EXTEND & PRETEND: A Guide to the Stock Market Road Ahead

Stock-Markets / Stock Markets 2010 Jun 11, 2010 - 12:54 AM GMTBy: Gordon_T_Long

It will likely surprise you but like a trolley car we are now locked into economic tracks that determine our financial destination. Unfortunately, it isn’t a place anyone would choose knowingly other than possibly the Bilderberg elite.

It will likely surprise you but like a trolley car we are now locked into economic tracks that determine our financial destination. Unfortunately, it isn’t a place anyone would choose knowingly other than possibly the Bilderberg elite.

Financially and economically we are lurching along, rocking from side to side with the occasional unexpected jarring flash crash jolt. But unlike a trolley line, for some reason no one seems to know what the destination is. Many are asking but few are willing to tell.

This road is well travelled and documented if you were to take the time to study the maps and not rely on the happy face media spin doctors for directions. Since the route of the current global economic path is now locked in, we need to either accept the ride or hastily exit. I’m up from my seat and headed for the door. What are you going to do?

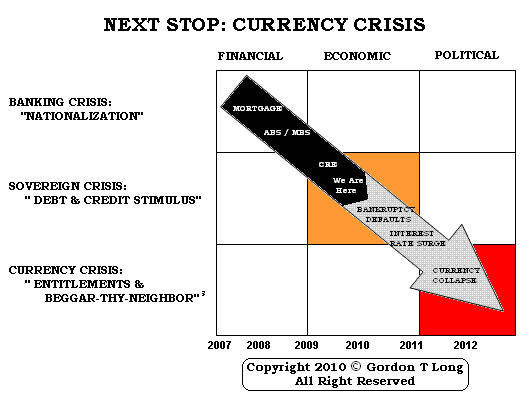

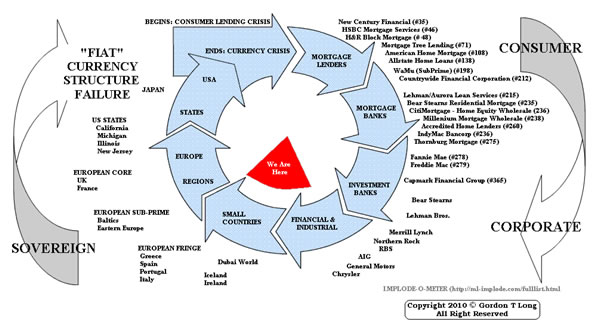

HISTORICAL FACT: A Financial Crisis is almost always followed by an Economic Crisis which is subsequently followed by a Political Crisis.

FINANCIAL CRISIS => ECONOMIC CRISIS => POLITICAL CRISIS

Banking Crisis Sovereign Debt Crisis Currency Crisis

When the financial crisis arrived in 2008, those who foresaw it in 2007 were not only prepared to capitalize on it, but ready to position for the economic crisis that they knew lay ahead. We are currently still in the midst of an economic crisis evidenced for some time by slowing global trade, unemployment, falling tax revenues and more recently, a sovereign debt crisis.

Have you prepared for the soon to emerge financial opportunities as the Stage 3 - Political Crisis unfolds?

I want to lay out the roadmap as simply and clearly as I can. Some no doubt will dispute it. What the nay-sayers need to fully understand however is that the roadmap, which this is part of, has served me remarkably well and resulted in a highly profitable decade. Maybe even more importantly, it has allowed me to sleep peacefully at night. The market drops for the most part have been ‘buying opportunities’ and market spikes have been excellent exit points.

Knowing the trend and destination has made all the difference.

