Bernanke's Claims That He Does Not "Fully Understand the Movement in the Gold Price"

Commodities / Gold and Silver 2010 Jun 10, 2010 - 06:18 AM GMTBy: GoldCore

Gold is currently trading at $1,223/oz and in euro, GBP, CHF, and JPY terms, at €1,017/oz, £840/oz, CHF 1,402/oz, JPY 111,318/oz respectively. Gold has fallen in all currencies today as traders have taken profits after the recent surge in prices. Gold priced in euros, UK pounds, Swiss francs and US dollars surged to record nominal highs on Tuesday on demand for a store of value. Concerns of a global economic slowdown allied with fears that debt laden European countries like Greece, Spain, Portugal and Hungary could default and lead to contagion have led to safe haven demand for gold in recent weeks.

Gold is currently trading at $1,223/oz and in euro, GBP, CHF, and JPY terms, at €1,017/oz, £840/oz, CHF 1,402/oz, JPY 111,318/oz respectively. Gold has fallen in all currencies today as traders have taken profits after the recent surge in prices. Gold priced in euros, UK pounds, Swiss francs and US dollars surged to record nominal highs on Tuesday on demand for a store of value. Concerns of a global economic slowdown allied with fears that debt laden European countries like Greece, Spain, Portugal and Hungary could default and lead to contagion have led to safe haven demand for gold in recent weeks.

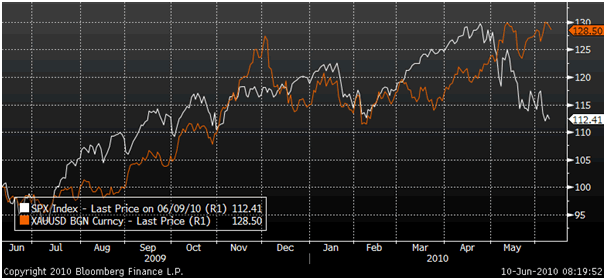

While Asian equities were mostly up overnight (except China despite healthy export figures), European indices are lower today after yesterday's slight falls in US indices. Gold's inverse correlation with equities over the long term is again being seen. Since mid April equities internationally, including the benchmark US indices the S&P 500, have broken down while gold has risen.

Gold in USD and the S&P 500 - Daily (1 Year)

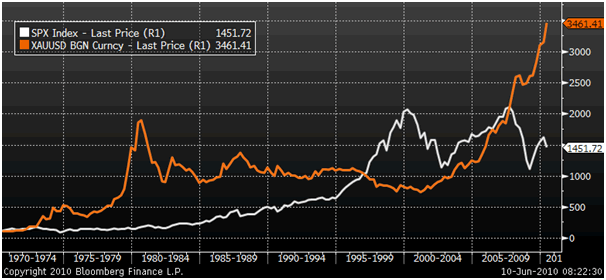

Gold can be correlated with equities in the very short term as seen during the current financial crisis when sharp falls in equities sometimes led to margin calls and speculative players liquidating long positions. However over the long term, gold is inversely correlated as was seen between 1970 and 2010 (see chart below). In the 1970s gold outperformed equities which went sideways for the decade. In the period from 1980 to 2000, gold performed poorly while equities surged in value. Since the year 2000, equities have again underperformed. This lack of correlation is a key reason for having a small allocation to gold in a portfolio. Over the long term it has been shown to reduce volatility in a portfolio and enhance returns. Indeed, gold has outperformed the S&P 500 since 1970.

Gold in USD and the S&P 500 - 1970-2010 (Monthly)

The possible bankruptcy of global behemoth BP, a bluest of blue chip stock, is doing nothing to calm market jitters. A growing awareness of challenging financial and economic problems in an uncertain world is leading to a reevaluation of equity risk and financial risk and gold is benefitting from this reevaluation.

Markets await announcements regarding interest rates from the Bank of England and European Central Bank, as well as the press conference that follows the ECB decision. Interest rates internationally are set to remain near record lows for the foreseeable future and thus the opportunity cost of owning gold and forgoing a yield is negligible.

In the US, data on the trade balance and weekly claims for unemployment benefits will be watched and analysts expect the trade deficit to increase to $41.0 billion from $40.4 billion in March. The still very high and rising US trade deficit could stifle recovery and will likely lead to a weaker dollar and higher gold prices.

In a strange admission, Ben Bernanke said that he didn't "fully understand the movement in the gold price". Bernanke admitted that "there's a great deal of uncertainty and anxiety in financial markets right now." He said that "some people believe that holding gold will be a hedge against the fact that they view many other investments as being risky and hard to predict at this point." Bernanke was trying to allay growing concerns about the emergence of inflation and claimed that commodities had " fallen quite severely recently."

