Seven Reasons We Are Glad To Have Stock Market Short Sell Positions

Stock-Markets / Stock Markets 2010 Jun 04, 2010 - 02:04 AM GMTBy: David_Grandey

Seven reasons we are glad we have short exposure.

Seven reasons we are glad we have short exposure.

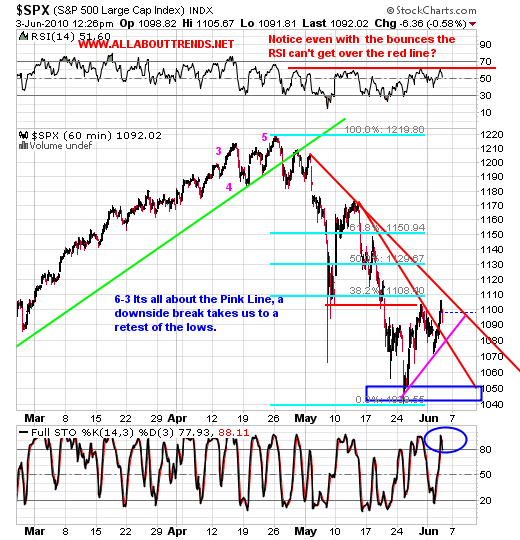

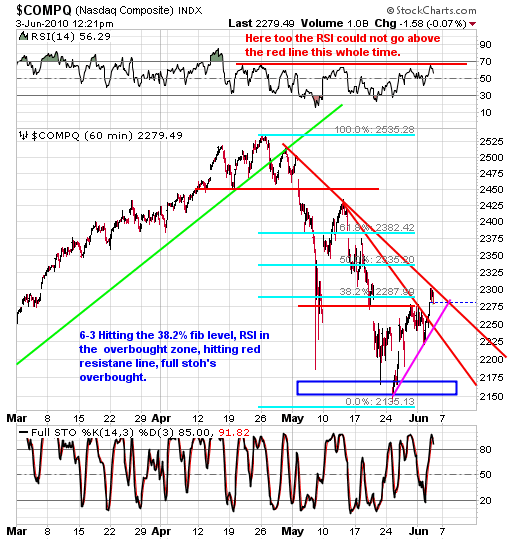

1. 38.2% Fibonacci retracement level was tagged and promptly turned back.

2. RSI at the level of the correction highs

3. Red Lines/ downtrend resistance levels hit.

4. The pink line is setting up a short sell Pullback Off Lows (POL) trade set up.

5. The S&P 500 hit the 200 day average again.

6. The Full Stohcastics are overbought

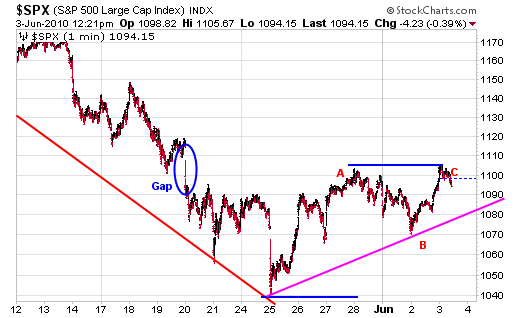

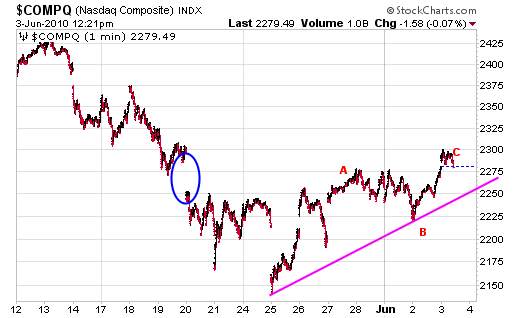

7. As shown in the charts below of the short term move off the recent 1040 level lows we’ve staged an Elliot Wave ABC up (Wave 4? for you Elliot Wave followers)

All of this bodes well for our short sells which by the way after making us sweat a little for a few hours are rolling over as we post.

Any break of the Pink Lines to the downside sets the ball rolling for a retest of the lows (5th wave?)

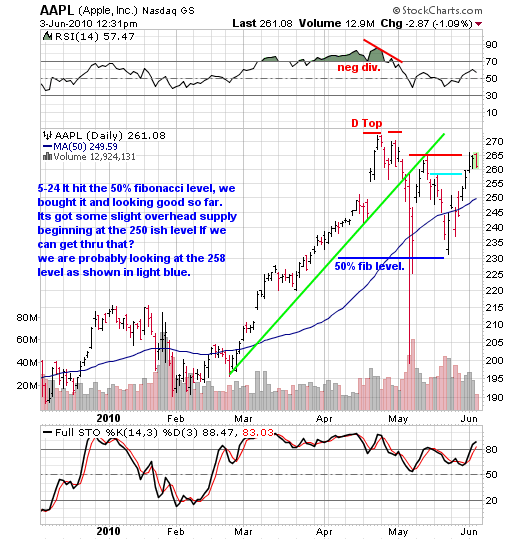

Even AAPL has been struggling right here. Why? Because it’s at resistance that’s why (Red line that has been on this chart for weeks).

In order to get us interested on the long side we need to see either a retest of the 1040 level on the S&P 500 or some sort of Pullback Off Highs (POH) pattern form.

Right now we are fine right where we are with exactly what we have out there.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.