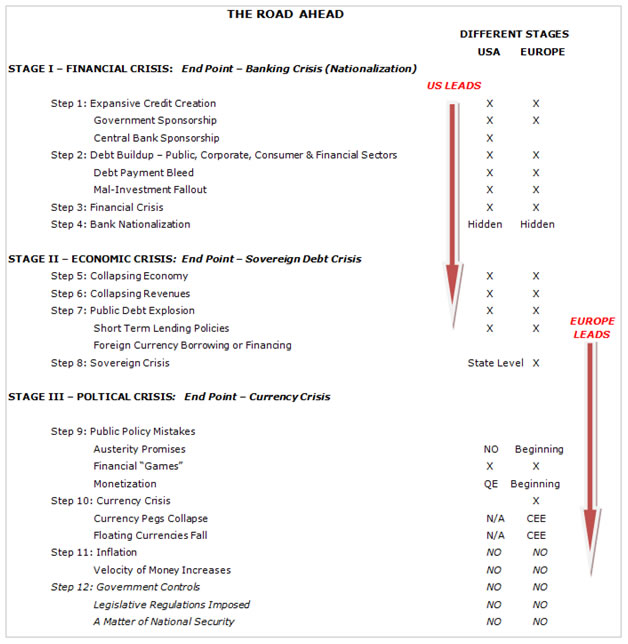

THE ROAD AHEAD

The soon to unfold political crisis will be marked with beggar-thy-neighbor policies that foster political conflict, a currency crisis which dramatically impacts standards of living and a broad curtailment of entitlement programs that will devastate generations of retiring lower and middle income citizens. We are early in what the future may possibly label as the Age of Rage. Paradyn adjustments in expectations and sense of entitlement lay ahead for those living in the developed G7 democracies.

Let me show you why a Political – Currency Crisis is just as predetermined as the tracks of our trolley ride and will have serious consequences for your investment strategy.

For the full research report with a detailed expansion of the following roadmap: See TIPPING POINTS

EXPLAINING STAGE III

Though we are still in the midst of the full emergence of Stage II, Europe has recently overtaken the US in the rate of the expected, unfolding events.

There is no mistaking the fact that the US has a sovereign crisis as measured by many indicators such as: Debt to GDP, deficit percentage, balance of trade, state, city and local government financial imbalances, underfunded pension plans and excess unfunded entitlement programs. However, relative to Europe, the US is still lagging and therefore is not currently getting the media attention that it will soon receive.

What will mark the beginning of Stage III is a major shift in political policies. In Europe, early signs were witnessed with the European bailout of Greece and the $1 Trillion Euro “TARP” like program. Both political decisions decisively diverged from the basis upon which the Maastricht Agreement was constitutionally approved. The level and urgency of the crisis forced this structural shift. Though this level of political shift has not yet occurred in the US, it soon will (the ‘Tea Party’ advocates would likely vehemently suggest we are well on our way).

The $61 Trillion unfunded entitlement problem associated with Medicare / Medicaid and Social Security is presently a monster on the door step now that baby boomers are beginning to retire at accelerating rates each month. No longer can the government obscure the true size of annual budget deficits through the use of payroll entitlement payments. State, city and local governments are increasingly in crisis as more and more can no longer fund what Americans have taken for granted as basic necessities such as police, fire, K-12 education and public works. Without greatly increased and urgently needed tax revenues, these programs will be drastically cut. We read of 100,000 to 300,000 teachers being cut which less than 18 months ago would have been thought unimaginable in America. With 40 million Americans on food stamps, tax revenue deficits are making what is a monumental problem even more intractable. All of this and more will lead to political decisions that will lead to major social unrest and public policy initiatives which will be startling breaks from the past.

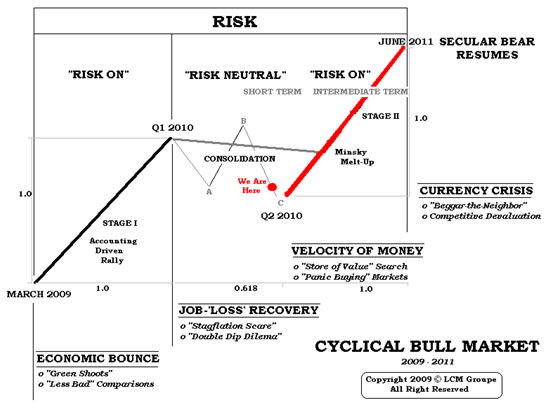

I fully expect to see a new $5 Trillion Quantitative Easing (QE) program marking the upcoming shift in the US to Stage III.

This will be what kicks off an accelerating increase in Velocity of Money that many inflations have been expecting. This has the potential to ignite a Minsky Melt-Up (Read: Extend & Pretend: Manufacturing a Minsky Melt-Up), though definitely not a certainty. The present rate of collapse in MZM, M1, M2 and M3 which supports the deflationists views, which I have held, is the ‘oil in the ointment’. The $5T QE program will be a desperate attempt aimed at reversing this

Massive monetization will eventually lead to a US currency crisis in the US by 2011- 2012.

