Gold and Gold Stock Update

Commodities / Gold and Silver 2010 Jun 03, 2010 - 10:05 AM GMTBy: Jordan_Roy_Byrne

The following is a brief snippet of Wednesday’s 16-page update. Go here for more information on our service and a free 14-day no risk trial.

The following is a brief snippet of Wednesday’s 16-page update. Go here for more information on our service and a free 14-day no risk trial.

Gold

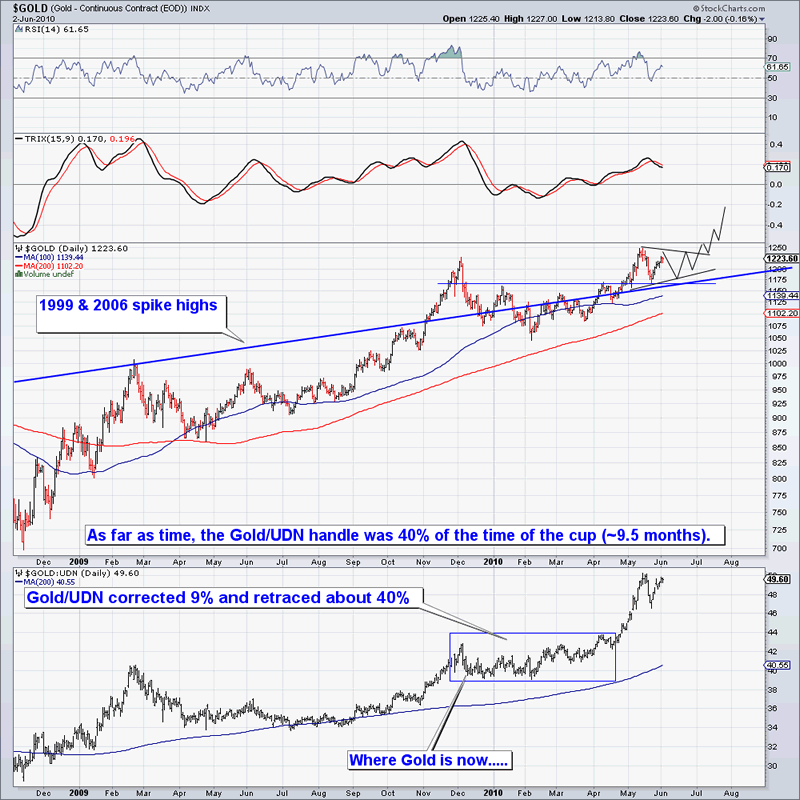

Gold remains on track (as far as our template). Here is the potential bullish outcome. The longer Gold holds above $1160 and that trendline, the more likely the bullish outcome.

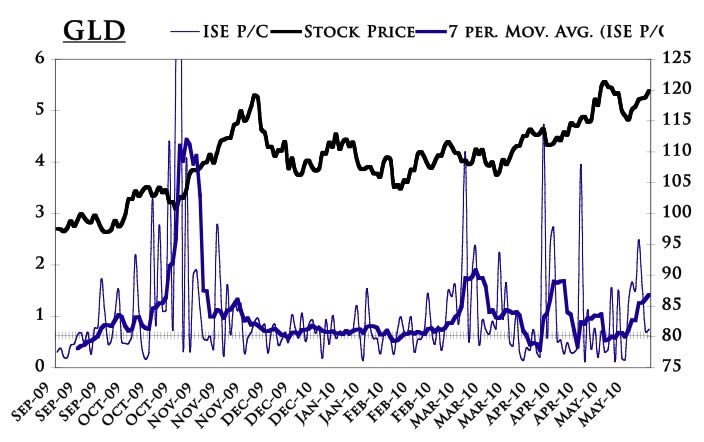

Sentiment remains supportive. See the GLD put-call below. Also, public opinion from sentimentrader.com is 69% bulls. Interim tops have occurred at 75% while significant tops at 85%. Consolidation for another month or two would leave public opinion near 60% bulls.

Gold Stocks

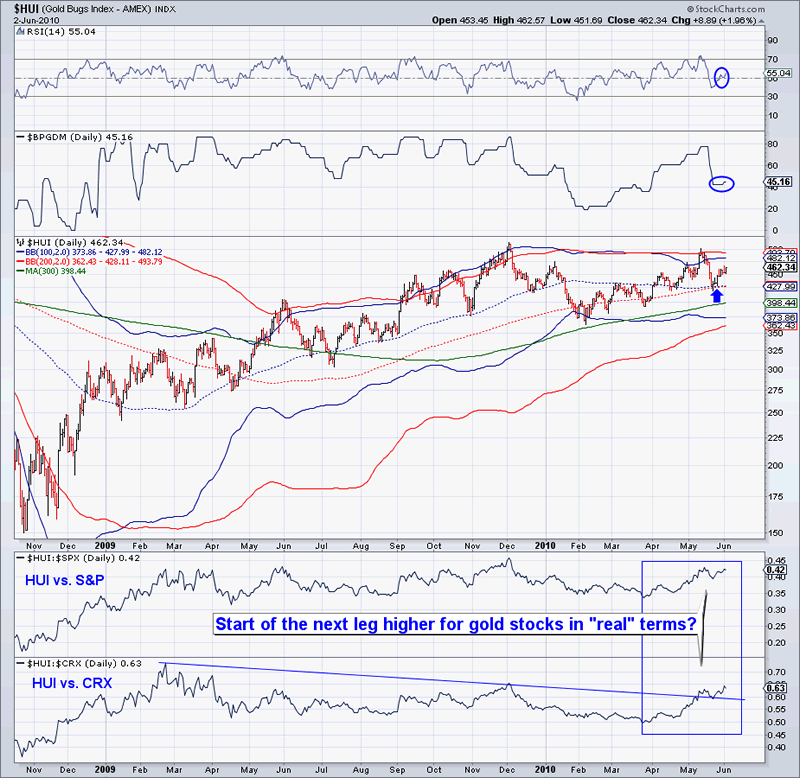

This is an interesting juncture for the gold stocks. There is enough evidence to make a case that the recent low will hold.

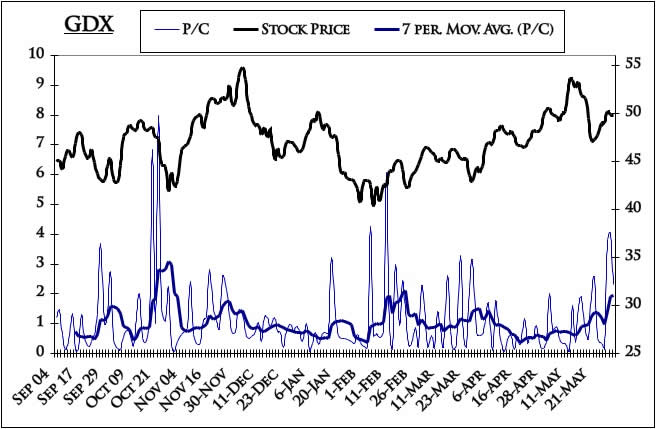

Note that the bullish percent index is at 45% (neutral to slightly oversold). Note that the 7-day GDX put-call is at a level consistent with bottoms. Note the put-call spike on Friday. Consider that gold stocks are performing well in real terms. Also consider that the HUI has twice recently held above both the 100 & 200 day-MA’s.

Initial support is 425-430, with very strong support at 380-400. Initial resistance is now 470-475.

Here is the GDX put-call data we referenced above.

While the outlook for Gold is very positive, the outlook for the gold stocks and various juniors is even brighter. Learn more about that in our premium service, which offers a free 14-day trial.

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.