Stocks Start the Week on the Front Foot

Stock-Markets / Stock Markets 2010 Jun 14, 2010 - 09:07 AM GMTBy: PaddyPowerTrader

Are markets becoming less sensitive to bad news or is it just priced in ? Poor retail sales data from the US on Friday (remember 60% plus of American GDP comes from private consumption) sent stocks lower early in the New York session. However, they closed up after a late rally led by IT and basic materials stocks. A better than expected consumer confidence number at 3pm BST Friday and a report from the Semiconductor Industry Association, which raised its chip sales forecast, sparked the comeback which helped the market overcome the largest drop in American retail sales since September.

Are markets becoming less sensitive to bad news or is it just priced in ? Poor retail sales data from the US on Friday (remember 60% plus of American GDP comes from private consumption) sent stocks lower early in the New York session. However, they closed up after a late rally led by IT and basic materials stocks. A better than expected consumer confidence number at 3pm BST Friday and a report from the Semiconductor Industry Association, which raised its chip sales forecast, sparked the comeback which helped the market overcome the largest drop in American retail sales since September.

National Semiconductor, which makes parts used by Apple and Research In Motion climbed 5% as technology companies in the S&P 500 rose 1.1%. Microsoft advanced 2.6%. and Pfizer increased 3.7% to lead gains in the Dow after a drug meant to prevent strokes proved successful in a study.

Asian equities started this week with a firm tone; Asian equities rallied by 0.6-1.6% with Shanghai index underperforming (+0.3%). The result of the general election in Belgium held over the weekend could be an additional factor which will worsen the chaotic situation in Europe (a Flemish party that wants to split Belgium triumphed in the parliamentary election), but the market seems to have ignored the news so far.

Today in Europe the bourses (bar Spain’s IBEX) have started on a positive footing. Stocks on the move include basic resources and mining shares (BHP Billiton, Rio Tinto, both up 2.5%) as copper, lead, nickel tin & zinc prices all ralled on the LMW. Steelmakers such as Salzgitter (up 3.5% on a broker upgrade from UBS to “neutral” from “sell” while ThyssenKrupp is better by 3%. Power equipment maker Alstrom is ahead by 4.5% after being added to BofA Merrill Lynch’s Global Research’s “Europe 1” list.

Eurotunnel is up 3.5% after announcing the acquisition of GB Railfreight from FirstGroup. Airport scanner maker Smiths Group is stronger by 4% after the EU imposed a 5 year tariff on the import of cheaper Chinese made scanners. In another anti competitive mood the EU also renewed a tariff on imports of ammonium nitrate from the Ukraine. The main beneficiary of the move is seen as BASF.

Today’s Market Moving Stories

- This morning the new forecasts published by the Prof Alan Budd’s new Office for Budget Responsibility (OBR) have taken a surprisingly optimistic view of the outlook for the UK public finances. Contrary to media expectations that it would project a much higher path for public borrowing than the previous Government predicted, the OBR has actually forecast that borrowing will be a cumulative £22bn lower between 2010 and 2015 than expected in the March Budget. This is despite the fact that the OBR is expecting a significantly weaker performance from the economy. While this year’s GDP forecast is left at 1.25%, next year’s has been pulled down from 3.25% to 2.6% and the figures for the following years are also lower by about 0.5% per annum. The implication is that the OBR has assumed that last year’s borrowing undershoot at least partly reflects lasting developments which will not just carry through into later years, but increase over the period. I suspect that the Government will still want to err on the side of caution, if only for political reasons. Note too that we don’t yet know what the Government’s fiscal mandate will be – it may require a significantly sharper fall in borrowing than the new forecasts imply. As such, I still expect a pretty tough Budget next week.

- Staying with the UK, some surprisingly hawkish talk from MPC member Andrew Sentence writes in the Times that the BOE could be forced to abandon its “highly expansionary” monetary policy — and raise interest rates — in the second half of the year. He said “As spare capacity has not exerted much downward pressure on inflation so far, there must be a high degree of uncertainty about its future impact”. He added “The turnaround in the economy since the middle of last year and the resilience of inflation highlight the issue of how long such an expansionary policy will remain appropriate”.

