" and appear to underestimating the risk of inflation and stagflation. Especially, as VAT is likely to rise in next week's emergency budget. Given the UK's poor fiscal position, sterling's underperformance versus gold is likely to continue.

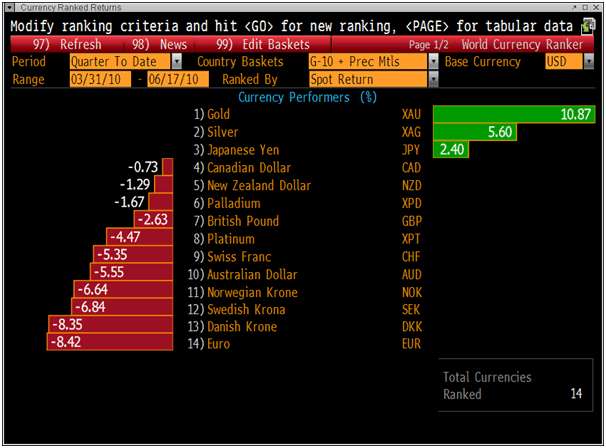

G10 Currencies and Precious Metals Performance - Quarter to Date.

Silver

Silver is currently trading at $18.47/oz, €14.92/oz and £12.49/oz.

Platinum Group Metals

Platinum is trading at $1,576/oz and palladium is currently trading at $474/oz. Rhodium is at $2,425/oz.

News

Gold prices may reach between $1,450 and $1,470 an ounce by the end of the year as investors look to bullion as a safer investment than currency trading, David Baker, a managing partner of Baker Steel Capital Managers, said in a Bloomberg Television interview (Bloomberg).

KABUL - An Afghan mining official says the untapped minerals in the war-torn country are worth at least $3 trillion - triple a U.S. estimate. Minister of Mines Wahidullah Shahrani said Thursday he's going to Britian next week to discuss how to attract foreign investors to mine one of the world's largest iron ore deposits in Bamiyan province. The relatively safe area is in the heart of the war-torn nation.

The U.S. Department of Defence earlier said Afghanistan's reserves of iron, copper, cobalt, gold and other prized minerals could be worth $1 trillion. Shahrani says that's conservative.

The ministry has been working with international partners to assess Afghanistan's mineral reserves and improve the expertise of Afghan geologists (AP).

European debt markets remain under high stress on persistent reports that Spain is in secret talks with EU officials and the International Monetary Fund for a support package of up to 250bn (£208bn), the largest rescue in history. The spreads on 10-year Spanish bonds jumped to a post-EMU high of 224 basis points above German Bunds as traders brace for a crucial auction by Madrid on Thursday. The relentless rise in bond yields replicates the pattern seen in Greece at the onset of crisis. Spain must raise 25bn of debt in a cluster of auctions in July. "We're in a dangerous and stressful situation," said Gary Jenkins, a credit expert at Evolution Securities. "Spain is a big enough borrower to wipe out the EU's rescue fund" (Daily Telegraph).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.