Gold Gains as Risk Trade Back on Despite Sovereign Debt and Banking System Stress

Commodities / Gold and Silver 2010 Jun 11, 2010 - 07:20 AM GMTBy: GoldCore

Global equities and commodities have rallied due to increased risk appetite despite real lingering risks. Gold has gained for the first time in four days in global markets and some investors continue to diversify into the safe haven on concern that Europe's sovereign debt and fiscal crisis isn't over. Hopes for a continuation of the recent global economic rebound are high and have seen oil, copper and most commodity prices rise this week and equities stabilise. Gold is currently trading at $1,220/oz and in Euro, GBP, CHF, and JPY terms, gold is trading at €1,008/oz, £832/oz, CHF 1,393/oz, JPY 111,709/oz respectively.

Global equities and commodities have rallied due to increased risk appetite despite real lingering risks. Gold has gained for the first time in four days in global markets and some investors continue to diversify into the safe haven on concern that Europe's sovereign debt and fiscal crisis isn't over. Hopes for a continuation of the recent global economic rebound are high and have seen oil, copper and most commodity prices rise this week and equities stabilise. Gold is currently trading at $1,220/oz and in Euro, GBP, CHF, and JPY terms, gold is trading at €1,008/oz, £832/oz, CHF 1,393/oz, JPY 111,709/oz respectively.

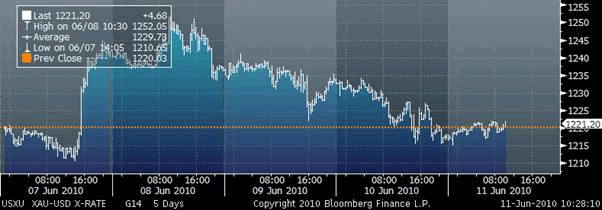

Gold in USD - 5 Day (Tick).

Gold is marginally higher on the week so far this morning (see chart above). A higher weekly close this week would be very bullish as it would follow last week's higher close and the month of May's higher close. The bears will be trying to paint the tape and keep prices lower on the week thereby manipulating the technicals and momentum traders into sellers. However, even a lower weekly close would not be disastrous as all of gold's moving averages (the 50, 100 and 200 DMA) are all rising and the MACD has crossed over which is also bullish technically.

A close above $1,250/oz and the recent record (nominal) high at $1,252/oz could see us rapidly rise to $1,300/oz. However we are now in the period of seasonal weakness for gold and gold may need some back filling and consolidation during the "summer doldrums". The traditionally quieter summer months of June and July when international jewellery demand declines and participants take holidays and volumes generally decline. However, this pattern does not always hold and those waiting to "time the market" might again get their fingers burnt as they have done in recent years. Support is at $1,195/oz and $1,165/oz.

Sovereign debt and banking system risk remains elevated and this will support gold for the foreseeable future. Hungary's debt auction failed to reach its target and Hungary sold its bills at higher yields than two weeks ago as markets remain uncertain and awaiting proof that the government's economic plan could be implemented. The bills were sold at higher yields than those of two weeks ago, before the market turmoil last week caused by the government's mixed messages about the state of Hungary's public finances. Concerns that Hungary may be close to a Greek-style debt crisis remain and there are growing concerns about sovereign debt issues and banks exposure to Bulgaria. Not to mention, European banking shares indicate a Greek debt default may be just a matter of time.

The European banking system remains stressed as seen in the ECB extending the emergency liquidity it is pumping into the eurozone financial system. Also, euribor has risen above euro Libor with European interbank lending rates diverging to their worst levels since they were launched in December 1998.

Gold in USD versus the DJIA - 1970-2010.

Silver

Silver is currently trading at $18.30/oz, €15.11/oz and £12.47/oz.

Platinum Group Metals

Platinum is trading at $1,545/oz and palladium is currently trading at $455/oz. While rhodium is at $2,425/oz.

Platinum and palladium appear to be consolidating after their recent sharp falls and investors are tentatively dipping their toes back in.

