Breaking News BP Gulf Oil Disaster, Blown a Hole in the Sea Floor?

Politics / Environmental Issues Jun 07, 2010 - 11:09 PM GMTBy: Submissions

Dr Stephen A Rinehart writes: These are from a close source (cannot confirm yet). If true, could world stock markets crash soon?! I am not the one who talked to Matt Simmons - the source talked to Matt Simmons. Interesting is Sen Nelson mentioned on National TV that there are "reports of oil seeping up from the seabed and if true may mean the relief well amy not work unless you can plug at the bottom because all the casing is damaged".

Dr Stephen A Rinehart writes: These are from a close source (cannot confirm yet). If true, could world stock markets crash soon?! I am not the one who talked to Matt Simmons - the source talked to Matt Simmons. Interesting is Sen Nelson mentioned on National TV that there are "reports of oil seeping up from the seabed and if true may mean the relief well amy not work unless you can plug at the bottom because all the casing is damaged".

Talked to Matt Simmons today. He had just appeared on the MSNBC Dylan Ratigan show where he told a similar tale. Here’s his story:

There are not cracks in the sea floor. The Thomas Jefferson, deployed from Woods Hole, will end up finding an open hole where the well and casing used to be, some miles away from where BP is working. It is putting out 100,000 to 150,000 bpd.

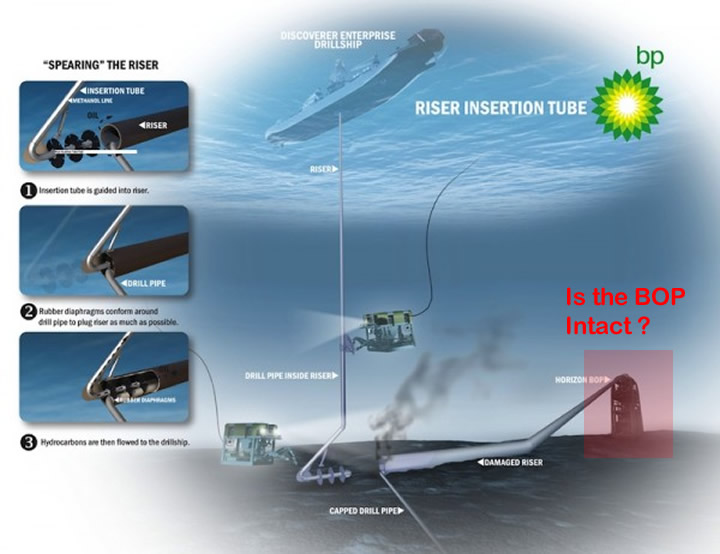

The explosion blew the Blowout Preventer off and left the riser on the sea floor. The recovery effort is just coming from the riser. The gas plumes you see in the videos are only 3 to 4 feet high. That’s not the main oil source.

The claims of 11,000 bpd recovery is just lies.

We don’t know where the BOP is. That’s just the riser you’re seeing.

The well must have blown at 50,000 psi.

When they find the oil well, it will be without any casing. All the casing blew out of the well. This is common occurrence. It was a bad cementing job. That is why relief wells cannot possibly work.

The Soviets put their bombs down the open hole (not true, of course). The Navy needs to come in with a device that can force a 7” A-bomb 18,000 feet down the well and detonate it.

You have to stop the gusher. It may cover 40% of the Gulf of Mexico 400 to 500 feet thick.

We should be deploying tankers to suck up the oil from the bottom.

Oil men have agreements with BP so they don’t talk. Many oil service companies are under confidentiality agreements with BP, so they can’t talk.

Oil pollution in the intake water will cause Gulf oil refineries to shut down. it takes 3 gallons of water for every gallon of gasoline produced. If they can’t get clean intake water, they’ll have to shut down. The price of oil and gas will go up. We don’t have much refined gas on reserve.

For some reason Wall Street firms are still issuing buy orders on BP. Today there are 20 sell 20 buy, and no shorts.

Goldman Sachs probably wants to be BP’s bankruptcy adviser.

By: Dr Stephen A Rinehart

stevecin@bellsouth.net

© 2010 Copyright Stephen A Rinehart - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.