Stock Market On the Edge of Something Very Big, Crash?

Stock-Markets / Financial Markets 2010 Jun 09, 2010 - 07:02 PM GMT U.S. stocks lost their gains Wednesday as Federal Reserve Chairman Ben Bernanke voiced

cautious optimism about the economy and the central bank's Beige Book also noted modest

improvement.

U.S. stocks lost their gains Wednesday as Federal Reserve Chairman Ben Bernanke voiced

cautious optimism about the economy and the central bank's Beige Book also noted modest

improvement.

"Everything is universally moving in the right direction, but we already knew that," said Jeffrey Kleintop, chief market strategist at LPL Financial of the Fed's June report, which noted improvement across all 12 districts.

Backlash at BP

The cost to protect BP Plc’s bonds against default soared to a record, more than nine times the level before one of its wells exploded in the Gulf of Mexico, as pressure on the company to suspend its dividend intensified.

Credit-default swaps on BP climbed 126.1 basis points to 386.9 basis points, according to CMA DataVision prices. More than 40 U.S. lawmakers called today for the London-based company to suspend its dividend and Interior Secretary Ken Salazar told a Senate committee that “significant additional” safety requirements will be imposed on oil and gas companies drilling in the Gulf.

Why Did The U.S. Refuse International Help on The Gulf Oil Spill?

(ZeroHedge) Despite the vow by President Obama to keep the Gulf oil spill a top priority until the damage is cleaned up, 50 days after the BP rig exploded, a definitive date and meaningful solution is yet to be determined for the worst oil spill in the U.S. history.

So, you would think if someone is willing to handle the clean-up with equipment and technology not available in the U.S., and finishes the job in shorter time than the current estimate, the U.S. should jump on the offer. But it turned out to be quite the opposite.

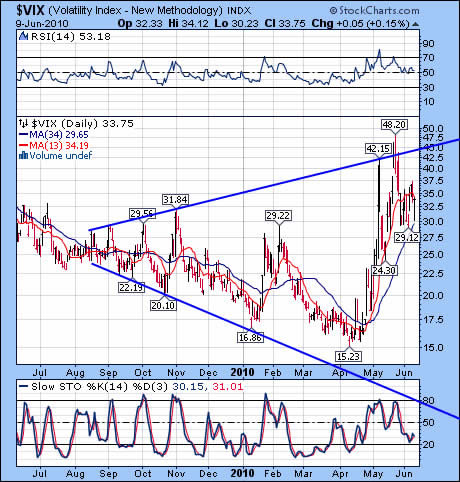

The VIX tested intermediate-term Support.

-- All of the see-sawing in the VIX

confirms the uptrend, even though it

closed below short-term Trend

Support at 34.19 today. The rally in

stocks that completed today was at a

smaller-degree than the rally which

topped on May 12th. However, the

VIX is giving this pause in the

decline a higher-degree pullback.

This is something that I have only

observed for the first time, and

suggests a very strong move is about

to happen.

-- All of the see-sawing in the VIX

confirms the uptrend, even though it

closed below short-term Trend

Support at 34.19 today. The rally in

stocks that completed today was at a

smaller-degree than the rally which

topped on May 12th. However, the

VIX is giving this pause in the

decline a higher-degree pullback.

This is something that I have only

observed for the first time, and

suggests a very strong move is about

to happen.

The CBOE Put-Call Ratio for equities ($CPCE) stayed neutral at .92 today. The pros have increased the $CPCI to 1.62 (more bearish) at the end of the day. The 10-day average is still 1.52. The NYSE Hi- Lo index closed down 32 points today to -108. The Hi-Lo index remains in bearish territory. Bullish territory starts at 95.

SPY retested short-term Resistance.

Action: Sell/Short/Inverse

-- The saying goes, “The markets

always rally before a crash.” SPY is

no different as it approaches the

Head and Shoulders Neckline

illustrated in the chart. This will be

the third attempt to break 104 since

the Flash Crash in May. It may just

be the charm.

Action: Sell/Short/Inverse

-- The saying goes, “The markets

always rally before a crash.” SPY is

no different as it approaches the

Head and Shoulders Neckline

illustrated in the chart. This will be

the third attempt to break 104 since

the Flash Crash in May. It may just

be the charm.