- Separately BOE monetary policy committee member Spencer Dale said “The UK economy continues to emerge from the effects of the financial crisis … That recovery is likely to gather pace over the next year. But the effects of the crisis are likely to persist for some time to come.” Although noting that the current spike in inflation was temporary, he added that “If [this] causes inflation expectations to rise, there is a risk that inflation may stay higher for longer”.

- This is a rare one newspaper-only scoop. Frankfurter Allgemeine reports this morning that EU officials will start talks about a bail out for Spain, citing unnamed sourced in Berlin. The paper said the situation had deteriorated so much that they did not want wait until the EU summit on Thursday. It also said neither the European Commission nor the ECB excluded an aid package. The paper quoted Spanish officials as denying that they are about to ask for EU aid, and immediatedly pointed out that Greek officials made the same claims before. The trigger is the freeze in the inter-banking market last week as the markets have lost confidence in the Spanish banking sector.

- In a separate news report, Frankfurter Allgemeine writes that Barroso and Trichet were worried about the state of Spanish banks, and pleaded for aid. The paper also cites the latest statistics from the BIS, according to which German banks had given credits to Spain of $202bn, more than half of which to Spanish banks. The exposure of French banks is $248bn – mostly to companies and households. The Spanish central bank estimates the extent of the bad loans to be €166bn, of which only a quarter has been written off so far. The Spanish bank bailout fund is €99bn. One of the problems now is that Spain has immediate finance needs at a time when market interest rates are rising sharply.

The long simmering move to break up Belgium gathered momentum Sunday as separatists won an emphatic election victory in Flanders, the prosperous Dutch-speaking half of the fiercely divided nation. A stunning electoral success for Bart de Wever’s Flemish nationalist party marks a significant new challenge to the fragile unity of a country where tensions between French and Dutch speakers run deep. Scheduled to take over the rotating presidency of the European Union in less than three weeks, Belgium will now do so with a caretaker administration and facing months of tortuous negotiations to put together a coalition government.

Bad News For Banking Stocks

- Banks are likely to lose a key battle in the US over whether they will be forced to spin off their lucrative swaps desks, reports the FT. Defeat has become more likely since Paul Volcker, the influential former Fed chairman, softened his opposition to the provision. Blanche Lincoln, the Senate agriculture chairman, is pushing the plan, which would force banks to create a separately capitalised subsidiary to house their derivatives dealing operations.

- European Union leaders are to throw their support behind proposals for a European tax on banks to help bear the huge costs of financial crises, according to a document obtained by AFP on Saturday. In the absence of a global consensus for such a tax, EU countries are prepared to press ahead with it in the 27-nation European Union at a Thursday summit in Brussels. According to a draft of the final summit statement, the leaders “agree that a tax on financial institutions be introduced to guarantee that they contribute to paying for the costs of crises.” EU leaders call on their finance ministers and the European Commission to prepare a report on what form the tax should take “in October 2010,” according to the document, which has already been approved by EU ambassadors. The document said that preparations for the tax should consider how it could be implemented without putting European banks at a disadvantage to competitors elsewhere which are free from such a levy. While a consensus has emerged in Europe in favour of such a tax, divisions persist over how to apply it, notably whether it should be on banks’ assets or profits.

- Menawhile, new UK Business Secretary Vince Cable is keen on separating retail from investment banking despite assurances from the Treasury that the prospect of such a split hasn’t been concluded yet, the Sunday Telegraph reported. “The coalition agreement is quite explicit. The Telegraph report said Cable, the Liberal Democrat Cabinet minister, “is thought to be distant” from the Conservative Chancellor, George Osborne He also suggested that the U.K. could act unilaterally if there was no global agreement. “How we do that,

over what time frame, whether you do that nationally or internationally, that kind of issue we have to pursue. But that is the clear direction in which we are going,” Cable said. The Telegraph report cited sources as saying that Osborne would make no decisions on banking until a banking commission put

out its report in the first half of next year.

The US has discovered nearly $ 1 trillion in untapped mineral deposits in

Afghanistan – iron, copper, cobalt, gold and critical industrial minerals such

as lithium.

