Stock Market Plunge on Disappointing Jobs Data, What's Next?

News_Letter / Financial Markets 2010 Jun 12, 2010 - 11:10 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

June 6th, 2010 Issue #34 Vol. 4

Stock Market Plunge on Disappointing Jobs Data, What's Next?Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The Dow closed the week sharply lower on Friday at 9932 against last weeks close of 10,136. The stock market had exhibited a tightening of its trading range for most of the week following a bounce off an early week low of 10,014 into a rally peak of 10,315 Thursday, as the market marked time ahead of the Fridays Jobs Report that disappointed market participants and resulted in a 333 point drop on the day right from the opening gap down and trend lower all the way into the close.

Last week-ends analysis (31st May - Sovereign Debt Crisis Fails to Deliver Knock Out Punch to Stock Markets) concluded in a trend that targeted a break below 10k during the week, in line with Dow still being in its downswing phase towards a low range of between 9,850 to 9,800 that had already been entered once during the preceding week and inline with the last in-depth analysis and forecast - (16 May 2010 - Stocks Bull Market Hits Eurozone Debt Crisis Brick Wall, Forecast Into July 2010) Stock Market Conclusion Despite the flash in the pan crash and prevailing Eurozone sovereign debt default gloom and doom, the bottom line is that this is still a stocks bull market with the Dow ONLY down less than 6% from its bull market peak. Therefore the sum of the above analysis concludes towards the stocks bull market under going its most significant and a highly volatile correction since its birth in March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ). This correction could last for several months and may extend all the way into early October, which suggests that the next 2 months are going to see an ABC correction to be followed by a sideways price action between the extremes of 10,900 to 9,800 and so despite continuing wild gyrations I would not be surprised if the Dow is little changed from its last closing price of 10,620 in 2 months time (16th July 2010). Expectations remain for the bull market to resume its trend towards a target of between 12k to 12.5k by late 2010 after the tumultuous trading period over the next few weeks. I have tried to illustrate a more precise Dow forecast projection in the below graph, reality will probably end up being far more volatile.

Friday's sharp drop into the close does not leave the stock market trend in a particularly easily decipherable short-term state. On face value this suggests further downside early next week, but the state of play is pretty close to the target range for a low of 9,800 to 9,850 which also suggests downside should be very limited, i.e. implies at worst a short-lived spike below the range, but more probably the range holds and the market reverses higher off of a higher low. On a less probable outcome a decisive break below 9,800 would target a continuation lower towards 9,500. Conclusion - The volatile sideways trading range continues with immediate trend targeting a continuation of last Fridays sell off into an early week low, perhaps in the range of 9800 to 9850. Thereafter expectations are for a rally towards the balancing point of the range at 10,350 as the market enters the upswing phase of its forecast trading range. Short-term Dow Trading - The market remains short as of Dow 10,230 targeting Dow 9850, with the Stop at 9,975 which is also the Reversal Buy trigger with an initial stop at 9,900 to target 10,275, so a 75 point risk for a 300 potential on the long-side. U.S. Economy - Jobs Report Fridays jobs report clearly indicates that the big picture is that of a two steps forward and one step back economic recovery as most of the new jobs added were highly temporary census workers. However corporations have never been more profitable as they are able to make profits on par with those at the 2007 peak with many millions fewer workers, which implies far greater productivity in the private sector at least as a consequences of continuing technological advancements. Eventually the private sector will start to hire again as the competitive value of each new worker increases, off course off shoring of jobs remains a long-term problem where employment trends are concerned. Pirates of the Mediterranean If things weren't bad enough with rogue banks bankrupting sovereign states, the icing on the cake for investors is rogue states playing up by threatening war, death and destruction. North Korea's loony tunes cartoonesk Dear Leader threatening nuclear armageddon, and Israel marks another breach of international Law by conducting piracy on the high seas Somali style, the only missing element being a ransom demand. Whilst propaganda is being pumped out by both sides as to who did what which culminated in the Israeli Militaries highly edited 2 minute video clip from a 90 minute commando assault that conveniently missed out the footage of snipers on Israeli helicopters shooting to kill the ship passengers and also ensuring that all captured footage of Israeli acts of terror were destroyed. To date the Israeli's have refused to allow for an United Nations investigation which is necessary to get at the real truth which probably lies somewhere in the middle of where the two opposed camps stand. However the bottom line is not what actually happened on the high seas, but the fact that 1.5 million palestinians are being kept in what effectively amounts to a giant concentration camp. Expect more market chaos, especially if the North Korean Dear Leader starts to think doomsday would be a good outcome for his dieing country. Your analyst, gearing up to focus on the UK housing market. Source and Comments : http://www.marketoracle.co.uk/Article20090.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Clive_Maund We had expected the broad stockmarket and the resource sector to stabilize and start to recover last week and they did, and while we are likely to see further recovery in the days and perhaps weeks ahead, there have been some ominous developments in the recent past that we would be most unwise to ignore. The market did not go into full crash mode because it was not technically ready to, although it got close to it, and crucial support held - for now. However, heavy technical damage was inflicted and a broad review of long-term charts reveals that a blood-curdlingly dangerous setup has developed across a wide spectrum of markets.

