Is Deflation in the United States Possible?

Economics / Deflation Jun 13, 2010 - 08:16 AM GMTBy: Frank_Shostak

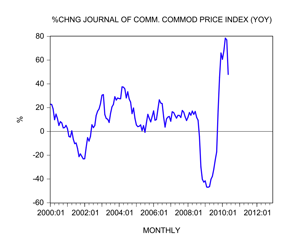

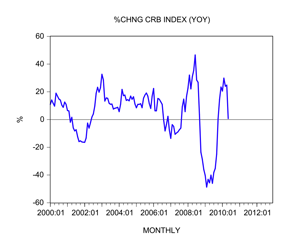

According to some analysts, a sharp decline in major commodity-price indexes has raised the specter of deflation. The Journal of Commerce's index (JCOM) fell by 8.5% in May from April while the Commodity Research Bureau's index (CRB) fell by 8.2% during that period. Also the growth momentum of these indexes plunged in May. The yearly rate of growth of the JCOM index fell to 47.9% from 77% in April, while the yearly rate of growth of the CRB index plunged to 0.7% from 24.9%.

According to some analysts, a sharp decline in major commodity-price indexes has raised the specter of deflation. The Journal of Commerce's index (JCOM) fell by 8.5% in May from April while the Commodity Research Bureau's index (CRB) fell by 8.2% during that period. Also the growth momentum of these indexes plunged in May. The yearly rate of growth of the JCOM index fell to 47.9% from 77% in April, while the yearly rate of growth of the CRB index plunged to 0.7% from 24.9%.

Now if some other price indexes were to come under pressure, would that imply that the economy has fallen into deflationary territory? To provide an answer to this question we need to define what deflation is all about. Contrary to popular thinking, deflation is not about a general decline in prices as such but about a decline in the money supply. Note that this is based on the same principle that inflation is not about a general increase in prices but rather about increases in money supply.

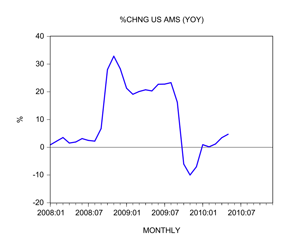

Since the price of a good is the amount of money paid per unit of the good, obviously, all other things being equal, the prices of goods in general will go up over time with increases in money supply and fall with decreases in money supply. To establish whether we are in deflation we need to find out what the money supply is doing. The latest data for our monetary measure, AMS,[1] shows that the yearly rate of growth stood at 4.7% in May against 1% in January. A positive figure for the rate of growth in money supply implies that, at the moment, inflation is still in force.

Note though that during October to December last year we actually had deflation. The yearly rate of growth of AMS stood at −6% in October, −10% in November and −7.1% in December.

Note though that during October to December last year we actually had deflation. The yearly rate of growth of AMS stood at −6% in October, −10% in November and −7.1% in December.

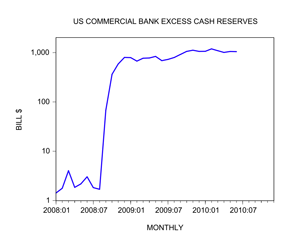

Normally the main driving force in the expansion of the money supply is the central bank's loose monetary policy. By means of monetary pumping, the central bank injects money into the banking system. This money in turn is amplified by commercial banks lending through fractional-reserve banking. Currently however, there seems to be a breakdown between the Fed's pumping and commercial banks' lending activity.

Despite all the massive monetary injections by the Fed, commercial banks have chosen to sit on the pile of pumped cash rather than lend it out. The level of excess reserves held by commercial banks has climbed to $1.05 trillion in early June from $1.4 billion in January 2008 while lending remains in free fall. The yearly rate of growth of lending fell to −11.4% in this May from −0.5% in May last year.

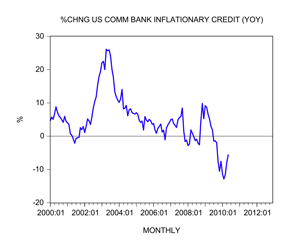

What matters for money supply, however, is not lending as such but inflationary lending, i.e., lending that was generated through fractional-reserve banking. The yearly rate of growth of our inflationary-credit proxy stood at −5.6% in May against +3% in May last year. (Note however that the growth momentum of the inflationary credit proxy shows at present a visible bounce [see the right-hand figure below].)