Europe will continue to accelerate with problems associated with currency pegs and Euro denominated lending finally coming home to roost for Central and Eastern Europe (CEE). The CEE as the ‘sub-prime” of Europe will be the final catalyst to tip the UK and France over the edge into a sovereign crisis and subsequent major political confrontations. The new government in the UK is already warning the British electorate on an almost daily basis of the gravity of the situation and the degree to which changes in social entitlement expectations will need to change in the near future. Like France they are afraid to be specific – yet!

The US is experiencing a major shift with government employment becoming the primary creator of jobs. The fundamental shift is most evident through a movement towards larger government with more regulation and control.

POLITICAL SHIFT- It will be about choices which this generation has never had to confront.

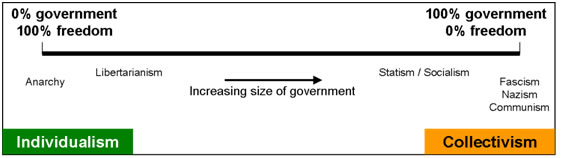

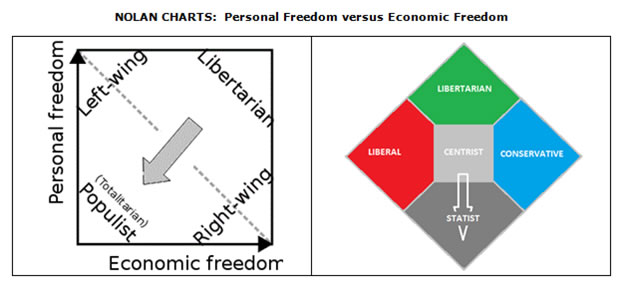

The political shift is not primarily a shift from right wing to left wing politics as many in the ‘party oriented’ media might suggest or debate. It is rather a shift that the current generation in western developed nations haven’t witnessed - a shift in direction that is other than left or right and is more about a movement in Economic freedom versus Personal freedom.

It would make this particular article too long to explain the above Nolan Diagrams to show how and why these changes will occur (I will do so in the next Extend & Pretend series article entitled: “A Matter of National Security” – sign-up). But suffice it to say that there will be clear tell-tales that will emerge.

SIGNALS & TELL TALES

You must be alert to and carefully watch for these tell-tale signals in the not too distant future.

LEGISLATIVE REGULATION

NEW PUBLIC POLICY INITIATIVES TARGET POLITICAL EXCUSES

Must hold government Debt Instruments (Bonds, Bills, Notes) Banks ‘LIQUIDITY’

Must hold government Debt Instruments (Bonds, Bills, Notes) Pensions ‘SAFETY’

Caps on Private Interest Rates – Ceilings Lenders ‘USERY’

Capital and Exchange Controls Investors ‘SPECULATION’ [Escape]

CONCLUSIONS:

Expect the unexpected going forward since markets hate uncertainty and nothing creates more uncertainty than political decision making and policy legislation. Markets will experience increasing levels of volatility with steeper rates of price movement both up and down. Flash Crashes and Flash Dashes will be common as millisecond advantages separate the dynamic hedging winners from losers.

Hard assets such as physical gold and silver have traditionally been the ideal vehicle for an environment of high inflation coupled with a currency crisis. I fully expect governments will strip these assets from holders either directly or through predatory taxation, fees or other trading limitations. They will be classified somewhere in the four categories discussed above. Alternatively, if it is not done in this fashion it will be controlled through intervention similar to national currencies in the forex arena. I personally suspect it is already being controlled in some fashion based on the March 25th whistleblower testimony by Andrew Maguire. It is a matter of national security in a beggar-thy-neighbor environment since gold and silver are the only real money in a fiat based system. Protect yourself accordingly.

The only protection from the future storms will be unencumbered, revenue producing assets. The trick is knowing which investments will sustain their ability to produce inflation adjusted free cash flow in the midst of a contracting economic environment. They may not be in the publicly traded or manipulated markets.

Thinking for yourself and thinking outside the box is paramount if you are to capitalize on this bumpy trolley ride.

For further background read: EXTEND & PRETEND - Manufacturing a Minsky Melt-Up.

Sign Up for the next release in the EXTEND & PRETEND series: Commentary

The previous EXTEND & PRETEND article: EXTEND & PRETEND: The Flash Crash Omen

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.