World Spotlight on South Africa

Economics / Africa Jun 11, 2010 - 06:48 PM GMTBy: Frank_Holmes

South Africa takes to the world stage today as it hosts the first World Cup to be played on the African continent. For the next 30 days, the eyes of the globe will be watching Rooney, Cristiano Ronaldo, Maicon and Messi battle it out for world soccer supremacy.

South Africa takes to the world stage today as it hosts the first World Cup to be played on the African continent. For the next 30 days, the eyes of the globe will be watching Rooney, Cristiano Ronaldo, Maicon and Messi battle it out for world soccer supremacy.

South Africa’s $287 billion economy is already the largest in Africa and it’s estimated that the World Cup will generate 400,000 jobs and contribute $7.3 billion to the country’s GDP, according to research firm Grant Thornton. It estimates 450,000 tourists will visit the country spending a total of $1.1 billion.

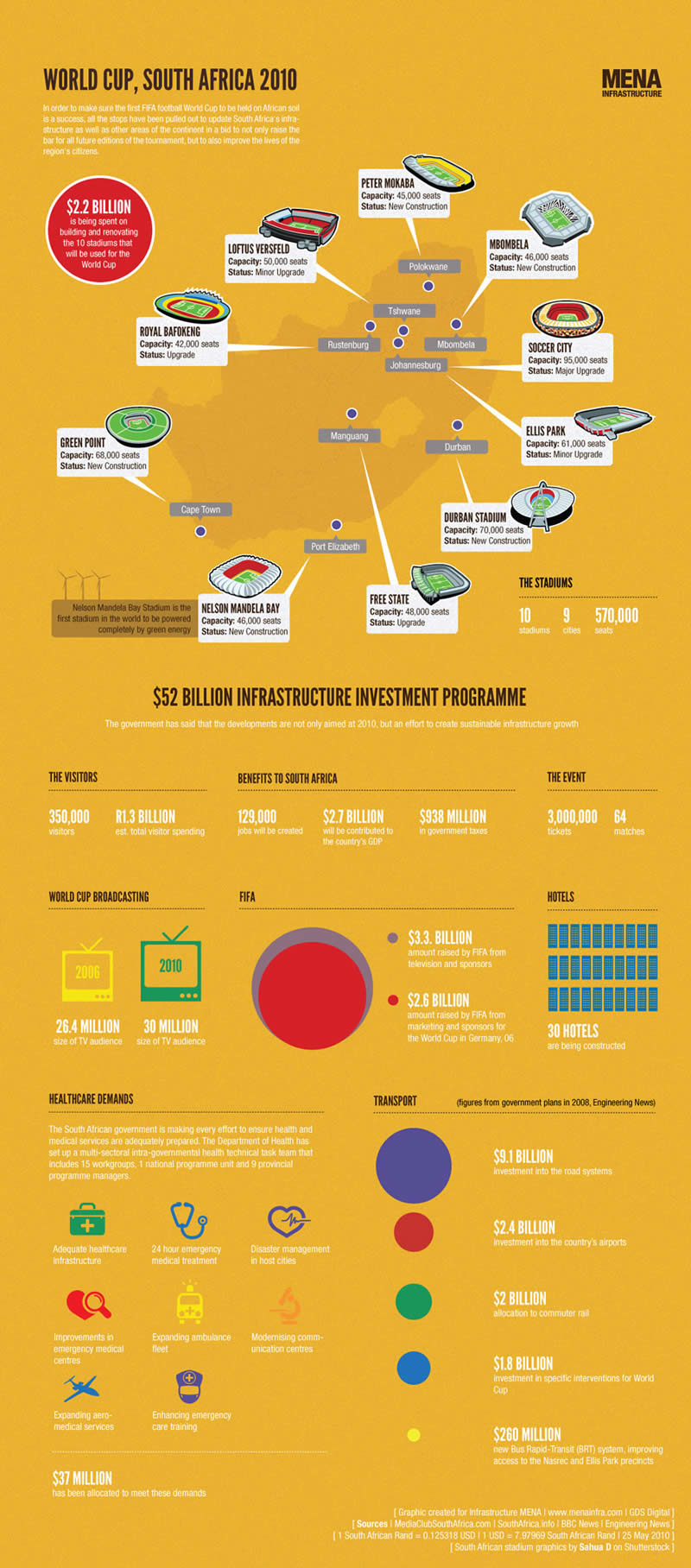

In preparation for this event, South Africa has given itself quite the makeover. This infographic from MENA Infrastructure details how South Africa has made substantial upgrades in its infrastructure.

A reported $2.2 billion was spent on 10 stadiums that will host the matches. Some of these, like the 46,000 seat Nelson Mandela Bay stadium in Port Elizabeth, the first stadium in the world to be completely powered by green energy, were new construction while others, like the 95,000 Soccer City stadium in Johannesburg, received major upgrades.

Another $9.1 billion was invested in the country’s road systems, $2.4 billion in airports and $2 billion on a new commuter rail. In all, the World Cup infrastructure program is estimated to have brought $52 billion in investment.

Once the games are over, the South African government hopes the investment will continue to pay dividends. World Cup hosts have experienced increased economic growth in the two years following the event. Analysis from Credit Suisse shows the host countries experienced 2.7 percent and 2.6 percent growth, respectively, in the years leading up to the World Cup but saw 3.2 percent and 3.7 percent economic growth in the two years after.

Only time will tell if this scenario plays out. Luckily we have the world’s best tournament to keep us entertained in the meantime. Enjoy the Cup!

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.