The probability of some event causing the market to gap through support overnight is very high. The H&S pattern sets up a target of 86.64, which is very close to the July 8 low of 85.77. My model suggests that we may see the markets meet their downside targets early next week.

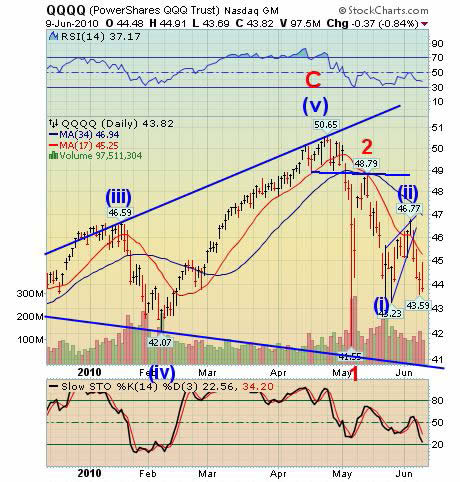

QQQQ makes its lowest close since February.

Action: Sell/Short/Inverse

-- QQQQ closed lower as it traces

out a complex Head & Shoulders

pattern with a neckline roughly

corresponding to the lower trendline

of the Broadening Top formation. It

appears that the very next target for

QQQQ will be the lower trendline of

the Broadening Top. However, I am

looking for a “normal” wave 3 that

may cut through the trendline on its

way to 37-38.00 or lower. A likely

target may be its (last) July low at

34.17.

Action: Sell/Short/Inverse

-- QQQQ closed lower as it traces

out a complex Head & Shoulders

pattern with a neckline roughly

corresponding to the lower trendline

of the Broadening Top formation. It

appears that the very next target for

QQQQ will be the lower trendline of

the Broadening Top. However, I am

looking for a “normal” wave 3 that

may cut through the trendline on its

way to 37-38.00 or lower. A likely

target may be its (last) July low at

34.17.

XLF is prepared to plunge through its neckline.

Action: Sell/Short/Inverse

-- XLF now appears ready to drop

below the Head & Shoulders

neckline which gives us a target of

10.50 – 11.00. Head & Shoulders

patterns work best at the beginning

of a third wave, which describes the

situation perfectly. The July, 2009

low was 10.73, which is the next

support level.

Action: Sell/Short/Inverse

-- XLF now appears ready to drop

below the Head & Shoulders

neckline which gives us a target of

10.50 – 11.00. Head & Shoulders

patterns work best at the beginning

of a third wave, which describes the

situation perfectly. The July, 2009

low was 10.73, which is the next

support level.

The brief spike to 14.37 this morning before XLF turned back down played out as expected. We are now starting the most powerful move of the series today.

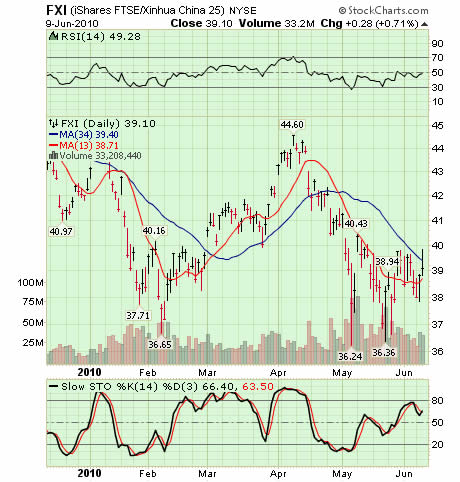

FXI appears ready to cross intermediate resistance.

Action: Buy/Long

-- FXI rallied briefly above

intermediate-term Trend Support at

39.40 today. It also had an upside

breakout, even though it settled

below Trend Support at the close.

This is very bullish action and should

be encouraging for those who have

doubted the upside reversal until

now.

Action: Buy/Long

-- FXI rallied briefly above

intermediate-term Trend Support at

39.40 today. It also had an upside

breakout, even though it settled

below Trend Support at the close.

This is very bullish action and should

be encouraging for those who have

doubted the upside reversal until

now.

$SSEC made a pretty substantial move today, as well, closing just below short-term Trend Resistance at 2590.