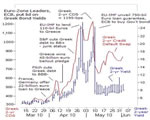

By: Jim_Willie_CB Natural forces are at work in Europe, powerful forces, in fact forces that are not evident. It is amazing how little the financial analysts notice the forces at all. Since the year 2007, a hidden force began to put pressure on the European Union financial underpinning. Like any fiat currency, the foundation resorts to debt. It came to my attention almost three full years ago that Spanish EuroBonds had a yield slightly higher than the benchmark German.

By: Marc Faber An hour long Presented by Marc Faber at "Austrian Economics and the Financial Markets," the Mises Circle in Manhattan in New York, New York. Includes an introduction by Mises Institute president Douglas E. French. We ain' t seen nothing' yet, says Marc Faber.

By: Gordon_Gekko Those who know Mr. Denninger know that he, well, for lack of a better word, hates Gold. It only goes to show the level of disinformation and ignorance prevalent in our society when even smart people like Karl fail to get it. From what I hear anybody even mentioning the word Gold runs the risk of being permanently banned from one of his "forums". In a recent commentary entitled "Ten Things for 2010" he was at it again bashing Gold. Here is what he had to say:

By: Dr Stephen A Rinehart Dr Stephen A Rinehart writes: Background: The following comments are based in part on my 45+ years experience in structural dynamics/mechanical engineering from Georgia Tech and extensive design/project management experience including offshore oil platforms, oil pipelines, conventional/nuclear DOD weapons effects and combat weapons designs, and environmental fate and transport of chemical/oil plumes.

By: Nadeem_Walayat The stock market ended last week little changed at Dow 10,136 (10,193), which belied the drama seen during the week that included a Tuesday nose dive into the forecast target zone for a low of between 9,800 and 9,850 before bouncing back all the way into Thursdays closing peak of 10,264. Fridays session sought to correct this 450 point rally with a sharp drop in the last 15 minutes of trading from 10,200, which suggests follow through to the downside early week.

By: Steve_Moyer "...and it is in such twilight that we must be aware of change in the air, however slight, lest we become unwitting victims of the darkness." ~William Orville Douglas First of all, please allow me to apologize for the infrequency of my Safehaven posts, as obviously I have become a fellow more inclined to write at market turns than one who chimes in on an ongoing basis. I appreciate to no end the number of emails I receive requesting updates, but my fingers are in a few more pies now (including the penning of a second screenplay with writing partner Tim Wells and the pursuit of my investment advisory representative license).

By: Michael Snyder So just how bad is the U.S. economy? Well, the truth is that sometimes it is hard to put into words. We have squandered the great wealth left to us by our forefathers, we have almost totally dismantled the world's greatest manufacturing base, we have shipped millions of good jobs overseas and we have piled up the biggest mountain of debt in the history of mankind.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.