Reuters/Jefferies CRB Commodity Index - 1 Year (Daily)

However, commodities (see Reuters/Jefferies CRB Commodity Index chart above) and oil prices have not fallen severely and there are still elevated prices gradually feeding through into growing inflation. US wholesale food prices are up 6.8% in the past year. Food prices for the month of March rose by 2.4%, the sixth consecutive monthly increase and the largest jump in over 26 years. Food inflation will accelerate to a 5 percent annual rate by December and average as much as 4 percent in 2010, topping government forecasts as meat and dairy costs jump, said William Lapp, a respected food and agricultural economist.

Bernanke appears to be again exaggerating the threat of deflation in order to justify record low interest rates and the most expansive monetary policy in US history. He likely realises that gold is again the "canary in the coalmine" but obviously cannot say that publicly due to the obvious ramifications for the dollar. Bernanke should not be puzzled by record (nominal) gold prices with the US fiscal position as poor as it has ever been in history and deteriorating. The US debt will top $13.6 trillion this year and climb to an estimated $19.6 trillion by 2015, according to a Treasury Department report sent to Congress with understandably little fanfare.

Gold did not react to the new sanctions against Iran but the sanctions bear watching from a geopolitical point of view. Iran's central bank recently stated it might exchange its euro reserves for US dollars and gold. The Central Bank of Iran (CBI) intends on converting about €45 million of its reserves into dollars and gold, Tehran's media reported. The report was later denied but the possibility of Iran or another nation hostile to the US interests (Venezuela, North Korea etc) using gold as a geopolitical and economic weapon remains.

Silver

Silver is currently trading at $17.98/oz, €14.95/oz and £12.35/oz.

Platinum Group Metals

Platinum is trading at $1,537/oz and palladium is currently trading at $455/oz. Rhodium is at $2,450/oz.

News

Russia trusts in the euro, in which it holds some of its international reserves, and thinks that the current weakening of the European currency is temporary, Russian Prime Minister Vladimir Putin said on Wednesday. "We trust (the euro) and believe (in it). Otherwise we would not have held so much of our funds, gold and forex reserves in the European currency," Putin told AFP and France 2 television channel ahead of his visit to Paris. Putin acknowledged that there are some problems, but thinks that "on the whole, the European financial authorities are acting absolutely correctly." "Discipline needs to be strengthened, budget deficits need to be watched...currency legislation needs partial changes. It should be the same, at least as far as possible for all European Union members. But on the whole, European economic fundamentals are solid," Putin said. France and Germany were the most financially stable, he said. "No one is interested in ruining the European Union. I think that (German Chancellor Angela) Merkel is right - if there is no euro, there is there is no European Union...and there are no objective reasons for a euro collapse. Yes, there are some difficulties. But I am sure that they are temporary" (RIA Novosti).

Global investors have little confidence in Europe's efforts to contain its debt crisis or in European Central Bank President Jean-Claude Trichet, with 73 percent calling a default by Greece likely. Only 23 percent say they expect the region's almost $1 trillion rescue package to both keep the European monetary union together and prevent a debt default by a government, according to a quarterly poll of investors and analysts who are Bloomberg subscribers. More than 40 percent say Greece is likely to abandon the euro (Bloomberg).

The World Bank on Wednesday said a double-dip recession could not be ruled out in some countries if investors lose faith in efforts in Europe and elsewhere to tackle rising debt levels. The World Bank's Global Economic Prospects 2010 report said slower growth in developed economies would deprive developing countries of healthy markets for their goods and would cut into investment. or the moment, worries that Greece's fiscal woes could spread to other highly-indebted countries, such as Spain and Portugal, has not affected growth in developing countries, the World Bank said."If markets lose confidence in the credibility of efforts to put policy on a sustainable path, global growth could be significantly impaired and a double-dip recession could not be excluded," the report said (Reuters).

Gold held in ETF Securities Ltd.'s European and Australian exchange-traded products rose 0.2 percent to a record 8.749 million ounces yesterday, according to the company's website (Bloomberg).

BP Plc fell 11 percent to the lowest in 13 years in London trading today. BP Plc bonds and credit-default swaps are trading as if the energy company has lost its investment-grade rating as costs mount from the worst oil spill in US history.

BP's $3 billion of 5.25 percent notes due in 2013 fell as low as a record 89.94 cents yesterday, pushing the yield to 7.57 percentage points more than Treasuries. The spread compares with an average of 7.26 percentage points for junk bonds, Bank of America Merrill Lynch indexes show. The cost to protect $10 million of BP debt for a year with credit-default swaps almost doubled to $512,000, according to CMA DataVision. It was $29,000 on April 30 (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.