It's Un-American To Be Bearish On Anything Besides Gold and Silver, Only Evil Speculators Short Stocks

Stock-Markets / Stocks Bear Market Jun 05, 2010 - 07:49 AM GMTBy: Adam_Brochert

It is un-American to be bearish on anything besides Gold and silver. Only evil, greedy speculators would bet against stocks. Only kooky people with guns and canned goods would be bullish on Gold. That would make me an un-American, evil, greedy, kooky, gun-toting, spam-eating speculative devil. As an example of the thoughts such an unstable and unfit being creates when evaluating the financial markets, please indulge me in yet another bearish scenario simulation that contradicts the "central bankstaz and governments would never let that happen" theme.

It is un-American to be bearish on anything besides Gold and silver. Only evil, greedy speculators would bet against stocks. Only kooky people with guns and canned goods would be bullish on Gold. That would make me an un-American, evil, greedy, kooky, gun-toting, spam-eating speculative devil. As an example of the thoughts such an unstable and unfit being creates when evaluating the financial markets, please indulge me in yet another bearish scenario simulation that contradicts the "central bankstaz and governments would never let that happen" theme.

I remain invested in puts on the triple bullish commercial real estate ETF (ticker: DRN) and to a lesser extent the triple bullish S&P 500 ETF (ticker: UPRO). This is playing with napalm, as leverage is a wicked tool of the depraved and cuts both ways. I don't take such a position just for the heck of it and I have experienced both the agony of defeat and the joy of victory when placing large, heavily leveraged bets for and against the markets.

I have recently discussed commercial real estate and previously posted on my rationale for shorting this sector of the market. I don't use the phrase "black bile bearish" in jest, I use it because I smell a bloodbath in the markets. My commercial real estate short is my largest trading position, while my largest overall position is in physical Gold (which I don't trade).

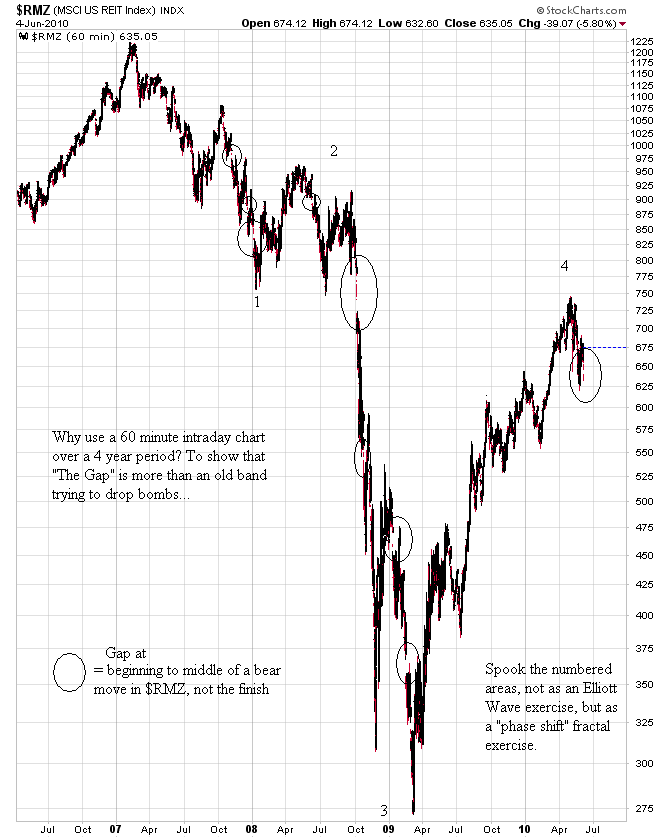

I want to get back to my previous "phase shift" concept in the commercial real estate sector versus the homebuilding sector, which I believe is still valid. Many are looking for a bounce next week (and even new highs for the "correction"), while I am looking for a continuation of the trend down. Here's a current 50 month 60 minute intraday chart of the $RMZ commercial real estate/REIT index (the index behind the triple levered DRN and DRV ETFs) thru today's close:

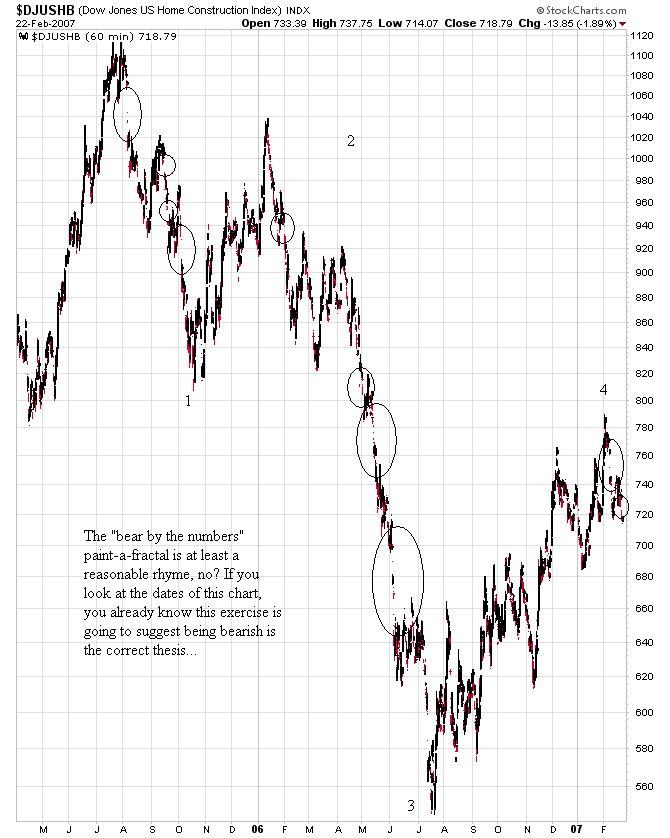

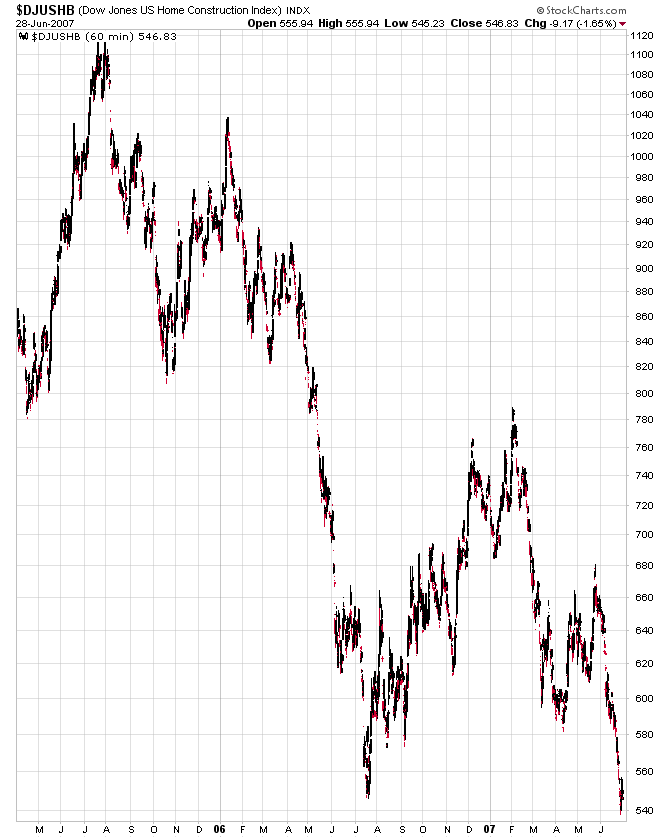

And here is a proposed "phase shifted" equivalent from the 2005-7 vintage bear market in homebuilders (roughly 2 year 60 minute intraday chart of $DJUSHB):

What comes next is good for da bears, of course. Here is the anticipated rhyme that "should" come next:

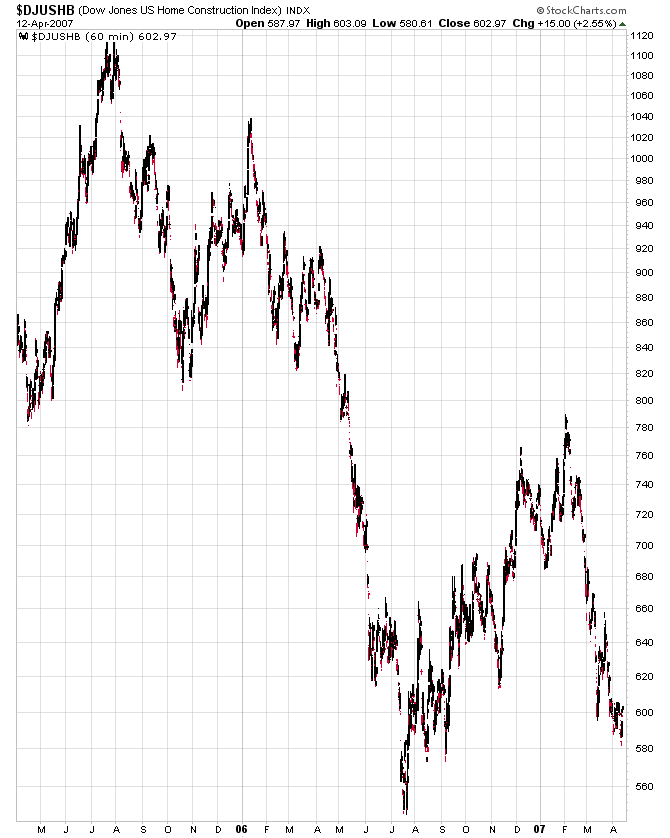

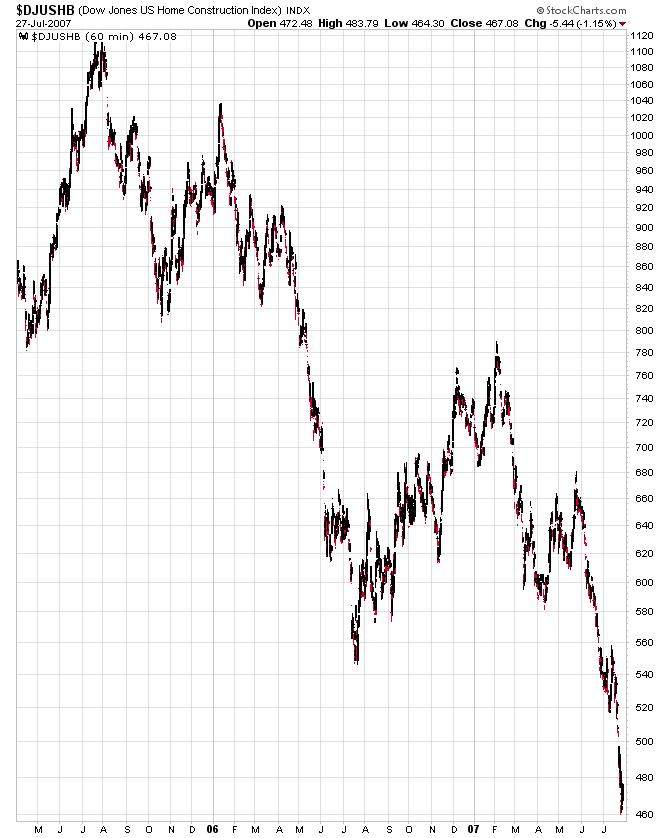

Of course, a speculator must be quick or all the gains by going short will be gone. Here's what came next:

And you can just imagine the massive rally higher that then followed:

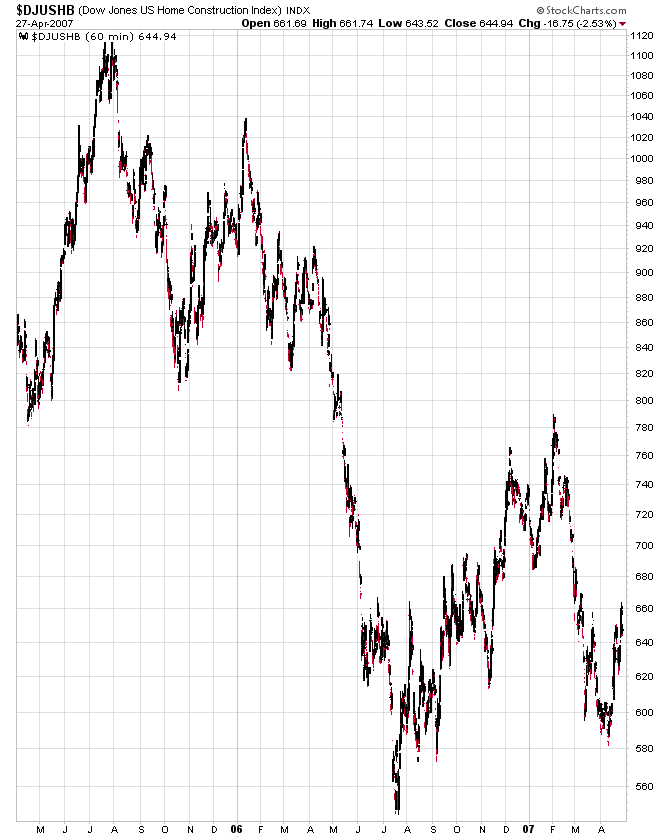

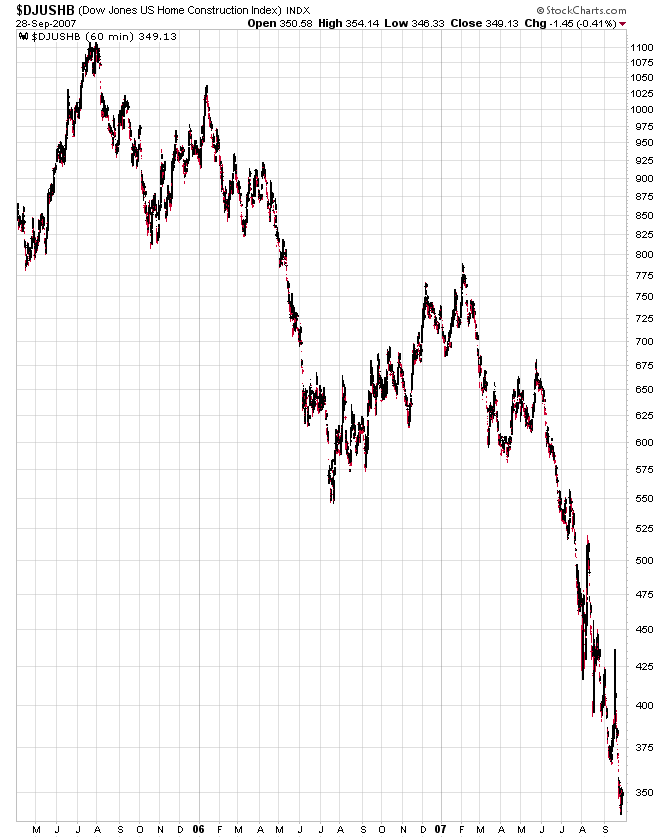

Greedy bears who failed to take profits at this point deserved the subsequent short squeeze slaughter, eh? Here it is in all its bullish glory:

All good things must come to an end and the bulls in all seriousness got their revenge as they always do. The printing press is infallible and Bernanke and widdle Timmy Geithner punish bears routinely. Here's what came next:

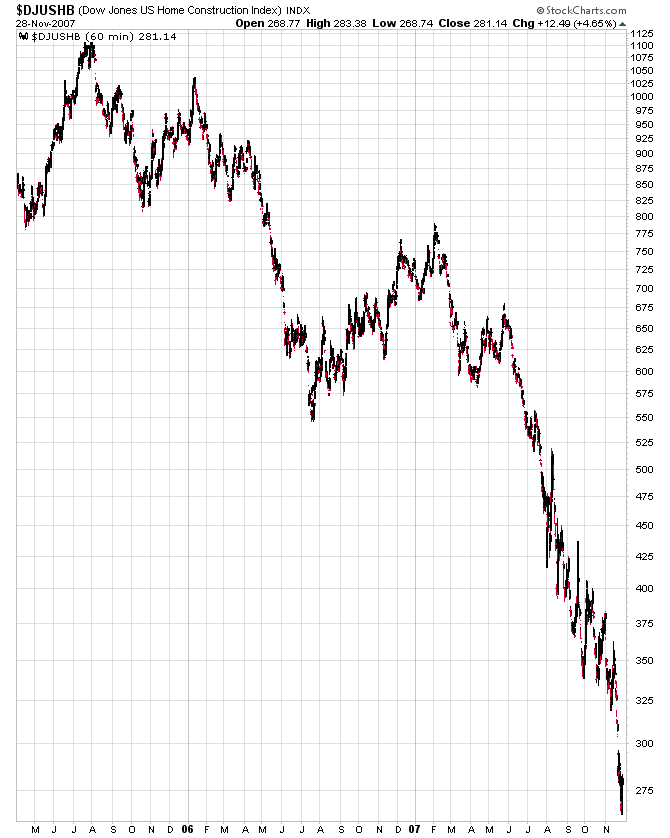

The carnage had to be over at that point, obviously, and here's what the subsequent bear massacre looked like:

Now do you understand what I mean by "black bile bearish"? Did you notice that the dates on these homebuilder index charts was 2005-2007, long before the Great Fall Panic of 2008? Did you notice that some of the biggest drops were during June, July and August of 2007? Fundamentals asserted themselves back then in the homebuilders, just as they now should do in commercial real estate. There is no recovery in real estate, nor is there any prospect for one in the near future. There is, however, the potential for a "moment of recognition" to return and panic selling to ensue in this sector (among others...).

For those keeping score, the time from the end of the first $DJUSHB chart shown to the end of the last $DJUSHB chart shown is about 10 months, during which time the $DJUSHB dropped about 60% or so. Add triple leverage and options and you can see why I call this bet "playing with napalm," but you can also probably see why I am excited about the opportunity.

In my opinion, the March 2009 lows in commercial real estate are as likely to hold as the Greek stock market's are...

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2010 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.