What is leading to the Global Markets Sell Off?

Stock-Markets / Financial Markets 2010 Jun 07, 2010 - 08:11 AM GMTBy: Dhaval_Shah

Markets behaviour in past few days have been quite chaotic and strangling, leaving investors completely clueless.

Markets behaviour in past few days have been quite chaotic and strangling, leaving investors completely clueless.

Everything under the sun(except Dollar & Gold) have been falling off the cliff. Take any currency, it is falling ferociously against dollar and loosing value against Gold.

Take any market(Capital markets) across the world, are losing ground rapidly and falling below 200 DMAs breaching all crucial supports.

Take any commodity, except precious metals, have been falling brutally since quite some time.

This scenario raises many questions. But, before answering them let us go through one by one market to better understand its present situation and its implications on broader markets and economy.

Let me take one by one

Currency

Have a look at the graphs of all major currencies of the world.

In past 3 months, every currency has plummeted 10% to 15% against Dollar. I am not talking about Euro only. Take any currency, developed nations currencies like Euro, Sterling, Swiss Franc, Swedish Krona or say Australian Dollar, New Zealand Dollar, currencies of natural resources rich nations or say India, South Korea, Brazil, Russia, emerging nations, ----virtually every currency except Japanese Yen, have fallen off the cliff in last 3 months.

Virtually, all currencies have been in free fall since quite some time.

And, here under is the chart of the Dollar Index.

It has moved up with healthy consolidation in between.

But, What does this indicate?

IS capital moving to safety?

Would this lead to repeat of 2008 crisis? When capital moved to safety, dollar went up, markets crashed and rest currencies imploded OR

IS it short to medium term reversal before downtrend in dollar resume?

I will answer it in short while.

Let us check other markets, which are affecting broader markets right now.

Stock Markets

Since end of April and start of May 2010, markets across the world have been in correction. Developed markets have corrected more than 12% and some are accelerating the pace of correction off late.

Emerging markets are also into severe correction, China corrected by 20% and India more than 10% in past 1 month.

Commodities

Situation is no different in commodity market either.

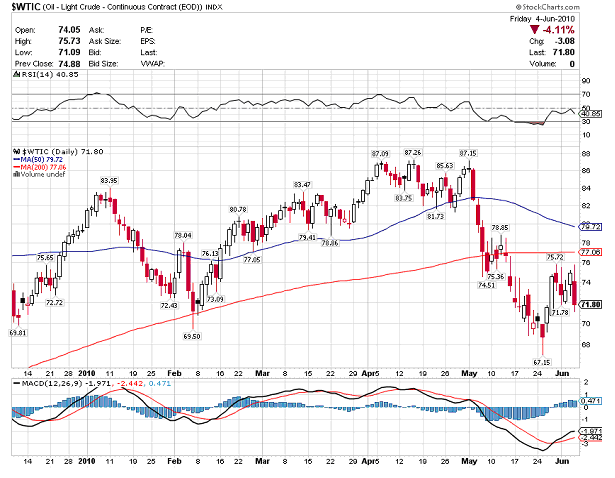

Oil lost more than 22% after hitting high of $87 in start of March. Now, trading around $67.

Copper fell 21% after hitting high of $368 in mid of May.

Aluminium lost more than 35% in 3 short months. It has been a free fall from the high of $140 in Jan, 2010 to $85 recently.

Agriculture commodities have not been pared either.

Reuters/Jefferies CRB Index is down 18% from high, it formed in Jan, 2010.

That’s the present scenario. Except Dollar and Gold, rest all, currencies, stocks and commodities, falling ferociously.

What are the primary concerns in broad market responsible for such a huge sell off across the markets?

Remember, end of the day what matters to market is free flow of money i.e. LIQUIDITY.

We have seen markets going up in weak economies if growth in money supply was not interrupted and velocity of money was less affected.

But, since quite some time growth in money supply has slowed and velocity standstill.

Since, Greece debacle, we have been constantly hearing about Austerity measures, reduction in Fiscal Deficits and wage cuts and freezing pension payouts for 2-3 years across the European nations.

