Could This Be The Pause That Refreshes the Stock Market Trend?

Stock-Markets / Stock Markets 2010 Jun 07, 2010 - 04:18 PM GMTBy: David_Grandey

The big question early this week is will be are we going straight to a retest of the recent lows if not more? Or are we going to backtest Monday? If we backtest we’ll be looking at shorting another name or two on our watch list.

The big question early this week is will be are we going straight to a retest of the recent lows if not more? Or are we going to backtest Monday? If we backtest we’ll be looking at shorting another name or two on our watch list.

Well folks it sure looks like a backing and filling type of day thus far with bouts of volatility back and forth.

Could this be a pause that refreshes? What we mean by that is that markets thrust and pause, almost as if it has to digest its gains before another move. In this case the markets have been thrusting to the downside as that is the overall trend of the market.

We are seeing volatility in a lot of our names with intra-day wild moves in the go go names of NFLX and CMG. Even BIDU was wicked as at the open you could have shorted at 74.00 and it’s been down to 71.46. Heck on a few hundred shares that would be a day traders dream.

Right now the jury is out as to whether this is a pause that refreshes before another thrust down or actual stabilization. We’ll know the next few days.

We’ll use thrusts down in the markets to lock in gains on our short-sell positions much like you want to buy the dips and sell the rips on the long side the opposite here is short the rallies and cover on the dips.

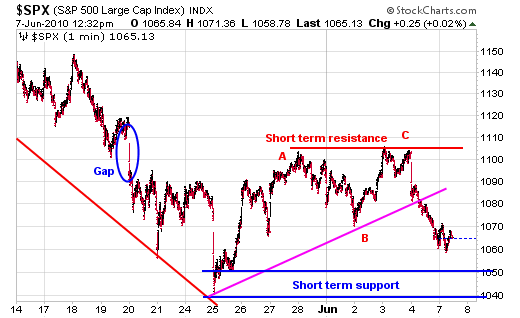

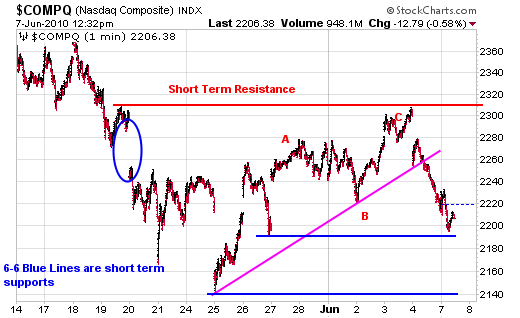

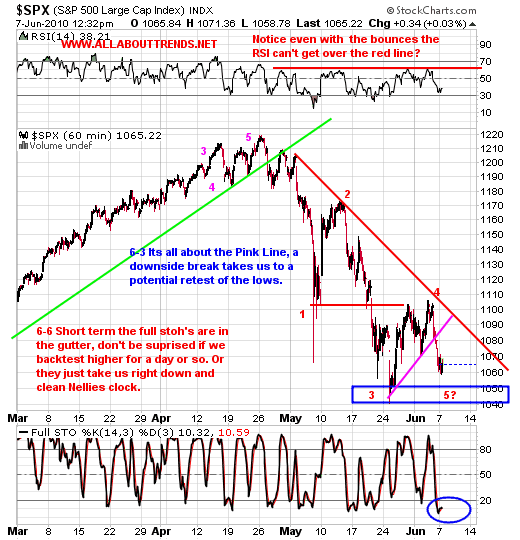

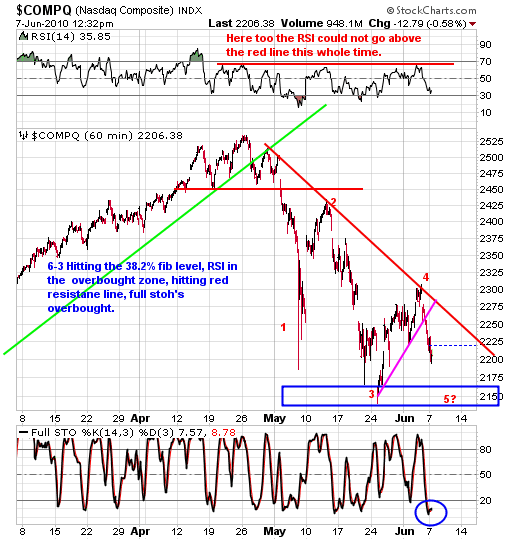

In th 60 minute time frequency not much has really changed, all the visible action is in the one minute charts below.

Notice the dip on May 25th? That MAY be as far as we go to the downside. A news driven event will blow that out of the water though should one occur, but how do you manage news driven events be it EU debt problems etc? Answer is you don’t because you never know when they are going to come if at all. This goes for both directions by the way.

See those big red downtrend lines off the April highs? You will get no lasting rally to the upside till those are crossed. Why? It’s downtrend resistance.

In the meantime the overall trend is clear and that is a stair step down. We have some nice gains being worked upon on the short side and it’s still early in the month. We want to protect and keep them the best we can as volatility reigns.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.