Albania, the New Frontier for Crude Oil Investors

Commodities / Crude Oil Jun 09, 2010 - 02:42 PM GMTBy: Marin_Katusa

By Marin Katusa, Chief Market Strategist, Casey Research Energy Division writes: After a troubled past, resource-rich Albania is trying to modernize itself into a good place to do business... and with astonishing success.

By Marin Katusa, Chief Market Strategist, Casey Research Energy Division writes: After a troubled past, resource-rich Albania is trying to modernize itself into a good place to do business... and with astonishing success.

Over the years, we've visited Albania more times than we'd care to admit. Although it's not a place we'd recommend for a family vacation, your investment dollars will find a happy home there. Unlike the rocky tale of Albania itself, the latest oil development stories are bound to have a much happier ending.

Albania, Diamond in the Rough?

Albania, about the size of Massachusetts, is surrounded by Montenegro, Kosovo, Macedonia, Greece, and the Adriatic Sea. It beats out only Moldova in gross domestic product (GDP) by population: at US$6,300 per person, it's dwarfed by the likes of America (US$45,800 per person) and even financially buggered Greece (US$30,000).

A lack of consistent energy and transportation infrastructure is partly responsible for Albania's sorry numbers. Areas outside capital Tirana and Durrës, a large port, still experience blackouts with fair regularity. Railways are limited, and while major cities are connected by highways, smaller roads can be relatively difficult to access and then to negotiate when you find them. The reasons the country is now having to play catch-up lie in 20th-century history.

Albania was one of the first casualties of World War II, when it was invaded by Italy on April 7, 1939, five months before Germany's more famous invasion of Poland. It fell within the week. The country bounced between Italian, Greek, Bulgarian, and then German hands for the next five years before being liberated by communist Albanian partisans in November 1944.

In the years following World War II, Enver Hoxha, the first secretary of the Communist Party of Labor of Albania, moved into power. Hoxha did improve health care, literacy, and other aspects of everyday life, but the country's economy in general stagnated. His isolationist policies and cult of personality discouraged international trade and, as a consequence, the development of infrastructure.

The book Albania: From Anarchy to Balkan Identity describes the country under Hoxha as "an island of increasing poverty and demoralisation, with a rapidly disintegrating infrastructure, crumbling buildings, malnourished and poorly clad workers and peasants using primitive agricultural equipment."

Hoxha finally died in 1985. Five years later, anti-communist sentiment swelled, and riots broke out within Albania as a result of overwhelming anti-communist sentiments. The personality cult of Hoxha was attacked in particular:

Anti-communist protestors pull down a statue of Hoxha in downtown Tirana in February 1991. (Photo courtesy of Berlin-based ESI, the nonprofit European Stability Institute.)

The end of Hoxha's rule, of communism in Albania, and of the Cold War in general brought economic improvements in the early 1990s as Albania struggled to transition to a multi-party, open-market system. Unemployment and inflation dropped while the country maintained a consistent 8% growth in its gross domestic product (GDP).

Unfortunately, inside that engine of newfound wealth were pyramid schemes set up by the unscrupulous, often with the backing of corrupt government officials. A substantial proportion of Albanians, unschooled in the workings of financial markets, were lured in by promises of high payouts. By the time these unsustainable investment schemes collapsed in early 1997, an estimated US$1.5 billion was invested among a population of less than 3.5 million. Life savings were wiped out for many Albanians, which led again to riots and an economic downturn. A new government, installed in the summer of 1997, struggled to restore public order and to revive trade and other healthy economic policies.

Looking for the Right Track

Albania today is still not without its problems. Roads total only 7,000 kilometers and railways 900 km. The country imports much of its electricity and most manufactured goods. Unemployment is high, and more than half the population is still involved in agriculture. Relations with Serbia, Russia, and China have been strained since Kosovo, a largely ethnic Albanian region, broke with Serbia in 2008. Internally, its political parties are also less than warm and fuzzy: the main opposition boycotted (and is still boycotting) Parliament in June 2009, accusing the ruling party of electoral fraud.

On the business front, Albania has still not fully constructed its business regulatory framework, which could lead to long delays in obtaining permits and other properly ordered ducks. In fact, the World Bank's "Doing Business" report stuck Albania at #173 out of 183 countries in dealing with construction permits, based on data from June 2008 to May 2009. (Overall, its "Ease of Doing Business" ranking is #82.)

Finally, Albania lacks pipelines, particularly in the north - a hurdle for oil and gas exploration and development:

Europe's network of oil and gas pipelines. Modified from this site, which quotes "various sources."

Sooo... Why Albania?