Let’s go through some major headlines

European countries vow to investors, we will cut deficits to rein in debt. Do not smash our beloved Euro.

““Italy Adopts $30 Billion of Cuts in EU Deficit Push””

Bloomberg, May 26

““The new Conservative-Liberal Democrat government in the U.K., which isn’t part of the euro, pledged this week to cut spending by the equivalent of $8.6 billion this year as it seeks to rein in a deficit of 11.1 percent of GDP. ””

Bloomberg, May 26

But, situation is squarely against these measures as unemployment hitting new highs

““Euro unemployment rate hits record 10.1 per cent: EU –ET Jun 1

BRUSSELS: The unemployment rate across the 16 countries that share the euro hit a record 10.1 per cent in April, with almost 16 million people out of work, the European Union said on Tuesday. ””

It also raises concerns of major slowdown, more severe than 2008, if Govts stops spending when private spending is still mired in to recession

““Luxury air travel: Out of the blue, into the red – ET Jun 4

NEW YORK: The economic downturn has clipped the wings of luxury air travel. Hi-end boutique airlines have fallen from the sky, business travelers

are bargain hunting online and most folks seated in the front of the plane have

"Luxury air travel has essentially been grounded," said Peter Yesawich, CEO of the travel marketing company Ypartnership, "One of the first prerequisites to go in a tough economy." Yesawich, whose company tracks travel trends, said that with the exception of long hauls, these days even most folks in first class are flying on upgrades. "It's said that real profit in any flight is front of plane. The rest covers the overhead," he explained. ””

And, finally, hyped austerity measures are not politically acceptable as it costs election to party

””Sarkozy Grapples With ‘Politically Unacceptable’ Cuts

Bloomberg, May 20

Sarkozy has said he will cut France’s deficit to 3 percent of economic output in 2013 from 8 percent now. His reliance on a spending freeze, economic growth and a pension overhaul will get him only partway there, according to Samuel-Frederic Serviere, a researcher at Ifrap, a Paris-based group that monitors government spending””

Towards Conclusion

That means, after dolling out stimulus in 2008-09 and after taking private debt(mostly bank’s debt) on Govt Balance sheet, Debt of major developed nations have grown to 100% to 200% in past 1 year.

And, mind well, this 200% does not include unfunded liabilities(like Medicare, Medicaid, social security and Pension liabilities), if that is included Debt stretches past to 400-500% for all major developed nations to their GDPs.

Such an enormous debt to GDP raised concerns among Investors on Govts repaying ability. And, rightly, it is patently unpayable debt by any measure.

Had it been good time for the economy, Investor would have taken a chance. As economy improves, tax revenue increases, Govt will pay out the debt.

But, this is recessionary period. Govts revenue falling off the cliff. Govts have spent gargantuan sums on bailing out too big to fail and again spent huge sums to uplift the economy.

And, now Govts are curtailing expenditures, reducing or withdrawing stimulus partial in some cases and full in other to calm investors and that results in lower income for consumers, less incentive for corporate, less credit to institutions and it results in to less growth or negative growth of the Economy.

These concerns are driving all markets, currency, stock and Commodity, down.

But, then, where these huge sums of bailout, stimulus and tax cut benefits(stimulus money) are lying?

In giant coffers of the banks!!!!!

Yes, you read it right. The huge sums, central banks doled out to banks with anticipation that in turn banks would lend to consumers and economy would return to normalcy, did not make to 1st step even.

Recent news in Bloomberg confirms

““Banks’ Overnight Deposits With ECB Increase to Record,

Bloomberg, June 3

Banks lodged 320.4 billion euros ($394 billion) in the ECB’s overnight deposit facility at 0.25 percent, compared with 316.4 billion euros the previous day, the Frankfurt-based central bank said in a market notice today. That’s the most since the start of the euro currency in 1999. Deposits have exceeded 300 billion euros for the past five days. ””

But, why banks are not lending to each other too?

“The banking crisis is back,” said Norbert Aul, an interest-rate strategist at Commerzbank AG in London. “The news flow over the past few weeks has spooked banks and since nobody knows how exposed individual financial institutions are, it’s deemed safer to park cash with the ECB rather than lend it on.”