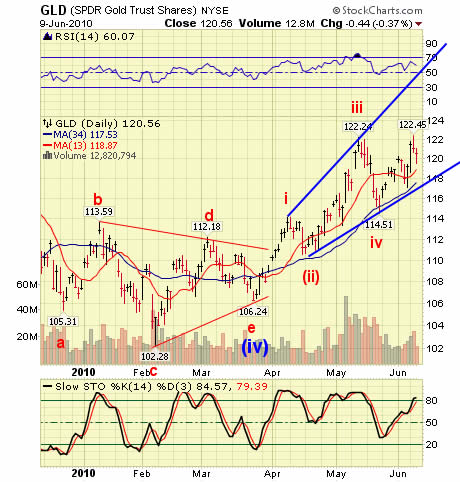

GLD stumbled, but maintained its uptrend.

Action: Maintain Longs, looking for

an exit

-- GLD stumbled after its breakout,

but is still advancing in a “wave c” of

a probable final zig-zag on its way to

my model target of 126.00.

Action: Maintain Longs, looking for

an exit

-- GLD stumbled after its breakout,

but is still advancing in a “wave c” of

a probable final zig-zag on its way to

my model target of 126.00.

Yesterday’s breakout is still being tested, but a more convincing emergence above 122.24 should bring the buyers back. It is doubtful that the volume will increase appreciably, however, since it will be the retail buyers pushing up the final spike in price. GLD is already in nosebleed territory, so it may not be wise to stay too long. I will keep you posted if a reversal pattern emerges.

USO is completing a wave (ii).

Action: Sell/Short/Inverse

-- Today’s rally in USO cleared

up the wave pattern as it spiked

toward intermediate-term Trend

Resistance at 35.93. This has two

implications. First, it may spike even

higher as it completes a higher

degree (to 35.93, perhaps?) second

wave. Second, wave (iii) may take

USO below 18.00 in wave (iii).

There is no “alternate count” in USO

at this time.

Action: Sell/Short/Inverse

-- Today’s rally in USO cleared

up the wave pattern as it spiked

toward intermediate-term Trend

Resistance at 35.93. This has two

implications. First, it may spike even

higher as it completes a higher

degree (to 35.93, perhaps?) second

wave. Second, wave (iii) may take

USO below 18.00 in wave (iii).

There is no “alternate count” in USO

at this time.

TLT has finished a pullback to short-term support.

Action: Maintain Longs, Look for

an exit early next week.

-- TLT found support at the shortterm

Trend Support at 97.25. It

appears that the next rally attempt

should break above the prior highs

and potentially target the 103.00

area. Once that target is reached, it

may be advisable to start taking

profits, unless you can watch the

pattern like a hawk.

Action: Maintain Longs, Look for

an exit early next week.

-- TLT found support at the shortterm

Trend Support at 97.25. It

appears that the next rally attempt

should break above the prior highs

and potentially target the 103.00

area. Once that target is reached, it

may be advisable to start taking

profits, unless you can watch the

pattern like a hawk.

The U.S. is now one of the top 5 sovereign deriskers as CDS activities are picking up. This does not bode well for our bond market. The perceived risk of default is now rising.

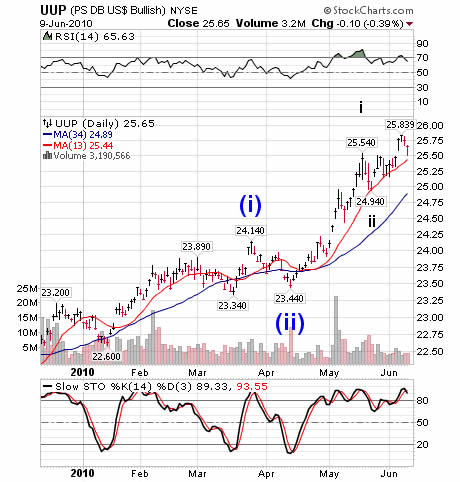

UUP also finds support at the 13-day moving average.

Action: Buy/Long

-- UUP pulled back to its short -term

Trend Support at 25.44 instead of

accelerating as I had expected.

Nothing has changed, though. Wave

iii of (iii) could go substantially

higher, targeting somewhere above

28.00 in the move immediately

before us.

Action: Buy/Long

-- UUP pulled back to its short -term

Trend Support at 25.44 instead of

accelerating as I had expected.

Nothing has changed, though. Wave

iii of (iii) could go substantially

higher, targeting somewhere above

28.00 in the move immediately

before us.

Tomorrow the pivot window for UUP opens, so we may see fireworks starting in the next move higher.

Have a great evening!

Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.