There actually are some attractive aspects in the cheerful picture we've painted so far. For one thing, we've yet to talk about the amount of Albania's hydrocarbon potential. Combined with gradual improvements in its political, financial, and social structures, Albania offers several investment advantages for risk-tolerant investors looking to get in near the ground floor. We'd be on the heels of several big names in the resource sector. Here are the advantages we see in Albania. This list is the product of many trips to the country as well as research-based analysis:

1. Pro-America relationship. Politically, Albania is a close ally of the United States, and Albanians in general tend to be very fond of America. Many still regard Bill Clinton as a hero for saving Kosovars during the war in Kosovo. Having a pro-American and thus pro-West attitude in both government and general public means there is less chance of sudden nationalization, short of a civil war or coup d'état.

2. Stabilizing and pro-business government. Albania's president, Bamir Topi, has been relatively quiet in his affairs and has a reputation for a nonpartisan approach. The most controversy he causes is his pro-Kosovo stance, which generally infuriates Serbia and Russia. A fair portion of his attention goes toward attracting more foreign capital into his impoverished nation. Much of his other time is spent trying to resolve the legislative boycott we noted above. Some improvements so far under his administration:

- Gradual simplification of the administrative and business regulations

- Corporate taxes lowered to 10%

- Exemption of most businesses from the Value-Added Tax (VAT)

- Easier access to credit

- Regulation that provides greater protection for investors

3. Improvements in infrastructure. With improvements in Albania's economy have come upgrades in transportation and trade. There's a new highway that runs along the coast, and another connects Durrës, the country's main port, to the central Balkans via Kukës. Infrastructure is a primary focus of the current regime, as the government understands that attracting more foreign investment requires building a more modern network to move people and goods around.

4. Long record of oil production. Albania's history with oil dates back some 2,000 years, when the Romans mined bitumen in the southwest (Apollonia, today the city of Fier) to caulk their ships. The first wells were drilled in the early 1900s, with Rockefeller's Standard Oil and the predecessor of BP, Anglo Persian Oil Company, leading the expansion of Albania's oil industry. In 1932, the largest European onshore oil field was discovered at Patos-Marinza, now operated by Bankers Petroleum. Oil production only began to dwindle under the poor leadership of Hoxha in the communist era.

5. Good fiscal structure for oil. Albania has improved its fiscal structure in the last decade. It's dropped its production sharing agreements, for example, letting more profits stay with businesses. For those who like the details, here are the latest fiscal terms: an 11% to 15% overriding tax-deductible royalty, with a 50% petroleum tax on the income. The total government take at US$80 oil ranges from the just above 50% for large deposits to closer to 60% for small deposits. That's slightly lower than the average government take in other developing countries.

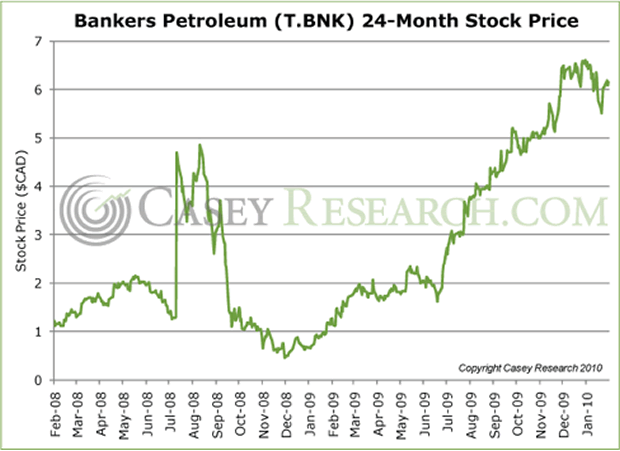

6. Potential rewards. In 2008, Switzerland-based Manas Petroleum (MNAP) announced it found an estimated 3 billion barrels of oil and 3 trillion cubic feet of natural gas at depth. That's an awful lot of oil. Another success story is Bankers Petroleum (T.BNK), which in the past two years has taken off from a low of C$0.46 to its high of C$9.18 in early April 2010 [graph needs updating]:

Clearly we see the potential to make plenty of money in Albania, despite the risks and potential difficulties. Fortunately for us number-crunching analysts, not many companies are currently operating there. The small field is narrowed even further when we focus just on the North American companies.

If you want to know which energy stocks are poised to profit handsomely from the opportunities in Albania, learn from the best in the field - Marin Katusa and his team. Marin, a former math professor and proficient early-seed investor with a vast network of industry connections, is a master in picking future stock winners in the junior exploration as well the large- to mid-cap energy sectors.

His boots-on-the-ground approach, combined with an early-warning algorithmic system, allows him to find just the right entry level to minimize risk and maximize returns. Learn why investing in the right oil companies, and other resources like nuclear and renewables, is essential for every prudent investor right now – because we are running out of oil… fast. Click here for more details.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.