News

Gold, which this week climbed to a record, may advance as investors buy the metal as a haven, a survey showed. Seventeen of 25 traders, investors and analysts surveyed by Bloomberg (Including GoldCore), or 68 percent, said bullion would rise next week. Five forecast lower prices and three were neutral. Gold for delivery in August was up 0.5 percent for this week at $1,223.50 an ounce at noon in New York yesterday.The metal climbed to a record $1,254.50 on June 8 and is up 11 percent this year on concern that debt-cutting measures by European nations will slow growth. Bullion also reached all-time highs in euros, British pounds and Swiss francs, while holdings in the world's biggest gold-backed exchange-traded fund reached a record. The euro this week slipped to its lowest level against the dollar in more than four years. The weekly gold survey that started six years ago has forecast prices accurately in 180 of 314 weeks, or 57 percent of the time. This week's survey results: Bullish: 17 Bearish: 5 Neutral: 3 (Bloomberg).

Gold held in ETF Securities Ltd.'s European and Australian exchange-traded products added 1,193 ounces to a record 8.75 million ounces yesterday, according to the company's website. European and Australian silver holdings rose 1.2 percent to a record 28.335 million ounces, while palladium assets dropped 2.5 percent to 490,497 ounces (Bloomberg).

Platinum demand may outpace supply by 33,000 ounces this year, compared with a surplus of 285,000 ounces last year, Barclays Capital said today in a report. The bank estimates palladium's surplus will narrow to 320,000 ounces this year, from 760,000 ounces in 2009 (Bloomberg).

Japan's new government will unveil a strategy to fix its tattered finances by June 22, the national strategy minister said today, in an effort to reassure investors that it will cut back the country's massive debts (Financial Times).

South Korea's government is likely to announce on Sunday new rules on currency trading that will apply to a range of trades and derivatives with the aim of making the won less volatile, officials said. Planned caps on currency forwards will also cover cross-currency swap trades as well as non-deliverable currency forwards, an official at the financial regulator said (Reuters).

SA's mining industry continued its recovery from the global economic downturn in April, with output growing 2,7% year on year, although there were lower production figures for commodities, including gold and copper. National mining production hit a low point early last year as international demand for commodities slumped during the economic crisis, but increasing industrial activity in India and China had subsequently driven up prices, encouraging miners to boost output. Gold production also fell in the year to April, by 6,2%, despite gold prices that have hit record highs. SA's gold miners have battled with rising costs and falling grades (AllAfrica.com).

Gold will continue to remain bullish in the coming years and apart from global factors the rising long-term investment demnad from India, China and other newly industrialised nations will play an important role in supporting gold, according to Jeffrey Nichols, Managing Director of American Precious Metals Advisors and a leading precious metals economist. Addressing the Mines and Money Conference in Beijing, he said that gold has historically been a preferred medium of savings in India, China, and many of the other Asian countries. As incomes rise, as more people enter the middle class, and the numbers of truly wealthy increase, it is only natural to see some of this money flow into gold (Commodity Online).

The price of gold in Vietnam fell by VND200,000 a tael (1.2 ounces) over the previous day on June 11 as global prices declined, triggered by profit-taking and positive economic indicators. Most gold shops bought gold at VND27.9 million a tael and sold it at VND27.95 million. Domestic gold prices dropped to below VND28 million last evening after the metal plunged on European markets (Saigon Giai Phong).

Rare gold double eagle coin worth $650,000 sold A particularly rare specimen of the Liberty double eagle gold coin has been sold to a collector. Park Avenue Numismatics acquired the coin - which was struck in 1854 and is thought to be worth $650,000 (£441,486) - and later sold it to a collector looking to complete a set of $20 Liberty Head double eagles. According to president of the company Bob Green, the piece was the finest example of the coin that he had ever seen. "This example was fresh to the market and when it surfaced I went after the coin without hesitation," he remarked. Just 3,250 of the coins were originally made. The 1854 Liberty double eagle is the second rarest double eagle to have been made by the New Orleans Mint. Last year, the US Mint struck a special edition gold double coin featuring an ultra high-relief design based on the original by Augustus Saint-Gaudens (World Gold Council).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.