Now a fall in inflationary credit, if not offset by the Fed's pumping, results in a decline of the money stock and hence in deflation. As we have seen so far, the money stock is still rising, which we suggest means that for the time being the Fed's monetary pumping via buying of assets is offsetting the decline in inflationary credit. Observe that currently the Fed is pumping at the yearly rate of 14% against the pace of contraction in inflationary credit of around 6%. Remember that whenever the Fed buys assets from nonbanks it boosts the demand deposits of the sellers of assets to the central bank. An increase in demand deposits implies an increase in money supply.

So it seems that irrespective of the decline in inflationary credit the Fed can always offset this fall through monetary pumping. (Again, the Fed could offset this fall by an aggressive buying of assets from nonbanks.) So in this sense one could argue that, given the Fed's readiness to pump money on a massive scale, the likelihood of deflation is not very high.

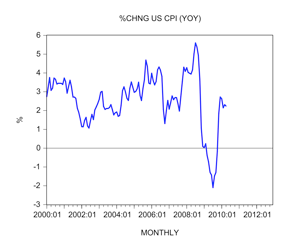

Now, we have to consider the fact that the Fed doesn't pay much attention to the money-supply data. For Fed policy makers, inflation or deflation is associated with movements in the consumer price index (CPI). After falling to −2.1% in July last year, the yearly rate of growth of the CPI climbed to +2.2% in April.

We suggest that, on account of a long time lag from changes in money supply to changes in the CPI, the past strong increases in money supply could lead to a further strengthening in the growth momentum of the CPI in the months to come. In response to this strengthening, the Fed is likely to tighten its monetary stance. This in turn could significantly slow down the rate of increase of the Fed's balance sheet. Hence, given the decline in banks' inflationary lending, this will result in a decline in the money supply — and hence deflation. (Even if the Fed were to decide to do nothing, the fall in inflationary credit would lead to a fall in the money supply.)

We suggest that, on account of a long time lag from changes in money supply to changes in the CPI, the past strong increases in money supply could lead to a further strengthening in the growth momentum of the CPI in the months to come. In response to this strengthening, the Fed is likely to tighten its monetary stance. This in turn could significantly slow down the rate of increase of the Fed's balance sheet. Hence, given the decline in banks' inflationary lending, this will result in a decline in the money supply — and hence deflation. (Even if the Fed were to decide to do nothing, the fall in inflationary credit would lead to a fall in the money supply.)

There is, however, another factor to consider: the fall in the growth momentum of money supply during November 2008 to November 2009 (the yearly rate of growth fell from +28% to −10%). The lagged effect from this fall is likely to produce a pronounced decline in economic activity, i.e., it will severely undermine various bubble activities. We suspect that a sharp fall in economic activity could cause the Fed to ignore the increase in prices and embark on aggressive pumping.

The increase in the money supply as a result of the Fed's money pumping is likely to result in a further weakening in the process of real-wealth generation, i.e., a weakening in the pool of real savings. A fall in the pool of real savings in turn leads to a fall in economic activity — we cannot fund the production of as many goods as before.

Hence, over time a strong money-supply rate of growth and the production of fewer goods implies a general increase in money per good, i.e., a general increase in prices. (Observe that what we have here is a general increase in prices and a fall in economic activity, which is what stagflation is all about.) Such a scenario is likely to be supportive of the price of gold.

Conclusion

A sharp fall in commodity prices has raised the specter of deflation in the United States. We suggest that what matters for deflation is the state of the money supply. As long as the money- supply rate of growth remains a positive figure, there can be no deflation.

Despite a decline in commercial banks' inflationary credit, the offsetting monetary pumping by the Fed has kept the money-supply rate of growth in positive territory. There is, however, always the possibility that the Fed could tighten its stance in response to a strengthening in the growth momentum of the CPI. This, coupled with a fall in inflationary credit, could result in a fall in money supply and thus the emergence of deflation.

However, we are of the view that, on account of the fall in the growth momentum of money supply between November 2008 and November 2009, US economic activity could come under pressure in a few months time. As a result, the Fed may embark on strong monetary pumping. We suggest this could lead to severe stagflation.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See his article archives. Comment on the blog.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.