Company / Equity News

- Axa confirmed that it is in talks to sell part of its U.K. life insurance unit to Clive Cowdery’s Resolution . The news came in a statement on the Les Echos Website. Axa havesaid that the price for the sale of part of its U.K. life insurance unit to Resolution Ltd. would be about 3.3 billion euros. The news came in a statement on the Les Echos Website.

- Cablevision Systems Corp., the fifth-largest U.S. cable operator, agreed to buy Bresnan Communications Co. for $1.36 billion, people close to the negotiations said.

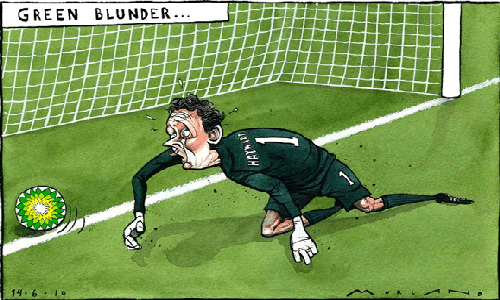

- Senior U.S. politicians are urging U.S. President Barack Obama to seek $100 billion in damages against BP for the Gulf of Mexico oil spill fiasco, a prospect which would almost certainly bankrupt the company, the Independent newspaper reported on Sunday. Without citing sources, the report said “it is understood” that a group of senior congressmen from Obama’s Democratic Party are pushing the President to sue for up to $100 billion, including punitive as well as physical damages even though it is not yet clear that BP failed to meet its responsibilities. It said the news will heap further pressure on BP’s board, which will meet on Monday to decide whether to suspend dividend payments, vital to U.K. pension funds, as up to GBP1.8 billion goes out to investors each quarter. On Wednesday, BP executives will meet Obama, who has called on BP to suspend dividend payments while it struggles to keep the oil spill under control. Meanwhile, the Sunday Times reported that BP is considering putting several billion dollars into a ring-fenced clean-up fund to appease U.S. concerns over the soaring cost of the Gulf of Mexico oil spill. The fund is one of several options to be put to the company’s board Monday. The report also cited unnamed sources as saying that dividend payouts may not be axed completely. But there is potentially a silver lining for some in the industry as heightened U.S. scrutiny of offshore drilling after the BP Plc spill, the worst in the nation’s history, may spur oil companies to replace aging rigs with new platforms made in South Korea and Singapore. Rig-makers Samsung Heavy Industries Co. and Keppel Corp. stand to benefit from drillers buying $300 million-plus semi- submersible rigs, which operate in waters as deep as 10,000 feet. About 57 percent of current units are more than 20 years old, according to Merrill Lynch.

- MSCI have announced that Bank of Ireland will be added to the MSCI Standard Index after the recent rights issue increased its shares in issue. The move from the MSCI Small Cap Index to the MSCI Standard Index will happen at the close of business today. Bloxham’s estimate that the move will see a demand for up to 140m shares or 640% of the recent 20 day average volume. Separately, Bank Pekao SA, Poland’s second largest bank, is reviewing the potential for bidding for of Bank Zachodni according to the bank’s CEO.

- Dana Petroleum has agreed to purchase Petro Canada Netherlands from Suncor for an adjusted consideration of $393m. Petro Canada has proved and probable reserves of 31m barrels and production of just over 12,000 barrels to its account this year. It is a class 1 transaction and so will require shareholder approval with completion in Q3. To finance the acquisition and to provide finance more broadly across the group, Dana has negotiated a $900m term loan and revolving credit facility with RBC. Davy’s comment that he deal fits into the Dana strategy of growth through a combination of acquisition and careful drilling programmes. The price and access to politically safe 2P reserves at a reasonable price should be value enhancing. We think that the debt re-structuring is a particularly favourable development.

- Lloyds Banking Group Plc is considering a public listing of the 600 retail branches it is required to sell after accepting state funds, the Sunday Times said, without saying where it got the information. The offering would create a new bank that would control about 5 percent of the country’s retail banking market and with an estimated market value of more than 3 billion pounds, the newspaper said. The bank is being advised by UBS and Merrill Lynch , the Times said

Some folks are taking this World Cup thing very seriously

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.