Even after 2 years of crisis, there is hardly any clarity on derivatives bets, banks and institutions bet on interest rates and details of Credit default Swaps, which spooked market and froze the credit markets completely in 2008.

Banks do not know, how vulnerable other banks and institutions are if 2008 episode is to repeat. And do not forget the cause of crisis of 2008, it was housing crisis due to sub prime loans doled out by banks at teaser rates.

Banks know well that neither unemployment nor growth is to return in short term. This would surely result in more foreclosures and default. To prevent the capital erosion banks need to make more provisions against probable losses to save its balance sheet and more to save its stock from the agony of hedge funds and money managers.

Apart from that, Crisis has devastated free capitalism structure wherein banks could innovate, structure and sell products as they wished. Now, they will require more capital to put aside before lending to safeguard health of the bank and less leverage to reduce speculation under higher regulatory supervisions as envisaged by Central Bankers and G20 Finance Ministers.

And, you know well, US, UK and European Union nations run on credit. Their institutions, Banks, Govt and consumers—all are deeply addicted to debt.

It(Credit) is like main artery of Economic body of these nations. And, now flow of blood has reduced causing many parts to disfunctionality.

If banks are not lending then stress must be visible in credit markets!!! Borrowing must get costlier and bond sales must fall!!!!

Is strain visible in money market?

Yes, it is visible on front screen.

Companies have issued $47 billion of debt in May, down from $183 billion in April and the least since December 1999, data compiled by Bloomberg show.

May remained the worst month in a decade for corporate bond sales.

Let me take you through recent credit market news first

““Libor Shows Strain, Sales Dwindle, Spreads Soar: Credit Markets

Bloomberg, May 24, 2010

Corporate bond sales are poised for their worst month in a decade, while relative yields are rising the most since Lehman Brothers Holdings Inc.’s collapse, as the response by lawmakers to Europe’s sovereign debt crisis fails to inspire investor confidence.

Companies have issued $47 billion of debt in May, down from $183 billion in April and the least since December 1999, data compiled by Bloomberg show. The extra yield investors demand to hold company debt rather than benchmark government securities is headed for the biggest monthly increase since October 2008, Bank of America Merrill Lynch’s Global Broad Market index shows.””

““Bond Sales Fall to Least in Decade, Yields Soar: Credit Markets

Bloomberg, May 27, 2010

Companies sold the least amount of bonds in a decade this month as concern Europe’s sovereign debt crisis will slow the global economy drove up relative borrowing costs by the most since the aftermath of Lehman Brothers Holdings Inc.’s collapse.

Borrowers issued $61.1 billion of debt in currencies from dollars to yen, a third of April’s tally and the least since December 2000, according to data compiled by Bloomberg. At least 13 companies withdrew offerings, including New York-based retailer Jones Apparel Group Inc. and theater chain operator Regal Entertainment Group.””

So, Liquidity situation is though comfortable with banks but banks are unwilling to pass on liquidity.

And, without liquidity markets do not function on upside.

Hence, Markets are looking for some actions from authorities to ease liquidity condition. But, it is not a cake walk for them now as it used to be before crisis.

More debt issuance will lead to higher borrowing cost for today and higher roll over cost of debt in coming future.

That leads to confusion and uncertainty in the market.

Will Govts across the world roll back stimulus packages, curtail fiscal deficits and hike interest rates?

If yes, markets will continue to slide. This recent slide has started on the back of such news only, from European nations first and later followed by fiscal cut news from England.

Will Govts resort to printing more?

If yes than Markets will welcome it with rally as it welcomed in 2009 March.

But, it would not be as easy as it was in 2009 to participate and profit from it.

Increased volatility suggests rough weather to prevail in market for extended period with periodical tornadoes on up and down sides.

Regards

Dhaval Shah

Blog: http://investmentacademy.wordpress.com

E-mail: investmentacademy@yahoo.com, academyofinvestment@gmail.com

© 2010 Copyright Dhaval Shah - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.